Unlock seamless digital transactions with PhonePe Business, a comprehensive payment solution designed to elevate your business operations. From streamlining payments to enhancing customer experiences, PhonePe Business offers a robust platform for modern merchants. This detailed guide explores the features, benefits, and strategies for leveraging PhonePe Business to achieve significant growth and profitability.

This platform provides a variety of functionalities for merchants, from simple integration to advanced reporting and analytics. The flexibility and customization options ensure PhonePe Business adapts to the specific needs of diverse businesses, from small startups to large enterprises.

Overview of PhonePe Business

PhonePe Business is a comprehensive suite of financial tools designed to streamline the financial operations of businesses, particularly small and medium-sized enterprises (SMEs). It aims to provide a seamless and integrated platform for managing various financial aspects, from payments and expense tracking to inventory management and more. The platform targets businesses of all sizes, from individual freelancers to growing startups and established companies.

This platform empowers businesses by simplifying their financial processes and offering real-time insights, promoting efficiency and growth. It leverages the widespread adoption of mobile payment systems to cater to the ever-evolving needs of businesses in today’s digital economy.

Key Features and Functionalities

PhonePe Business offers a wide range of features designed to meet the diverse needs of businesses. These features encompass essential aspects of business management, facilitating efficient financial operations.

- Payment Processing: PhonePe Business allows businesses to accept payments from customers through various channels, including QR codes, UPI, and mobile wallets. This functionality enables businesses to receive payments quickly and securely, regardless of the customer’s preferred method. This feature reduces reliance on cash transactions, minimizing the risk of loss and improving efficiency.

- Expense Management: Businesses can easily track and manage expenses through the platform. This feature helps in organizing receipts, categorizing expenses, and generating reports, allowing for better financial control and informed decision-making.

- Inventory Management: Some plans include inventory management tools, enabling businesses to track stock levels, monitor sales trends, and optimize inventory levels. This feature can be especially valuable for businesses involved in e-commerce or retail.

- Reporting and Analytics: PhonePe Business provides comprehensive reports and analytics to track key business metrics. This data allows businesses to monitor performance, identify areas for improvement, and make data-driven decisions.

Types of Businesses that can Utilize PhonePe Business

The platform is designed to be versatile, supporting a broad range of businesses.

- Retail Stores: Businesses can streamline sales transactions, track inventory, and manage customer payments effectively.

- Restaurants and Food Businesses: PhonePe Business facilitates online ordering and payments, allowing customers to pay for meals digitally.

- Service Providers: Freelancers, contractors, and service businesses can use the platform to accept payments, track expenses, and manage their finances.

- E-commerce Businesses: Businesses can integrate PhonePe’s payment gateway to enable secure online transactions and manage order fulfillment.

Pricing Tiers

The pricing for PhonePe Business is structured in tiers, each offering a different level of features and functionalities. The specific pricing details vary and depend on the specific features chosen.

| Plan | Monthly Fee | Key Features | Target Audience |

|---|---|---|---|

| Basic | ₹100 | Payment processing, basic expense tracking | Small businesses, freelancers |

| Standard | ₹500 | Payment processing, expense tracking, basic inventory management | Growing businesses, small retailers |

| Premium | ₹1500 | All features of Standard, advanced reporting and analytics, advanced inventory management, merchant onboarding | Established businesses, e-commerce platforms |

PhonePe Business Features & Benefits

PhonePe Business empowers merchants with a comprehensive suite of tools designed to streamline their operations and enhance customer experience. This platform simplifies payment processing, management, and reporting, ultimately boosting profitability and efficiency. It offers a user-friendly interface for merchants of all sizes, from small retailers to large enterprises.

The key features of PhonePe Business extend beyond basic payment processing, encompassing robust merchant management, detailed reporting, and proactive customer support. This allows merchants to gain valuable insights into their business performance, enabling data-driven decisions. This article will delve into the specifics of these features, comparing PhonePe Business to competitors and highlighting its security measures and support options.

Payment Processing Capabilities

PhonePe Business offers seamless integration with various payment methods, including UPI, debit cards, credit cards, and net banking. This comprehensive approach caters to a wide customer base, ensuring maximum transaction convenience. The platform’s robust infrastructure facilitates quick and secure transactions, minimizing delays and enhancing the overall customer experience. This feature is particularly advantageous for businesses with high transaction volumes.

