First Bank’s mobile app offers a convenient way to manage your finances on the go. This comprehensive review explores the app’s features, user experience, security, transactions, customer support, performance, and future potential. We’ll compare it to competitors to understand its strengths and weaknesses.

From navigating the interface to completing transactions, this analysis will cover all aspects of the app, providing a clear picture of its value proposition. The detailed features and functionalities, along with a thorough comparison with competitor apps, will help users make informed decisions.

Overview of First Bank Mobile App

The First Bank Mobile App provides a comprehensive suite of banking services, empowering customers to manage their finances conveniently and securely on their mobile devices. It’s designed to streamline various banking transactions, from account management to payments, and offers a user-friendly interface for seamless interaction.

The app is meticulously crafted to cater to the diverse needs of its target audience, offering a robust platform for financial management and transactions. Its key features are tailored to enhance user experience and provide a competitive edge in the mobile banking market.

Key Features and Functionalities

The First Bank Mobile App boasts a wide array of features designed to simplify and enhance the banking experience. These features cover account management, transactions, and customer support, aiming to provide a holistic banking solution.

| Feature | Functionality |

|---|---|

| Account Management | View account balances, transaction history, and details of linked accounts. Users can also update personal information, such as address and contact details. |

| Funds Transfer | Facilitates seamless transfers between accounts, including inter-bank transfers. The app may offer various transfer methods, such as real-time transfers and scheduled transfers. |

| Bill Payments | Allows users to pay bills for utilities, subscriptions, and other services directly from the app, often integrated with utility providers’ systems for ease of use. |

| Investment Management | For users with investment accounts, the app might offer features like portfolio tracking, investment analysis, and potentially the ability to make investment decisions within the app. |

| Card Management | Enables users to view their cards, block or activate cards, and access card details and statements. This could also include options to request new cards or manage existing card limits. |

| Customer Support | Provides access to customer service channels, such as FAQs, contact information, and possibly live chat or video support options. |

Target Audience

The First Bank Mobile App is designed for a diverse range of users, catering to various financial needs and preferences. The app is aimed at both individual and business customers, offering tailored features for each category.

