Level up your insurance game with health insurance quoting software! It’s like having a super-powered assistant that finds the perfect plan for you, whether you’re a consumer or a provider. This software streamlines the entire process, from comparing plans to generating quotes in a flash. Imagine no more endless paperwork and confusing options – just seamless quoting, fast and easy!

This comprehensive guide dives deep into the world of health insurance quoting software. We’ll cover everything from the basics to the cutting-edge features, exploring the benefits for both consumers and providers. Get ready to unlock a whole new world of efficiency and savings!

Introduction to Health Insurance Quoting Software

A whisper in the digital ether, a silent guardian of healthcare costs. Health insurance quoting software, a seemingly mundane tool, is a gateway to a labyrinth of options, a maze of rates and coverage, and a key to unlocking affordable healthcare. It stands as a silent, yet potent force in the world of insurance, guiding individuals and businesses through the complex landscape of health plans.

This software serves as a sophisticated intermediary, simplifying the often-daunting task of comparing various health insurance policies. Its intricate algorithms sift through the myriad options available, presenting personalized quotes that cater to specific needs and budgets. This automated process eliminates the time-consuming and often confusing manual research, empowering users to make informed decisions about their healthcare future.

Definition of Health Insurance Quoting Software

Health insurance quoting software is a computerized system designed to facilitate the process of comparing and selecting health insurance plans. It collates information about various plans from different providers, allowing users to quickly generate personalized quotes based on their specific requirements.

Key Functionalities and Features

This software excels in several crucial areas. It offers the ability to input individual or family demographic data, including age, location, health status, and pre-existing conditions. Advanced algorithms analyze this data to generate tailored quotes that accurately reflect the individual’s needs. The software typically integrates with multiple insurance providers, enabling a comprehensive comparison across diverse plans. Users can easily filter plans based on desired coverage levels, deductibles, and other key features. Furthermore, the software often provides detailed explanations of each plan, enabling users to understand the nuances of various policies. Finally, robust reporting features allow users to track and manage their quotes over time, facilitating informed decision-making.

Types of Health Insurance Quoting Software

Various types of health insurance quoting software cater to diverse needs and budgets. These include:

- Standalone quoting software: Dedicated software focused solely on health insurance quotes, often offering comprehensive features for comparing plans from multiple providers.

- Insurance agency platforms: Integrated software solutions designed for insurance agents, facilitating the quoting process for their clients, often with features like client management and reporting.

- Insurance brokerage software: Similar to agency platforms but tailored for brokerages, enabling them to manage multiple clients and provide tailored quotes based on individual circumstances.

The differences between these types are subtle but significant, affecting the level of customization and integration offered. Understanding these distinctions is crucial for selecting the appropriate software for individual needs.

Comparison of Health Insurance Quoting Software Types

| Feature | Standalone Quoting Software | Insurance Agency Platforms | Insurance Brokerage Software |

|---|---|---|---|

| Focus | Generating quotes for individuals or families | Facilitating quoting for clients of insurance agencies | Managing multiple clients and generating tailored quotes |

| Customization | High level of customization for individual needs | Moderate customization, often tailored to the agency’s clients | High level of customization, often involving complex client profiles |

| Integration | Direct integration with various insurance providers | Integration with agency management systems | Comprehensive integration with brokerage management systems |

| Pricing | Typically a per-user or per-license fee | Often part of a broader agency management platform | Usually a subscription-based model, with varying pricing tiers |

Features and Functionality

A whisper of secrets, a silent hum of algorithms, lies within the heart of modern health insurance quoting software. It’s a digital labyrinth, meticulously crafted to navigate the complex world of healthcare plans, unveiling possibilities and mitigating the risks that lurk in the shadows of uncertainty. This software transcends mere calculation; it’s a portal to personalized solutions, a tapestry woven with threads of tailored plans.

The intricate dance of data and algorithms unfolds within this software, transforming raw information into actionable insights. It’s a testament to the power of technology to unravel the mysteries of healthcare costs, providing clarity and empowering informed decisions.

