Accounting software has revolutionized how businesses manage finances, moving from tedious manual methods to streamlined digital platforms. This evolution has brought about a multitude of options, from basic general ledger systems to sophisticated enterprise solutions. Understanding the diverse types, features, and implementation strategies is crucial for businesses seeking to optimize their financial processes. This guide delves into the world of accounting software, exploring its history, functionality, implementation, and benefits.

Choosing the right accounting software requires careful consideration of various factors, including budget, scalability, and integration needs. This article will provide a comprehensive overview, comparing different types of software and highlighting key features to aid in your decision-making process.

Introduction to Accounting Software

Accounting software has revolutionized the way businesses manage their financial data, evolving from tedious manual methods to sophisticated digital platforms. This transformation has streamlined processes, reduced errors, and empowered businesses to make data-driven decisions. From small startups to multinational corporations, accounting software has become an indispensable tool for efficient financial management.

A Brief History of Accounting Software Development

The journey of accounting software began with simple tools for manual calculations, gradually evolving into complex systems. Early adopters used calculators and spreadsheets to manage their financial records. The advent of personal computers marked a turning point, paving the way for dedicated accounting software packages. The 1980s and 1990s witnessed the rise of desktop accounting software, offering more functionality and ease of use compared to manual methods. This led to increased efficiency and accuracy in financial reporting. Subsequently, the internet and cloud computing technologies brought about a new era of accounting software, enabling access from anywhere and anytime. This accessibility and enhanced features have transformed the accounting landscape for businesses of all sizes.

Evolution from Manual Methods to Digital Platforms

The transition from manual accounting methods to digital platforms has been gradual but profound. Initially, businesses relied on physical ledgers, journals, and invoices. This method was time-consuming, prone to errors, and offered limited analytical capabilities. The introduction of accounting software automated many tasks, including data entry, calculations, and reporting. This automation significantly reduced manual effort and improved accuracy. Digital platforms further streamlined processes by enabling real-time data access, enhanced collaboration, and advanced reporting features. This has empowered businesses to make informed decisions based on up-to-date financial information.

Different Types of Accounting Software

Accounting software encompasses a wide range of applications designed to manage various aspects of a business’s finances. General ledger software manages accounts, tracking debits and credits. Accounts payable software handles vendor invoices and payments. Inventory management software helps track stock levels and costs. Other specialized applications exist for specific industries or business functions. These diverse types of software address different aspects of financial operations, contributing to the overall efficiency of financial management.

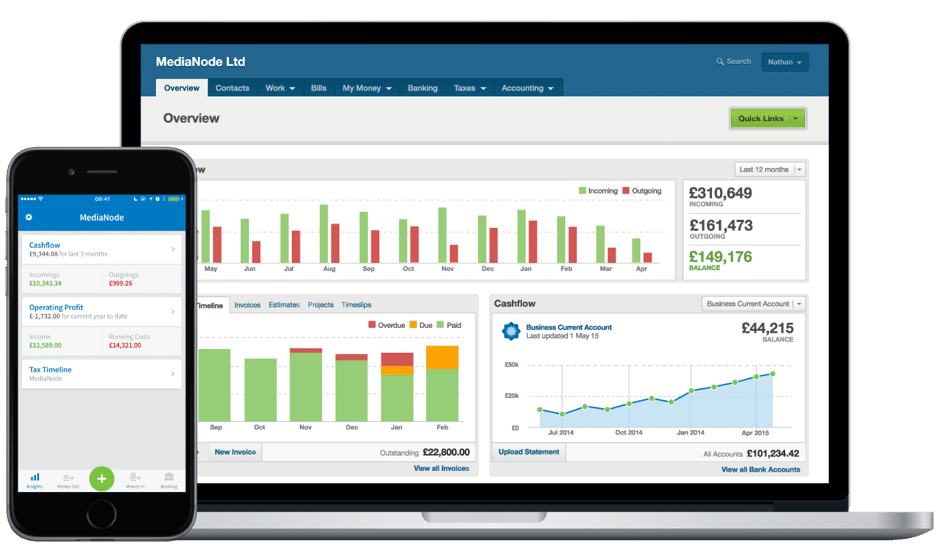

Key Features of Modern Accounting Software

Modern accounting software boasts a multitude of features that enhance efficiency and decision-making. These include automated data entry, streamlined workflows, real-time reporting, and advanced analytics capabilities. Modern systems can integrate with other business applications, enabling a seamless flow of information across the organization. Financial reporting and analysis tools are often built into the software, providing key insights into financial performance. Security features are also crucial to protect sensitive financial data.