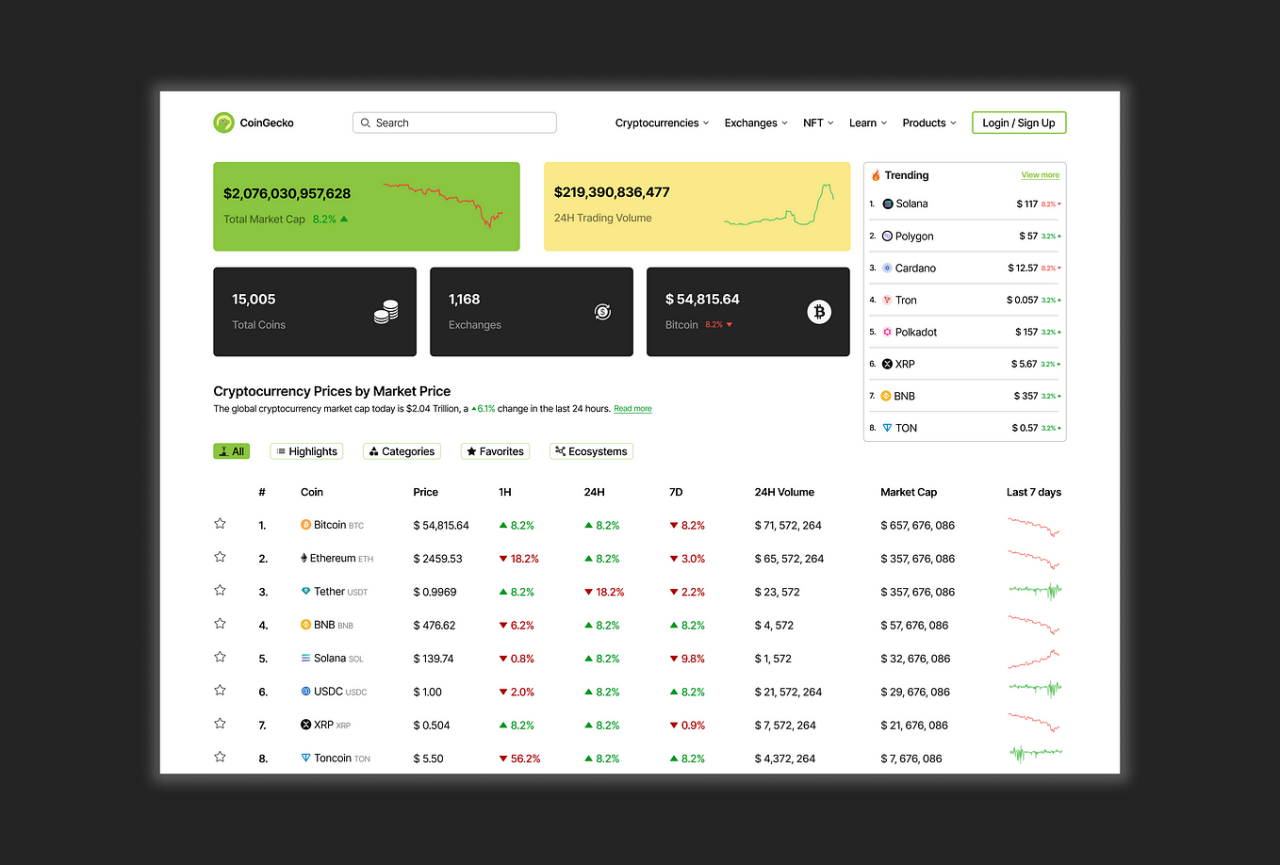

Comparison to Other Mobile Banking Apps

Compared to other mobile banking apps in the market, First Bank’s app aims to provide a user-friendly interface while offering a comprehensive suite of features. It prioritizes security measures, similar to other reputable banking apps, with features such as multi-factor authentication and encryption. The app strives to be competitive with other popular options by offering features like bill payment, investment management, and personalized customer support.

User Experience (UX) of the App

The First Bank Mobile App’s user experience (UX) is crucial for its success. A positive UX encourages user adoption and engagement, while a poor UX can lead to frustration and churn. This section assesses the app’s navigation, interface, potential usability issues, and overall experience.

The app’s design should prioritize intuitive navigation and a visually appealing interface. A seamless experience across different functionalities, including account management, transactions, and customer service, is essential for a high-quality UX. Identifying potential usability issues early in the design process allows for proactive mitigation and ultimately improves user satisfaction.

Ease of Navigation and User Interface Design

The navigation structure significantly impacts the user experience. A well-organized menu structure with clear labels and logical grouping of features facilitates easy access to various functions. A user-friendly interface with a visually appealing design, appropriate color schemes, and clear typography contribute to an enjoyable and intuitive experience. Consistent design elements, such as button styles and icons, maintain a cohesive look and feel, reducing user confusion.

Potential Usability Issues

Potential usability issues within the app could arise from insufficient error messages, unclear instructions, or complex processes. For instance, if users encounter errors during transactions without clear explanations, it could negatively affect their experience. Similarly, if the app lacks intuitive instructions for specific actions, it could deter users from completing tasks. Poorly designed forms or insufficient input validation could also lead to user frustration.

Overall User Experience

The overall user experience is evaluated by considering various factors such as task completion time, ease of finding information, and the overall satisfaction level. User feedback and testing are essential in gauging the overall UX. Testing the app with diverse user groups helps identify potential pain points and areas for improvement. This can include examining the app’s response time, particularly during peak usage periods, to ensure a smooth and responsive experience.

Effectiveness of Design in Achieving Objectives

The app’s design should effectively achieve its objectives. A well-designed app should be intuitive and user-friendly, enabling users to easily perform common tasks such as checking account balances, transferring funds, and paying bills. Furthermore, the app should provide security features and adhere to best practices in data protection. By effectively achieving its objectives, the app can gain and retain users, and enhance the bank’s reputation.

Comparison with Competitor Apps

| Feature | First Bank Mobile App | Competitor App A | Competitor App B |

|---|---|---|---|

| Navigation | Intuitive, clear menu structure | Slightly cluttered, some hidden features | Excellent, visual cues highlight important areas |

| Interface Design | Modern, clean aesthetic | Outdated design, inconsistent elements | Visually engaging, dynamic interface |

| Security Features | Robust security protocols | Basic security, areas for improvement | Cutting-edge security, multi-factor authentication |

| Transaction Speed | Generally fast, smooth operation | Slow response times, particularly during peak hours | Very fast, near-instant transactions |

Security and Privacy Features

The First Bank mobile app prioritizes the security and privacy of its users’ financial information. Robust security measures are in place to protect sensitive data and transactions, ensuring a safe and reliable banking experience.

