UBA app download is more than just a digital tool; it’s a gateway to a streamlined and secure financial experience. This comprehensive guide explores the intricacies of the UBA mobile application, from its fundamental functionalities to the meticulous security measures in place. We’ll delve into the user-friendly interface, the process of downloading and installation, and highlight the key features that enhance financial management.

This guide will walk you through the steps of downloading the UBA app, outlining the various features and functionalities available to users. We’ll also cover the crucial aspects of security and privacy, essential for maintaining the integrity of your financial transactions. Ultimately, this resource aims to provide a clear understanding of the UBA app and its value proposition.

Introduction to the UBA App

The UBA mobile application provides a convenient and secure platform for managing your UBA accounts on the go. It streamlines various banking activities, enabling users to access their financial information and perform transactions efficiently, anytime, anywhere. This comprehensive mobile banking solution offers a range of functionalities designed to cater to the diverse needs of UBA customers.

Key Functionalities

The UBA mobile app offers a wide array of features designed to simplify banking procedures. These features encompass account management, payment processing, fund transfers, and more. These functionalities are seamlessly integrated to provide a user-friendly experience for all users.

Target Audience

The UBA mobile app is designed for a broad spectrum of users, including individual account holders, business owners, and corporate clients. Its comprehensive features cater to a diverse range of financial needs and preferences.

Features and Functionalities

The table below details the key features and functionalities of the UBA mobile app.

| Feature | Functionality |

|---|---|

| Account Management | View account balances, transaction history, and details for multiple accounts. Users can also update their personal information and manage security settings within the app. |

| Payments | Initiate and manage various payment types, including bill payments, utility payments, and merchant payments. The app often integrates with popular payment gateways and allows for secure and efficient transactions. |

| Transfers | Perform both inter- and intra-bank transfers with ease and speed. The app usually provides real-time transaction updates and confirmation. Users can also set up recurring transfers and manage transfer limits. |

| Investment Management | Access and manage investment portfolios, view investment performance, and initiate investment transactions. This feature might include investment tracking and reporting, as well as access to investment-related information. |

| Security Features | Benefit from robust security measures like two-factor authentication and biometric logins to safeguard account information and prevent unauthorized access. The app often provides a detailed security overview to guide users on best practices. |

| Customer Support | Gain access to customer support channels within the app, enabling users to quickly resolve inquiries or issues with the support team. This can include a help center, FAQs, or live chat support. |

Downloading and Installation

The UBA mobile app provides convenient access to various financial services on the go. Downloading and installing the app is a straightforward process, enabling users to seamlessly manage their accounts and transactions. This section details the process for different devices and app stores.

Downloading the UBA App

The UBA app is available for download across various platforms, ensuring accessibility for a wide range of users. The app is optimized for both Android and iOS devices. Downloading from the appropriate app store ensures compatibility and a smooth user experience.

Installation Steps

This section Artikels the steps for installing the UBA app on both Android and iOS devices. Following these instructions ensures a successful installation and a functional app.

- Android Devices: Open the Google Play Store app. Search for “UBA Mobile App” and select the official UBA app from the results. Tap the “Install” button to begin downloading. Once downloaded, tap the “Open” button to launch the app.

- iOS Devices: Open the Apple App Store app. Search for “UBA Mobile App” and select the official UBA app from the results. Tap the “Get” button to begin downloading. Once downloaded, tap the “Open” button to launch the app.

Requirements for Using the UBA App

Certain requirements must be met to use the UBA mobile app effectively. These requirements ensure a secure and seamless user experience. A compatible device running a supported operating system and a stable internet connection are essential for optimal performance.

- Device Compatibility: The UBA app is optimized for various Android and iOS devices. Users should ensure their device meets the minimum specifications for optimal functionality.

- Operating System: The UBA app is designed to be compatible with specific versions of Android and iOS. Ensure your operating system is updated to the supported version for a smooth experience.

- Internet Connectivity: A stable internet connection is necessary for accessing and using the UBA app. This includes features like account management, fund transfers, and other transactions.

Step-by-Step Guide for Downloading and Installing the UBA App

This step-by-step guide simplifies the process for both Android and iOS users.

- Open the relevant app store (Google Play Store for Android, Apple App Store for iOS).

- Search for “UBA Mobile App” and select the official app.

- Tap the “Install” (Android) or “Get” (iOS) button to initiate the download.

- Allow the installation to proceed. This might involve granting permissions for the app.