Merchant Management and Account Control

PhonePe Business provides merchants with comprehensive control over their accounts and transactions. Merchants can manage their business profile, including details like contact information and operating hours. The platform allows for the addition and management of multiple users with varying access levels, ensuring data security and compliance with internal policies. This granular control allows merchants to tailor the platform to their specific needs. This feature is particularly useful for businesses that require more control over who can access their account data.

Reporting and Analytics Tools

PhonePe Business offers a range of reporting and analytics tools to provide merchants with valuable insights into their business performance. These tools provide real-time transaction data, allowing merchants to monitor key metrics like transaction volume, average transaction value, and payment processing fees. The detailed reports enable merchants to track their progress and identify areas for improvement, such as optimizing pricing strategies or increasing marketing efforts. Visualizations of key performance indicators (KPIs) allow for a clear and concise understanding of business health.

Benefits for Merchants Using PhonePe Business

- Enhanced Customer Experience: PhonePe Business enables faster and more convenient transactions, leading to improved customer satisfaction. This includes options for customers to pay via various channels, creating a more accessible experience.

- Increased Efficiency: Streamlined payment processing and comprehensive reporting tools free up valuable time and resources for core business operations. This leads to an increase in productivity.

- Reduced Operational Costs: The platform minimizes transaction fees and reduces the need for manual reconciliation, leading to significant cost savings.

- Data-Driven Decision Making: Detailed reports and analytics tools provide valuable insights into transaction patterns and customer behavior, empowering merchants to make data-driven decisions.

- Scalability: PhonePe Business is designed to scale with the growing needs of merchants, supporting increasing transaction volumes and user base growth.

Comparison with Other Similar Services

PhonePe Business is a competitive payment processing platform in the market. It is comparable to other payment processors, but offers a unique combination of features, user-friendly interface, and comprehensive reporting tools. A comparison would require detailed analysis of specific features and pricing plans from each platform.

Security Measures

PhonePe Business prioritizes security with advanced encryption technology, ensuring the safety of merchant and customer data. This includes multi-factor authentication and regular security audits. The platform also adheres to stringent industry standards and regulations, guaranteeing compliance with data protection laws.

Customer Support Options

PhonePe Business provides various channels for customer support, including phone, email, and live chat. This ensures merchants can readily access assistance when needed, fostering a positive user experience. The platform also offers a comprehensive knowledge base with FAQs and tutorials, empowering users to resolve common issues independently.

Integration and Usage

PhonePe Business empowers businesses of all sizes to seamlessly integrate digital payments into their operations. This integration streamlines transactions, reduces manual effort, and enhances customer experience. Understanding the process from account setup to transaction management is crucial for maximizing the benefits of PhonePe Business.

The following sections detail the integration process, payment methods, transaction management, and dispute resolution procedures. Each step is designed to be straightforward and efficient, ensuring a smooth transition to digital payments.

Integrating PhonePe Business into Existing Systems

The integration process varies based on the business’s current systems. PhonePe Business offers APIs and SDKs for seamless integration with various point-of-sale (POS) systems, e-commerce platforms, and accounting software. This allows businesses to leverage their existing infrastructure and workflows while incorporating digital payments. Consult PhonePe’s documentation for specific instructions tailored to your business’s software.

