QuickBooks Desktop is a powerful accounting software solution designed for businesses of all sizes. This guide delves into the intricacies of QuickBooks Desktop, covering everything from its fundamental functionalities to advanced customization options. We will explore its user interface, data management processes, reporting capabilities, and troubleshooting strategies, ensuring a thorough understanding for both novice and experienced users.

From setting up your initial accounts to generating detailed financial reports, QuickBooks Desktop provides a comprehensive toolkit for managing your finances effectively. Understanding its diverse features and functionalities is key to maximizing its potential for your specific business needs. This guide aims to empower you with the knowledge and skills necessary to leverage QuickBooks Desktop for streamlined accounting and informed decision-making.

Introduction to QuickBooks Desktop

QuickBooks Desktop is a robust, widely-used accounting software designed for small and medium-sized businesses. It offers a comprehensive suite of tools for managing various aspects of financial operations, from invoicing and expense tracking to payroll and reporting. This detailed overview will explore QuickBooks Desktop’s functionalities, available versions, key differentiators, and its comparison to cloud-based alternatives.

QuickBooks Desktop Functionalities

QuickBooks Desktop empowers businesses with a suite of tools for efficient financial management. It facilitates invoicing, expense tracking, and reporting, enabling business owners to monitor cash flow, analyze profitability, and make informed decisions. The software also encompasses functionalities for inventory management, payroll processing, and bank reconciliation, catering to the diverse needs of small and medium-sized businesses.

QuickBooks Desktop Versions and Editions

QuickBooks Desktop offers various versions and editions tailored to specific business needs and sizes. These editions differ in their features, functionalities, and price points. The specific versions available may vary depending on the time of the year or the current release from Intuit. The most common versions are Pro, Premier, and Enterprise.

Key Features Differentiating QuickBooks Desktop

QuickBooks Desktop excels in its detailed and comprehensive approach to accounting, particularly for businesses with complex financial operations. It offers a user-friendly interface with customizable reports, providing valuable insights into business performance. Its robust features extend to inventory management and payroll processing, ensuring a centralized system for handling various financial tasks.

Comparison to Cloud-Based Alternatives

| Feature | QuickBooks Desktop | Cloud-Based Alternatives |

|---|---|---|

| Pricing | Typically a one-time purchase, with potential add-on costs for advanced features. | Usually a subscription model, with pricing varying based on features and usage. |

| Accessibility | Requires a computer and internet connection for initial installation and access. | Accessible from any device with an internet connection. |

| Data Security | Data security is the responsibility of the business owner, and proper security measures need to be implemented. | Data is typically stored and secured on the cloud provider’s servers, offering enhanced security features and data backup. |

| Customization | Offers extensive customization options, including tailored reports and workflows. | Customization options often vary, and some features might be limited in cloud-based alternatives. |

| Scalability | Scalability depends on the chosen edition, with some versions offering limited expansion. | Scalability is generally more flexible, adapting easily to changing business needs and growth. |

The table above provides a comparative overview of QuickBooks Desktop and cloud-based alternatives. The choice between these options depends on specific business requirements, budget considerations, and the desired level of control over data management.

