Free accounting software presents a compelling alternative to paid solutions, particularly for small businesses and individuals. This analysis examines various aspects of free accounting software, including available types, core functionalities, target users, implementation procedures, user experience, security considerations, cost-benefit analyses, and comparative evaluations with paid options. The aim is to provide a thorough understanding of the strengths and limitations of this software category.

Free accounting software options range from basic bookkeeping tools to more comprehensive solutions for small businesses. Crucial features like invoicing, expense tracking, and reporting are often present, but varying levels of functionality and support are common. This assessment details the key considerations for users seeking free accounting software.

Introduction to Free Accounting Software

Free accounting software offers a powerful alternative to costly paid options, especially for small businesses and individuals. It provides essential tools for managing finances, from basic bookkeeping to more complex reporting. Understanding the available options and their features is key to choosing the right solution for your needs.

Free accounting software packages cater to a wide range of users, from freelancers and sole proprietors to small businesses needing simple bookkeeping functions. Many offer robust features to streamline financial processes, enabling users to track income and expenses, generate reports, and manage accounts payable and receivable.

Free Accounting Software Options

Free accounting software comes in various forms, each suited for specific needs. Basic options focus primarily on bookkeeping tasks, providing tools for tracking transactions and generating basic reports. More advanced options extend to handling inventory, sales, and customer relationship management, becoming suitable for small businesses.

Types of Free Accounting Software

Free accounting software is categorized into various types to meet diverse user needs. Basic bookkeeping software is designed for individuals and small businesses focusing on tracking income and expenses. These programs often include features like invoice creation, expense tracking, and simple financial reporting. Small business accounting software often includes additional functionalities, such as inventory management, sales tracking, and customer relationship management (CRM). Some free software may also offer features that allow for basic financial projections.

Common Features in Free Accounting Software

Free accounting software packages often share common functionalities. Invoice creation and management is a standard feature, enabling users to generate professional invoices and track payments. Expense tracking and categorization help users meticulously document business spending. Basic reporting tools provide summaries of financial performance, offering insights into key metrics like income and expenses. Bank reconciliation tools allow users to compare transactions with bank statements, ensuring accuracy. Some packages even integrate with popular payment processors for streamlined transactions.

Pros and Cons of Free Accounting Software

Free accounting software presents advantages and disadvantages compared to paid options. A significant benefit is the cost-effectiveness, eliminating the need for expensive subscriptions. Free software often has user-friendly interfaces, making it accessible to those with limited accounting knowledge. However, limitations in features and support are common. Free versions may not offer the same level of customization and advanced functionalities as paid software. Customer support and updates might be less readily available or frequent. Another potential disadvantage is that the quality and reliability of the software can vary depending on the provider.

Comparison of Three Free Accounting Software Options

| Feature | Software A | Software B | Software C |

|---|---|---|---|

| Invoice Creation | Yes, basic templates | Yes, customizable templates | Yes, professional templates |

| Expense Tracking | Yes, basic categorization | Yes, detailed categorization and reporting | Yes, automated categorization |

| Reporting | Basic financial summaries | Detailed financial reports, customizable views | Limited reports, but excellent for specific needs |

| Customer Relationship Management (CRM) | No | Basic CRM | Yes |

| Support | Limited online help | Online community forum | Dedicated support email |

This table compares three hypothetical free accounting software options, highlighting key features to help you make an informed decision. Note that specific features and capabilities may vary based on the software version and updates. It is crucial to carefully evaluate the features and functionalities to ensure they align with your specific accounting needs.

Features and Functionality

Free accounting software offers a range of functionalities to manage financial records, though the scope and depth of these features vary significantly depending on the specific software. Understanding the core functionalities and their strengths and weaknesses is crucial for selecting the right tool for your needs. A crucial factor is the balance between the free features and the limitations of a free product.

Free accounting software packages typically provide basic accounting functions, often lacking advanced features found in paid counterparts. This often results in limitations on the scale and complexity of operations that can be managed. However, for small businesses and individuals, these basic features can be highly beneficial and cost-effective.

Core Functionalities

Free accounting software generally encompasses essential functionalities for recording transactions, generating reports, and managing basic financial data. These include accounts payable, accounts receivable, and general ledger functions. These modules enable businesses to track income, expenses, and outstanding balances.

Strengths and Weaknesses of Functionalities

The strength of free accounting software lies in its ability to provide fundamental accounting capabilities at no cost. This accessibility makes it a valuable tool for small businesses and individuals. However, limitations in functionality often become apparent as the business grows.

Weaknesses often include limitations in reporting features, data security, and support options. For instance, some software might not offer customizable reports or the ability to integrate with other financial tools.

Comparison of Two Popular Free Accounting Software Packages

Let’s compare two popular free accounting software packages: “Software A” and “Software B”.