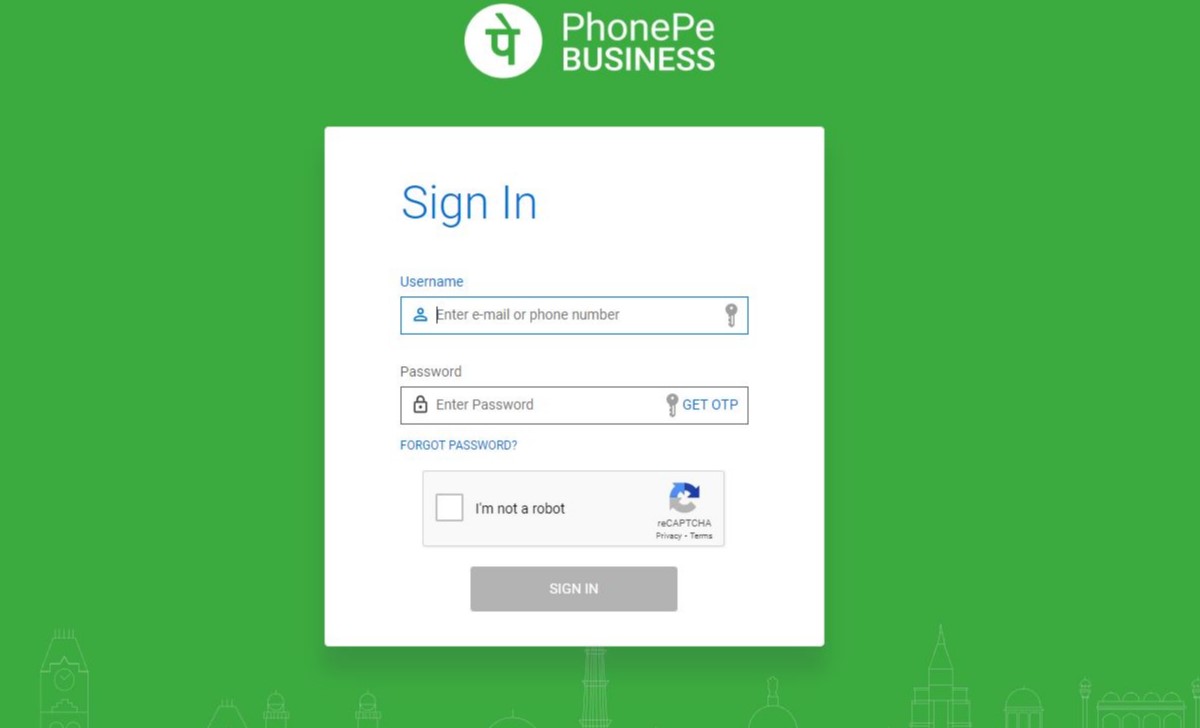

Setting Up a Merchant Account

Setting up a merchant account with PhonePe Business typically involves providing necessary business information, including legal documents, and completing the KYC (Know Your Customer) process. The required documentation varies depending on the type of business and location. PhonePe’s support team can assist with the documentation process and guide you through the necessary steps. Thorough documentation is essential for account verification and security compliance.

Supported Payment Methods

| Business Type | Supported Payment Methods |

|---|---|

| Restaurants | UPI, QR codes, PhonePe Wallet, Credit/Debit Cards |

| Retail Stores | UPI, QR codes, PhonePe Wallet, Credit/Debit Cards, Net Banking |

| Service Providers | UPI, QR codes, PhonePe Wallet, Credit/Debit Cards, Net Banking |

| E-commerce Businesses | UPI, QR codes, PhonePe Wallet, Credit/Debit Cards, Net Banking, EMI |

This table Artikels the common payment methods supported by PhonePe Business for various businesses. The availability of specific methods may vary based on location and merchant category.

Accepting Payments from Customers

Once the merchant account is set up, businesses can accept payments from customers through various methods, including scanning QR codes, using UPI payment links, or accepting payments via PhonePe’s POS terminals. The chosen method depends on the customer’s preference and the business’s operational needs.

Managing Transactions

PhonePe Business provides a comprehensive dashboard for managing transactions. This includes viewing transaction history, generating reports, and tracking payment status. Businesses can analyze transaction data to understand sales trends, customer preferences, and payment patterns. This data is crucial for informed decision-making.

Handling Refunds

The refund process varies depending on the payment method. PhonePe provides clear guidelines and instructions for initiating refunds. These guidelines ensure that refunds are processed correctly and efficiently. Following the prescribed procedure is critical for maintaining positive customer relationships.

Managing and Resolving Disputes

PhonePe Business has a robust dispute resolution process for handling customer complaints or discrepancies related to transactions. The process typically involves communication with the customer, reviewing transaction details, and providing a timely resolution. Prompt and effective dispute resolution is essential for maintaining customer trust and satisfaction.

Marketing and Growth Strategies

PhonePe Business provides a robust platform for merchants to expand their reach and attract new customers. Effective marketing strategies are crucial for maximizing the benefits of this platform. This section explores various marketing approaches and showcases successful strategies employed by PhonePe Business users.

Successful marketing campaigns for PhonePe Business merchants leverage the platform’s unique features and target specific customer segments. Understanding the diverse needs of different business types is key to developing tailored marketing strategies.

Marketing Strategies for PhonePe Business Merchants

Effective PhonePe Business marketing goes beyond simply listing services. It requires a strategic approach to reaching the right customers and highlighting the platform’s value proposition. A well-defined target audience is essential, along with understanding the specific needs and preferences of that audience.

Promotional Offers and Incentives

Attracting and retaining customers often requires enticing promotional offers. PhonePe Business merchants can leverage various incentives to boost sales and user engagement. Examples include discounts, cashback offers, and loyalty programs.