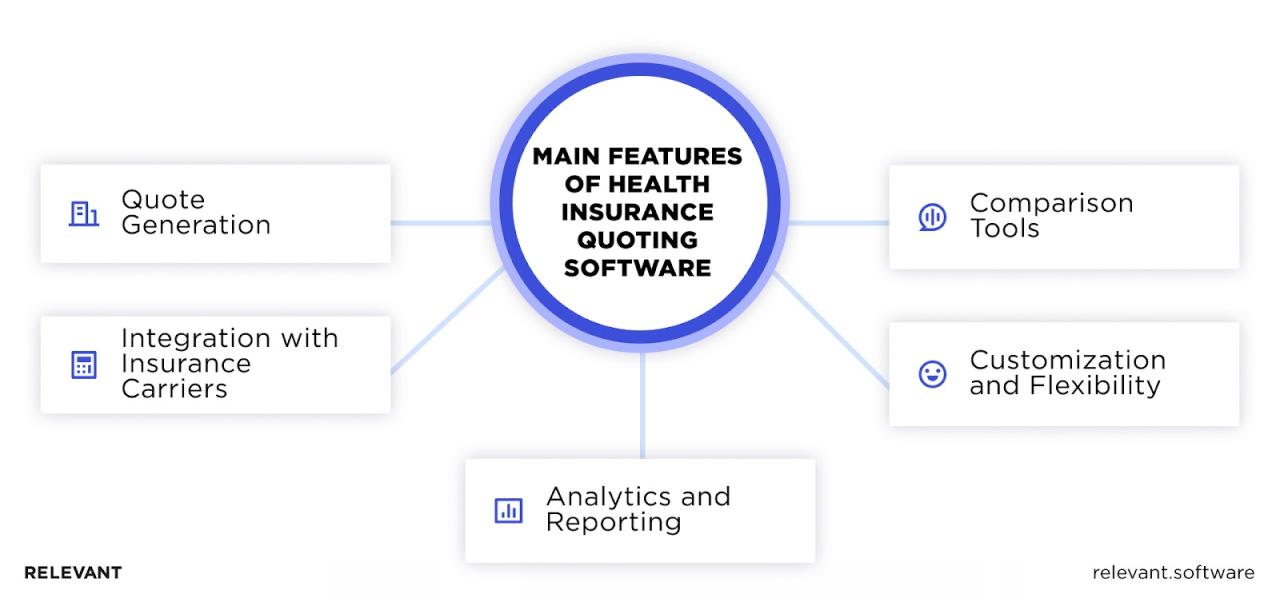

Key Features of Modern Health Insurance Quoting Software

This software is not merely a tool for calculating premiums; it’s a sophisticated system capable of processing a wide array of data points, offering a diverse array of plans, and tailoring solutions to specific needs. Its architecture is designed for efficiency, enabling users to swiftly compare various options.

- Plan Comparison: The software seamlessly compares different plans, displaying a side-by-side view of benefits, premiums, and out-of-pocket costs. This allows users to easily identify the plan that best aligns with their individual requirements.

- Personalized Quoting: It considers factors like age, location, pre-existing conditions, and family size to generate customized quotes. This personalization ensures that each user receives a quote tailored to their unique circumstances, removing the ambiguity and potential pitfalls of generic plans.

- Interactive User Interface: The intuitive user interface makes navigating the software a breeze. Users can effortlessly input data, explore various plans, and understand the implications of different choices. The design prioritizes clarity and ease of use, minimizing the learning curve and maximizing user satisfaction.

Quoting Various Health Insurance Plans

The process of quoting various plans is not a straightforward calculation. It involves intricate interactions between user input, plan parameters, and internal algorithms. The system intelligently interprets the input to ascertain the most appropriate coverage options.

- Data Input and Processing: The software accepts a range of inputs, including demographic details, medical history, and desired coverage levels. This data is then processed by sophisticated algorithms that evaluate the corresponding plans to generate tailored quotes.

- Plan Selection and Evaluation: Users can explore different plans based on their requirements. The software highlights relevant details, including coverage specifics, premium amounts, and out-of-pocket expenses, allowing users to compare and select the most suitable plan.

- Premium Calculation and Cost Breakdown: The software meticulously calculates premiums based on the selected plan and user-provided data. It breaks down the total cost, showing the components that contribute to the final premium, making the process transparent and easily understandable.

