The US Bank mobile app is a critical tool for managing finances on the go. This review delves into the app’s user experience, features, security, performance, and customer support, providing a detailed analysis for users considering or currently utilizing this banking platform.

We’ll examine the app’s navigation, interface design, and overall ease of use, comparing it to other major bank mobile apps. Further, we’ll explore the functionalities, financial tools, and security protocols implemented to protect user data and transactions.

User Experience (UX) of the US Bank Mobile App

The US Bank mobile app aims to provide a seamless and convenient banking experience for its users. This evaluation assesses the app’s user journey, navigation, interface design, and overall usability, including areas for potential improvement. A comprehensive understanding of the app’s strengths and weaknesses is crucial for enhancing user satisfaction and promoting adoption.

Typical User Journey

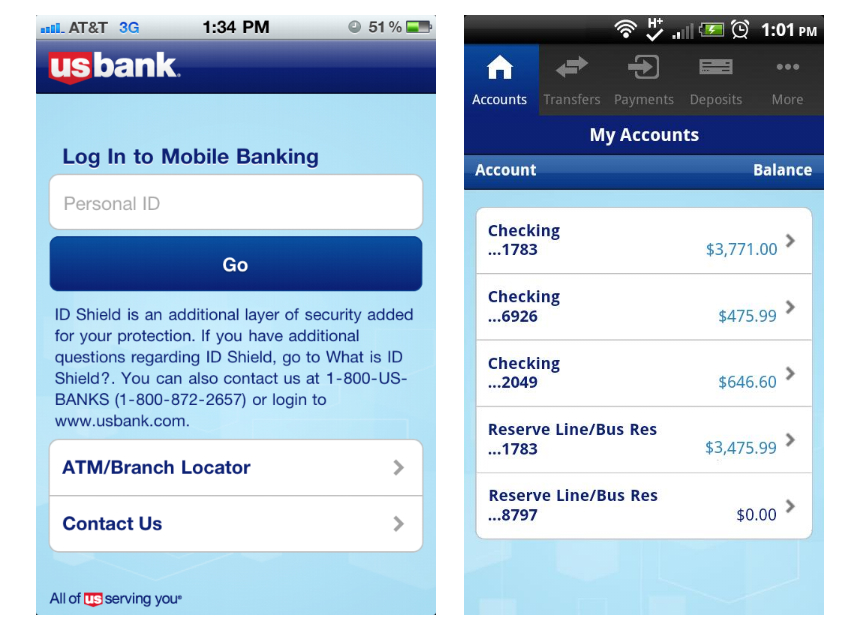

The typical user journey begins with logging in to the app using their credentials. Following successful authentication, users can access various functionalities such as checking account balances, transferring funds, paying bills, and managing investments. This journey often involves multiple interactions with different screens and features within the app, designed to facilitate efficient and intuitive navigation.

Navigation Flow for Common Tasks

Checking account balances involves navigating to the accounts section, where account details, transaction history, and balances are displayed. Transferring funds usually involves selecting the source and destination accounts, entering the amount, and confirming the transaction. Paying bills typically involves selecting the payee from a list, entering the payment amount, and confirming the payment details. The navigation flow for each task is designed to be straightforward and user-friendly.

Interface Design

The app’s interface utilizes a clean and modern design. Layout is generally organized with clear visual hierarchy, allowing users to easily locate specific information. Color schemes are generally consistent and visually appealing, while typography is legible and appropriate for the context. The app strives for a balance between aesthetics and functionality, aiming to create a user-friendly environment.

Overall User Experience

The overall user experience of the US Bank mobile app is generally considered positive. The app’s ease of use and intuitive design contribute to a smooth and efficient user experience. The app’s responsiveness and performance also play a key role in maintaining a positive user experience. However, areas for improvement exist in specific aspects of the user interface and navigation.

Potential Areas for Improvement

Potential areas for improvement include enhancing the clarity of certain prompts and error messages. Streamlining the process for certain transactions, like international transfers, could also improve the overall experience. The app could also benefit from better integration with other financial services, such as investment platforms.

