Small business owners, are you drowning in spreadsheets and struggling to keep track of your finances? Xero Accounting offers a powerful, cloud-based solution to streamline your accounting processes, freeing up your time and energy for what matters most: growing your business. This comprehensive guide delves into the features, setup, and best practices of Xero, helping you understand how this software can revolutionize your financial management.

From invoicing and payments to reporting and integrations, we’ll cover everything you need to know to confidently navigate the world of Xero. We’ll also explore how Xero can be tailored to specific business types, from sole proprietorships to nonprofits, and examine industry-specific use cases. Plus, we’ll provide practical examples and real-world success stories to inspire you.

Introduction to Xero Accounting

Tired of spreadsheets that make your eyes glaze over? Xero Accounting is like a friendly, digital accountant, ready to handle your business’s finances with a smile (and maybe a few witty comments about your spending habits). It’s designed to streamline your bookkeeping, making it easier to track income, expenses, and everything in between. Imagine a world where your financial records are organized, accessible, and instantly understandable – that’s the Xero experience.

Xero Accounting is a cloud-based accounting software specifically designed for small businesses and freelancers. It’s not just about recording transactions; it’s about empowering you to make informed decisions about your business. From invoicing and expense tracking to reporting and analysis, Xero helps you stay on top of your finances and focus on what matters most: growing your business.

Core Features and Benefits

Xero offers a suite of features designed to simplify the accounting process. These include intuitive invoicing tools, automated expense tracking, and robust reporting capabilities. This helps you quickly generate financial reports and stay on top of your cash flow. Xero’s user-friendly interface is a huge plus for anyone, even those with limited accounting experience.

User Base

Xero’s target audience is broad, encompassing a variety of businesses and individuals. Small businesses, sole proprietors, and freelancers find Xero particularly helpful due to its straightforward approach and affordability. It’s not just for those with a million-dollar budget; it’s tailored to make financial management accessible to everyone, regardless of business size. It’s like having a personalized accountant in your pocket, available 24/7, without the exorbitant fees.

Xero Accounting Plans and Pricing

Choosing the right Xero plan is crucial for your business needs. Here’s a breakdown of the different options, so you can pick the one that best suits your budget and requirements:

| Plan | Monthly Price | Key Features |

|---|---|---|

| Starter | $12.50 | Basic invoicing, expense tracking, and reporting. Perfect for new businesses or those with minimal needs. |

| Essentials | $25.00 | Enhanced features like inventory management and more comprehensive reporting. Suitable for businesses with increasing transaction volumes. |

| Premium | $50.00 | All the features of the Essentials plan, plus advanced payroll and subscription management. Ideal for businesses with complex financial needs. |

Note: Prices are subject to change. Contact Xero for the most up-to-date information.

Xero Accounting Features

Tired of spreadsheets that look like a cat walked across them? Xero Accounting is here to save the day (and your sanity). This isn’t your grandma’s accounting software; it’s a sleek, modern system designed to make managing your finances as effortless as ordering a pizza online. Let’s dive into the amazing features that make Xero the talk of the town.

Xero offers a comprehensive suite of tools for handling everything from invoicing to reporting. It’s like having a personal financial assistant that never takes a coffee break (or gets distracted by shiny objects). Whether you’re a freelancer hustling solo or a small business owner juggling a million tasks, Xero is your trusty sidekick.

Invoicing and Payments

Xero streamlines the invoicing process, making it a breeze to send professional invoices and track payments. Imagine effortlessly creating customized invoices with just a few clicks, complete with all the necessary details. You can even send them directly to your clients via email, ensuring that they get the message and don’t miss out on your hard work. Xero handles payment processing seamlessly, letting you track payments in real-time and automatically categorize them. This ensures you always know where your money is and when you’ll get paid.

Reporting and Analytics

Xero’s reporting features are a game-changer for any business. It provides insightful reports that help you understand your financial performance in a clear and concise manner. These reports can cover everything from profit and loss statements to cash flow forecasts. Imagine having all this data at your fingertips, ready to be analyzed. You can easily spot trends, identify areas for improvement, and make smarter business decisions.