- Once downloaded, tap “Open” to launch the app.

- Follow the on-screen prompts for account setup and verification, if applicable.

User Interface and Navigation

The UBA mobile app prioritizes a user-friendly interface, aiming for intuitive navigation. This design approach is crucial for seamless access to financial services, allowing users to manage their accounts effectively. The layout and design elements are carefully considered to minimize complexity and maximize usability.

The app’s interface is designed with a clean, modern aesthetic, ensuring a positive user experience. The navigation is straightforward, allowing users to quickly locate the features they need. Clear visual cues and concise text descriptions further enhance usability, making the app accessible to a wide range of users.

Layout and Design

The UBA app employs a material design aesthetic, featuring a predominantly light-toned color palette with accents of a specific brand color. This creates a visually appealing and uncluttered interface. The layout is organized into distinct sections, each dedicated to a specific function, like account management, transactions, and payments. This structure enables users to quickly identify and access the information they require.

Ease of Navigation

Navigation within the app is intuitive. Users can easily switch between different sections using clear and concise menu options. The app’s design incorporates logical grouping of features and clear labeling, making it effortless for users to find what they need. Search functionality is also available for advanced searching, allowing users to find specific transactions or account details quickly.

Common User Interface Elements

The UBA app utilizes standard mobile banking interface elements. These include icons, buttons, and text fields for input. These elements are consistently used throughout the app, contributing to a familiar and predictable user experience. The use of clear visual cues, such as color-coding and icons, aids in distinguishing different types of transactions or account details.

Comparison with Other Mobile Banking Apps

| Feature | UBA App | Other App |

|---|---|---|

| Navigation | Intuitive, clear menu structure, logical grouping of features, and search functionality. | Navigation may be less intuitive or have a less structured approach. |

| Design | Clean, modern aesthetic, predominantly light-toned color palette with specific brand accents. | May use a different design aesthetic, including darker tones or different color schemes. |

| Account Information | Detailed account information is clearly presented. | Presentation of account information might be less comprehensive or visually appealing. |

| Security Features | Security measures are prominently displayed. | Security measures might be less prominent. |

This table provides a general comparison. Specific features and implementation might vary across different mobile banking applications.

Key Features and Functions

The UBA mobile app offers a comprehensive suite of financial tools, designed to streamline various banking transactions and enhance user experience. These features cater to a broad spectrum of financial needs, from everyday account management to complex transactions.

The app empowers users with convenient access to their accounts, enabling efficient management of funds, payments, and investments. This accessibility and functionality contribute to improved financial literacy and control.

Account Management

The app provides a straightforward way to monitor your financial standing. Real-time account balance information is readily available, allowing users to stay informed about their current account status. This feature enables proactive financial planning and decision-making.

- Balance Inquiry: Users can quickly check their account balances for all linked accounts, providing an instant overview of their financial situation. This feature eliminates the need for phone calls or visits to a branch.

- Transaction History: A detailed history of all transactions is available for review. This allows users to track their spending patterns and identify potential discrepancies, enabling greater financial transparency.

Funds Transfer

The app streamlines the process of transferring funds between accounts, both within UBA and to other banks. This facilitates easy and secure money movement, promoting efficiency in personal and business finances.

- Inter-Account Transfers: Funds can be transferred effortlessly between various accounts held with UBA, simplifying budget management and facilitating transactions within the user’s financial network.

- Inter-Bank Transfers: Users can initiate transfers to accounts held at other banks. This allows for seamless financial transactions across various institutions, enhancing the versatility of the app.

Bill Payments

The app streamlines the process of paying bills, enabling users to schedule payments and track their progress. This feature enhances the overall user experience by integrating a comprehensive billing management system.

- Utility Bills: Users can pay electricity, water, and other utility bills directly from the app. This avoids the need for separate payments and ensures timely bill settlements.

- Other Bills: The app allows users to pay a variety of other bills, including credit card payments, insurance premiums, and subscriptions. This consolidates bill payment activities into a single platform, enhancing convenience and saving time.

Investment Management (Optional Feature)

Some UBA app versions include investment tools. These tools provide a convenient way to manage investments within the app.

- Investment Portfolios: Users can view and manage their investment portfolios. This offers a centralized platform to track investment performance and monitor their financial progress.

- Investment Transactions: The app allows users to track investment transactions, providing insights into their investment activity.