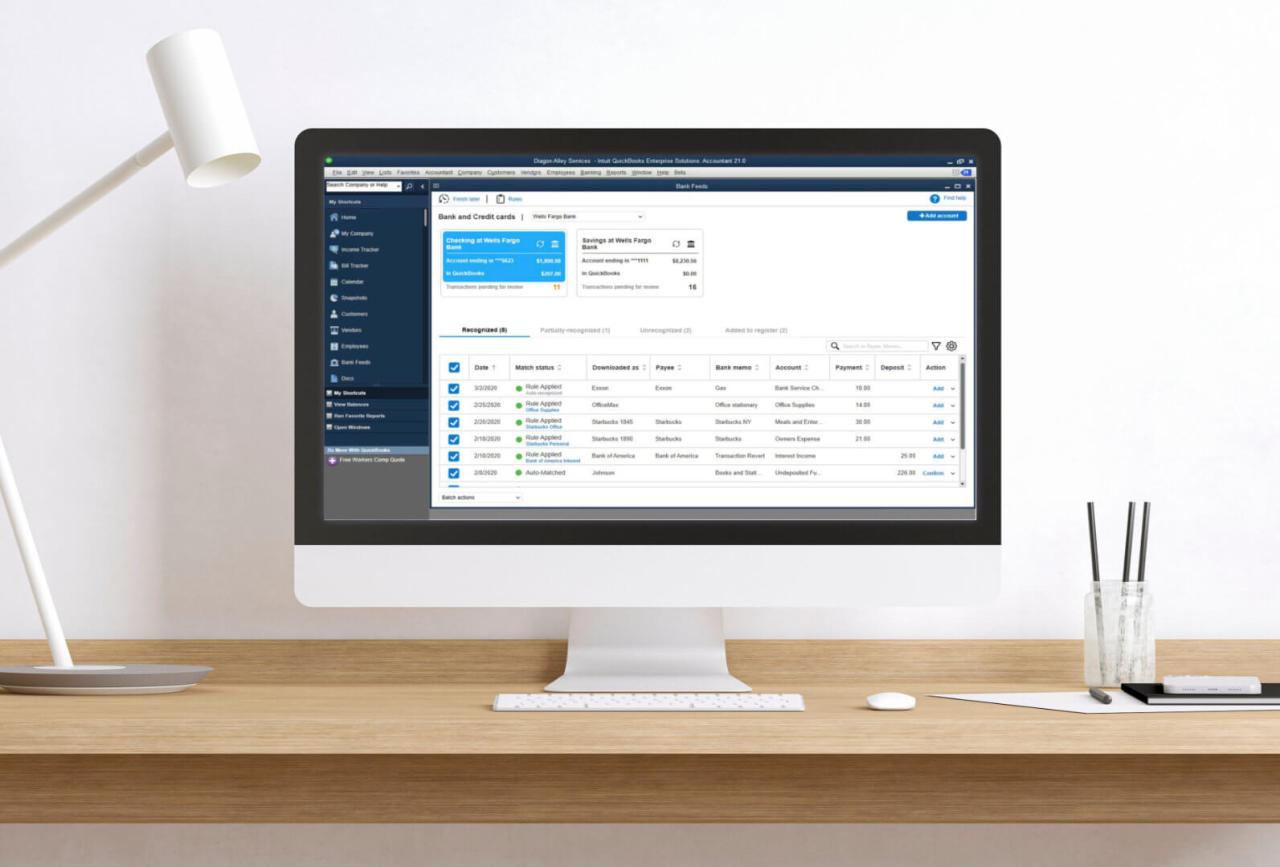

User Interface and Navigation

QuickBooks Desktop’s user interface is designed for intuitive navigation, allowing users to quickly access and manage financial data. Its layout and organization are structured to streamline accounting tasks, making it easier to input, track, and analyze business transactions. This section delves into the specifics of QuickBooks Desktop’s interface, from its overall structure to the functions of individual windows and screens.

Understanding QuickBooks Desktop’s navigation is crucial for efficiency. A clear comprehension of the software’s layout, coupled with familiarity with its various windows and menus, allows users to perform tasks more rapidly and accurately. This streamlined approach significantly reduces the time needed to manage accounting information.

Layout and Organization

The QuickBooks Desktop interface is primarily divided into multiple windows and screens, each designed for specific tasks. The main window typically displays a menu bar at the top, with tools for navigation and functions organized logically. Below the menu bar, the main workspace is organized to display various reports, transactions, and settings. This structured approach ensures users can easily access and manage information.

Navigating the Software

QuickBooks Desktop’s navigation is intuitive and user-friendly. The software utilizes menus, toolbars, and keyboard shortcuts to facilitate seamless movement between different screens and functions. By understanding the hierarchy of these elements, users can efficiently locate specific information and complete tasks with minimal effort.

Different Windows and Screens

QuickBooks Desktop presents various windows and screens to cater to different user needs. The Company window is central, displaying the overall financial picture of the business. Other windows, such as the Chart of Accounts, provide a detailed view of specific accounts and transactions. Understanding these distinct windows is vital for managing different aspects of business finances effectively.

Primary Menus and Functions

The following table Artikels the primary menus and their corresponding functions within QuickBooks Desktop.

| Menu | Primary Function |

|---|---|

| File | Managing the company file, including opening, saving, and exporting data. Also includes options for printing reports and creating new companies. |

| Edit | Modifying data entry, such as correcting errors, inserting new transactions, and making changes to existing records. |

| View | Adjusting the display of data, including selecting different views, sorting options, and modifying screen layout for optimal readability. |

| Insert | Adding data into the current context, such as inserting new transactions or records. |

| Window | Managing multiple open windows, allowing users to switch between different views of the same data. |

| Help | Accessing support documentation, tutorials, and troubleshooting guides to address any questions or issues. |

Data Entry and Management

Mastering data entry and management in QuickBooks Desktop is crucial for accurate financial reporting and informed decision-making. Efficiently inputting transactions and organizing accounts ensures a smooth workflow, preventing errors and facilitating insightful analyses. This section will detail the process of entering financial transactions, managing accounts, and demonstrating common transaction types. We’ll also cover crucial steps like bank reconciliation and data backup strategies.