Expense Tracking and Management

Managing expenses is a crucial aspect of running a business. Xero makes expense tracking a painless process. With just a few clicks, you can record expenses, categorize them, and automatically categorize receipts to simplify your accounting. You can even attach receipts directly to the expense entries. Xero’s system keeps everything organized and easily accessible. Imagine effortlessly seeing which departments are spending the most and identifying cost-cutting opportunities.

Comparison with Other Accounting Software

| Feature | Xero | QuickBooks | FreshBooks |

|---|---|---|---|

| Ease of Use | Excellent, user-friendly interface | Good, but can be overwhelming for beginners | Very user-friendly, intuitive |

| Invoicing | Robust, customizable options | Good, but limited customization | Simple, effective for freelancers |

| Reporting | Comprehensive, insightful reports | Good, but may require extra steps for advanced reporting | Basic reporting, but good for tracking income |

| Expense Tracking | Streamlined expense categorization | Good expense tracking, but not as automated | Simple expense tracking, limited categorization |

This table provides a basic comparison of Xero’s features with other popular accounting software options. It highlights the key differences and strengths of each, helping you make an informed decision. Remember that the best software for you depends on your specific needs and business size.

Setting Up Xero Accounting

Welcome to the exhilarating world of Xero! Setting up your Xero account is like building a digital fortress for your finances. It’s not rocket science, but it does require a little bit of attention to detail. Think of it as laying the groundwork for a successful financial future. Get ready to conquer your accounting with Xero!

Setting up your Xero account is the crucial first step to harnessing its power. It’s akin to establishing a command center for your business finances. Proper setup ensures accurate reporting, streamlined workflows, and ultimately, a clearer picture of your financial health. The more meticulous you are in this initial phase, the smoother the ride will be in the long run.

Creating Your Xero Account

This involves providing basic business information like your name, address, and the type of business you run. Remember to choose a strong password that you won’t forget – you don’t want to be locked out of your digital treasury!

Adding Users and Roles

Adding users and assigning roles is crucial for managing access to your Xero account. Think of it like assigning different levels of security clearance in a high-security facility. Give each team member the exact permissions they need, preventing accidental oversights and safeguarding your sensitive financial data.

- To add a user, navigate to the ‘Settings’ section and then select ‘Users’. You’ll be prompted to enter the user’s details and assign them a role.

- Roles define the level of access each user has. A ‘Bookkeeper’ might be able to enter transactions, while an ‘Administrator’ can handle everything, including account settings.

- Careful consideration of roles prevents unauthorized access to critical data, making your financial operations more secure.

Connecting Bank Accounts and Credit Cards

Connecting your bank accounts and credit cards to Xero is like giving Xero a direct line to your financial transactions. This seamless integration allows for automatic bank feeds and reconciliation, significantly reducing the manual effort in keeping your financial records up-to-date.

- Xero’s bank feed feature automatically imports transactions from your bank accounts. This automated process saves you a lot of time and effort. It’s like having a personal financial assistant who handles the tedious work for you.

- Connecting your credit cards is equally important, especially for businesses that use credit cards for transactions. It ensures a complete picture of your financial activities, enabling better financial planning.

- Ensure the bank accounts and credit cards are correctly linked to avoid any data mismatches and potential errors in financial reporting.

The Importance of Accurate Data Entry

Accurate data entry is the bedrock of reliable financial reporting. It’s like building a house on solid foundations; without it, your entire financial structure will be compromised. Xero’s reports and insights are only as good as the data you feed it. Enter transactions accurately to avoid costly errors and ensure a clear financial picture.

Common Setup Errors and Solutions

- Error: Incorrect bank account details entered.

- Solution: Double-check the account details. Use the exact routing numbers and account numbers provided by your bank.

- Error: Issues with connecting your bank account.

- Solution: Ensure the bank account supports online banking. Check if your internet connection is stable.

- Error: Difficulty adding users or assigning roles.

- Solution: Refer to Xero’s support documentation for specific guidance. The help resources are comprehensive and helpful.

Xero Accounting for Specific Business Types

Xero, the digital accounting darling, isn’t just for one size fits all businesses. It’s like a chameleon, adapting to the unique needs of various enterprises. From the solopreneur hustling in their pajamas to the multinational corporation navigating a complex global market, Xero has a feature for you. Let’s dive into how Xero’s flexible framework can be tailored for different business types.

