Free invoice templates provide a practical and cost-effective solution for businesses of all sizes. This comprehensive guide explores the various facets of free invoice creation, from understanding different formats to navigating legal considerations and effective usage strategies. The document delves into the practical aspects of generating free invoices, ensuring compliance with legal requirements, and maximizing their efficiency.

The guide details the different types of free invoice templates, outlining their features and typical use cases. It also provides a step-by-step process for creating free invoices, along with a comparison of various software tools and platforms available. Moreover, the guide emphasizes the importance of legal compliance and offers a breakdown of common mistakes to avoid when utilizing free invoice solutions.

Understanding Free Invoice Formats

A well-structured invoice, free or otherwise, is crucial for smooth financial transactions. Free invoice templates, often available online, offer a convenient solution for businesses needing invoices without significant costs. They come in various styles, each designed for specific needs, ranging from simple one-page transactions to detailed professional reports.

This discussion delves into the different types of free invoice templates, their common elements, structural organization, and diverse formats, providing valuable insights for anyone needing to create or understand these important financial documents.

Types of Free Invoice Templates

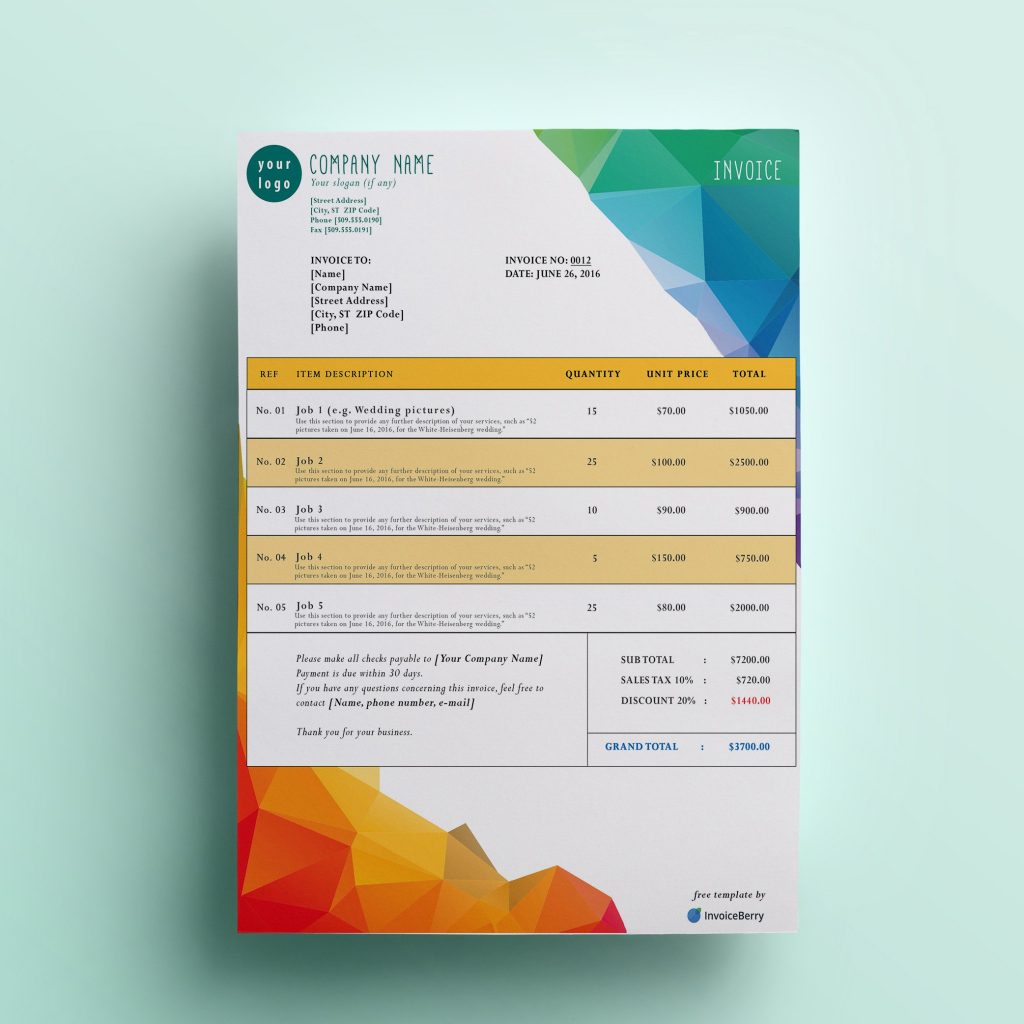

Various free invoice templates cater to different needs and preferences. These range from straightforward, minimalist designs to more sophisticated, professional-looking templates. Customizable templates provide maximum flexibility for businesses needing unique features or branding.