Accurate financial data is the bedrock of effective business operations. By meticulously entering and managing your financial transactions, you equip yourself with the tools to analyze trends, project future performance, and make data-driven choices. This allows for better resource allocation and ultimately leads to greater profitability.

Entering Financial Transactions

The process of entering transactions in QuickBooks Desktop involves several steps. First, identify the transaction type, selecting the appropriate form from the software’s menu. Next, input the necessary details, including dates, amounts, descriptions, and account information. Crucially, ensure accuracy by cross-referencing information with supporting documents. Double-checking ensures that the entered data aligns with the actual transactions, reducing the likelihood of errors.

Managing Accounts

Effective account management is essential for maintaining a clear and organized financial picture. QuickBooks Desktop allows you to categorize transactions into various account types, such as assets, liabilities, equity, revenue, and expenses. This categorization is fundamental to understanding the financial health of your business. Properly categorizing transactions allows you to track income and expenses effectively.

Transaction Types

QuickBooks Desktop supports a wide range of transaction types, each requiring specific information. Invoices represent sales transactions, while bills document purchases. Payments encompass both receiving and remitting funds. Each transaction type has its own specific fields and settings within the software, requiring careful attention to detail during input. Understanding these distinct transaction types allows for accurate financial record-keeping.

- Invoices: Represent sales transactions and require details like customer name, invoice date, due date, item descriptions, and quantities. These are essential for tracking revenue and customer interactions.

- Bills: Document purchases and necessitate vendor information, bill date, due date, and item descriptions. Accurate bills facilitate tracking expenses and vendor relationships.

- Payments: Involve receiving or remitting funds. For payments received, record the date, amount, and customer details. For payments made, include the vendor information, date, and amount.

Bank Reconciliation

Reconciling bank statements in QuickBooks Desktop ensures that your financial records match your bank statements. This process involves comparing the transactions in QuickBooks with those on your bank statement. Any discrepancies must be investigated and resolved to maintain data accuracy. This critical step is essential for identifying errors and maintaining financial transparency.

- Step-by-step Process: Start by downloading your bank statement. In QuickBooks, navigate to the Banking section and select the relevant account. Enter the bank statement’s beginning balance and reconcile each transaction. If discrepancies exist, carefully review each transaction to pinpoint the source of the difference. Review the bank statement carefully to identify any deposits or withdrawals that may have been missed in QuickBooks. Finally, review the reconciled statement and make any necessary adjustments.

Data Backup and Restoration

Backing up your QuickBooks data is crucial for preventing data loss due to hardware failure or software errors. QuickBooks Desktop provides various backup options, including external hard drives, cloud storage, and network drives. Restoring data from a backup is a straightforward process, typically involving selecting the backup file and restoring it to your system. This procedure safeguards your financial data and enables you to quickly recover from potential disruptions.

- Backup Strategies: Regular backups are essential to protect your data. Employ a schedule for backing up your data, such as daily or weekly backups. Store backups in a separate location to prevent data loss from a single point of failure. Consider using cloud-based storage solutions for added security and accessibility. Regularly test your backup procedures to ensure they function correctly.

- Restoration Procedures: When restoring data, carefully follow the software’s instructions. Ensure the backup file is compatible with your current version of QuickBooks Desktop. Restoring from a backup allows you to quickly recover your financial data in case of unforeseen events.

Reporting and Analysis

Unlocking the power of your QuickBooks data involves understanding and leveraging its reporting capabilities. Reports are the key to gaining valuable insights into your business performance, identifying trends, and making informed decisions. This section will guide you through the various report types, the customization options, and practical examples to illustrate their use in different business scenarios.

Comprehensive reporting empowers you to analyze financial data effectively. By customizing reports, you can tailor the information to your specific needs, highlighting crucial performance metrics and providing actionable insights. This approach fosters strategic decision-making and facilitates better business management.