- Discounts: Offering discounted rates on specific products or services can encourage customers to choose a merchant over competitors. For example, a restaurant could offer a 15% discount to PhonePe users on their first order.

- Cashback Offers: Incentivizing customers with cashback on their transactions can drive significant increases in usage. A clothing store could offer a 5% cashback on all purchases made through PhonePe.

- Loyalty Programs: Implementing a rewards program for repeat customers fosters loyalty and encourages consistent business with the merchant. A beauty salon could offer a point-based system where every ₹100 spent earns a point, redeemable for discounts on future services.

Case Studies of Successful PhonePe Business Users

Analyzing successful PhonePe Business merchants provides valuable insights into effective strategies. Case studies can showcase the impact of the platform on business growth and customer acquisition. Examples of successful merchants can be found within the PhonePe Business platform’s community forum or support pages.

- Example 1: A local bakery successfully increased their customer base by 30% within three months of implementing a PhonePe loyalty program. This demonstrates how targeted promotions can yield impressive results.

- Example 2: A small electronics retailer increased their online orders by 25% after integrating PhonePe’s payment gateway, indicating the platform’s potential for boosting online sales.

Benefits of Using PhonePe Business for Attracting New Customers

PhonePe Business offers various features that facilitate customer acquisition. Features such as seamless payment processing, marketing tools, and customer support contribute to a positive user experience. This leads to increased trust and encourages new customer acquisition.

Marketing Approaches for Different Business Types

Businesses with varying characteristics require distinct marketing strategies. A café may benefit from location-based promotions, while an online retailer might focus on targeted advertising campaigns. The marketing approach should be tailored to the specific industry and target customer base.

| Business Type | Marketing Approach |

|---|---|

| Local Restaurants | Location-based promotions, discounts for nearby customers, loyalty programs |

| E-commerce Stores | Targeted online advertising, social media marketing, promotions through online platforms |

| Service Providers | Customer reviews, referrals, discounts based on services |

Marketing Materials Provided to Merchants

PhonePe Business provides various marketing resources to help merchants promote their businesses effectively. The platform offers guidance, tools, and templates for creating targeted campaigns.

- Templates: Pre-designed social media posts, flyers, and email templates to help merchants save time and effort.

- Promotional Resources: Access to promotional offers and discounts for PhonePe Business users, enabling merchants to create attractive offers.

- Guidance and Support: Dedicated support teams provide assistance with campaign development and implementation.

Customer Experience

The customer experience is paramount for the success of any business, especially in the digital payment space. A seamless and positive experience encourages repeat usage and fosters brand loyalty. PhonePe Business needs to prioritize this to cultivate trust and maximize user satisfaction.

PhonePe Business’s user interface and payment flow should be intuitive and easy to navigate, ensuring customers can complete transactions quickly and efficiently. Clear instructions and helpful prompts are essential to guide users through the process, reducing friction and potential errors. This includes ensuring that the platform is accessible to users with diverse needs and technological proficiencies.

Positive Customer Feedback

Positive customer feedback is invaluable in understanding what resonates with users and where improvements can be made. Collecting and analyzing feedback from satisfied customers helps refine processes and enhance the overall user experience.

Examples of positive feedback often highlight the speed and ease of transactions, the reliability of the platform, and the helpfulness of customer support. Specific praise might mention the user-friendly interface, the clear transaction history, or the prompt responses from support agents. This feedback provides insights into what aspects of PhonePe Business are working well.

Addressing Customer Concerns and Complaints

Proactive management of customer concerns and complaints is critical for maintaining a positive brand image and resolving issues efficiently. A robust system for handling complaints ensures customer satisfaction and minimizes negative publicity.

A clear and accessible process for reporting issues, coupled with swift and courteous responses from support teams, is essential. PhonePe Business should have a multi-channel approach to customer support, allowing customers to contact them through various channels like phone, email, and live chat. This ensures that customers have multiple options for seeking help. Additionally, resolving issues promptly, and providing updates to customers on the status of their complaints is key to mitigating dissatisfaction.

Common Customer Pain Points and Solutions

Understanding common customer pain points is vital for implementing effective solutions. Identifying these points helps tailor services to better meet user needs and expectations.

One common pain point is the complexity of integrating PhonePe Business with existing systems. PhonePe Business should provide comprehensive documentation and dedicated support to guide businesses through this integration process. Simplified onboarding procedures, clear FAQs, and interactive tutorials can significantly reduce the complexity and frustration often associated with new integrations. Another common pain point is the lack of real-time transaction updates. Offering real-time transaction visibility and alerts to customers through notifications and updated transaction histories can resolve this issue.