- Simple Templates: Ideal for small transactions or occasional invoicing, these templates focus on clarity and essential information. They often lack decorative elements, making them easy to understand and quickly process.

- Professional Templates: These templates offer a more polished look, enhancing professionalism. They typically include branding elements, logos, and visually appealing layouts, making them suitable for frequent invoicing and building trust with clients.

- Custom Templates: These templates provide maximum flexibility, allowing businesses to tailor the design, layout, and included information to match specific requirements. They are beneficial for companies with particular branding needs or complex transaction structures.

Common Elements on Free Invoice Templates

Free invoice templates, regardless of style, usually share common elements to ensure clarity and accuracy. These elements are crucial for efficient financial record-keeping and proper communication.

- Invoice Number: A unique identifier for each invoice, making it easy to track and manage transactions.

- Invoice Date: The date the invoice was created, crucial for tracking payment timelines and record-keeping.

- Bill To Information: Recipient’s details, including name, address, and contact information.

- Bill From Information: The details of the business issuing the invoice, including name, address, and contact information.

- Description of Goods/Services: A clear list of the products or services provided, along with quantities and prices.

- Subtotal, Taxes, and Total Amount Due: Calculations for the invoice’s total amount, including applicable taxes, facilitating accurate payment processing.

- Payment Terms: Instructions on payment methods, due dates, and any late payment penalties. This is crucial for setting clear expectations.

Structure and Organization of a Free Invoice Document

A well-structured free invoice document enhances clarity and efficiency. It’s designed to present information logically and easily.

- Header: Typically includes the invoice number, date, and other identifying information.

- Body: This section details the goods or services rendered, including descriptions, quantities, unit prices, and line-item totals.

- Footer: The footer usually contains calculations for the subtotal, taxes, and the total amount due, along with payment terms and contact information.

Examples of Free Invoice Formats

Various free invoice formats are available online, differing in design and content. Simple formats are often text-based, while professional formats incorporate visual elements and clear layouts.

| Format Type | Key Features | Typical Use Cases |

|---|---|---|

| Simple | Basic information, straightforward layout, minimal design | Small transactions, one-time invoices, internal use |

| Professional | Visually appealing, branding elements, detailed calculations | Regular invoicing, clients needing professional presentation, and building trust |

| Customizable | Adjustable design, layout, and content | Businesses with specific branding needs, complex transaction structures, and tailored invoice requirements |

Generating Free Invoices

A free invoice, a marvel of modern commerce, is a document that captures the essence of a transaction, bridging the gap between a service rendered and payment received. It’s a beautifully crafted, albeit digital, declaration of financial obligation. Creating one, however, isn’t rocket science. Just follow the steps Artikeld below, and you’ll be issuing invoices like a seasoned accountant in no time.

Methods for Creating Free Invoices

The world of free invoice generation is vast and varied, offering a plethora of options to suit every need and skill level. From simple templates to sophisticated software, the choice is yours. Each method has its own set of advantages and disadvantages, which we will explore further.

