Diving deep into the Citi Mobile App, this review explores its features, user experience, security, and more. From its core mobile banking functionalities to customer support, we’ll examine every aspect of the app, ultimately assessing its strengths and weaknesses against competitors.

The app’s functionality extends beyond typical banking, encompassing investment tools and seamless integration with other Citi products. Understanding the target audience and user journey is key to evaluating its effectiveness. This analysis aims to provide valuable insights for both current and potential users.

Overview of Citi Mobile App

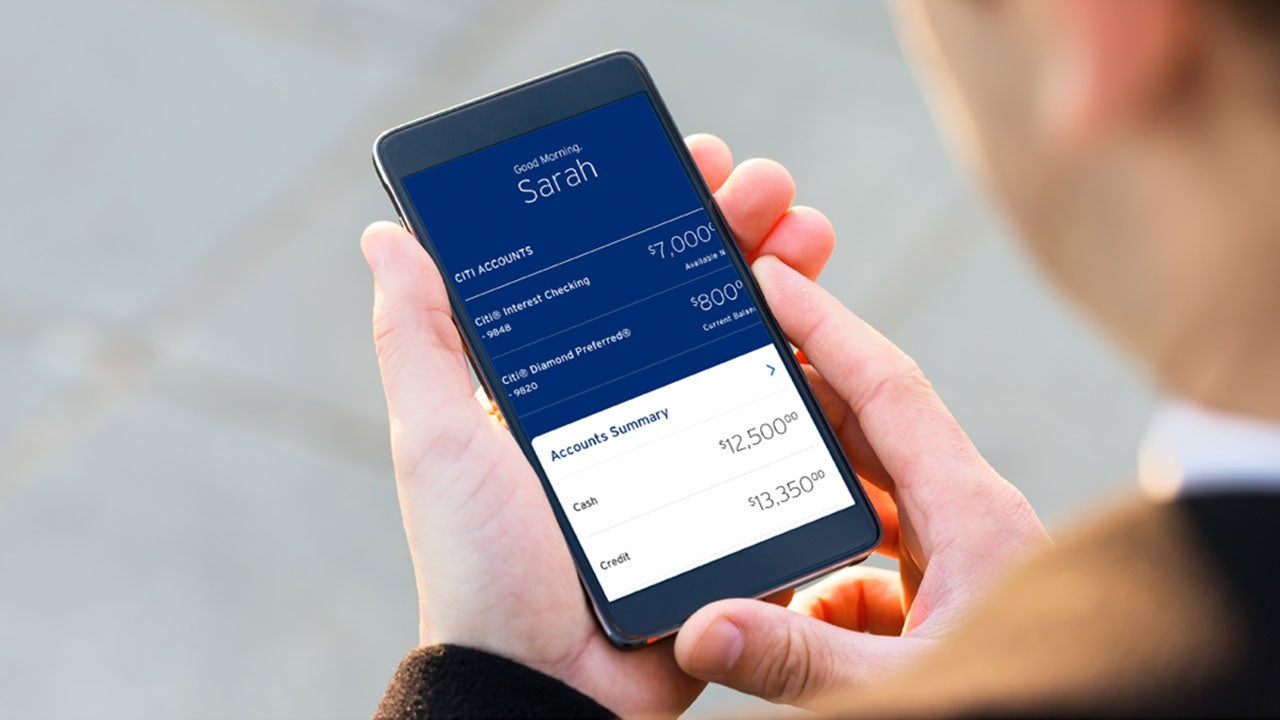

The Citi Mobile App provides a comprehensive digital banking platform for Citibank customers. It streamlines banking activities, allowing users to manage accounts, make payments, and access financial insights from anywhere, anytime. This ease of access, combined with robust security features, makes the app a valuable tool for managing personal finances effectively.

Purpose and Functionalities

The Citi Mobile App serves as a primary interface for Citibank customers to interact with their accounts and financial products. Key functionalities include account balance inquiries, bill payments, fund transfers, and investment management. It also facilitates the tracking of transactions and offers insights into spending habits. Additionally, the app empowers users to manage their credit cards and access their reward programs.