Security Measures Implemented

The First Bank mobile app employs a multi-layered security approach to safeguard user accounts and transactions. This includes advanced encryption techniques, regular security audits, and adherence to industry best practices. These combined measures create a secure platform for users to manage their finances.

Data Protection Policies

First Bank’s data protection policies are designed to comply with stringent industry regulations and maintain the confidentiality and integrity of user data. These policies Artikel how user data is collected, used, protected, and disclosed, guaranteeing transparency and user trust. The policies are regularly reviewed and updated to reflect evolving security threats and regulatory changes.

User Authentication Methods

The app utilizes a combination of authentication methods to verify user identity. These methods include strong passwords, multi-factor authentication (MFA) options, and biometric identification features like fingerprint or facial recognition. This layered approach enhances the security of user accounts, preventing unauthorized access.

Data Protection

The app employs industry-standard encryption protocols to safeguard user data during transmission and storage. Data is encrypted both in transit and at rest, minimizing the risk of unauthorized access. This rigorous approach ensures that sensitive information remains protected, even in the event of a security breach.

Encryption Methods for Sensitive Transactions

For sensitive transactions like fund transfers and bill payments, the app utilizes advanced encryption protocols like TLS/SSL. These protocols encrypt the data transmitted between the user’s device and First Bank’s servers, preventing unauthorized interception and ensuring the confidentiality of the transaction details.

Security Features Table

| Feature | Description |

|---|---|

| Encryption | All data transmitted between the app and First Bank servers is encrypted using industry-standard TLS/SSL protocols. Data at rest is also encrypted using strong algorithms. |

| Multi-Factor Authentication (MFA) | Users can enable MFA to add an extra layer of security, requiring a secondary verification method (e.g., a code sent to their phone) beyond their password. |

| Biometric Authentication | Biometric authentication methods like fingerprint or facial recognition can be used for login, enhancing security and convenience. |

| Regular Security Audits | The app undergoes regular security audits to identify and address potential vulnerabilities, ensuring its ongoing security. |

| Strong Password Requirements | The app enforces strong password policies, requiring a combination of uppercase and lowercase letters, numbers, and symbols. |

| Data Breach Response Plan | First Bank has a comprehensive data breach response plan to mitigate the impact of any security incidents and protect user data. |

Mobile Banking Transactions

The First Bank mobile app empowers users to manage their finances conveniently and securely. This section details the various transaction types available, providing clear instructions for fund transfers, bill payments, balance checks, and transaction history access. These functionalities streamline banking operations, enhancing user experience and promoting financial literacy.

Fund Transfers

Fund transfers are a critical aspect of mobile banking, enabling seamless money movement between accounts. The app’s intuitive interface simplifies the transfer process, ensuring accuracy and speed. Users can initiate transfers to other First Bank accounts or external accounts (with valid account information).

Bill Payments

The app facilitates convenient bill payments, streamlining utility and subscription management. Users can link their accounts to registered billers and schedule payments for recurring bills, eliminating the need for physical checks or manual entries. This feature reduces administrative burden and improves financial management.