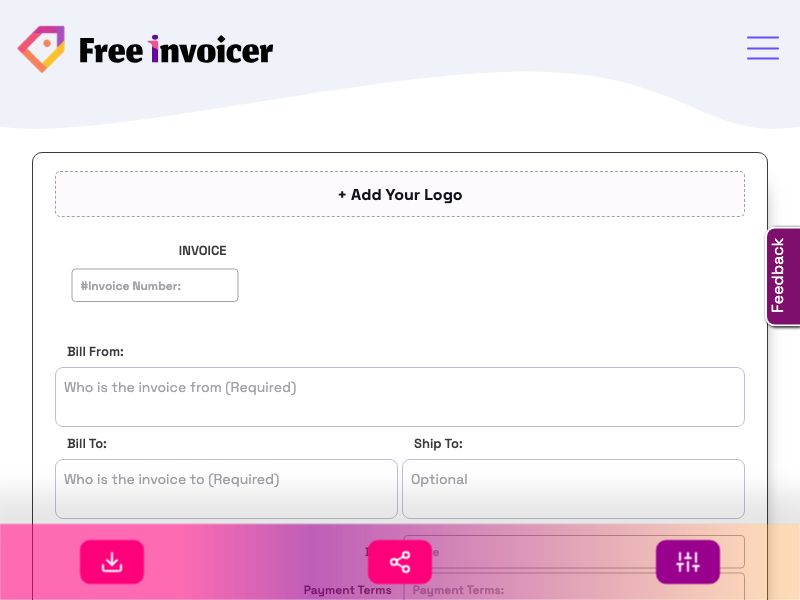

- Using Online Templates: Online invoice templates are readily available and can be customized to a degree. These templates, often found on websites dedicated to small business resources, usually require minimal technical skills and can be a great starting point for those new to invoicing. However, their customization options might be limited, and they may not offer the advanced features found in dedicated software.

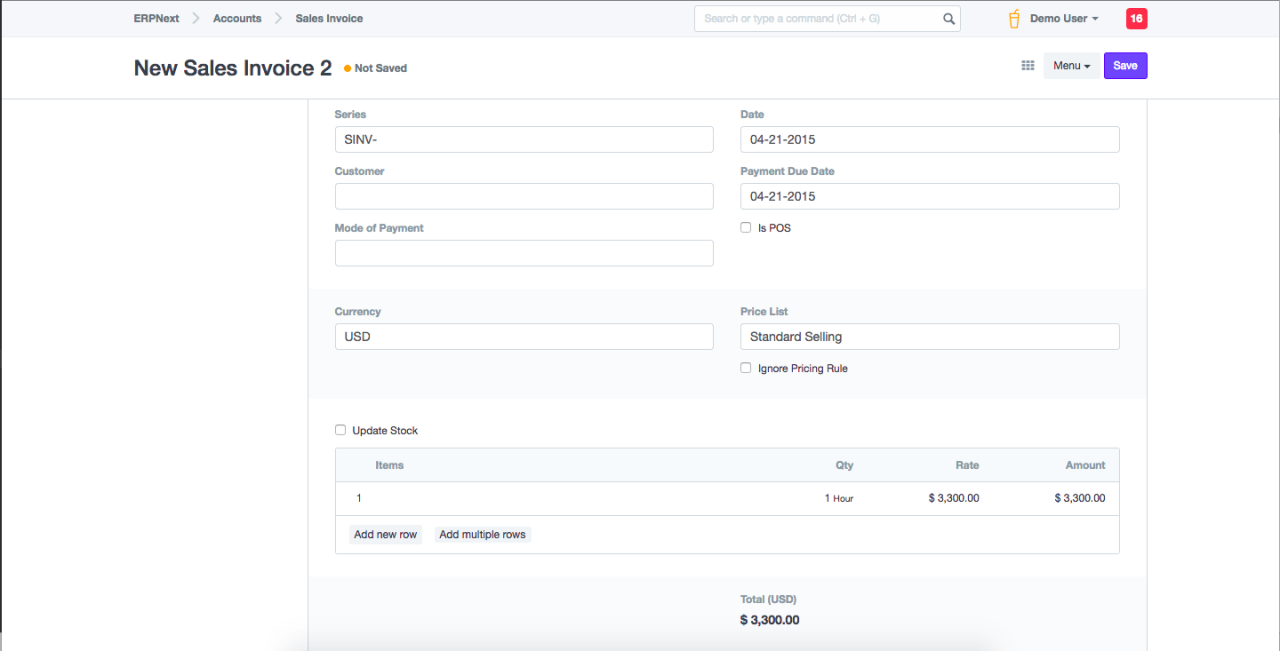

- Employing Spreadsheet Software: Spreadsheet programs like Microsoft Excel or Google Sheets can be utilized to create invoices. This method allows for a high degree of control and customization, empowering you to tailor the invoice to your specific requirements. However, it may demand more technical proficiency and time investment than online templates. Furthermore, maintaining consistency and accuracy across multiple invoices can be challenging. Consider using formulas and formatting features to enhance the invoice’s professional appearance.