Key Differentiating Features

Several features set the Citi Mobile App apart from other banking apps. These include:

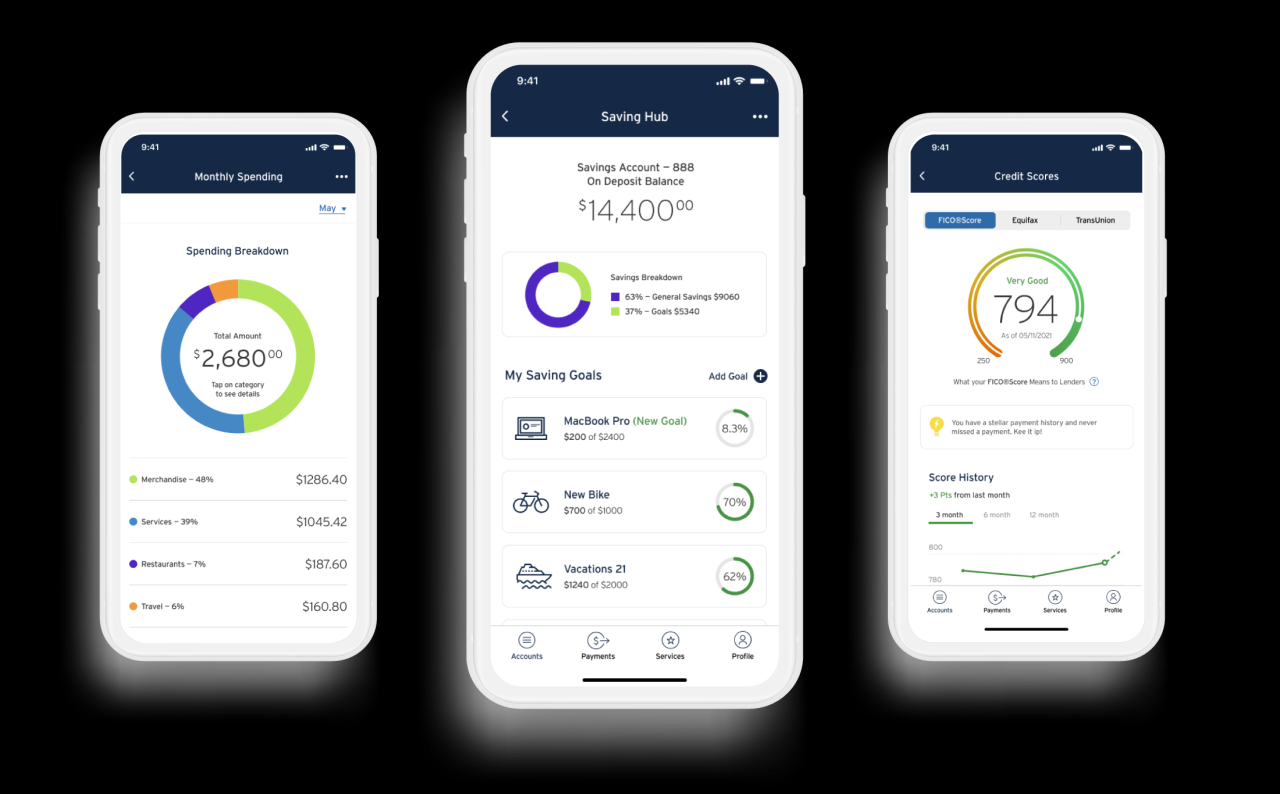

- Personalized Financial Insights: The app goes beyond basic transaction tracking by offering personalized financial summaries and budgeting tools, allowing users to monitor their spending and savings patterns.

- Secure Transaction Management: Advanced security protocols and multi-factor authentication ensure the safety of financial transactions within the app.

- Seamless Integration with Citi Products: The app integrates seamlessly with other Citi products, such as investment accounts and credit cards, providing a unified view of the user’s financial portfolio.

- 24/7 Availability: The app is accessible anytime, anywhere, enabling users to manage their finances regardless of location or time constraints.

Target Audience

The Citi Mobile App caters to a diverse range of individuals and families who value convenience, security, and comprehensive financial management tools. This includes current Citibank account holders seeking a streamlined digital banking experience. The app’s functionality is suitable for both casual and sophisticated users.