Available Report Types in QuickBooks Desktop

QuickBooks Desktop offers a diverse range of reports categorized to address specific business needs. These reports provide a detailed view of financial transactions, allowing you to track key metrics, monitor cash flow, and analyze profitability. Different report types offer different perspectives on your business performance.

- Financial Statements: These reports form the core of financial reporting, including the Balance Sheet, Income Statement (Profit & Loss), and Cash Flow Statement. They provide a snapshot of your company’s financial health at a specific point in time or over a period.

- Profit and Loss (P&L) Reports: These reports track revenue and expenses over a period, helping you understand profitability trends and identify areas for improvement. The P&L highlights the financial performance of your business by summarizing income and costs.

- Balance Sheet Reports: This report presents a snapshot of your assets, liabilities, and equity at a specific point in time. It offers a crucial overview of your company’s financial position.

- Cash Flow Reports: These reports analyze the movement of cash in and out of your business. They provide valuable insights into the ability to meet short-term obligations.

- Customer and Vendor Reports: These reports help you analyze your customer and vendor relationships, identify top customers, and manage outstanding invoices. This allows for targeted marketing strategies and better vendor management.

- Inventory Reports: These reports track your inventory levels, costs, and sales, assisting in inventory management and avoiding stockouts or overstocking. This is essential for businesses with inventory.

Creating and Customizing Reports

Creating and customizing reports is straightforward within QuickBooks Desktop. The process involves selecting the desired report type, specifying the date range, and customizing the displayed data fields.

- Report Selection: Select the report type from the available options within the Reports menu. Different report types offer varying levels of customization.

- Date Range: Specify the date range for the report to filter the data and focus on a particular period. This allows for analyzing specific time frames and identifying trends.

- Data Fields: Customize the data fields included in the report. This is crucial for tailoring the report to focus on relevant metrics and gain valuable insights.

- Grouping and Sorting: Group and sort the data to gain further insights and identify patterns. This feature allows you to analyze the data from various perspectives.

Examples of Useful Reports

Different businesses benefit from various reports. A retail store might focus on sales trends, while a service-based business might analyze customer profitability.

- Profit and Loss (P&L): This report is vital for understanding the profitability of your business. It identifies areas where revenue is exceeding expenses, or where costs might be too high.

- Balance Sheet: This report showcases the financial position of your company. It helps in evaluating the assets, liabilities, and equity of your business.

- Customer Aging Report: This report helps track outstanding invoices and identify customers with overdue payments. It’s crucial for managing receivables and collections.

- Sales by Product Report: This report helps you understand which products are selling well and which are not. This information is essential for making informed decisions about your product offerings.

Exporting Reports

Exporting reports to other applications is a critical step for further analysis and integration with other business tools. QuickBooks Desktop allows for various export formats, enabling easy data transfer and manipulation.

- Export Options: QuickBooks Desktop offers several export options, including CSV, Excel, PDF, and others. These options ensure that you can use the data in various applications and tools.

- Data Transfer: Exporting reports into other applications like spreadsheets or presentation software allows for deeper data analysis and visualization. This feature provides a seamless way to use the data from QuickBooks in other software.

Common Issues and Troubleshooting

QuickBooks Desktop, while a powerful accounting tool, can encounter various problems. Understanding these common issues and their troubleshooting steps is crucial for maintaining data integrity and avoiding costly delays. This section provides a comprehensive guide to identifying, resolving, and preventing typical QuickBooks Desktop problems.

Troubleshooting QuickBooks Desktop issues often involves methodical steps and a clear understanding of potential causes. By identifying the root of the problem, you can apply the appropriate solutions and prevent future occurrences. Knowing how to seek support for complex or persistent issues is also vital for ensuring timely resolution.

Connection Problems

Connection problems are a frequent source of frustration when using QuickBooks Desktop. These problems can range from network issues to incorrect login credentials. Understanding these potential issues is vital for swift resolution.

- Network Connectivity Issues: Verify your internet connection and network settings. Ensure the necessary ports are open for QuickBooks to communicate with the network. Try connecting to a different network or using a different internet service provider if possible.

- Incorrect Login Credentials: Double-check your QuickBooks username and password. Ensure the information is entered accurately, and try logging in again. If you’ve recently changed your password, make sure you use the updated credentials.

- Firewall or Antivirus Conflicts: Check if your firewall or antivirus software is blocking QuickBooks. Add QuickBooks to the list of allowed applications or adjust the firewall settings. Similarly, check if the antivirus software is interfering with the application’s processes.