- Leveraging Free Invoice Generation Software: Several online platforms and applications provide free invoice creation tools. These tools often offer user-friendly interfaces, allowing for easy input of client information, product details, and totals. Many of these tools are designed with ease of use in mind, making them ideal for entrepreneurs and freelancers. However, the available features might be more limited compared to paid software, and some tools might impose restrictions on the number of invoices that can be generated or the amount of data they can handle.

Step-by-Step Invoice Creation

Generating a free invoice is a straightforward process. Follow these steps to ensure your invoices are professionally presented and accurate.

- Gather Client Information: Ensure you have the client’s name, address, contact information, and any relevant account numbers. Accurate client details are crucial for effective communication and payment processing.

- Specify Invoice Details: Set the invoice date, invoice number (a unique identifier for each invoice), and a description of the services or products provided. These details provide a clear record of the transaction.

- Enter Service/Product Details: List the services or products, quantities, unit prices, and calculate the total amounts. Use a clear and concise format to prevent confusion and ensure accuracy. A simple table is recommended.

- Calculate Subtotals and Totals: Sum up the amounts for each item to arrive at a subtotal for each line and a grand total for the invoice. Consider employing a formula in your spreadsheet software to automate this process.

- Include Payment Terms: Clearly specify the payment terms, including due dates and accepted payment methods. This is essential for managing cash flow effectively and establishing clear expectations with clients.

- Review and Submit: Before finalizing the invoice, double-check all information for errors. Once verified, you can send the invoice electronically or print it for physical delivery.

Comparing Methods

| Method | Advantages | Disadvantages |

|---|---|---|

| Online Templates | Ease of use, readily available | Limited customization, potentially less secure |

| Spreadsheet Software | High degree of customization, control | Requires technical proficiency, time-consuming |

| Free Invoice Software | User-friendly interfaces, often with automated features | Limited features compared to paid software, potential restrictions |

Free invoice creation methods each present unique trade-offs. The best choice depends on your technical skills, the complexity of your invoices, and your budget.

Legal Considerations for Free Invoices

Navigating the legal labyrinth of invoicing, even with free templates, can feel like deciphering ancient hieroglyphs. But fear not, intrepid invoice-issuers! Understanding the legal necessities for your free invoices can save you from headaches (and potentially hefty fines) down the road. We’ll tackle the legal aspects, ensuring your free invoices are not just free, but also legally sound.

Free invoice formats, while convenient, still demand adherence to legal requirements. Accuracy and completeness are paramount. A missing date, or an incorrect description, can lead to a cascade of complications, and potentially even legal action. Therefore, meticulous attention to detail is crucial. Remember, a well-crafted invoice is your silent advocate, safeguarding your business dealings and facilitating smooth transactions.

Legal Requirements for Invoices

Free invoices, while cost-effective, must meet legal standards. These standards ensure the accuracy and reliability of the information contained within the document. Failure to comply with these requirements can lead to legal issues, such as disputes and misunderstandings. Therefore, it is essential to understand the legal implications of using free invoice templates and ensure they comply with relevant regulations.

- Accurate Information is Key: Each element of your free invoice, from the date to the description of goods or services, must be accurate and precise. Inaccurate information can lead to significant problems, ranging from disputes over pricing to issues with tax calculations. Ensuring the accuracy of your free invoices will significantly reduce the risk of legal complications.

- Completeness of Information: Your invoice should include all necessary details, including the names and addresses of both the buyer and seller, the date of the transaction, a clear description of the goods or services provided, the quantity and price of each item, the total amount due, and the payment terms. Missing information can lead to delays and misunderstandings, so ensure your free invoice is comprehensive.

- Compliance with Tax Regulations: The specific tax regulations vary by jurisdiction. Be certain that your free invoice complies with all applicable tax laws, including those concerning sales tax, VAT, and other levies. Failure to comply with these regulations can lead to severe penalties.

Using Free Invoice Templates

Free invoice templates offer convenience, but they should be used cautiously. Careful consideration is needed to ensure compliance with legal requirements. Remember, a template, no matter how free, is not a substitute for legal counsel or thorough research.

- Template Selection: Carefully evaluate the templates you choose. Ensure that the chosen template is appropriate for your needs and complies with legal requirements. Templates should accurately reflect the services provided. This will protect you against potential misunderstandings and disputes.