Advantages and Disadvantages

| Advantages | Disadvantages |

|---|---|

| Convenience and ease of use | Potential for security breaches if not used securely |

| Access to accounts anytime, anywhere | Limited functionality in some app versions |

| Streamlined financial transactions | Dependence on network connectivity |

| Improved financial management | App may not be available in all regions |

| Real-time updates | User interface might require adjustment for some |

Security and Privacy

The UBA mobile app prioritizes the security and privacy of its users’ financial data. Robust security measures are in place to protect sensitive information from unauthorized access and misuse. This section details the implemented security protocols and user account protection strategies, along with the app’s privacy policies and terms of service.

The app’s security infrastructure is designed to safeguard user information throughout the entire transaction process. Advanced encryption techniques and multi-layered authentication protocols are employed to ensure the confidentiality and integrity of user data.

Data Protection Measures

The UBA app utilizes industry-standard encryption protocols to protect sensitive data transmitted between the app and the UBA servers. This ensures that even if an unauthorized party intercepts the data, it remains unreadable and unusable. Furthermore, the app employs secure data storage methods on its servers, which are regularly audited to maintain compliance with security best practices.

Account Security

Maintaining a secure account is crucial for safeguarding your financial information. Users can implement several strategies to enhance their account security. Strong passwords, coupled with two-factor authentication (2FA), significantly bolster account protection. 2FA adds an extra layer of security by requiring a second verification step, typically via a text message or authenticator app, before transactions can be processed. Regularly reviewing account activity for any unauthorized transactions is also critical. Users should promptly report any suspicious activity to the UBA support team.

Privacy Policies and Terms of Service

The UBA app’s privacy policy Artikels how user data is collected, used, and protected. This document provides transparency regarding data usage and user rights. The policy clearly defines the permissible uses of personal information, ensuring that user data is handled responsibly and ethically. The app’s terms of service describe the acceptable use of the app and Artikel the legal agreements between the user and UBA. Understanding these policies is vital for ensuring responsible use of the app and compliance with the stipulated terms.

Customer Support and Help

The UBA mobile app prioritizes user experience and provides comprehensive support channels to address any issues or queries promptly. This section details the available support options, ensuring users can effectively resolve problems and maximize their app usage.

UBA’s customer support system aims to provide efficient and helpful solutions for app-related inquiries. This includes accessible FAQs, detailed help documents, and direct contact methods.

Contacting UBA Customer Support

UBA offers multiple avenues for contacting customer support, ensuring accessibility for users. Users can choose the method most convenient for them.

- Phone Support: A dedicated phone line is available for users to speak directly with a support representative. This allows for immediate assistance and clarification on complex issues.

- Email Support: Users can submit inquiries via email, allowing for detailed explanations and documentation of the problem. This method facilitates a written record for tracking and follow-up.

- Live Chat: A live chat feature allows for real-time interaction with support agents. This is beneficial for quick responses and immediate resolutions to common problems.

Support Channels for the App

Various support channels enhance the user experience and provide multiple ways to resolve issues.

- Frequently Asked Questions (FAQs): A comprehensive FAQ section addresses common app-related queries, providing quick answers to typical user problems. Users can often find solutions without needing to contact support directly, saving time and effort.

- Help Documents: Detailed help documents offer in-depth explanations and instructions for using the app’s features and functions. These resources are valuable for users seeking a deeper understanding of specific functionalities.

- Help Center: A dedicated help center provides a central hub for all support materials. This ensures that users can easily locate relevant information and guides for different functionalities of the app, ensuring easy navigation.

Efficiency of UBA’s Customer Support

UBA’s commitment to providing efficient customer support is evident through its diverse channels and readily available resources. The quick response times and comprehensive support options contribute to a positive user experience. UBA’s dedication to resolving user issues efficiently is a key aspect of their customer-centric approach.

UBA App Support Options:

– FAQs

– Help Center

– Contact Us

– Phone Support

– Email Support

– Live Chat

Alternatives and Competitors

The UBA app competes in a crowded mobile banking market. Understanding the features and strengths of competing apps helps users make informed decisions. A comparative analysis highlights areas where UBA excels and identifies potential areas for improvement.

A comprehensive review of competitor applications provides a clearer picture of the mobile banking landscape. This analysis considers various factors, including fees, transaction speed, and customer support, to offer a nuanced perspective on UBA’s position within the market.