Benefits of Using Accounting Software

Using accounting software offers a plethora of benefits over manual methods. Automation significantly reduces errors and saves time, allowing accounting personnel to focus on strategic tasks. Real-time data access enables better decision-making and improved financial management. Improved accuracy in financial reporting reduces the risk of errors and ensures compliance with accounting standards. The ability to generate various reports and financial statements allows for better financial analysis and forecasting. Furthermore, software solutions enhance data security and compliance.

Comparison of Accounting Software Types

| Feature | Cloud-Based | On-Premise | Small Business | Enterprise |

|---|---|---|---|---|

| Cost | Generally lower upfront cost, subscription-based fees | Higher upfront cost for software and hardware | Lower cost options tailored to specific needs | High cost, often customized solutions |

| Scalability | Highly scalable, easily adaptable to growing needs | Scalability can be limited by hardware and infrastructure | Designed for manageable growth and expansion | Extremely scalable, supporting large volumes of data and users |

Cloud-based accounting software typically offers lower upfront costs, allowing businesses to avoid large initial investments. On-premise software requires significant investment in hardware and software upfront. Small business solutions are often more affordable and easier to implement, while enterprise solutions are designed for large organizations with complex needs. Scalability is a key differentiator, with cloud-based options being highly adaptable to growth.

Implementation and Integration

Implementing accounting software is a critical step for any business seeking to streamline its financial operations. A well-executed implementation process not only ensures the software meets the business’s needs but also minimizes disruption and maximizes the return on investment. Successful integration with existing systems is equally important for maintaining data integrity and avoiding redundant processes.

The implementation process encompasses several key stages, from initial planning to post-implementation support. Careful planning, thorough data migration, and a well-defined integration strategy are vital for a smooth transition. Understanding the various methods for integrating accounting software with other systems and troubleshooting potential issues are essential for long-term success.

Implementation Steps

A structured approach to implementation is crucial for minimizing disruptions and ensuring a successful transition. This involves careful planning, thorough testing, and a phased approach to deployment.

- Needs Assessment: This initial step involves evaluating the current accounting processes, identifying pain points, and determining the specific requirements of the new software. Consider factors like business size, industry, and future growth plans.

- Software Selection: Based on the needs assessment, select accounting software that best aligns with the business’s requirements and budget. Thoroughly research different options and compare features, functionalities, and pricing models.

- Data Migration Planning: This is a critical stage. A well-defined plan for migrating existing data to the new system is essential to avoid data loss or corruption. This involves assessing the data, creating a migration strategy, and testing the process thoroughly.

- System Configuration: Configure the software according to the business’s specific needs, setting up user roles, permissions, and other parameters. This stage ensures that the software operates effectively within the company’s workflows.

- Training and Support: Provide comprehensive training to all users on how to effectively utilize the new accounting software. Establish a clear support structure for ongoing assistance and problem resolution.

- Go-Live and Post-Implementation Support: Execute a phased implementation, allowing for a smooth transition. Monitor the software’s performance post-implementation and provide ongoing support to address any issues that may arise.

Data Migration and Conversion

Accurate data migration is paramount for maintaining the integrity of financial records. Incorrect data can lead to significant errors and complications.

- Data Validation: Thoroughly validate the data before migration to identify and correct any inconsistencies or errors. This includes checking for completeness, accuracy, and format compliance.

- Data Transformation: If necessary, transform the data to conform to the new accounting software’s data structures. This might involve converting formats, data types, or other modifications.

- Data Cleansing: Cleanse the data to remove duplicates, irrelevant entries, and any other anomalies. This ensures data accuracy and efficiency within the new system.

Integration Methods

Integrating accounting software with other business systems is essential for seamless data flow. Different integration methods cater to various needs and complexities.

- API Integration: Using Application Programming Interfaces (APIs) allows for direct communication and data exchange between different systems. This method is ideal for real-time data synchronization.

- File-Based Integration: This method involves exchanging data through files (e.g., CSV, Excel). While simpler, it might not offer real-time updates and may require manual intervention.

- Third-Party Integration Tools: Employing dedicated integration tools facilitates the connection of different software systems. These tools automate data exchange and reduce manual effort.

Troubleshooting Common Implementation Issues

Anticipating and addressing potential issues during implementation is crucial. Having a proactive approach can minimize downtime and maintain a smooth transition.

- Data Errors: Identify and resolve data errors during migration to prevent inaccuracies in the new system.

- User Resistance: Address user concerns and resistance to the new software through effective training and communication.

- System Conflicts: Resolve any conflicts or compatibility issues between the new accounting software and existing systems.