Sole Proprietorships: The Solo Act

Sole proprietorships, the entrepreneurial one-person shows, often find accounting a bit daunting. Xero simplifies the process. It streamlines income tracking, expense management, and invoice generation, making it a breeze for solopreneurs to keep tabs on their financial health. Imagine no more frantic scribbling in notebooks – Xero’s intuitive interface helps you maintain a clear picture of your financial journey.

Small Businesses: The Power of Teamwork

Small businesses, those dynamic hubs of activity, need a system that’s both user-friendly and powerful enough to handle the growing demands. Xero’s robust features can help with everything from invoicing and expense tracking to managing multiple accounts and reporting on performance. With Xero, you can keep your small business on track and your finances organized, no matter how busy things get.

Multiple Locations: Navigating the Spread

Running a business with multiple locations can be like herding cats – but with Xero, it’s more like orchestrating a symphony. Xero’s system lets you track transactions from different sites, manage inventory across locations, and generate reports that show the performance of each branch. This provides a clear picture of the financial health of each part of your operation, allowing for better decision-making.

Non-Profits: The Impactful Approach

Non-profits are about more than just money; they’re about impact. Xero, with its dedication to transparency, offers specialized tools to track donations, manage expenses, and fulfill regulatory requirements for non-profits. It’s a powerful tool for maximizing the impact of your organization’s efforts, while keeping everything organized and transparent.

Xero Suitability Comparison Table

| Business Type | Xero’s Strengths | Potential Challenges |

|---|---|---|

| Sole Proprietorship | Intuitive interface, easy invoicing, streamlined expense tracking. | May need limited customization for complex needs. |

| Small Business | Scalable, robust features for growing needs, excellent inventory management. | Learning curve for complex integrations. |

| Multiple Locations | Centralized reporting, streamlined inventory tracking, flexible location management. | Potential need for specialized integrations for international transactions. |

| Non-Profit | Transparent reporting, compliance tools, dedicated support for donation tracking. | Specific reporting requirements may require customization. |

Xero Accounting Integrations

Tired of juggling multiple apps for your business? Xero, thankfully, understands your pain. It’s like having a Swiss Army knife for accounting—it’s not just good at one thing, it’s great at many! Xero’s integration with other business tools is a game-changer, allowing you to seamlessly connect your financial data with other crucial parts of your operations.

Xero’s integration strategy isn’t just about linking things; it’s about streamlining your entire workflow. Imagine effortlessly transferring data from your sales platform to your accounting software, all in one go. This smooth data flow reduces errors, saves you time, and frees you up to focus on what truly matters—growing your business.

Xero’s Integration Ecosystem

Xero boasts a vast network of integrations, making it a versatile solution for businesses of all sizes. This ecosystem of connected apps is a real lifesaver for entrepreneurs who don’t want to spend hours manually transferring data. It’s like having a super-powered assistant who handles all the tedious tasks.

Popular Third-Party Integrations

Xero seamlessly integrates with numerous popular business applications, enhancing its functionality beyond just accounting. These integrations cover everything from inventory management to customer relationship management (CRM). This allows you to get a holistic view of your business operations.

- E-commerce Platforms: Xero integrates with platforms like Shopify and WooCommerce. This means you can automatically sync sales data from your online store directly into your Xero account, eliminating the need for manual data entry. No more tedious copy-pasting!

- Invoicing and Payment Processing: Integrating Xero with payment gateways like Stripe and PayPal allows for automated invoice creation and payment processing. This simplifies the entire invoicing process, and you can say goodbye to late payments and unpaid invoices.

- Customer Relationship Management (CRM) Tools: Integrating Xero with CRMs like HubSpot and Zoho enables the seamless flow of customer data. This helps you to maintain detailed customer profiles and track sales interactions all within one platform.

- Inventory Management Systems: Connecting Xero with inventory management systems ensures accurate tracking of stock levels and automatically updates your accounting records with purchase and sales data. This helps you avoid stockouts and overstocking issues.