Typical User Journey

A typical user journey within the Citi Mobile App might begin with account login. Then, users can access account balances, view transaction history, pay bills, and transfer funds between accounts. The app further enables users to manage their credit cards, view reward points, and access investment portfolios. This streamlined navigation allows users to manage their finances efficiently.

Integration with Citi Products

The Citi Mobile App integrates seamlessly with various Citi products, enhancing the overall user experience. For example, users can link their investment accounts directly within the app, allowing for consolidated portfolio management. Furthermore, payment options are unified, enabling users to make payments across different Citi products with ease. This unified platform fosters a holistic view of the user’s financial landscape.

User Experience (UX) Analysis

The user experience of a mobile banking app is crucial for customer satisfaction and retention. A well-designed app should be intuitive, efficient, and aesthetically pleasing. This analysis examines the Citi Mobile App’s strengths and weaknesses, its navigation, ease of use, and compares it to a competitor’s app.

The Citi Mobile App’s user interface is generally clean and organized, but some areas for improvement are evident. Navigation is fairly straightforward, but could be more streamlined in certain sections. Direct comparisons with leading competitors will highlight areas where Citi can enhance its user experience.

Citi Mobile App UI Strengths

The Citi Mobile App’s interface is generally well-structured, with clear visual hierarchy. Icons are recognizable, and the color scheme is generally easy on the eyes. The layout is often responsive and adjusts well across different screen sizes. Key functionalities like account access and transaction history are readily available.

Citi Mobile App UI Weaknesses

While the app has a good layout, some sections feel cluttered. For example, the investment management section could be improved with clearer categorization of investment products. The design might not be as visually engaging as competitors, potentially leading to a less enjoyable user experience. The loading times for certain pages can be perceived as slow.

Navigation and Ease of Use

The Citi Mobile App’s navigation is generally straightforward, with clear menus and intuitive pathways. However, users might encounter minor roadblocks in certain areas, such as the process for transferring funds between accounts or setting up recurring payments. A streamlined process and clearer instructions would enhance user experience.

Comparison with a Competitor (Example: Chase Mobile)

| Feature | Citi Mobile | Chase Mobile |

|---|---|---|

| Account Overview | Clear presentation of account balances, but some data might be buried within sub-menus. | Visually appealing and easy-to-read account summary. |

| Transaction History | Thorough transaction history, but filtering options are not as intuitive as the competitor’s. | Advanced filtering options and sorting capabilities, allowing users to easily identify specific transactions. |

| Security Features | Robust security measures, with clear notifications for unusual activity. | Similar security measures, but with a more streamlined and user-friendly interface for managing security settings. |

| Investment Management | Basic investment tools, but lacks visual appeal and ease of use compared to Chase. | More comprehensive and visually appealing investment tools, making it easier for users to manage investments. |

Suggestions for Improvement

To enhance the user experience, Citi could focus on streamlining the navigation, particularly in areas like transferring funds and setting up recurring payments. Improved loading times would significantly enhance the overall user experience. Consider incorporating visual aids and intuitive design elements to improve the user interface and investment management section. Implementing a user feedback system would allow Citi to address specific pain points identified by its customers.

Security and Privacy Features

The Citi Mobile App prioritizes safeguarding user data and financial information. Robust security measures are in place to protect sensitive details from unauthorized access and maintain user trust. This section details the implemented security protocols, privacy policies, and a comparative analysis with other banking apps.

Security Measures Implemented

The Citi Mobile App utilizes a multi-layered approach to security. This involves encryption of data both in transit and at rest, ensuring that sensitive information cannot be intercepted or compromised. Advanced authentication methods, such as biometric logins and multi-factor authentication, are employed to verify user identity and prevent unauthorized access. Regular security audits and penetration testing are conducted to identify and address potential vulnerabilities proactively.

Data Protection and Financial Information Security

User data and financial information are protected through a combination of encryption technologies and access controls. Data is encrypted using industry-standard protocols, rendering it unreadable to unauthorized parties. Strict access controls are enforced, limiting access to sensitive information to authorized personnel only. Furthermore, regular security updates and patches are deployed to mitigate any newly discovered vulnerabilities.