Data Errors

Data errors can lead to inconsistencies and inaccuracies in your financial records. Proper identification and resolution are critical for maintaining the integrity of your financial data.

- Data Corruption: Regular backups are essential to prevent data loss due to corruption. Restore from a recent backup if possible. If the data is corrupted, you might need to seek professional help for repair.

- Incorrect Data Entry: Carefully review your data entry for any typos, missing information, or formatting errors. Double-check figures and ensure data accuracy to prevent future issues.

- Missing or Incorrect Account Codes: Confirm that all transactions are categorized with the correct accounts. Ensure that the codes are accurate and match your chart of accounts.

Preventing Common Problems

Proactive measures can significantly reduce the likelihood of encountering problems. By implementing these strategies, you can enhance the stability and efficiency of your QuickBooks Desktop operations.

- Regular Backups: Create regular backups of your QuickBooks data to safeguard against data loss from hardware failures, software errors, or accidental deletions. Automate this process whenever possible.

- Data Validation: Periodically validate your data to identify and correct any errors. Implement checks to ensure data accuracy and consistency.

- Keeping QuickBooks Updated: Stay current with the latest QuickBooks updates to benefit from bug fixes and improved functionality. These updates often include security patches to mitigate vulnerabilities.

Seeking Support

If troubleshooting steps fail to resolve the issue, it’s crucial to seek appropriate support. Consulting experts or leveraging online resources can help in such situations.

- QuickBooks Support Forums: Leverage the vast community of users and experts on QuickBooks support forums to find solutions to similar problems. Share details about your specific issue to get relevant guidance.

- QuickBooks Desktop Help Center: Utilize the extensive resources available in the QuickBooks help center. This resource provides detailed articles and tutorials that address common problems.

- Professional Accountant or Consultant: If the problem persists, consider seeking professional help from an accountant or QuickBooks consultant. They possess the expertise to diagnose and resolve complex issues.

Integration with Other Applications

QuickBooks Desktop’s power extends beyond its core accounting functions. Its integration with other applications allows for a streamlined workflow and a more comprehensive view of your business operations. This seamless connection reduces manual data entry and enhances overall efficiency, which directly impacts the accuracy and timeliness of your financial reporting.

The ability to connect QuickBooks with other applications such as email, payment processors, and inventory management systems provides a holistic view of your business operations. This integrated approach saves time and reduces errors, making QuickBooks Desktop a valuable asset for businesses of all sizes.

Connecting QuickBooks to Email

Integrating QuickBooks with email systems allows for automated receipt tracking, invoice notifications, and streamlined communication with customers and vendors. This integration improves efficiency by automating repetitive tasks and reducing manual intervention.

Connecting QuickBooks to Payment Processors

Seamless integration with payment processors allows for automatic reconciliation of transactions and reduces manual data entry. This feature streamlines the payment process, ensuring that all payments are properly recorded and reconciled within QuickBooks. This integration minimizes errors and streamlines accounting procedures.

Connecting QuickBooks to Inventory Management Systems

Many businesses benefit from linking QuickBooks Desktop to inventory management systems. This connection allows for real-time tracking of inventory levels, automatic cost calculations, and accurate inventory valuation. This integration is crucial for businesses that rely on a steady supply chain and need to accurately reflect inventory data in their financial reports.

QuickBooks Desktop Compatibility with Other Software

The compatibility of QuickBooks Desktop with other software varies based on the specific application. A comprehensive list of compatible software is not always readily available, but QuickBooks support resources and online communities can provide valuable insights into specific integrations. This information is often available in the form of lists and guides on QuickBooks’ official website and in the knowledge base.

| Software Category | Examples | Compatibility Notes |

|---|---|---|

| Email Clients | Gmail, Outlook, Yahoo Mail | Integration often requires specific add-ons or third-party tools. |

| Payment Processors | PayPal, Stripe, Square | Integration is generally available, often with specific API connections. |

| Inventory Management Systems | Fishbowl Inventory, Zoho Inventory | Compatibility often requires a bridge or intermediary tool to transfer data. |

| CRM Systems | Salesforce, Zoho CRM | Limited direct integration. Data may require manual entry or use of third-party tools. |

Connecting to Third-Party Services

The process for connecting QuickBooks Desktop to third-party services often involves installing add-ons or utilizing specific APIs provided by the third-party application. These steps can vary depending on the particular application, but usually include downloading and installing the integration tool and then configuring the connection within QuickBooks Desktop.