Direct Competitors and Their Key Features

Several mobile banking applications offer similar services to the UBA app. These competitors often focus on specific strengths, such as faster transaction speeds or user-friendly interfaces. Key features of direct competitors often include features like international money transfers, investment options, and a range of payment solutions.

Comparison of UBA App with Competitors

The following table contrasts the UBA app with a few prominent competitors in terms of key features. This comparison highlights potential advantages and disadvantages of choosing the UBA app over alternatives.

| Feature | UBA App | Example Competitor App (GTBank Mobile) |

|---|---|---|

| Fees | UBA typically charges fees for certain transactions, such as international money transfers or ATM withdrawals outside the network. Fees vary based on transaction type and amount. | GTBank charges fees for international money transfers and ATM withdrawals outside the network, similar to UBA. Fees depend on transaction type and amount. |

| Transaction Speed | UBA app generally aims for a quick transaction processing time, with varying speeds depending on the type of transaction and network conditions. | GTBank’s mobile app typically prioritizes transaction speed, aiming for swift processing of transactions. Actual speed can vary. |

| Customer Support | UBA offers various customer support channels, including phone support, email, and online chat. Response times and efficiency vary depending on the channel and demand. | GTBank offers similar customer support options, including phone support, email, and online chat. Response times and efficiency vary depending on the channel and demand. |

Mobile Banking Trends

Mobile banking is rapidly evolving, driven by technological advancements and changing customer expectations. This dynamic landscape presents both opportunities and challenges for financial institutions like UBA. Staying ahead of these trends is crucial for maintaining a competitive edge and providing a superior user experience.

Current Trends in Mobile Banking

Mobile banking platforms are increasingly integrated with other financial services and lifestyle apps, fostering seamless experiences. This trend reflects a shift towards holistic financial management, offering customers a comprehensive view of their financial health and facilitating convenient access to various services. For instance, many users now expect to be able to pay bills, manage investments, and track spending within the same mobile app.

Emerging Technologies and Innovations

Several technologies are driving innovation in mobile banking. Biometric authentication, such as fingerprint or facial recognition, is becoming more prevalent, offering a secure and convenient alternative to traditional passwords. AI-powered chatbots and virtual assistants are improving customer service by providing instant support and resolving common issues quickly. Furthermore, the adoption of open banking initiatives allows for greater integration with third-party financial applications, providing users with more choices and personalized financial services.

Impact on the UBA App

These trends are impacting the UBA app by demanding enhancements in security, integration, and personalized features. The app needs to incorporate robust biometric security measures to cater to the growing adoption of biometric authentication. Moreover, seamless integration with other financial services and lifestyle apps will be crucial for delivering a comprehensive user experience. Finally, personalized recommendations and proactive financial advice based on AI analysis will be necessary to keep pace with the increasing demand for personalized financial services.

Examples of Recent Mobile Banking Innovations

Several recent innovations demonstrate the evolving nature of mobile banking. Some banks have introduced AI-powered budgeting tools that analyze spending patterns and provide personalized recommendations for saving and investing. Others have integrated peer-to-peer (P2P) payment features within their mobile apps, allowing customers to send and receive money from other users seamlessly. Furthermore, the increasing adoption of open banking is enabling users to connect their accounts with third-party financial management tools, offering a broader range of options for financial management.

Illustrative Use Cases

The UBA mobile app provides a wide range of functionalities designed to enhance the banking experience for its users. This section demonstrates practical use cases, showcasing how the app simplifies various financial tasks and offers a convenient alternative to traditional banking methods.

The app’s intuitive design and user-friendly interface make it accessible to users of all technical proficiencies. These examples highlight how the UBA app streamlines daily financial activities, from basic transactions to complex financial management.

Managing Personal Finances

The UBA app offers comprehensive tools for managing personal finances. Users can easily monitor their account balances, track transactions, and create budgets. This feature empowers users to make informed financial decisions.

- Account Balance Check: Users can instantly view their account balances for all linked accounts, including savings, current, and investment accounts, providing a clear overview of their financial position. This allows for quick assessment of funds available for immediate transactions or long-term planning.

- Transaction History: Detailed transaction history allows users to review all transactions made within a specified period, categorized by type and amount. This feature aids in understanding spending patterns and identifying potential discrepancies or fraudulent activities.

- Budgeting Tools: The app provides tools to help users create and track budgets, enabling them to allocate funds efficiently and monitor their progress toward financial goals. This function supports users in developing sound financial habits and ensuring they stay within their budget constraints.