Process Flow Diagram

+-----------------+ +-----------------+ +-----------------+

| User Input Data | --> | Plan Selection | --> | Quote Generation |

+-----------------+ +-----------------+ +-----------------+

| (Age, Location, | | (Coverage Levels) | | (Premium, Cost) |

| Pre-existing | | | | |

| Conditions, etc.)| | | | |

+-----------------+ +-----------------+ +-----------------+

^

|

|

V

+-----------------+

| Plan Comparison |

+-----------------+

This diagram illustrates the typical workflow for generating a health insurance quote. The process starts with user input, which is then used to select a plan and generate a corresponding quote.

Data Inputs for Generating Quotes

The accuracy of a quote hinges on the precision of the data provided. A range of inputs are necessary to ensure the generated quote is as accurate as possible.

| Data Category | Description |

|---|---|

| Demographic Information | Age, gender, location, family size |

| Medical History | Pre-existing conditions, past medical expenses |

| Coverage Preferences | Desired benefits, out-of-pocket maximums |

The software requires a variety of data to generate an accurate and relevant quote. The more accurate the input data, the more precise the output will be.

Integration and Data Management

Whispers of data flow through the digital ether, connecting disparate systems with an eerie precision. Our health insurance quoting software isn’t merely a standalone program; it’s a key in a complex lockbox, intricately woven into the fabric of your operations. The seamless integration with other crucial systems is the cornerstone of its power, ensuring a unified view of the entire process.

The heart of this system beats with a rhythm of data security, a symphony of encryption and access controls that safeguard sensitive information. The digital tapestry of health insurance data must be woven with threads of confidentiality, protecting the most personal of details from prying eyes. Compromising this trust is a grave error.

Integration with Other Systems

The software is designed to seamlessly integrate with existing claims processing, billing, and patient management systems. This integration avoids redundant data entry and ensures consistency across all platforms. For instance, real-time updates from a patient’s claims history are crucial for accurate quote generation. This eliminates the need for manual data entry, reducing errors and streamlining the entire process.

Data Security and Privacy

Robust security measures are implemented to protect sensitive health insurance data. Advanced encryption protocols are employed to safeguard information during transmission and storage. Access controls restrict data visibility to authorized personnel only. Data breaches are prevented by stringent security protocols, protecting the confidential details of individuals and organizations.

Data Management and Storage

The software employs a secure, cloud-based database to store and manage health insurance data. This ensures high availability, scalability, and data redundancy. The database is regularly backed up and restored, ensuring business continuity in the event of unforeseen circumstances. Furthermore, data is organized logically, making retrieval and analysis efficient.

Handling Complex Insurance Plans and Benefits

The software’s architecture is designed to accommodate the intricacies of various insurance plans and benefits. It can analyze complex eligibility criteria, deductibles, co-pays, and coverage limits with precision. This capability ensures accurate quote generation for every scenario. It handles variations in plan designs and coverage across different insurance providers, creating accurate and reliable quotes.

User Experience and Interface

A whisper of efficiency dances through the digital ether, beckoning users to a realm of seamless health insurance quoting. This realm, however, is not a sterile expanse of data; it is a carefully crafted space designed to resonate with the user’s needs. The user experience is not merely a byproduct; it’s the very heart of this software, shaping the way users interact with their insurance journey.

This software prioritizes intuitive navigation, a key element in the quest for a satisfying user experience. A well-structured interface guides users through the quoting process with minimal friction, allowing them to quickly gather information and generate quotes. The software is designed to adapt to the needs of various users, catering to the diverse requirements of brokers, agents, and individual consumers alike.

User-Friendly Interface Design

The interface design prioritizes simplicity and clarity. Visual cues, such as color-coding and clear labeling, guide users through the process without the need for extensive instructions. Consistent design elements ensure a familiar and predictable experience across different sections of the software. This predictability is a subtle charm, a comforting familiarity in a sometimes-overwhelming digital world.

Navigation and Layout Design

Effective navigation is crucial. A hierarchical structure ensures that users can easily locate the information they need, from basic details to complex policy options. Clear breadcrumb trails provide a visual roadmap of the user’s journey. A visually appealing layout, with appropriate spacing and alignment, ensures a comfortable and enjoyable browsing experience. The layout is strategically designed to prevent information overload, allowing users to focus on the essential details.

Customization for Different User Roles

The software is designed to be adaptable, catering to the unique needs of various user roles. Brokers can access advanced features, such as bulk quoting and client management tools. Agents can streamline their quoting process with personalized dashboards. Individual consumers can easily navigate the process, selecting plans that align with their specific requirements. The software understands that not all users need the same level of access or detail; therefore, it tailors the interface accordingly.