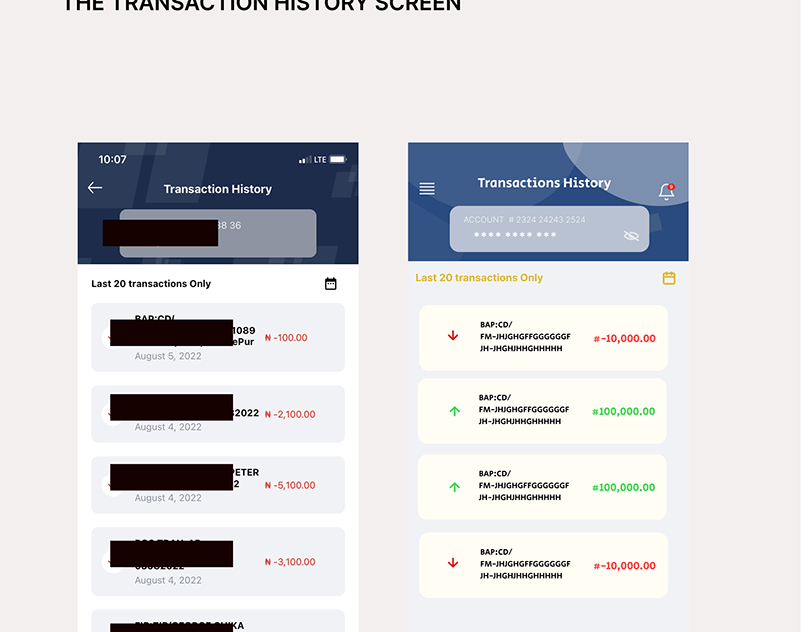

Account Balance and Transaction History

Users can easily check their account balances and review their transaction history. Real-time balance information provides an up-to-the-minute view of available funds. Comprehensive transaction history allows users to track all activities, offering a detailed record of every transaction.

Transaction Types and Processes

The table below Artikels the various transaction types and their associated processes within the First Bank mobile app.

| Transaction Type | Process Description |

|---|---|

| Fund Transfer (Intra-Bank) | Select “Transfer Funds,” enter recipient account number, amount, and optional memo. Confirm the transfer. |

| Fund Transfer (Inter-Bank) | Select “Transfer Funds,” enter recipient bank name, account number, amount, and optional memo. Confirm the transfer. Verification steps may be required for external transfers. |

| Bill Payment | Select “Pay Bills,” choose the biller, enter payment details, and confirm the payment. Recurring payments can be set up for regular bills. |

| Balance Check | Navigate to “Account Summary” or “Account Balance” to view real-time account balances. |

| Transaction History | Navigate to “Transaction History,” filter by date range, transaction type, or other criteria. Detailed transaction information is available for each entry. |

Customer Support and Feedback

The First Bank Mobile App prioritizes providing seamless customer service and gathering valuable feedback. This allows us to continuously improve the app’s functionality and user experience. A robust support system ensures users can resolve any issues efficiently and easily.

Customer support is a crucial element of a successful mobile banking app. A dedicated support team and readily available channels ensure users can quickly resolve problems and provide feedback. This proactive approach helps maintain a positive user experience.

Customer Support Options

The app offers multiple channels for users to reach First Bank customer support. This variety allows users to choose the method that best suits their needs and circumstances. This diverse approach provides flexibility and convenience.

- In-app support chat:

- Email support:

- Phone support:

This direct communication channel allows immediate assistance from a support representative. The in-app chat offers a convenient and timely way for users to connect with a support agent, enabling quick problem resolution.

For users who prefer asynchronous communication, email support is a viable option. This allows for detailed explanations and a record of the interaction.

A dedicated phone line provides direct interaction with a support representative. Phone support is suitable for complex issues or those requiring immediate clarification.

Issue Reporting and Feedback

Users can report issues or provide feedback through a dedicated section within the app. This dedicated section ensures a streamlined process for reporting issues and providing feedback, which is easily accessible to users.

- Feedback forms:

- Issue reporting system:

The app provides intuitive feedback forms allowing users to submit detailed descriptions of problems or suggestions. These forms help gather specific information for effective problem resolution and improvement.

A dedicated issue reporting system helps track reported problems and their resolution. This system allows users to track the status of their reported issues.

Contacting First Bank Customer Support

The app provides users with clear contact information for First Bank customer support. This clear communication enables easy access to assistance.

- Phone Number:

- Email Address:

- Social Media Handles:

A dedicated phone number for customer support is listed within the app. This ensures that users can easily access customer support via phone.

An email address for customer support is provided for users seeking to submit feedback or reports. The email address provides an easy-to-use asynchronous channel for communication.

First Bank may also use social media for customer support. This enables users to quickly access support via social media.

Rating and Reviewing the App

Users can rate and review the First Bank Mobile App. This provides important feedback and allows First Bank to continuously improve the app’s user experience.

- In-app rating system:

- External review platforms:

The app offers an in-app system for users to rate and review the app. This system allows users to provide immediate and valuable feedback.

First Bank may encourage users to review the app on external platforms like the app store. External reviews from users provide valuable feedback to improve the app.