Sending and Receiving Money

The UBA app simplifies money transfers between users and businesses.

- Inter-Account Transfers: Users can quickly transfer funds between their various UBA accounts (e.g., current, savings) with just a few taps. This eliminates the need for manual transfers through physical branches or other channels, making transactions efficient and convenient.

- Person-to-Person Payments: The app allows users to send and receive money to other UBA app users quickly and securely, eliminating the need for physical checks or cash transfers. This is a valuable feature for peer-to-peer transactions, such as settling bills or making payments to friends and family.

- Business Payments: The app enables users to make payments to businesses directly through the app, facilitating transactions such as utility bill payments or subscriptions.

Investment Management

The app facilitates investment management by providing a platform to access and manage investment accounts.

- Investment Portfolio Overview: The app offers a clear overview of the user’s investment portfolio, displaying investment holdings, values, and performance. This feature allows users to monitor the growth and value of their investments.

- Investment Tracking: The app tracks the performance of investments, allowing users to monitor the value of their investments and understand the potential returns over time.

- Fund Transfer: The UBA app enables the transfer of funds between different investment accounts within the platform, providing a seamless and secure way to manage investments.

Illustrative Image Examples (Descriptions):

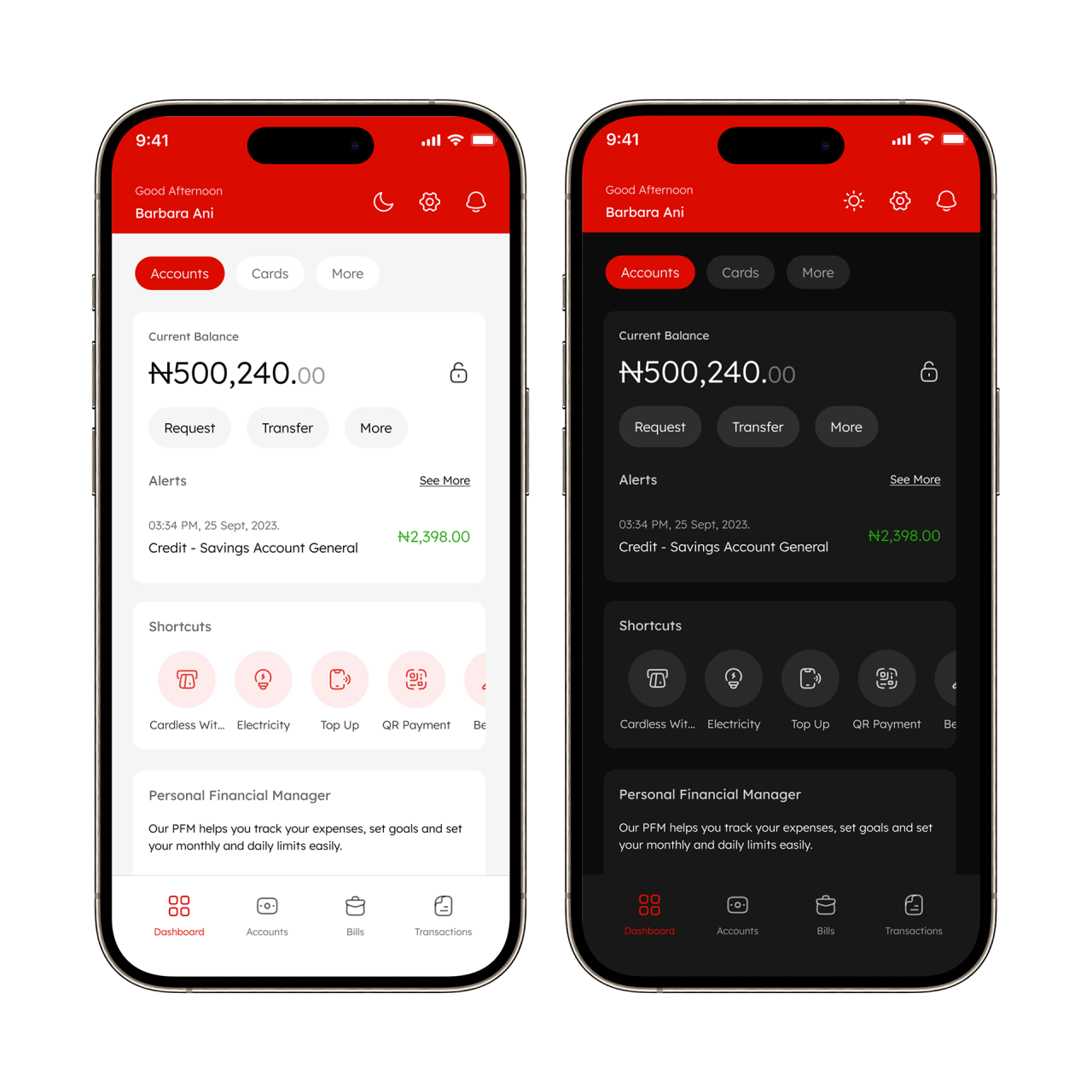

Image 1: Displays the user interface for checking account balances. The screen clearly shows the account name, balance, and transaction history. A graph visualizes the balance trend over time. This demonstrates the ease of accessing and understanding financial information.

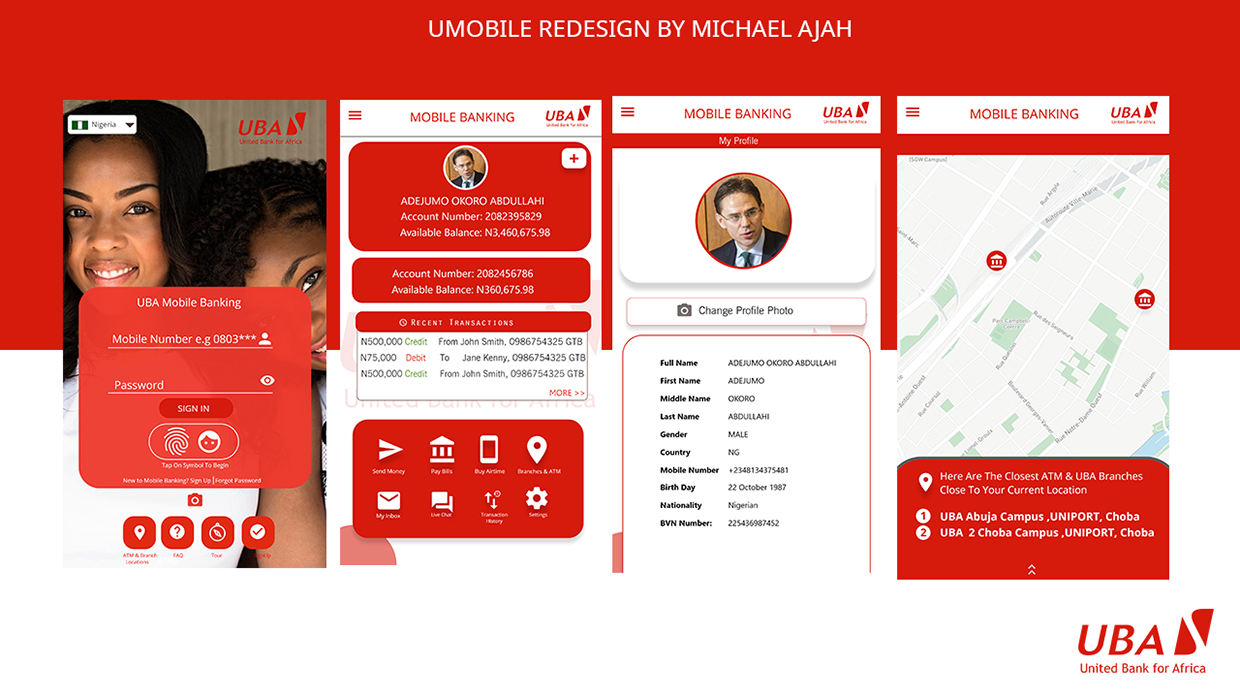

Image 2: Shows the user interface for initiating a person-to-person transfer. Fields for recipient’s account number or mobile number, and the amount to be transferred are clearly visible. The image highlights the speed and simplicity of sending money through the app.

Image 3: Depicts the user interface for viewing investment portfolios. The screen displays a summary of the investments, their current values, and recent performance. This visual representation provides a quick overview of investment performance and helps users track their investment growth.

Final Review

In conclusion, the UBA app offers a robust and user-friendly mobile banking platform. From seamless account management to secure transactions, the app addresses the needs of modern financial users. This guide has provided a comprehensive overview of the app, covering its installation, features, security protocols, and customer support. By understanding the nuances of the UBA app, users can confidently navigate the digital landscape of mobile banking.