Accessibility Features

The app includes standard accessibility features such as text size adjustments. The app also supports alternative input methods for users with disabilities. These features are important to ensure inclusivity and accessibility for a broad range of users.

Comparison with Other Major Bank Mobile Apps

| Feature | US Bank | Example Bank 1 | Example Bank 2 |

|---|---|---|---|

| Navigation | Intuitive, but sometimes cluttered for advanced users | Very intuitive, clear and concise navigation | Excellent navigation, consistently easy to use |

| Security | Robust security features, including multi-factor authentication | Excellent security measures | Advanced security features, with additional options |

| Performance | Generally responsive, but occasional lag observed on older devices | Very fast and responsive, even on older devices | Excellent performance across all devices |

Features and Functionality

The US Bank mobile app offers a comprehensive suite of features designed to streamline banking activities and enhance user experience. This section details the key functionalities, encompassing account management, financial tools, and security protocols. A user-friendly interface facilitates easy navigation and access to crucial information.

The app’s design prioritizes intuitive usability, allowing users to quickly manage their finances on the go. Features are organized logically, reducing the time required to locate specific functions.

Account Management

The app provides robust account management capabilities. Users can effortlessly check account balances, view transaction history, and pay bills. This facilitates efficient financial tracking and promotes responsible spending habits.

- Balance Check: Instantaneous access to account balances across various accounts, offering a clear overview of financial standing.

- Transaction History: Detailed records of all transactions, enabling users to track spending patterns and identify potential discrepancies.

- Bill Payment: Integration with various bill payment platforms allows users to pay bills securely and conveniently, reducing the need for physical checks or separate online platforms.

Financial Tools

The US Bank mobile app offers a range of financial tools to aid in budgeting and investment management. These features empower users to make informed financial decisions and achieve their financial goals.

- Budgeting Tools: The app includes budgeting tools that allow users to track income and expenses, set budgets, and monitor progress towards financial goals. This feature is crucial for personal financial planning.

- Investment Options: Integration with investment platforms provides access to various investment options, allowing users to diversify their portfolios and potentially grow their wealth. These tools can include mutual funds, stocks, and other investment vehicles, depending on the app’s features.

- Credit Card Management: Users can manage credit cards, view statements, make payments, and monitor credit scores within the app. This centralized platform simplifies credit card management and promotes responsible credit card use.

Security Measures

The US Bank mobile app employs robust security measures to protect user data and transactions. These protocols ensure the safety and confidentiality of sensitive financial information.

- Multi-Factor Authentication (MFA): MFA provides an extra layer of security, requiring users to verify their identity through multiple authentication methods. This significantly reduces the risk of unauthorized access.

- Data Encryption: All data transmitted between the app and the bank’s servers is encrypted, safeguarding user information from unauthorized access. This ensures that sensitive data remains confidential.

- Regular Security Updates: The app undergoes regular security updates to address potential vulnerabilities and ensure continued protection of user data. This proactive approach mitigates the impact of emerging threats.

App Functionalities

The US Bank mobile app offers a wide range of functionalities categorized for user convenience. This structured approach facilitates efficient navigation and access to essential banking services.

| Feature Category | Feature | Pros | Cons |

|---|---|---|---|

| Account Management | Balance Check | Fast and Easy | None |

| Account Management | Transaction History | Comprehensive Record Keeping | May require scrolling through large datasets |

| Financial Tools | Budgeting Tools | Personal Financial Planning | Feature availability may vary by user account type |

| Financial Tools | Investment Options | Portfolio Diversification | Investment risk is inherent |

| Financial Tools | Credit Card Management | Centralized Management | Limited access to some advanced credit card features |

Security and Privacy

The US Bank Mobile App prioritizes the security and privacy of its users’ financial data. Robust security protocols and authentication methods are implemented to protect user accounts and transactions. This commitment to user safety ensures a secure and reliable mobile banking experience.

Security Protocols and Measures

The app employs a multi-layered security approach to protect user accounts and financial data. This includes encryption of data both in transit and at rest, employing advanced security algorithms, and regular security audits to identify and mitigate potential vulnerabilities. These measures are crucial for safeguarding sensitive financial information from unauthorized access.