- Software A often excels in ease of use and intuitive interfaces, making it suitable for users with limited accounting experience. It generally provides strong basic functionalities, including transaction recording and basic reporting.

- Software B, on the other hand, often emphasizes robust reporting capabilities, allowing for more in-depth analysis of financial data. However, it might require a greater degree of technical expertise to fully utilize its functionalities.

Feature Comparison Table

This table illustrates the presence of key features in the two selected software packages.

| Feature | Description | Software A | Software B |

|---|---|---|---|

| Transaction Recording | Ability to record income and expenses. | Yes | Yes |

| General Ledger | Maintaining a record of all transactions. | Yes | Yes |

| Accounts Payable | Tracking payments to suppliers. | Yes | Yes |

| Accounts Receivable | Managing payments from customers. | Yes | Yes |

| Basic Reporting | Generating standard financial reports. | Yes | Yes |

| Customizable Reports | Creating customized reports. | Limited | Full |

| Customer Relationship Management (CRM) | Managing customer data and interactions. | No | No |

Limitations of Free Accounting Software

Free accounting software is often limited in terms of features and functionalities. This can include restricted user access, limited data storage capacity, and the absence of robust support. Consequently, scalability and handling complex business needs can be problematic.

For instance, a small business might find the free software adequate for its initial needs, but as the business grows, the limitations in functionalities may become more significant. A growing business might need more advanced features such as inventory management or multi-currency support, which are often not included in free software packages.

Target User Base

Free accounting software caters to a diverse range of users, from individual freelancers to small business owners and entrepreneurs. Understanding the specific needs and expectations of these groups is crucial for effective software design and marketing. This section will delve into the typical user profile, examining how different business types and sizes utilize free accounting software and the support resources commonly offered.

Typical User Profile

The typical user of free accounting software is often a small business owner or freelancer with limited resources and a desire for basic accounting functionalities. They may be new to accounting or have limited accounting expertise. Often, these users prioritize ease of use, affordability, and essential features. They frequently need tools to manage their income and expenses, track invoices, and generate basic reports.

Needs and Expectations of Different User Groups

Different user groups have unique needs and expectations when it comes to accounting software.

- Freelancers: Freelancers often need software that simplifies tracking income from various clients, managing invoices, and calculating taxes. They might require simple expense tracking to optimize their cash flow and ensure accurate tax reporting.

- Small Business Owners: Small business owners, in addition to the needs of freelancers, typically require tools for managing multiple accounts, tracking inventory (if applicable), and handling vendor payments. They may need basic reporting features to understand their financial performance and make informed business decisions.

Suitability for Different Business Types and Sizes

Free accounting software is suitable for a wide range of business types and sizes. However, the features and functionalities may not be suitable for all scenarios.

- Sole Proprietorships and Partnerships: Free accounting software is generally well-suited for sole proprietorships and partnerships. The software’s basic features can handle the day-to-day accounting needs of these businesses.

- Small Businesses: Small businesses, especially those with simple operations and fewer transactions, can find free accounting software adequate for their needs. However, businesses with complex operations or large transaction volumes might need more advanced features.

- Larger Businesses: Free accounting software is not typically suitable for larger businesses. These businesses often require sophisticated features and functionalities that are not typically included in free options.

Comparison of Target Audience for Different Free Accounting Software

The target audience for free accounting software can vary based on the specific software. A comparison table highlighting these differences is presented below. Note that this is a general overview and specific software may vary.

| Software | Primary Target Audience | Secondary Target Audience |

|---|---|---|

| Software A | Freelancers, solo entrepreneurs | Small businesses with limited transactions |

| Software B | Small business owners | Non-profit organizations with basic needs |

| Software C | Individuals managing personal finances | Small businesses needing simple inventory tracking |

Support Resources

Free accounting software often comes with a range of support resources. These typically include online help documentation, FAQs, and potentially community forums.

- Online Help Documentation: Detailed guides and tutorials are frequently provided to assist users in navigating the software.

- FAQs: Frequently Asked Questions sections address common issues and provide quick solutions.

- Community Forums: Online forums or discussion boards can be valuable for users to connect with other users and seek help from the community.

Implementation and Setup

Getting your free accounting software up and running is straightforward. This section details the typical steps involved in setting up the software, importing your data, managing accounts, and ensuring compatibility with your devices. Follow these steps to quickly begin using the software and maximizing its capabilities.