Privacy Policies and Terms of Service

Citi’s privacy policy and terms of service Artikel the specific data handling practices for the mobile app. The policy details how user data is collected, used, and protected, ensuring transparency and compliance with relevant regulations. Users are advised to review these documents thoroughly for a comprehensive understanding of the app’s privacy policies.

Comparison with Other Banking Apps

Citi Mobile App security measures are comparable to, and in some cases exceed, those of other leading banking apps. Factors such as encryption strength, authentication protocols, and data protection mechanisms are evaluated to ensure a robust security posture. However, specific security features and their effectiveness may vary across different banking platforms.

Security Feature Effectiveness

| Security Feature | Effectiveness | Description |

|---|---|---|

| Encryption | High | Data at rest and in transit is encrypted using strong encryption algorithms, making it difficult for unauthorized access. |

| Multi-Factor Authentication | High | Requires multiple forms of verification (e.g., password, one-time code) to access accounts, adding an extra layer of security. |

| Biometric Authentication | High | Utilizes biometric data (e.g., fingerprints, facial recognition) for a secure login, minimizing the risk of unauthorized access. |

| Regular Security Audits | High | Proactive security assessments identify potential vulnerabilities and address them before they can be exploited. |

| Security Updates | High | Regularly updated software patches and security fixes address newly discovered vulnerabilities. |

Mobile Banking Features

The Citi Mobile App offers a comprehensive suite of mobile banking features, designed to streamline financial management and provide users with convenient access to their accounts. This section details the core functionalities, focusing on payments, transfers, bill payments, investment tools, and comparisons to competitor apps.

Core Mobile Banking Features

The Citi Mobile App provides a wide range of features for managing accounts on the go. These include account balance checks, transaction history reviews, and bill pay options. Users can also perform fund transfers between their own accounts or to external accounts.

Payment Features

The app’s payment features enable users to make secure payments to merchants or individuals. These features are typically integrated with popular payment networks for added security and transaction processing efficiency. For example, users can use the app to make mobile payments, pay utility bills, or even send money to friends and family. This capability offers a simplified alternative to traditional payment methods, providing convenience and speed.

Transfer Features

The Citi Mobile App facilitates seamless fund transfers between various account types. This includes the ability to transfer money between linked Citi accounts, and in some cases, to external accounts using various methods, including bank transfers and third-party platforms. This capability is essential for managing finances across different accounts efficiently.

Bill Payment Features

The Citi Mobile App allows users to schedule and manage their bill payments. Users can link their accounts to various billers and set up automatic payments for recurring bills. This feature helps to maintain financial responsibility and avoids late fees. It also offers an overview of past and upcoming payments for easy management.

Investment-Related Tools and Functionalities

The Citi Mobile App often integrates investment tools, enabling users to manage their investment portfolios within the app. This may include features such as checking investment account balances, tracking investment performance, and even making certain investment transactions. This functionality allows for a holistic financial management experience.

Comparison to Competitor Apps

Compared to competitor mobile banking apps, Citi’s offering typically focuses on providing comprehensive financial management tools, including investment management and a robust payment system. Some competitor apps might excel in specific areas like the ease of use of a particular payment method or the investment platform’s user interface.

Table of Mobile Banking Features

| Feature | Description |

|---|---|

| Account Balance Check | View current account balances instantly. |

| Transaction History | Review recent transactions for all linked accounts. |

| Fund Transfers | Transfer funds between linked accounts and potentially external accounts. |

| Bill Payments | Schedule and manage bill payments for various utility and other services. |

| Investment Tools | Check investment account balances, track performance, and manage investments. |

| Payment Processing | Process payments to merchants or individuals using secure payment networks. |

| Security Features | Multi-factor authentication, encryption, and other security protocols. |

Customer Support and Accessibility

The Citi Mobile App prioritizes user satisfaction by offering various support channels and ensuring accessibility for all users. This section details the available customer support options, the process for resolving issues, and the app’s accessibility features.

The Citi Mobile App aims to provide a seamless and helpful experience for all users. Comprehensive support channels, clear issue resolution procedures, and adherence to accessibility standards are key elements of this commitment.

Customer Support Channels

The Citi Mobile App provides multiple channels for user support, catering to different preferences and needs. This approach ensures users can readily access assistance when required.

- The app includes a comprehensive FAQ section covering common issues, providing quick and easy solutions for many user queries.