Integration Pros and Cons Table

This table highlights the advantages and potential drawbacks of specific Xero integrations, providing a comprehensive overview for informed decision-making.

| Integration | Pros | Cons |

|---|---|---|

| Shopify | Automatic data sync, improved sales tracking, streamlined reporting. | Potential for slight delays in data transfer, complexity in configuring the initial integration. |

| Stripe | Automated payment processing, simplified invoicing, reduced payment errors. | Limited customization options, possible integration fees. |

| HubSpot | Enhanced customer relationship management, improved sales pipeline tracking, better sales insights. | Steeper learning curve for some users, possible need for additional training. |

| Zoho Inventory | Accurate stock tracking, automatic inventory updates, improved inventory management. | Requires familiarity with both platforms, potential data incompatibility issues. |

Streamlining Workflows with Integrations

Xero integrations dramatically streamline workflows, enabling a more efficient and effective business operation. Imagine this: a customer places an order online, the order data automatically updates your inventory and accounting systems, and the customer receives an invoice. This is the power of seamless integrations!

Xero Accounting Training and Support

Feeling overwhelmed by Xero? Don’t worry, you’re not alone! Learning new accounting software can feel like deciphering ancient hieroglyphics, but fear not, fellow entrepreneurs. Xero provides a plethora of resources to help you navigate the world of spreadsheets and invoices with confidence. We’ll cover everything from online tutorials to direct support, so you can conquer Xero and start focusing on what truly matters: growing your business!

Xero’s support system is designed to be as user-friendly as possible. Whether you’re a seasoned accountant or a complete novice, you’ll find assistance readily available. From detailed documentation to helpful FAQs, Xero is committed to empowering you with the tools you need to thrive.

Xero Support Documentation

Xero’s support documentation is a goldmine of information. It covers a wide range of topics, from basic setup to advanced features. Think of it as your very own personal Xero encyclopedia. You can find answers to frequently asked questions, detailed guides, and even troubleshooting tips. It’s a great place to start if you’re encountering a snag. Navigating the extensive documentation is easy, just use the search function and find your specific needs.

Methods of Contacting Xero Support

Need immediate assistance? Xero offers various avenues to connect with their support team. You can reach out via phone, email, or even through their helpful online chat. Choosing the best method depends on the urgency of your issue. For complex problems, a phone call might be the most effective way to get personalized guidance, while simple queries can be solved through the online chat or email.

Online Xero Tutorials and Guides

Looking for step-by-step instructions? The internet is brimming with Xero tutorials and guides, from YouTube channels to dedicated websites. These resources offer a plethora of visual aids, interactive exercises, and helpful tips to master Xero. Search online for “Xero tutorial for beginners” or “Xero accounting for [your business type]” to find relevant guides and videos.

Types of Xero Support Available

Xero provides a variety of support options, ensuring there’s something for every user. This table summarizes the different support channels available:

| Type of Support | Description |

|---|---|

| Self-Service Resources | Documentation, FAQs, and online tutorials. Perfect for finding quick solutions and exploring various Xero functionalities. |

| Online Chat | Instant support from Xero’s team. Ideal for quick questions and immediate assistance. |

| Email Support | A more formal way to submit inquiries. Useful for more intricate problems that need thorough explanation. |

| Phone Support | Direct interaction with a support agent. Best for complex issues requiring personalized guidance and troubleshooting. |

Xero Accounting Best Practices

Unlocking the full potential of Xero involves more than just setting it up; it’s about mastering the art of keeping your finances ship-shape. This section dives into the best practices that transform Xero from a tool to a financial superhero, saving you time, stress, and potential headaches.

Data Security and Protection

Protecting your Xero data is paramount. Think of it like safeguarding your crown jewels—you wouldn’t want them falling into the wrong hands, would you? Implementing robust security measures is crucial. This includes using strong passwords, enabling two-factor authentication, and regularly reviewing your access controls. Avoid the “weak password” trap – choose something complex and unique to each account.

Minimizing Errors and Maximizing Accuracy

Mistakes happen, but minimizing them is key. Xero’s intuitive design helps, but diligent data entry and regular review are your best friends. Double-checking invoices, meticulously recording transactions, and implementing automated workflows are all excellent ways to maximize accuracy. Don’t be a human calculator; use technology to your advantage!

Regular Backups and Data Maintenance

Regular backups are not just a good idea; they’re a necessity. Imagine losing all your financial records—a disaster! Xero’s backup features are designed to protect you, but consistent backups and proper data maintenance are your safety net. Schedule regular backups and store them securely in multiple locations. Think of it as a financial insurance policy.