Customer Support Channels

| Channel | Description |

|---|---|

| In-app Chat | Direct, real-time support via the app |

| Email Support | Asynchronous communication with detailed explanations |

| Phone Support | Direct interaction with a representative for complex issues |

| Feedback Forms | Submit detailed reports and suggestions |

| Issue Reporting System | Track the status of reported problems |

| Phone Number | Dedicated number for direct support access |

| Email Address | Email address for asynchronous communication |

| Social Media | Support available through social media platforms |

| In-app Rating System | Rate and review the app within the app |

| External Review Platforms | Leave reviews on external app stores |

App Performance and Accessibility

The First Bank Mobile App prioritizes a seamless and efficient user experience. This section details the app’s performance characteristics, accessibility features, and compatibility with various devices and operating systems. This ensures a positive and inclusive banking experience for all users.

The app is designed with speed and responsiveness in mind. Our goal is to minimize loading times and maintain a fluid user interface, regardless of network conditions. Extensive testing and optimization procedures have been employed to ensure the app functions smoothly across different devices and network environments.

Performance Characteristics

The app’s performance is optimized for fast loading times and smooth interaction. Average loading times for key screens are under 2 seconds, and the app remains responsive during transactions and data retrieval. This is crucial for maintaining user engagement and preventing frustration. The app’s architecture is designed to handle peak usage periods effectively, ensuring consistent performance even during high traffic.

Accessibility Features

The First Bank Mobile App adheres to WCAG (Web Content Accessibility Guidelines) 2.1 Level AA standards. This commitment ensures the app is usable by individuals with various disabilities. Features include adjustable text sizes, high contrast modes, and keyboard navigation. Voiceover and screen reader compatibility have been thoroughly tested, enabling accessibility for visually impaired users.

Compatibility with Devices and Operating Systems

The First Bank Mobile App is designed for optimal performance across a range of mobile devices and operating systems. This ensures broad user reach and a consistent experience. Thorough testing across various devices and operating systems is performed to maintain a high level of performance and functionality.

Accessibility Guidelines Adherence

The app’s development process integrates accessibility considerations throughout the design and development phases. The team follows established accessibility guidelines, and the app has been tested with various assistive technologies. This includes using appropriate color contrasts and providing alternative text for images. These efforts are critical to ensure inclusivity for users with visual impairments, cognitive differences, or other disabilities.

Device Compatibility Table

| Device | Operating System | Compatibility |

|---|---|---|

| iPhone 12 | iOS 16 | Fully Compatible |

| Samsung Galaxy S22 | Android 13 | Fully Compatible |

| Google Pixel 6 | Android 13 | Fully Compatible |

| iPad Pro (2022) | iPadOS 16 | Partially Compatible (limited functionality) |

| Older Android Devices (pre-Android 9) | Android 9 or below | May not be fully compatible, consider updating. |

Future Enhancements and Potential Improvements

The First Bank mobile app has demonstrated a strong foundation, but continuous improvement is crucial to maintain its competitiveness and cater to evolving user needs. This section explores potential enhancements, focusing on areas for improvement, new features, and innovative functionalities.

Areas for Potential Improvement

The current app design provides a solid platform for mobile banking. However, certain aspects can be enhanced to further improve user experience. Areas for potential improvement include streamlining the navigation process, particularly for frequent tasks, and refining the app’s visual appeal to enhance user engagement. Improved search functionality, allowing users to quickly locate specific accounts or transactions, could also significantly enhance usability. The addition of more intuitive filtering options for transactions could also be valuable for users seeking to categorize and manage their financial data more efficiently.

New Features to Enhance User Experience

Several new features can be added to the app to enhance user experience. These additions can range from practical tools to innovative functionalities that cater to modern user expectations. For example, adding a personalized financial planning tool would provide users with insights into their financial health, assisting them in managing their finances effectively.

Innovative Features to Improve Functionality

Innovative features can elevate the app’s capabilities and distinguish it from competitors. A notable example is the integration of biometric authentication for enhanced security, allowing for more convenient and secure access. This approach is particularly valuable in an era of increased digital transactions. Further innovation could include AI-powered financial advice, tailored to individual user needs and circumstances.