- A dedicated customer service phone line offers direct support from trained representatives, handling more complex issues.

- Online chat support enables users to interact with support agents in real-time, resolving inquiries promptly.

- Email support allows users to submit detailed inquiries and receive personalized responses.

Issue Resolution Process

The process for resolving issues or inquiries within the Citi Mobile App is designed to be efficient and user-friendly.

- Users can first attempt to find answers to their queries within the app’s FAQ section.

- If the FAQ does not provide a solution, users can contact the customer service phone line, initiate an online chat, or send an email.

- The support team will guide users through the necessary steps to resolve the issue, providing solutions and troubleshooting assistance.

- In cases requiring further investigation, the support team may request additional information to better understand the user’s situation.

Accessibility Concerns

The Citi Mobile App prioritizes accessibility for all users. The design and functionalities of the app are reviewed and updated to ensure compatibility with assistive technologies. This includes features such as adjustable text sizes, color contrast options, and keyboard navigation.

- The app adheres to WCAG (Web Content Accessibility Guidelines) standards to ensure accessibility for users with disabilities.

- Users with visual impairments can utilize screen readers and other assistive technologies to navigate the app effectively.

- Users with motor impairments can use the app’s keyboard navigation and alternative input methods.

Support Options and User Needs

The diverse support options within the Citi Mobile App cater to a wide range of user needs and preferences.

| Support Option | Estimated Response Time | Contact Method |

|---|---|---|

| FAQ | Instant | In-app |

| Phone Support | Within 1-2 minutes (average) | 1-800-CitiBank |

| Online Chat | Within 5 minutes (average) | Citi Mobile App |

| Email Support | Within 24 hours (average) | CitiBank Email |

Emerging Trends and Future Potential

Citi Mobile App must adapt to the evolving mobile banking landscape to remain competitive and meet customer expectations. This section explores emerging trends, potential technological integrations, and a future roadmap aligned with industry best practices. A key consideration is the need to continuously enhance user experience, security, and accessibility while keeping pace with innovative financial technologies.

Emerging Trends in Mobile Banking

The mobile banking sector is rapidly evolving, driven by customer demand for seamless, secure, and personalized experiences. Key trends include the increasing use of biometrics for authentication, the integration of artificial intelligence (AI) for personalized financial advice and fraud detection, and the rise of open banking APIs for enhanced financial management tools. Furthermore, the emphasis on mobile-first strategies and the integration of financial tools within everyday apps, like social media platforms, is becoming increasingly prominent.

Potential for Incorporating New Technologies

Several emerging technologies offer exciting opportunities for improving the Citi Mobile App. AI-powered chatbots can provide 24/7 customer support, offering quick solutions to common queries and proactively identifying potential issues. Blockchain technology can enhance security by providing immutable transaction records and streamlining cross-border payments. Furthermore, augmented reality (AR) could revolutionize the way users interact with their financial information, potentially offering interactive visualizations of financial data or providing a more immersive experience for complex financial products.

Future Roadmap for Citi Mobile App

The future roadmap for Citi Mobile App should prioritize seamless integration of emerging technologies, while maintaining the app’s core strengths. This includes implementing robust AI-powered features for fraud detection, personalized financial recommendations, and proactive customer support. Furthermore, the incorporation of blockchain technology can enhance security and streamline cross-border transactions. By proactively addressing the evolving needs of customers, Citi can maintain its position as a leader in the mobile banking industry.

Comparison with Competitors

Competitors like Bank of America, Chase, and Wells Fargo have already started implementing AI-powered chatbots and biometrics for enhanced security. They are also focusing on seamless integration with third-party apps and services, mirroring the growing trend of financial tools being embedded within daily applications. Citi needs to proactively evaluate these strategies and consider how to differentiate its offering while embracing innovation.