Common Pitfalls to Avoid in Xero Accounting

Some common mistakes can sink your financial boat. Avoid neglecting bank reconciliations, as these are your financial sanity checks. Don’t underestimate the importance of keeping detailed records – they’re your best friends when things get complicated. Remember, Xero is a powerful tool, but you need to use it effectively.

Strategies for Efficient Financial Reporting

Financial reporting doesn’t have to be a dreadful chore. Leveraging Xero’s reporting features allows you to create insightful reports quickly. Regularly generate reports, and analyze trends to gain a deeper understanding of your business performance. Use visualizations to make your financial insights more accessible and engaging, turning data into actionable strategies.

Xero Accounting Use Cases

Tired of spreadsheets that make your eyes glaze over? Xero Accounting is the digital superhero your business needs, saving you from the spreadsheet abyss and bringing you closer to financial freedom. Imagine a world where your finances are as organized as your perfectly-curated Instagram feed. Xero helps make that a reality.

Xero Accounting isn’t just another accounting software; it’s a versatile tool designed to help businesses of all shapes and sizes streamline their financial processes. From small startups to established enterprises, Xero’s adaptability shines through, providing a solution tailored to specific needs.

Real-World Xero Success Stories

Xero’s adaptability makes it a great choice for various businesses. Here are a few examples showcasing its effectiveness across industries.

- A local bakery, “Sweet Surrender,” used Xero to manage their ever-growing order volume. Their meticulous tracking of ingredients and sales helped them optimize their inventory, leading to increased efficiency and profit margins. No more frantic inventory checks or misplaced spreadsheets!

- A growing tech startup, “InnovateNow,” leveraged Xero’s integrations to automate their invoicing and payment processes. This not only freed up valuable time for their team but also significantly improved cash flow management. Their newfound financial clarity allowed them to focus on innovation and growth.

- A thriving landscaping company, “GreenThumb,” used Xero’s project management features to keep track of their various client projects. The detailed tracking of expenses and revenues enabled them to accurately invoice clients and manage their finances with unparalleled ease. Goodbye, tangled spreadsheets!

Successful Xero Implementations

Xero’s successful implementations are a testament to its user-friendly interface and robust features.

- Many small businesses have found Xero’s intuitive interface to be a significant asset. Its straightforward design makes it easy for even those with limited accounting experience to manage their finances effectively. No more feeling lost in a sea of numbers!

- The integration of Xero with various other business tools, like email marketing platforms, allows for seamless data flow and automation, boosting productivity and efficiency. This means less time spent on manual data entry and more time focusing on growth.

- Xero’s customizable dashboards provide real-time insights into key financial metrics. This allows businesses to track their progress, identify potential problems, and make informed decisions, turning data into actionable strategies. Say goodbye to guesswork!

Xero and Cash Flow Management

Xero streamlines cash flow management by providing real-time insights into income and expenses. This transparency helps businesses anticipate potential cash flow issues and proactively take steps to address them.

Xero’s ability to automate tasks such as invoicing and payment processing significantly reduces the time needed for manual accounting procedures, freeing up valuable resources for other important business functions.

Factors Contributing to Xero Success

Several factors contribute to the success of Xero users. These include user-friendliness, powerful integrations, and a robust support network.

- Xero’s user-friendly design makes it easy for users of all levels of accounting expertise to navigate the platform. Even beginners can quickly grasp the essentials and get their finances organized.

- The extensive library of Xero integrations helps businesses connect their various tools, streamlining workflows and automating processes. This ensures smooth data flow and reduces manual errors.

- Xero’s dedicated support team provides prompt and helpful assistance to users encountering any challenges or issues. This ensures a smooth transition and ongoing support for every business.

Case Study: “TechSolutions”

TechSolutions, a rapidly growing software development company, successfully implemented Xero to manage their finances. The software’s ability to automate invoicing and track expenses significantly improved their cash flow management. Xero’s detailed reporting features allowed TechSolutions to identify areas for cost optimization, leading to a 15% increase in profit margins within the first year of implementation. No more late invoices or lost revenue!

Xero Accounting for Specific Industries

Tired of spreadsheets that look like a toddler’s crayon masterpiece? Xero’s got you covered, offering tailored solutions for businesses across various sectors. From keeping track of retail inventory to managing restaurant reservations, Xero adapts to your unique needs, making accounting a breeze (or at least less of a headache).