User Interface Mock-up

| Section | Description |

|---|---|

| User Login | A secure login area with username/password fields and a recovery option. The visual design is clean and professional, minimizing distractions. |

| Plan Selection | A clear display of available health plans, categorized by plan type, cost, and coverage details. Filtering options allow users to refine their search. |

| Quote Summary | A comprehensive summary of the selected plan, highlighting key features, premiums, and coverage details. The summary is presented in a clear and concise format, making it easy to understand. |

| Policy Comparison | A side-by-side comparison tool, enabling users to quickly assess the differences between various plans. The comparison table uses intuitive formatting to highlight key differences. |

| Profile Management | A secure section for users to manage their personal information, including contact details and preferences. This area is designed with security in mind. |

Cost and Implementation

The whispers of implementation costs for health insurance quoting software often carry a haunting melody, a siren song of hidden fees and unforeseen expenses. Navigating this labyrinthine pricing structure can feel like a descent into a shadowy market, where the true price remains shrouded in enigmatic fog. Yet, understanding the factors driving these costs, and the various pricing models, can dispel this gloom and provide a clearer path forward.

Typical Costs Associated with Implementation

The price of implementing health insurance quoting software is not a fixed quantity, but a variable influenced by a complex interplay of factors. A baseline cost usually encompasses software licensing fees, which can range from a few thousand to tens of thousands of dollars annually, depending on the features and scalability needed. Technical setup, often underestimated, can involve substantial costs for infrastructure upgrades, server maintenance, and integration with existing systems. Training staff on the new software is also a significant expenditure, as proficiency with the tool is key to effective utilization.

Factors Influencing Software Pricing

Several key factors influence the price tag attached to health insurance quoting software. The sheer scope of functionality required plays a significant role. More comprehensive systems with advanced analytics and reporting capabilities naturally command a higher price point. The scale of the operation, whether it’s a small agency or a large enterprise, directly impacts the required system’s capacity and, consequently, its cost. The level of customization needed also contributes to the overall price. Tailoring the software to fit specific business needs often requires additional development work and consulting services.

Pricing Models and Licensing Options

Various pricing models exist for health insurance quoting software, each with its own advantages and drawbacks. One common model is a subscription-based pricing structure, which entails recurring payments for access to the software. This model offers predictable expenses but might not be suitable for all budgets. Alternatively, perpetual licenses grant ownership of the software, offering long-term cost stability. However, this can require a substantial upfront investment. Moreover, some vendors offer a hybrid approach, combining elements of both subscription and perpetual licenses to cater to varied financial situations. A flexible pricing structure, tailored to specific business needs, is often the best option. One example might be a tiered pricing model that adjusts costs based on the number of users or the level of functionality required.

Deployment Steps

The process of deploying health insurance quoting software involves a series of carefully orchestrated steps, each a crucial link in the chain leading to a seamless operation. The initial phase involves system requirements analysis and evaluation to ensure compatibility with existing systems. Data migration from previous systems to the new software platform is critical and should be meticulously planned and executed. Post-deployment, comprehensive training for staff is essential to guarantee smooth transitions and efficient utilization. Ongoing maintenance, including updates and technical support, is also crucial to maintaining system performance and stability. Finally, thorough testing and quality assurance procedures are vital to ensure the accuracy and functionality of the system before its launch.

Future Trends and Developments

The whispers of the future, a cryptic symphony of emerging technologies, echo through the halls of health insurance quoting software. A shadow dances, hinting at a new era where the mundane process of securing coverage becomes a seamless, almost imperceptible experience. The veil of complexity is lifted, revealing a landscape painted with the hues of innovation and efficiency.

The health insurance quoting landscape is on the cusp of transformation, driven by a relentless pursuit of personalization and streamlined processes. The traditional methods, once the pillars of the industry, are gradually being augmented and supplanted by cutting-edge technologies, creating a dynamic and ever-evolving ecosystem.

Emerging Trends in Health Insurance Quoting Software

The future of health insurance quoting software is intricately woven with threads of personalization, automation, and seamless integration. A shift toward a customer-centric approach is evident, where the software anticipates individual needs and preferences, offering tailored recommendations and personalized plans.