- Customization and Adaptation: Don’t blindly copy and paste. Customize the template to match your specific requirements. The template should be tailored to your unique business needs and not just a generic copy-paste. A tailored template will ensure clarity and avoid ambiguity in the transaction details.

- Review and Verification: Always review and verify the information contained in the free invoice template before sending it. Thorough review can help identify potential errors or omissions that could lead to legal complications. Take your time and double-check to ensure you are compliant with legal requirements.

Ensuring Compliance with Regulations

Maintaining compliance with relevant regulations is essential for free invoice users. This process is not a one-time task; it is an ongoing commitment. This means continually updating your knowledge of legal requirements.

| Requirement | Explanation | Importance |

|---|---|---|

| Accurate Dates | Invoices must accurately reflect the transaction date. | Avoids disputes over timing and payment deadlines. |

| Clear Descriptions | Descriptions of goods/services should be unambiguous. | Facilitates understanding of the transaction and avoids disputes. |

| Correct Pricing | Prices must be accurate and reflect the agreed-upon amounts. | Avoids payment disagreements and ensures accurate accounting. |

| Accurate Contact Information | Include complete and accurate contact details. | Allows for effective communication and resolution of issues. |

Using Free Invoices Effectively

Embarking on the exhilarating journey of running a business often involves navigating a labyrinth of financial intricacies. Free invoice templates, like trusty, well-worn maps, can illuminate the path to streamlined accounting and efficient client management. Let’s delve into the practical applications of these digital tools, transforming them from mere templates into powerful instruments of business success.

Harnessing the power of free invoice templates can significantly enhance your business operations, enabling you to efficiently track income, manage clients, and maintain meticulous records. The correct implementation of these templates, coupled with smart organization, empowers entrepreneurs to focus on what truly matters: growing their businesses.

Managing Clients with Free Invoices

Free invoice templates are more than just documents; they are crucial tools for fostering strong client relationships. By providing a standardized format for communication, you demonstrate professionalism and efficiency. Each invoice serves as a tangible record of your services rendered, fostering clarity and minimizing misunderstandings.

Tracking Income with Precision

Accurate income tracking is paramount for any business. Free invoice templates, when meticulously utilized, provide a structured framework for recording income and expenses. Regular review of invoice data allows for a clear understanding of financial performance, enabling informed decision-making and growth strategies. Categorizing invoices based on client, project, or service type enhances this insight, providing a more nuanced understanding of revenue streams.

Maintaining Organized Records

Maintaining organized records is essential for any business. Free invoice templates, combined with digital tools, can revolutionize how you manage your business’s paperwork. Storing invoices digitally facilitates quick retrieval, eliminating the need for cumbersome physical filing systems. Software solutions, often accompanying free invoice templates, allow for efficient searching and sorting, enabling quick access to vital financial information. Employing a consistent naming convention for files and folders significantly contributes to this organization, allowing for seamless retrieval of specific invoices.

Optimizing Invoice Communication

Crafting and sending invoices effectively is a cornerstone of strong client relationships. Free invoice templates, when personalized and tailored to your brand, communicate professionalism and credibility. Clearly defining payment terms and deadlines within the invoice itself reduces potential misunderstandings and promotes timely payments. Adding a professional email signature further enhances the overall communication experience.

Best Practices for Creating and Sending Invoices

- Clarity is Key: Clearly state the services rendered, quantities, rates, and total amounts due.

- Professional Design: Maintain a professional aesthetic to establish credibility.

- Prompt Communication: Send invoices promptly after service completion.

- Payment Terms: Clearly Artikel payment terms and deadlines in the invoice.

- Follow Up: If payment is not received on time, follow up politely.

Benefits of Free Invoices for Various Business Situations

Free invoice templates offer significant advantages across a wide spectrum of business types. Their simplicity and accessibility make them an invaluable asset for freelancers, small businesses, and entrepreneurs alike. By providing a clear and structured format for invoicing, free templates can help to streamline the financial management process and promote efficiency.

Tips for Effective Free Invoice Usage

- Establish a Consistent System: Develop a consistent method for creating, sending, and storing invoices.

- Utilize Software: Leverage accounting software or spreadsheet programs to organize and manage invoices.