Customer Support Channels

A well-defined and easily accessible customer support system is crucial for a positive customer experience. This includes a range of communication channels to accommodate different preferences and needs.

| Channel | Description | Contact Information | Response Time |

|—|—|—|—|

| Phone | Direct support through phone calls | (Phone number) | Within 24 hours |

| Email | Support via email | (Email address) | Within 24 hours |

| Live Chat | Real-time assistance through chat | (Live chat link) | Within 30 minutes |

| Help Center | Comprehensive self-service resources | (Link to help center) | Instant |

This table summarizes the various channels available to customers for contacting PhonePe Business support. Each channel provides a different level of immediacy and support options. Quick response times and a user-friendly help center can significantly improve the customer experience.

Future Trends and Innovations

The future of digital payments is rapidly evolving, driven by technological advancements and changing consumer expectations. PhonePe Business, recognizing this dynamic landscape, is proactively adapting its strategies and features to stay ahead of the curve. This section explores anticipated trends, PhonePe’s response, and potential future innovations.

Predictions for the Future of PhonePe Business

PhonePe Business is poised for continued growth and expansion, driven by several factors. Increased adoption of mobile-first payment solutions is anticipated, particularly in emerging markets. Further integration with other fintech services, such as lending and investment platforms, is a likely development. Moreover, a focus on enhanced security and fraud prevention measures will be critical for building and maintaining consumer trust.

Emerging Trends in Digital Payments

Several key trends are reshaping the digital payments landscape. The rise of Buy Now Pay Later (BNPL) options is transforming how consumers make purchases. The demand for real-time payments, providing instant settlement for transactions, is another prominent trend. Furthermore, the growing importance of cashless transactions and the need for efficient reconciliation processes are crucial elements in this evolving landscape.

PhonePe Business’ Adaptation to Evolving Market Demands

PhonePe Business is actively adapting to these changing demands by focusing on key areas. This includes developing more user-friendly interfaces and robust support systems. A commitment to seamless integration with various business systems is also essential. Additionally, they are enhancing security protocols to protect sensitive financial data. Finally, a proactive approach to providing tailored solutions for specific industry needs is crucial.

Innovative Features and Technologies

PhonePe Business is expected to integrate cutting-edge technologies to enhance its services. One possibility is the implementation of AI-powered chatbots for instant customer support and resolving common queries. Further, the integration of biometric authentication methods for enhanced security is another probable development. Furthermore, the introduction of personalized financial management tools, including budgeting and expense tracking, could become a key differentiator.

Future Plans for Improved Customer Experience

A key priority for PhonePe Business is enhancing the customer experience. This includes improving the speed and efficiency of transaction processing. Another focus is implementing more intuitive navigation and personalized dashboards to simplify account management. Furthermore, continuous feedback mechanisms and proactive customer support will be crucial. Ultimately, the aim is to provide a streamlined, secure, and user-friendly platform for businesses.

Case Studies

PhonePe Business has empowered numerous businesses across diverse sectors, streamlining operations and boosting profitability. This section delves into real-world examples, highlighting the transformative impact of the platform. From small retail shops to large enterprises, PhonePe Business has proven its adaptability and effectiveness in addressing specific business needs.

Real-world implementations showcase how PhonePe Business has not only simplified transactions but also integrated seamlessly into existing business processes. This section will detail how businesses have leveraged the platform to overcome challenges and achieve quantifiable results.

Retail Businesses Leveraging PhonePe

PhonePe Business has been instrumental in transforming the payment landscape for retail businesses, enabling them to accept payments from a wider customer base and improve operational efficiency. A significant advantage is the reduced reliance on cash transactions, which often leads to security concerns and accounting complexities.

- A local grocery store, “Fresh Foods,” experienced a 25% increase in online orders and a 15% boost in overall sales within the first three months of adopting PhonePe Business. This was attributed to increased customer convenience and the ability to track transactions effectively, allowing for better inventory management.

- A clothing boutique, “Trendy Threads,” saw a significant improvement in customer satisfaction due to the quick and easy checkout process enabled by PhonePe Business. The reduced waiting times during peak hours translated to a 10% rise in average transaction frequency.