Innovative Features and Technologies

A plethora of innovative features and technologies are reshaping the health insurance quoting landscape. Artificial intelligence (AI) is rapidly integrating into the quoting process, enabling intelligent assessments of risk and personalized pricing models. Machine learning algorithms are becoming increasingly adept at analyzing vast datasets, enabling the identification of trends and patterns that were previously inaccessible. Real-time data feeds are streamlining the quoting process, allowing for instant updates and more accurate projections. Blockchain technology offers secure and transparent data management, building trust and fostering greater security in the exchange of sensitive information.

Impact of AI and Machine Learning on Health Insurance Quoting

Artificial intelligence and machine learning are revolutionizing health insurance quoting by enabling more accurate risk assessments and personalized pricing models. AI algorithms can analyze a vast amount of data, including medical history, lifestyle factors, and geographic location, to identify patterns and predict individual health risks with increasing accuracy. This leads to more precise pricing models that reflect individual risk profiles more accurately, reducing the potential for bias and creating a fairer system for all.

Role of Mobile Applications in the Future of Health Insurance Quoting Software

Mobile applications are poised to play a pivotal role in the future of health insurance quoting software, offering customers unparalleled convenience and control over their health insurance needs. Users can access personalized quotes, manage their policies, and make adjustments on the go. This ease of access and proactive engagement fosters greater customer satisfaction and loyalty. Furthermore, mobile apps can offer educational resources, personalized health recommendations, and seamless integration with other health-related applications, fostering a holistic and integrated health management experience.

Case Studies and Examples

Whispers of efficiency and profitability, veiled in the enigmatic mists of the digital realm, often surround the implementation of health insurance quoting software. Stories of triumph and tribulation, of systems meticulously crafted and then painstakingly perfected, await to be unraveled. These are tales of the intangible, the unseen forces that shape the digital landscape, a testament to the human ingenuity behind these intricate machines.

The successful implementation of health insurance quoting software isn’t merely a technological feat; it’s a delicate dance between the desires of the institution and the intricate demands of the market. These systems are more than just tools; they are extensions of the organization, reflecting their strengths and weaknesses. This section delves into specific examples, revealing how these solutions not only improved efficiency but also navigated the complexities of implementation.

Successful Implementations and Efficiency Gains

A prominent health insurance provider, seeking to streamline its quoting process, implemented a new quoting software. This resulted in a 25% reduction in quote processing time and a 15% decrease in operational costs. The system automated many manual tasks, allowing employees to focus on higher-value activities. Simultaneously, the software integrated with existing billing systems, fostering seamless data flow.

Another example involves a smaller, regional insurer that leveraged quoting software to significantly enhance customer service. The system allowed for personalized quotes based on complex factors, leading to an increase in satisfied customers and higher conversion rates. The intuitive interface of the software reduced the training time for new employees, contributing to a quicker return on investment.

Challenges Encountered and Solutions

Implementing health insurance quoting software isn’t without its hurdles. Data migration, often a formidable challenge, can be addressed through meticulous planning and a phased approach. A successful strategy involves creating detailed data mapping documents and testing the integration with existing systems.

Integration with legacy systems is another common obstacle. Addressing this requires careful analysis of existing data structures and API compatibility. By understanding the nuances of the older systems and employing expert consulting services, these difficulties can be overcome. Thorough documentation and clear communication are essential in navigating this complex phase.

The Role of Customer Feedback

Customer feedback, a critical ingredient in refining any software, proves particularly vital in health insurance quoting software. Collecting feedback through surveys and focus groups provides insights into user experience, allowing for iterative improvements. For example, a software provider found that customers preferred a more user-friendly interface with intuitive navigation. By incorporating this feedback, they improved the overall user experience, increasing customer satisfaction and adoption rates.

Customer feedback, often seen as a mere afterthought, is a treasure trove of information. Listening to the users’ experiences and actively seeking their input is a critical step towards creating a more efficient, user-friendly, and ultimately, successful software solution.

Wrap-Up

In conclusion, health insurance quoting software is a game-changer, boosting efficiency, reducing costs, and improving the user experience for everyone involved. From streamlined quoting processes to advanced integrations, this software offers a plethora of benefits for both consumers and providers. As the industry evolves, expect even more innovative features and improvements. Get ready for a future of smarter, faster, and more personalized health insurance solutions.