Connecting QuickBooks to other applications often requires careful configuration to ensure data accuracy and security.

Security Considerations

Protecting your QuickBooks Desktop data is paramount. A robust security strategy prevents financial losses, maintains compliance, and safeguards your business’s reputation. This section details essential security measures to ensure the integrity and confidentiality of your QuickBooks data.

Implementing strong security practices in QuickBooks Desktop is crucial to protect your financial information from unauthorized access and potential threats. Comprehensive security measures go beyond basic passwords and encompass proactive strategies to mitigate risks associated with malware, viruses, and data breaches.

Password Protection and Access Control

Strong passwords are the first line of defense against unauthorized access. Creating complex passwords that are difficult to guess is essential. Use a combination of uppercase and lowercase letters, numbers, and symbols. Avoid using easily guessable information like birthdays, names, or common words. Regularly change your passwords to further enhance security. Restrict access to QuickBooks Desktop to authorized personnel only. Use the built-in user accounts and permissions within QuickBooks Desktop to manage who can view and modify data. This granular control limits potential damage from unauthorized actions.

Data Backup and Recovery

Regular data backups are critical for disaster recovery. Data loss can have severe consequences for your business, impacting operations and financial stability. Establish a robust backup strategy that involves backing up your QuickBooks data regularly to an external hard drive, cloud storage, or a combination of both. Consider using a scheduled backup process to ensure continuous data protection. Test your backup and recovery procedures periodically to verify their effectiveness. This proactive approach ensures that you can restore your data quickly in case of unforeseen circumstances.

Malware and Virus Protection

Protecting your computer from malware and viruses is crucial to prevent unauthorized access and data corruption. Maintain up-to-date antivirus software installed on your system. Run regular scans to detect and remove any malicious software. Be cautious about opening attachments or clicking links from unknown sources. Avoid downloading software or files from untrusted websites. Regularly update your operating system and QuickBooks Desktop software to patch vulnerabilities. These measures will help safeguard your data from evolving threats.

Recommended Security Practices

Implementing the following security practices strengthens your QuickBooks Desktop system’s defenses.

- Regular Software Updates: Keeping QuickBooks Desktop and your operating system updated addresses known vulnerabilities and incorporates security enhancements. This is a critical step to minimize potential exploits. Check for updates regularly and install them promptly.

- Firewall Configuration: Configure your firewall to block unauthorized access to your computer and network. This acts as a barrier against malicious attempts to infiltrate your system.

- Strong Network Security: Employ strong passwords and access controls for your network. Use a VPN (Virtual Private Network) if working remotely to protect data transmitted over public networks. Secure your Wi-Fi network with a strong password and avoid using open or unsecured networks.

- Employee Training: Educate employees on security best practices, including password management, phishing awareness, and safe data handling. This creates a security-conscious culture within your organization.

- Regular Security Audits: Conduct regular security audits to identify potential vulnerabilities and implement corrective actions. This proactive approach ensures that your security posture remains robust and up-to-date.

Best Practices and Tips

QuickBooks Desktop offers powerful tools for managing finances, but maximizing its potential requires understanding best practices. These strategies can help you streamline workflows, optimize performance, and avoid common pitfalls, ensuring your business data is accurate and readily accessible.

Efficient use of QuickBooks Desktop hinges on adopting best practices for data entry, report generation, and overall system maintenance. By implementing these techniques, businesses can gain valuable insights into their financial health and make data-driven decisions.

Data Entry Optimization

Proper data entry is crucial for accurate financial records. Consistent formatting and timely input minimize errors and ensure data integrity. Employing clear naming conventions for accounts and transactions enhances organization and reduces confusion. Validating data against pre-defined parameters helps maintain accuracy and prevents mistakes.

Performance Optimization Strategies

QuickBooks Desktop performance can be optimized through several strategies. Regular backups are essential to safeguard data in case of system failures. Closing unnecessary programs and applications while running QuickBooks can improve system responsiveness. Keeping QuickBooks updated with the latest patches and service packs addresses potential bugs and security vulnerabilities, boosting performance and stability. Regularly clearing temporary files and unnecessary data can free up system resources. Consider upgrading your computer’s hardware (RAM, hard drive) if performance issues persist.