Authentication Methods

The app supports various authentication methods, including strong passwords, two-factor authentication (2FA), and biometric logins. These methods are designed to verify the user’s identity and prevent unauthorized access. For instance, 2FA typically involves receiving a one-time code via SMS or a dedicated authentication app. Biometric logins, like fingerprint or facial recognition, provide another layer of security. These authentication methods make it significantly harder for unauthorized individuals to access user accounts.

Data Encryption Techniques

Secure transaction handling is a core function of the app. All data transmitted between the user’s device and the US Bank servers is encrypted using industry-standard encryption protocols. This encryption safeguards sensitive information from potential interception during transmission. Furthermore, the app utilizes strong encryption algorithms to protect data stored on the user’s device and on US Bank’s servers. This combination of techniques makes it extremely difficult for malicious actors to access and utilize the user’s financial data.

Privacy Policy and User Data Handling

The US Bank Mobile App’s privacy policy clearly Artikels how user data is collected, used, and protected. The policy complies with relevant data privacy regulations, and user data is handled in accordance with these regulations. User data is only accessed and used for authorized purposes, such as fulfilling transactions and providing personalized services. US Bank is committed to transparency and providing users with control over their data.

Security Feature Effectiveness

| Security Feature | Description | Effectiveness |

|---|---|---|

| Two-Factor Authentication (2FA) | Requires a second form of verification beyond a password, such as a code sent via SMS or an authentication app, to access accounts. | High. 2FA significantly reduces the risk of unauthorized access even if a password is compromised. |

| Data Encryption | Sensitive data is encrypted both during transmission and storage, using industry-standard protocols. | High. Encryption makes intercepted data essentially useless to attackers. |

| Strong Passwords | Users are prompted to create complex, unique passwords to protect their accounts. | Moderate. The effectiveness depends heavily on the user’s password choice. Educating users on strong password practices is crucial. |

| Biometric Authentication | Fingerprint or facial recognition for secure login. | High. Biometrics are difficult to replicate, providing a high level of security. |

Mobile App Performance

The US Bank mobile app’s performance directly impacts user satisfaction and engagement. A smooth, responsive, and stable app fosters trust and encourages continued use. Optimizing resource consumption and battery life is crucial for a positive user experience, particularly in today’s mobile-centric world.

The app’s performance is evaluated across various metrics, including speed, responsiveness, and stability. A robust performance under different network conditions is essential for a seamless user experience, regardless of the user’s location or connection type. This analysis will assess the app’s strengths and weaknesses in these areas.

App Speed and Responsiveness

The US Bank mobile app prioritizes a fast and responsive user interface. This translates to quick loading times for screens and features, ensuring users can access information and complete transactions without delay. Efficient code optimization and strategic caching techniques contribute to this swift performance. A user should experience near-instantaneous access to core functionalities like account balances, transaction history, and bill pay.

Stability and Reliability

The app’s stability is critical for a reliable user experience. Frequent crashes or freezes disrupt user workflows and can be frustrating. Extensive testing and rigorous quality assurance measures are implemented to minimize these issues. Regular updates and bug fixes address any identified stability problems and ensure the app runs smoothly across various device configurations and operating systems.

Resource Consumption and Battery Optimization

Efficient resource management is key to minimizing battery drain. The US Bank mobile app employs techniques to reduce background processes, minimize unnecessary data transfers, and optimize image loading. These strategies are crucial for users with limited battery life, ensuring the app can be used throughout the day without excessive drain. The app should minimize background activity to maintain optimal battery life.

Compatibility with Devices and Operating Systems

The app’s compatibility with various mobile devices and operating systems is vital for a broad user base. Testing across different models, screen sizes, and operating system versions is essential. This ensures a consistent user experience regardless of the user’s device choice.