Xero’s adaptability allows it to be customized for different industries, providing a user-friendly experience and saving businesses valuable time and resources. No more frantic last-minute accounting nightmares! Xero’s the ultimate digital assistant, simplifying financial management for every type of business.

Retail Sector Customization

Retailers often face the challenge of managing inventory and sales data effectively. Xero’s robust inventory tracking features allow you to monitor stock levels, predict demand, and optimize your purchasing strategies. Imagine being able to instantly see which products are flying off the shelves and which are gathering dust – that’s the power of Xero. Real-time insights into sales trends empower retailers to make informed decisions, from pricing adjustments to targeted marketing campaigns. Xero’s seamless integration with point-of-sale systems further streamlines the entire retail process.

Service Business Support

Service businesses often deal with complex billing structures and client management. Xero’s invoice management tools facilitate accurate and timely invoicing, ensuring you get paid on time. Xero simplifies tracking billable hours, materials, and project costs, allowing you to precisely calculate profits and losses. It also streamlines client communication, making interactions more organized and efficient. This is a huge relief for service-based businesses, eliminating the frustration of manual record-keeping and helping them focus on what they do best – providing excellent service.

Restaurant Advantages

Restaurants deal with a constant flow of orders, inventory, and staff management. Xero’s point-of-sale (POS) integration makes tracking orders and payments effortless. The automated reporting features offer insights into sales trends, inventory turnover, and profitability. Imagine instantly knowing which dishes are the most popular, and which ingredients need restocking. Xero helps you manage everything from ingredient costs to staff wages, allowing restaurant owners to stay on top of their finances and make smarter decisions.

Construction Company Benefits

Construction companies have unique financial needs, requiring meticulous tracking of expenses, materials, and labor. Xero simplifies the process by allowing for detailed project tracking and accurate cost allocation. Xero helps manage payments to subcontractors and suppliers, and provides tools to track project progress and manage budgets. It allows you to maintain an organized workflow and provides timely access to financial data, crucial for project success.

Professional Services Sector Utilization

Professional service firms, such as law firms and consulting companies, need sophisticated tools for managing client billing, expenses, and revenue. Xero’s billing features enable accurate and automated invoicing, tracking billable hours, and generating detailed financial reports. It also supports time tracking and expense management, streamlining the billing process for professional services. Xero allows for seamless collaboration and data sharing, improving internal efficiency and client satisfaction.

Xero Accounting – Illustrative Data

Xero, the accounting software, is like a well-organized digital filing cabinet for your business finances. Let’s peek inside and see some sample data to get a feel for how Xero presents your business’s financial health. Forget boring spreadsheets; Xero makes understanding your money a breeze!