Streamlining Workflows

Streamlining workflows in QuickBooks Desktop enhances efficiency and productivity. Batch processing transactions for recurring activities such as payroll or utility bills reduces manual input and minimizes errors. Utilizing QuickBooks Desktop’s automation features for tasks like invoice generation and expense tracking further streamlines operations. Implementing a clear organizational structure for data entry, report generation, and task management is essential. Integrating QuickBooks Desktop with other business applications, if possible, can further optimize workflow and information sharing. This allows seamless data transfer between systems.

Frequently Asked Questions (FAQs)

This section addresses common queries regarding QuickBooks Desktop usage.

- How can I prevent common data entry errors? Employ consistent formatting, utilize clear naming conventions for accounts and transactions, and validate data against pre-defined parameters.

- What are the best practices for backing up QuickBooks data? Regular backups to external hard drives or cloud storage are crucial. Consider using QuickBooks’ built-in backup tools and schedule automated backups for enhanced security.

- How can I troubleshoot slow performance in QuickBooks Desktop? Close unnecessary applications, ensure sufficient system resources (RAM, hard drive space), and keep QuickBooks updated with the latest patches and service packs. Clearing temporary files can also improve performance.

- How do I integrate QuickBooks Desktop with other business applications? Some applications offer integrations. Check for compatibility and consult with QuickBooks support for assistance. If direct integration isn’t possible, consider exporting data into compatible formats for import into other applications.

Advanced Features and Customization

QuickBooks Desktop, while offering a robust foundation for managing finances, allows for customization to cater to specific business needs. Understanding advanced features and customization options empowers users to tailor the software to streamline workflows, enhance data analysis, and ultimately optimize business performance. This section delves into the available options for customizing QuickBooks Desktop to reflect unique industry requirements and workflows.

Custom Field Creation

Custom fields extend QuickBooks’s functionality by enabling the addition of specific data points not initially included in the standard templates. This enhanced data collection provides a deeper understanding of business operations, helping in more targeted decision-making. For instance, a retail business might need to track product color or size, while a construction company might want to log material costs. These custom fields can be added to existing records, providing an extra layer of granularity for specific industry requirements.

Custom Report Creation

QuickBooks’ reporting capabilities are highly customizable. Users can tailor reports to precisely meet their business needs, going beyond standard financial statements. A customized report can summarize data from various sources, creating a personalized dashboard reflecting key performance indicators (KPIs) or specific metrics vital to the business. For example, a real estate company can generate a report tracking rental income, expenses, and vacancy rates for each property.

Integration with Other Applications

Advanced users can leverage QuickBooks Desktop’s API and third-party integrations to connect the software with other applications, fostering seamless data flow and automated processes. This can significantly reduce manual data entry and enhance overall efficiency. For example, an accounting firm might integrate QuickBooks with a time-tracking software to automatically record client billable hours. This streamlines the invoicing process and provides accurate time-tracking records.

Industry-Specific Customization

Different industries have unique requirements, and QuickBooks Desktop offers various customization options to address these specific needs. The software provides a platform for tailoring data fields, reports, and workflows to match industry-specific procedures.

- Retail: Custom fields can track product attributes (color, size, material) for inventory management and sales reporting. Customized reports can analyze sales trends by product category or specific promotions.

- Construction: Custom fields can track job costs, materials used, and project timelines. Reports can monitor project budgets, track labor hours, and analyze profitability for each job.

- Real Estate: Custom fields can track property details, rental income, expenses, and tenant information. Custom reports can provide insights into property performance, rental income projections, and vacancy rates.

Advanced Features and Tools

Advanced users can leverage QuickBooks Desktop’s advanced features to streamline complex processes. These features offer substantial benefits in terms of time savings, improved accuracy, and comprehensive data analysis.

- Scheduled Tasks: Users can automate tasks, such as generating reports or sending invoices, to streamline workflows and reduce manual intervention.

- Custom Scripting: Advanced users can create custom scripts to automate repetitive tasks and integrate with other applications, boosting efficiency.

- API Integration: Accessing the API enables the creation of custom applications and integrations to further enhance the software’s functionality. This allows seamless data exchange with other business systems.

Ultimate Conclusion

In conclusion, QuickBooks Desktop offers a robust suite of tools for managing accounting tasks efficiently. This guide has provided a comprehensive overview of its functionalities, from basic operations to advanced features. By understanding the various aspects of QuickBooks Desktop, businesses can enhance their financial management processes and gain valuable insights into their performance. Remember to consult the software’s resources and support channels for specific issues and further assistance.