- Regular Review: Regularly review your invoices to monitor financial performance.

- Record Keeping: Maintain comprehensive records of all invoices, receipts, and payments.

- Client Communication: Use invoices to communicate effectively with clients about services rendered.

Free Invoice Alternatives

Embarking on a journey beyond the humble free invoice? Well, buckle up, because the world of invoicing software is a veritable playground of features and functionalities! Free invoices are like a breezy picnic, great for a quick bite, but sometimes you crave a full-fledged gourmet meal. Alternatives offer a plethora of options, catering to diverse needs and budgets.

A wealth of options awaits those seeking more robust invoicing tools, from simple expense tracking apps to sophisticated paid invoicing software. These alternatives often provide a richer experience, offering greater control, advanced features, and, dare we say, a more professional appearance. Let’s delve into this digital buffet and discover what’s on offer.

Paid Invoicing Software Options

Paid invoicing software packages are designed to streamline the entire invoicing process, from creation and sending to tracking and payment. They provide a sophisticated approach, automating tedious tasks and often integrating with other business tools. This elevates the experience from basic record-keeping to a streamlined workflow.

- Invoicing software like FreshBooks, Zoho Books, and Xero, among others, provide robust features like automated invoicing, recurring billing, and integrated accounting. These platforms often offer customizable templates, allowing for a professional, personalized approach to invoices.

Comparing Free and Paid Invoicing Solutions

Free invoicing solutions, while a great starting point, may not always meet the needs of growing businesses or those with complex requirements. Paid alternatives, while requiring an upfront investment, frequently offer greater value in terms of functionality, automation, and support. A crucial comparison hinges on understanding the specific needs of the user and their business.

| Type | Features | Cost | Pros | Cons |

|---|---|---|---|---|

| Free Invoice Generators | Basic invoicing, limited customization | Free | Easy to use, suitable for small tasks | Limited features, no customer support, often lack integrations |

| Paid Invoicing Software | Advanced features, automation, integrations | Subscription fee | Enhanced functionality, professional appearance, support | Initial cost, potential learning curve |

Examples of Paid Invoicing Software and Their Key Features

Let’s look at a few popular options to illustrate the possibilities.

- FreshBooks: Known for its user-friendly interface and comprehensive invoicing capabilities. Key features include automated billing, recurring invoices, and expense tracking. It seamlessly integrates with other business tools like accounting software.

- Zoho Books: Zoho Books is another popular choice, emphasizing its all-in-one approach to accounting and invoicing. Its strengths include its ability to manage finances, track inventory, and handle payroll, all from a single platform. This integration makes it a valuable tool for businesses seeking comprehensive financial management.

- Xero: Xero is a cloud-based accounting software solution that is often considered a robust choice for managing business finances, including invoicing. It is praised for its ease of use and comprehensive reporting features.

Common Mistakes to Avoid with Free Invoices

Navigating the digital realm of invoicing, especially with free templates, can be a delightful experience, but pitfalls await the unwary. Errors, though often unintentional, can lead to complications. This section will illuminate common mistakes and equip you with strategies to prevent them, ensuring your invoices maintain a professional air and avoid unnecessary headaches.

Creating and using free invoices requires attention to detail, just like any other professional document. The potential consequences of errors, ranging from simple misunderstandings to significant financial repercussions, highlight the importance of meticulousness. Accuracy and clarity are paramount, and we will explore common pitfalls and how to avoid them.

Misrepresenting Costs and Services

Inaccurate or misleading descriptions of services rendered or costs incurred can cause confusion and disputes. Always ensure your invoice accurately reflects the agreed-upon work and associated fees. Avoid vague or ambiguous language; use precise terminology and quantifiable data. For example, instead of “design services,” specify “logo design and branding guidelines,” along with the number of hours and associated rates.

Missing Crucial Information

Invoices should include essential details to prevent misunderstandings and facilitate payment. Missing client information, project details, dates, or payment terms can lead to delays and complications. A complete invoice will contain the client’s name, address, contact details, invoice number, invoice date, description of services, quantity, unit price, total amount, payment terms, and a signature line.

Format and Presentation Errors

A poorly formatted invoice can negatively impact your credibility. Using inconsistent formatting, poor font choices, or an overall unorganized presentation can undermine the professionalism of your invoice. Stick to a clear and consistent layout, using a professional font and clear headings. Ensure the invoice is easy to read and understand at a glance.