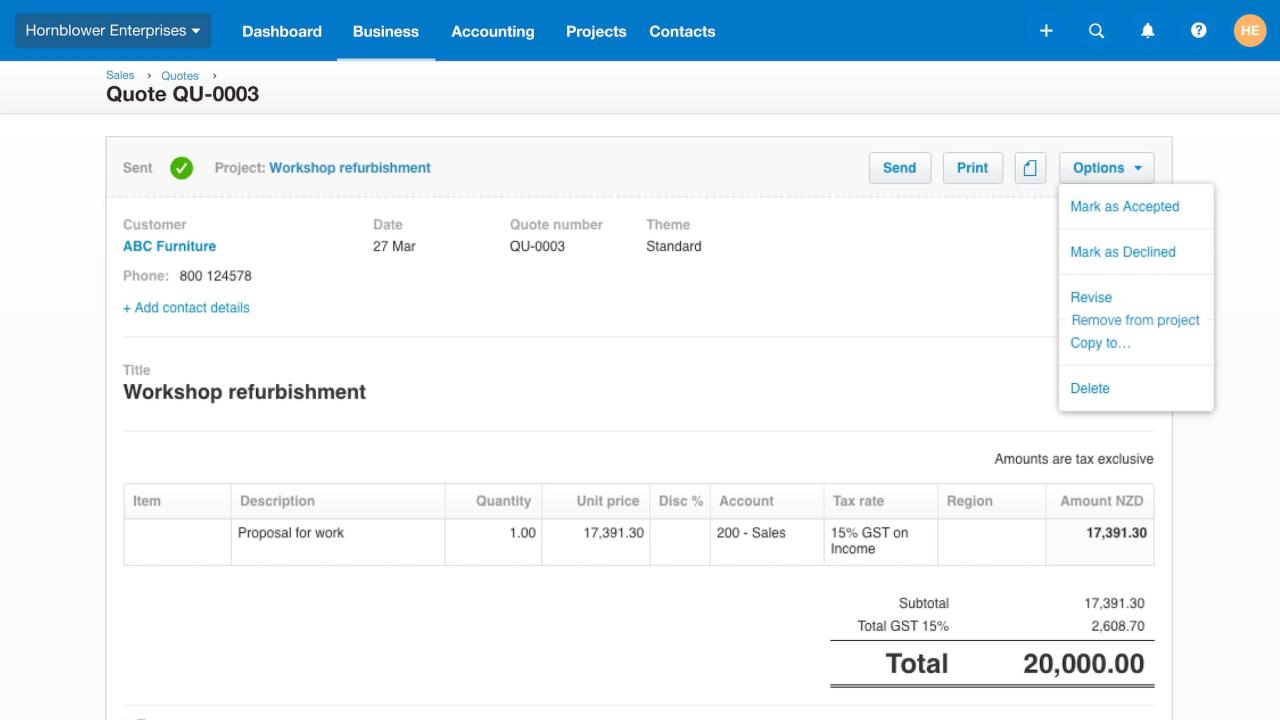

Sample Invoice Generated in Xero

Xero’s invoice creation is intuitive and straightforward. A typical invoice displays essential information like invoice number, date, customer details, and itemized descriptions of services or products. The invoice will also show the quantity, description, unit price, and total amount of each item. The invoice format is designed to be professional and easily readable, making it suitable for both internal and external use. A well-designed invoice clearly communicates the transaction details, facilitating efficient payment processing and record-keeping.

Sample Balance Sheet Report from Xero

The balance sheet, a cornerstone of financial reporting, presents a snapshot of a company’s assets, liabilities, and equity at a specific point in time. Xero’s balance sheet report provides a clear picture of your company’s financial position. It typically lists assets, such as cash, accounts receivable, and equipment, on one side. The other side shows liabilities, like accounts payable, loans, and deferred revenue, alongside equity, reflecting the owners’ stake in the company. The balance sheet’s equality, where assets equal the sum of liabilities and equity, is crucial for financial accuracy.

Sample Profit and Loss Statement from Xero

The profit and loss (P&L) statement, often called the income statement, tracks a company’s financial performance over a specific period, usually a month, quarter, or year. Xero’s P&L report neatly displays revenues, costs of goods sold (COGS), operating expenses, and ultimately, the net profit or loss. This report helps businesses understand their profitability trends and identify areas where they can improve efficiency or increase revenue. The P&L statement is a vital tool for monitoring the company’s financial health and making informed business decisions.

Sample Bank Reconciliation Report

A bank reconciliation report in Xero compares your company’s bank statement with its internal records. This report helps identify any discrepancies between the two, such as outstanding checks, deposits in transit, and errors. By comparing the bank balance to your company’s book balance, you can pinpoint any discrepancies, ensuring the accuracy of your financial records. This process helps avoid errors and maintain a strong financial foundation. A well-maintained bank reconciliation process is critical for financial integrity.

Examples of Xero’s Dashboard and Reporting Features

Xero’s dashboard provides a summary view of key financial metrics, offering quick access to crucial data. It displays graphs and charts to easily understand revenue, expenses, and other critical metrics. Xero’s reporting features go beyond basic summaries. You can customize reports to suit your specific needs, selecting the data points that are most important for your business analysis. Visualizations, like charts and graphs, make complex financial information easy to digest and understand. This enables data-driven decisions, making your business smarter.

Last Word

In conclusion, Xero Accounting is more than just software; it’s a powerful tool for small businesses to gain control of their finances. By understanding its features, setup process, and best practices, you can unlock greater efficiency, accuracy, and ultimately, business growth. Whether you’re a seasoned entrepreneur or just starting out, this guide equips you with the knowledge to maximize the potential of Xero and build a stronger financial foundation for your company.