Choosing the Right Accounting Software

Selecting the right accounting software is crucial for any business, ensuring smooth financial operations and accurate reporting. A well-chosen system can streamline workflows, reduce errors, and provide valuable insights into financial performance. The wrong choice, however, can lead to inefficiencies, increased costs, and difficulties adapting to changing business needs. This section delves into the key factors for making an informed decision.

Factors to Consider in Software Selection

Choosing accounting software is not a one-size-fits-all process. Businesses must carefully evaluate their specific needs and requirements to ensure compatibility and effectiveness. Critical factors include the size and structure of the business, industry-specific needs, and anticipated future growth.

Evaluating Software Based on Business Needs

A comprehensive evaluation process involves scrutinizing the software’s features and functionalities to determine their alignment with the business’s unique requirements. This includes assessing the software’s capacity to handle different transaction types, its reporting capabilities, and its integration potential with other systems. For example, a retail business will require different functionalities compared to a manufacturing company. Specific features like inventory management, point-of-sale integration, and detailed cost accounting are critical for retailers.

Questions to Ask Potential Vendors

Thorough vendor evaluation is vital for selecting the right accounting software. Asking pertinent questions about the software’s functionalities, pricing models, and support services will provide valuable insight into the software’s strengths and weaknesses. Critical questions include inquiries about scalability, integration capabilities, customer support, and training resources. These questions will highlight the vendor’s commitment to client satisfaction and provide insights into the software’s reliability.

Pricing Models and Subscription Options

Pricing models vary significantly among accounting software providers. Businesses need to compare different subscription options, considering factors like the number of users, features included, and potential add-on costs. One common model is a tiered pricing structure, offering varying levels of functionality at different price points. Another is a subscription-based model, where the software is accessed on a monthly or annual basis. Understanding these nuances is vital for budgetary planning and cost management.

Scalability and Future Growth

The chosen accounting software should accommodate the business’s projected growth. A solution with limited scalability can hinder expansion and potentially require costly upgrades or migrations in the future. Businesses should consider the software’s ability to handle increasing transaction volumes and user numbers as the company evolves. For example, a startup that anticipates significant growth within the next few years should select a scalable solution to prevent future complications.

User Training and Support

Effective user training and support are integral to the successful implementation of accounting software. Vendors offering comprehensive training programs and readily available support resources demonstrate a commitment to user satisfaction and minimize the learning curve. Consider the quality and accessibility of online resources, FAQs, and dedicated support teams when evaluating different software options. Comprehensive training ensures that employees can effectively utilize the software and maximize its benefits.

Benefits and Advantages of Using Accounting Software

Accounting software has revolutionized the way businesses manage their financial operations. Its adoption has led to significant improvements in efficiency, accuracy, and compliance, enabling businesses to make more informed decisions. This enhanced visibility into financial data empowers strategic planning and fosters sustainable growth.

The implementation of accounting software streamlines financial processes, reducing manual errors and freeing up valuable time for more strategic tasks. This ultimately translates to higher productivity and profitability. Furthermore, the software’s analytical capabilities provide a deeper understanding of financial performance, allowing for proactive adjustments and improved decision-making.

Impact on Efficiency and Productivity

Accounting software automates many repetitive tasks, such as data entry, invoice processing, and reconciliation. This automation significantly reduces the time spent on manual processes, freeing up employees to focus on more complex and strategic tasks. Businesses can accomplish more with the same workforce, leading to increased productivity and efficiency. For example, a small retail business using accounting software can process invoices and reconcile accounts significantly faster than if they were done manually.

Accuracy and Error Reduction

Accounting software minimizes human errors by automating calculations and data entry. The software enforces data consistency and integrity, reducing the likelihood of errors. For instance, if an invoice is entered with an incorrect amount, the software can flag it for review, preventing errors in financial statements and reports. The built-in validation checks and error-proofing features in modern accounting software help maintain the integrity of financial records. The risk of miscalculations and transcription errors is greatly minimized.

Role in Financial Reporting and Analysis

Accounting software provides a comprehensive platform for generating financial reports, such as balance sheets, income statements, and cash flow statements. These reports offer valuable insights into a company’s financial health. Moreover, the software allows for various financial analyses, including trend analysis, ratio analysis, and variance analysis, providing detailed information to track performance and identify areas for improvement. Detailed reports help business owners and managers make better, more informed decisions.

Importance of Timely and Accurate Financial Data

Timely and accurate financial data is crucial for informed decision-making. Accounting software ensures that financial information is readily available and accessible, enabling businesses to make timely decisions. For instance, a business can quickly identify a decline in sales and take immediate corrective actions if the software provides a real-time view of sales data. The software facilitates rapid response to changes in the market and allows businesses to react to opportunities and challenges in a proactive manner.