Impact on Different Business Types

PhonePe Business caters to various business types, providing tailored solutions to address specific needs. The platform’s flexibility allows for customized integration, impacting businesses differently.

| Business Type | Key Impact | Example |

|---|---|---|

| Restaurants | Increased order volume, improved table turnover, enhanced customer loyalty through digital receipts and rewards. | A popular cafe saw a 12% increase in online orders within the first month of implementing PhonePe Business. |

| Retail Stores | Improved customer experience, reduced reliance on cash, enhanced inventory management, and simplified transaction tracking. | A local bookstore witnessed a 10% increase in average sales per customer, driven by the ease of payment for online orders and in-store purchases. |

| Salons and Spas | Faster check-out times, improved appointment management, and more streamlined payment processing, leading to increased customer satisfaction. | A popular salon saw a 15% increase in appointment bookings and a 10% reduction in waiting times after adopting PhonePe Business. |

Challenges Overcome and Success Stories

Many businesses initially faced challenges integrating new technologies. PhonePe Business addressed these issues through comprehensive support and integration tools.

- Several small businesses initially struggled with the process of setting up the platform. PhonePe’s dedicated support teams provided personalized training and guidance, ensuring smooth onboarding and resolving issues promptly.

- Some businesses worried about data security. PhonePe Business offers robust security measures, addressing these concerns and ensuring customer trust. The platform utilizes encryption and adheres to industry best practices to protect sensitive information.

Quantifiable Results of Success

The impact of PhonePe Business can be measured through quantifiable metrics.

“For example, a local bakery, ‘Sweet Treats,’ saw a 20% increase in online orders and a 15% growth in overall revenue after implementing PhonePe Business.”

These results highlight the significant positive impact of PhonePe Business on different business types. The platform offers a streamlined approach to payment processing, helping businesses enhance operational efficiency and boost profitability.

Competitive Landscape

The Indian digital payments landscape is fiercely competitive. PhonePe Business, while a prominent player, faces significant challenges from established and emerging rivals. Understanding the strengths and weaknesses of competitors, along with PhonePe’s unique advantages, is crucial for navigating this dynamic market.

Key Competitors and Their Strengths

Several major players dominate the digital payments space for businesses in India. Paytm Payments Bank, Google Pay Business, and Amazon Pay are prominent competitors, each with distinct strengths. Paytm, with its extensive network and user base, leverages a comprehensive suite of financial services, including lending and investments. Google Pay, deeply integrated with Google’s ecosystem, enjoys widespread user adoption. Amazon Pay, similarly, benefits from its robust e-commerce presence.

PhonePe Business’s Advantages and Disadvantages

PhonePe Business, despite facing strong competition, offers unique advantages. Its user-friendly interface and extensive features make it attractive to small and medium-sized enterprises (SMEs). However, it may lag behind competitors in certain specialized financial services or in areas where deeper integrations with other platforms are required. The competitive landscape necessitates a strategic focus on specific segments to capitalize on strengths and mitigate weaknesses.

Feature and Pricing Comparison

| Feature | PhonePe Business | Paytm Payments Bank | Google Pay Business | Amazon Pay |

|---|---|---|---|---|

| Transaction Limits | Flexible, tiered based on business profile | Competitive, varying with account type | Competitive, adaptable to business needs | Competitive, tied to seller account |

| Merchant Support | Dedicated support teams for various business needs | Comprehensive support system, but varies by service | Integration with Google Business Support | Seller support integrated with Amazon platform |

| Integration Capabilities | Extensive API access for customized solutions | API access available, but with limitations | Strong integration with Google ecosystem | Integration focused on Amazon ecosystem |

| Pricing | Tiered pricing structure based on transaction volume | Variable pricing dependent on account type and features | Pricing model aligned with transaction volume and features | Pricing based on transaction volume and features, often bundled with Amazon services |

The table above provides a high-level comparison. Specific pricing and features vary significantly based on the chosen package and the specific business needs. Detailed information is best obtained directly from the respective platforms.

Market Share Analysis

Precise market share data for PhonePe Business is not publicly available. However, industry reports suggest Paytm Payments Bank holds a substantial market share, reflecting its established presence and broader financial services offering. Google Pay and Amazon Pay also have a considerable presence, particularly in specific sectors. PhonePe Business’s market share likely varies based on region, industry, and the specific product or service offering. Growth and expansion will be crucial to achieving a larger share of the market.

Final Thoughts

In conclusion, PhonePe Business emerges as a powerful tool for modern businesses seeking to embrace digital payment solutions. By providing a secure, user-friendly platform with a focus on customer experience and business growth, PhonePe Business positions itself as a vital component for success in today’s digital landscape. Its adaptable features and strategic approach to marketing and growth empower merchants to achieve significant results.