Errors in Calculations

Errors in calculations can lead to significant discrepancies and disputes. Double-check all calculations, including amounts, taxes, and discounts. Utilize spreadsheet software or other calculation tools to minimize errors and verify accuracy. Consider using a calculator specifically designed for accounting purposes.

Ignoring Legal Requirements

Failing to comply with legal regulations regarding invoicing can have severe consequences. Different jurisdictions have specific requirements for invoices. Research and understand the regulations applicable to your business and location to ensure compliance. Consult with legal counsel if necessary to ensure you meet all relevant regulations.

Using Inadequate Free Invoice Tools

Some free invoice tools might lack features necessary for comprehensive invoicing or have hidden limitations. Thoroughly research and evaluate free invoice tools before selecting one. Consider the specific needs of your business and choose a tool that offers the necessary functionality.

Common Pitfalls to Avoid with Free Invoice Tools

- Limited customization options: Some free invoice tools may restrict customization options, potentially affecting branding or compliance with specific requirements. Check the tool’s features and flexibility before committing.

- Hidden costs or limitations: Free invoice tools might have limitations or hidden costs that can become problematic as your business grows. Understand the full scope of features and costs before using a free tool.

- Security concerns: Free tools may not offer the same level of security as paid solutions. Assess the security measures of the tool and ensure it protects sensitive data.

- Integration challenges: Compatibility issues with other business software can lead to inefficiencies. Ensure the free invoice tool integrates seamlessly with existing systems.

Illustrative Examples of Free Invoices

Free invoices, while undeniably liberating in their accessibility, demand a certain finesse to ensure they are both legally sound and practically useful. Imagine a beautifully crafted, yet surprisingly simple, document, capable of handling even the most complex transactions with the elegance of a well-orchestrated symphony. This section dives into the specifics, providing concrete examples for various scenarios.

Understanding the correct formatting, crucial details, and different business needs is key to maximizing the effectiveness of free invoice templates. It’s like having a recipe for a perfect cake – the ingredients (data) and method (formatting) are vital for the desired result.

Correctly Formatted Free Invoice for a Specific Service

A well-structured free invoice clearly Artikels the service provided, the agreed-upon price, and the expected payment schedule. Below is an example for a social media management service:

| Invoice Number | Date | Client Name | Client Address |

|---|---|---|---|

| INV-2024-001 | October 26, 2024 | Acme Corporation | 123 Main Street, Anytown, CA 12345 |

| Description | Quantity | Rate | Amount |

|---|---|---|---|

| Social Media Management (10 hours) | 1 | $50/hour | $500 |

| Subtotal | Tax (8%) | Total |

|---|---|---|

| $500 | $40 | $540 |

Payment Terms: Net 30 days.

This invoice, using a simple table format, effectively communicates all necessary information, from client details to payment terms. It is a straightforward, yet comprehensive document that can be easily customized for various services.

Including Crucial Information

Accurate and complete information is vital. Client details, invoice number, date, service description, quantity, rates, and importantly, payment terms must be included. A well-organized invoice streamlines the process, preventing misunderstandings and ensuring smooth financial transactions.

Examples of Free Invoice Templates

Numerous free invoice templates are available online. These templates often offer pre-designed layouts and fields to facilitate input. Look for templates that cater to your specific needs.

Invoices Addressing Different Business Needs

Free invoices can be tailored for different businesses and services. For instance, a freelance writer might use a template that details the number of words written, while a consultant might use one that lists hours of consultation. The key is to include the necessary specifics for each unique transaction.

Visually Appealing Format Examples

A visually appealing format is crucial for attracting attention and improving readability. Consider using different colors for different sections, clear fonts, and appropriate spacing. Think of it as an advertisement for your service – it must be eye-catching, but also professional. The example above, with its clear tables, exemplifies this.

Final Review

In conclusion, this guide provides a thorough overview of free invoices, covering essential aspects from format types to legal considerations and practical application. By understanding the intricacies of free invoice generation and usage, businesses can leverage these tools effectively, ensuring efficient client management, accurate record-keeping, and adherence to legal standards. The exploration of alternatives and potential pitfalls further equips users to make informed decisions.