Advantages for Compliance and Regulatory Reporting

Accounting software helps businesses meet their compliance and regulatory reporting requirements. The software can generate reports tailored to specific regulatory standards, such as GAAP or IFRS. This feature simplifies the process of meeting compliance requirements and reduces the risk of penalties or legal issues. For example, many accounting software solutions offer specific features to comply with local tax regulations. Proper reporting and adherence to standards are essential for maintaining a company’s legitimacy and reputation.

Impact of Automation on Staff Workload

Automation through accounting software reduces the workload for accounting staff. By automating routine tasks, accounting software allows staff to focus on more complex tasks, such as financial analysis, strategic planning, and client management. This leads to increased staff efficiency and reduced staff burnout. Staff can dedicate their time to higher-value activities, which is vital for long-term business success. For example, an accountant can spend less time on data entry and more time on interpreting financial statements, leading to a more efficient and productive work environment.

Case Studies and Real-World Applications

Accounting software has revolutionized the way businesses manage their finances. Its adaptability and efficiency have led to widespread adoption across various sectors. This section delves into practical applications, showcasing how successful implementations have transformed financial processes and driven business success.

Successful implementations of accounting software frequently involve a meticulous understanding of the specific needs of the business. By tailoring the software to address unique challenges and opportunities, companies can maximize its potential to improve financial management.

Retail Industry Example

A small clothing boutique, “Threads of Style,” initially struggled with manual record-keeping. Inaccurate inventory tracking led to stockouts and overstocking, impacting profitability. Implementing accounting software allowed “Threads of Style” to track inventory levels in real-time. This enabled proactive ordering and minimized losses. Improved cash flow management, facilitated by the software’s automated invoicing and payment tracking, resulted in more predictable revenue streams. The software also streamlined reporting, enabling better decision-making regarding pricing strategies and product offerings. Ultimately, “Threads of Style” experienced a significant boost in profitability and operational efficiency.

Manufacturing Industry Example

A medium-sized manufacturing company, “Precision Components,” faced challenges in managing complex production processes and tracking costs. The traditional method of manual data entry was prone to errors and time-consuming. By implementing an integrated accounting software solution, “Precision Components” streamlined its cost accounting. The software automated the tracking of materials, labor, and overhead costs, leading to accurate and detailed cost reports. This improvement allowed the company to optimize production processes, leading to significant cost reductions and improved profitability. Real-time access to financial data empowered managers to make informed decisions regarding pricing, resource allocation, and production schedules.

Hypothetical Scenario: A Small Bakery

Imagine “Sweet Sensations,” a small bakery. They use accounting software to manage their daily transactions. The software automates tasks such as recording sales, processing payments, and generating invoices. This automation frees up the bakery staff to focus on core baking operations. The software allows them to track inventory levels of ingredients, enabling them to predict ingredient needs and place orders efficiently. Real-time cash flow reports enable them to manage expenses effectively, ensuring the business has the necessary funds to cover operational costs and future growth. The bakery can use this data to make strategic decisions, such as identifying popular items and adjusting production based on demand.

Customization and Tailoring

Accounting software is not a one-size-fits-all solution. Many systems offer customization options, allowing businesses to adapt the software to their specific needs. This tailoring enhances the software’s effectiveness and usability. Customizable features might include specific reporting formats, unique workflows, or custom integrations with other business systems. This level of customization allows businesses to ensure the software aligns precisely with their operations, fostering greater efficiency and improved financial outcomes.

Impact on Financial Processes

Accounting software significantly impacts financial processes by automating tasks, improving data accuracy, and providing real-time insights. Automation reduces manual errors, freeing up personnel for more strategic tasks. Enhanced data accuracy leads to more reliable financial reports and better decision-making. Real-time insights allow businesses to respond swiftly to changing market conditions and operational needs. This, in turn, contributes to greater profitability and improved financial health.

Cash Flow Management

Accounting software plays a pivotal role in managing cash flow. Features like automated invoice generation and payment tracking enable businesses to streamline their cash inflows and outflows. This feature provides businesses with real-time visibility into their cash position, helping them anticipate potential shortfalls and optimize financial resources. Regular cash flow reports help businesses identify trends and make necessary adjustments to ensure they maintain a healthy cash balance. For example, “Sweet Sensations” uses the software to track customer payments and automate invoice generation. This leads to predictable revenue streams and minimized financial risks.

Summary

In conclusion, accounting software is no longer a luxury but a necessity for businesses of all sizes. Its ability to automate processes, enhance accuracy, and improve financial reporting makes it an indispensable tool for informed decision-making. By carefully evaluating the available options and understanding the implementation process, businesses can leverage accounting software to optimize their financial operations and achieve their strategic goals.