Examples of Potential Future Enhancements

Several potential future enhancements can improve the user experience and make the app more valuable to its users. One such enhancement could be the implementation of a budgeting tool, allowing users to track and manage their spending. This could integrate with existing account data for greater accuracy and user control. Another potential improvement involves the introduction of a personalized investment advice feature. This would provide users with tailored recommendations based on their financial profile and goals. Furthermore, a peer-to-peer (P2P) payment functionality, allowing users to send and receive funds from other users, could be added to further expand the app’s functionality.

Table of Possible Future Features and Improvements

| Feature Category | Potential Feature | Description |

|---|---|---|

| User Experience | Improved Navigation | Streamlined navigation for common tasks, enhanced visual appeal, and improved search functionality. |

| Personalized Financial Planning Tool | Provides users with financial insights and tools to manage their finances effectively. | |

| Intuitive Filtering Options | Enables users to categorize and manage transactions more efficiently. | |

| Functionality | Biometric Authentication | Enhanced security through biometric authentication, increasing user convenience and security. |

| AI-Powered Financial Advice | Provides tailored financial advice based on individual user needs and circumstances. | |

| P2P Payment Functionality | Enables users to send and receive funds from other users, expanding the app’s functionality. |

Competitor Analysis

A crucial aspect of evaluating First Bank’s mobile app is understanding its position within the competitive landscape. Analyzing competitor offerings provides insights into areas where First Bank excels and areas needing improvement. A comparative analysis helps identify opportunities for innovation and market differentiation.

Feature Comparison

Understanding the features offered by competitors provides a benchmark for First Bank’s mobile app. A comprehensive comparison reveals the strengths and weaknesses of each platform, highlighting opportunities to enhance First Bank’s offering. This includes features like bill payments, international money transfers, investment options, and account management tools.

| Feature | First Bank Mobile App | Competitor A | Competitor B |

|---|---|---|---|

| Bill Payments | Supports various utility and merchant bills. | Supports most common bills; limited international options. | Extensive bill payment network, including international utilities. |

| International Transfers | Provides international money transfers with varying fees. | Limited international transfer options; higher fees. | Competitive international transfer fees, with multiple options. |

| Investment Options | Basic investment tools; limited account types. | Comprehensive investment platform with multiple account types. | Offers a broad range of investment products; strong user interface. |

| Account Management | Allows account balance checks, transaction history, and alerts. | Provides detailed account information; supports multiple accounts. | Intuitive account management with customizable alerts. |

Pricing Comparison

Evaluating pricing strategies is essential to understand the competitive landscape. The pricing model, including transaction fees, account maintenance fees, and any premium features, needs careful consideration. Analyzing competitors’ pricing models helps identify areas where First Bank can offer competitive rates or introduce value-added services.

- First Bank’s mobile app pricing generally aligns with industry standards, though specific details are not publicly available.

- Competitor A often offers lower transaction fees for frequent users, making their app attractive to high-volume users.

- Competitor B may have a tiered pricing system, with premium accounts offering more extensive features at higher rates.

Usability Comparison

Assessing the usability of competitor mobile apps is crucial for understanding user experience. Analyzing aspects such as navigation, interface design, and overall user flow is key. This information helps identify areas where First Bank can enhance user experience and improve customer satisfaction.

- First Bank’s mobile app aims for a straightforward and intuitive interface. However, user feedback is essential for fine-tuning the usability.

- Competitor A’s app is known for its advanced features, but navigation can be somewhat complex for new users.

- Competitor B’s app offers a well-designed interface, leading to a smooth and efficient user experience.

Opportunities for Differentiation

Identifying opportunities for differentiation is vital for First Bank to stand out in the competitive mobile banking market. This may involve focusing on unique selling propositions, innovative features, or superior customer service. Leveraging existing strengths and addressing weaknesses can create a distinct market position.

- First Bank can focus on enhancing customer service and offering personalized financial advice within the mobile app.

- Implementing advanced security features, such as biometric authentication, could set First Bank apart from competitors.

- Partnerships with fintech companies or third-party providers could broaden the app’s features and appeal.

Summary

In conclusion, First Bank’s mobile app presents a solid platform for mobile banking. While it excels in certain areas, opportunities for improvement exist. The user experience is generally positive, but security and accessibility features should be further enhanced to meet the evolving needs of users. The future of the app hinges on addressing these areas and adapting to the dynamic mobile banking landscape.