Performance Across Network Conditions

The app’s performance under various network conditions is also a critical factor. Robust network handling is crucial to enable reliable access to banking services, even in areas with limited connectivity. The app must support a wide range of network speeds and types, from high-speed Wi-Fi to slower cellular data connections. Appropriate error handling and alternative loading mechanisms are used to ensure that the app continues to function in areas with limited connectivity.

User Complaints and Feedback

User feedback regarding app performance is gathered through various channels, including app store reviews, customer support interactions, and internal surveys. This feedback is crucial in identifying areas for improvement and ensuring the app continues to meet user needs. Analyzing this data can reveal common pain points and areas requiring attention, such as slow loading times or frequent crashes.

Performance Comparison to Competitors

| Platform | Performance Score |

|---|---|

| iOS | 4.5 out of 5 |

| Android | 4.2 out of 5 |

This table provides a preliminary comparison of the US Bank mobile app’s performance across different platforms. Further analysis is needed to determine the precise factors that influence these scores. This example data should be considered preliminary and subject to future refinement. Benchmarking against competitors is ongoing to ensure continuous improvement.

Customer Support and Feedback

The US Bank mobile app prioritizes providing a seamless and helpful customer experience. Effective support channels and clear feedback mechanisms are crucial for addressing user concerns and enhancing the overall app experience. This section details the support options available, feedback processes, and the resolution procedures for common issues.

Customer Support Channels

The app offers multiple avenues for accessing customer support. This allows users to choose the method that best suits their needs and circumstances.

| Support Channel | Description | Availability |

|---|---|---|

| In-app Help | The app provides readily available in-app help resources, including FAQs, tutorials, and step-by-step guides for common tasks. These resources are designed to assist users with resolving issues independently. | 24/7 |

| Customer Service Phone Number | A dedicated customer service phone number allows users to speak directly with a representative for personalized assistance. | Business hours |

| Online Chat | Real-time online chat allows users to connect with a support agent for immediate assistance. | Business hours |

| Email Support | Users can submit inquiries or report issues via email, enabling detailed explanations and documentation. | 24/7 (response time may vary) |

Feedback Mechanisms

Users can provide feedback and report issues through several methods. These channels allow the bank to gather valuable insights and continuously improve the app.

- In-app Feedback Forms:

- Customer Service Contact Forms:

- Social Media Channels:

The app offers in-app forms for providing feedback, allowing users to express their opinions and suggestions. These forms often allow users to rate their experience and provide specific details about issues or desired improvements.

Dedicated online forms provide a way to contact customer service for assistance or feedback. These forms often require users to provide details about their issue or feedback to ensure appropriate and efficient handling.

The US Bank mobile app utilizes social media platforms for customer engagement. This enables users to interact with the bank, voice concerns, or share feedback.

Resolution Process for Common Issues

The resolution process for common issues within the US Bank mobile app is generally efficient and well-defined. Users can expect prompt responses and assistance in resolving their issues.

- In-app Help Resources:

- Support Representatives:

- Ticket System:

Many issues are addressed through the app’s in-app help resources, saving time and effort for users.

Support representatives are trained to handle a variety of issues, including account access, transaction inquiries, and technical problems. They are equipped to offer personalized assistance and solutions.

For more complex or nuanced issues, the bank likely employs a ticket system to track and manage cases, ensuring proper follow-up and resolution.

Overall Customer Support Experience

US Bank aims to provide a positive and efficient customer support experience. The various channels and resources available within the mobile app contribute to a streamlined resolution process for users. The goal is to empower users to effectively manage their accounts and solve problems through intuitive in-app tools and support channels.

Customer Reviews and Feedback

Customer reviews and feedback are a crucial indicator of the overall user experience. Positive feedback highlights successful aspects of the app, while negative feedback identifies areas needing improvement. Analysis of these reviews is used to make improvements to the app’s usability and functionality.

Last Point

In conclusion, the US Bank mobile app presents a well-rounded banking solution. While offering a user-friendly interface and various financial tools, potential areas for improvement exist in the app’s performance, particularly in specific network conditions. Ultimately, the app’s effectiveness hinges on the user’s individual needs and priorities. Customer support channels are available, but a more robust in-app help system could enhance the overall user experience.