Future Potential Features and Functionalities

| Feature | Description | Justification |

|---|---|---|

| AI-Powered Financial Advice | Personalized recommendations for investments, budgeting, and financial planning, powered by machine learning algorithms. | Provides proactive and tailored financial guidance, enhancing customer engagement and satisfaction. |

| Blockchain-Based Transactions | Secure and transparent cross-border transactions leveraging blockchain technology. | Improves security, reduces transaction times, and facilitates international money transfers. |

| Augmented Reality (AR) Financial Visualization | Interactive visualizations of financial data, making complex information more accessible and engaging. | Enhances user comprehension and engagement, potentially leading to better financial decisions. |

| Integration with Social Media Platforms | Facilitates seamless financial transactions and information access within social media applications. | Provides a convenient and integrated experience for customers who utilize social media extensively. |

| Enhanced Biometric Authentication | Improved security measures using facial recognition or fingerprint scanning for increased authentication security. | Offers a more convenient and secure login experience, reducing fraud risks. |

Citi Mobile App Competitor Analysis

The mobile banking landscape is fiercely competitive, with numerous apps vying for customer attention. Understanding the strengths and weaknesses of key competitors is crucial for Citi to effectively position its mobile app and maintain its market share. This analysis will highlight key competitors, assess their relative strengths and weaknesses, and compare their features to Citi’s offering.

Key Competitors

Several prominent financial institutions offer robust mobile banking apps, posing a significant challenge to Citi. These include apps from major banks such as Bank of America, Chase, Wells Fargo, and Capital One, along with specialized fintech competitors offering alternative banking services. Understanding their market positioning, customer base, and unique value propositions is essential for a thorough evaluation.

Competitor Strengths and Weaknesses

Each competitor possesses distinct advantages and disadvantages. Bank of America, for instance, benefits from its extensive branch network and established brand recognition, potentially attracting a large customer base. However, its user interface might not be as intuitive or user-friendly as some of the newer fintech apps. Chase, known for its comprehensive suite of financial products, could offer a more holistic banking experience, but its mobile app might be perceived as less innovative compared to some of its competitors. Wells Fargo’s strength lies in its comprehensive suite of financial products and services, attracting a broad customer base, but it might need to improve on its app’s user experience to better compete. Capital One, focused on credit cards and other financial products, may have a strong following among its target demographic, but might not have the same level of breadth of banking services compared to others. Fintech competitors often excel in user experience and innovative features, but may lack the brand recognition and established security protocols of established banks.

Feature Comparison

The table below provides a comparative overview of key features offered by various competitors, juxtaposed with Citi’s mobile app. This table highlights the overlap and differences in functionalities, allowing for a clear understanding of Citi’s position in the market.

| Feature | Citi Mobile App | Bank of America | Chase | Wells Fargo | Capital One | Example Fintech |

|---|---|---|---|---|---|---|

| Account Management | Deposit, transfer, view statements | Deposit, transfer, view statements | Deposit, transfer, view statements | Deposit, transfer, view statements | Deposit, transfer, view statements | Deposit, transfer, view statements |

| Payment Methods | Bill pay, person-to-person | Bill pay, person-to-person, mobile payments | Bill pay, person-to-person, mobile payments | Bill pay, person-to-person, mobile payments | Bill pay, person-to-person | Bill pay, person-to-person, mobile payments, BNPL |

| Investment Management | Limited investment options | Comprehensive investment options | Comprehensive investment options | Comprehensive investment options | Limited investment options | Investment platform |

| Security Features | Biometric authentication, two-factor authentication | Biometric authentication, two-factor authentication | Biometric authentication, two-factor authentication | Biometric authentication, two-factor authentication | Biometric authentication, two-factor authentication | Strong security protocols |

| Customer Support | 24/7 phone and online support | 24/7 phone and online support | 24/7 phone and online support | 24/7 phone and online support | 24/7 phone and online support | 24/7 chat support |

Competitive Landscape Analysis

The mobile banking market is characterized by intense competition, with a constant drive for innovation and improvement. Existing banks are increasingly incorporating fintech features, while fintech companies are leveraging technology to offer services that challenge traditional banking models. This competitive landscape necessitates a proactive approach for Citi, emphasizing continuous innovation, user-centric design, and a commitment to security.

Closing Notes

In conclusion, the Citi Mobile App presents a well-rounded mobile banking experience, but areas for improvement exist. While its security features and core banking functions are strong, the user experience and customer support could be enhanced. A thorough comparison with competitor apps reveals opportunities to refine the app’s design and offerings. The app’s future potential hinges on its ability to adapt to emerging trends in mobile banking, while maintaining a strong focus on user needs and security.