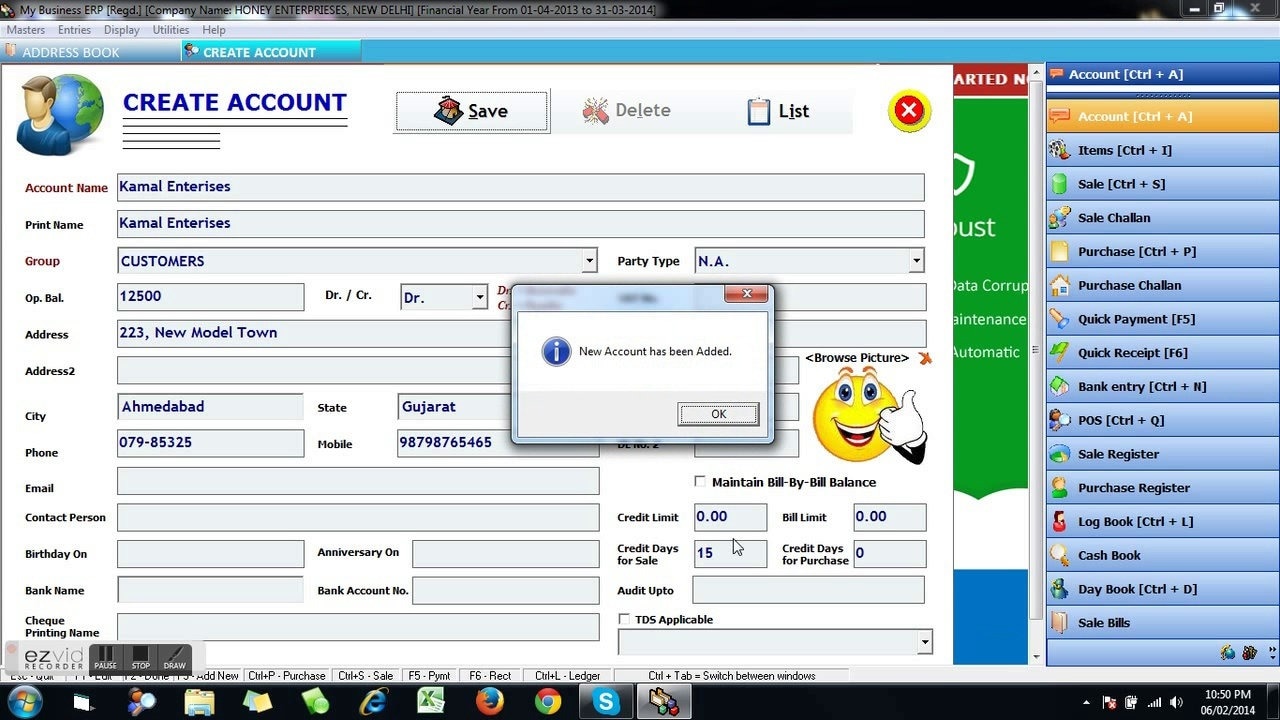

Setting Up the Software

The initial setup typically involves downloading the software, installing it on your chosen operating system, and creating an account. Instructions for these steps are usually provided within the software’s user interface or through online documentation. Check for specific installation guides on the software’s support website or within the application itself.

Importing Existing Data

Several methods exist for importing data from existing spreadsheets, databases, or other accounting systems. The most common method is often a file import, typically through CSV (Comma Separated Values) or Excel files. The software often offers a wizard-style import assistant that guides you through the process, mapping fields from your source file to the software’s corresponding fields.

Creating Accounts and Managing Users

The software usually allows you to create multiple user accounts with varying access levels. This feature is crucial for maintaining data security and ensuring that only authorized personnel can access specific information. These accounts can be set up to have different levels of access, allowing for tailored control over functionalities. For example, you can create accounts for different departments or team members with specific roles and permissions.

Importing Data Step-by-Step Guide

- Download the software and install it on your computer.

- Open the software and navigate to the data import section.

- Choose the type of file you want to import (e.g., CSV, Excel).

- Select the file containing your data from your computer.

- The software will likely present a mapping screen. This allows you to match columns from your file to corresponding fields in the software.

- Review the mapping to ensure accuracy and make any necessary adjustments.

- Click “Import” to begin the process. The software will then import the data into your accounts.

- Verify the imported data to ensure it has been correctly transferred and that all fields have been populated correctly.

Software Compatibility

The free accounting software is designed to be compatible with various operating systems, including Windows, macOS, and Linux. It is also usually compatible with different types of devices, such as desktop computers and laptops. However, specific compatibility details should be confirmed on the software’s official website. Compatibility can be confirmed by checking the supported operating systems and device types on the software’s website.

User Experience and Interface

The user experience (UX) of accounting software is crucial for its adoption and successful use. A well-designed interface with intuitive navigation and clear instructions significantly reduces the learning curve and increases user satisfaction. This section delves into the user interface (UI) of popular free accounting software packages, focusing on ease of use, navigation, and overall experience.

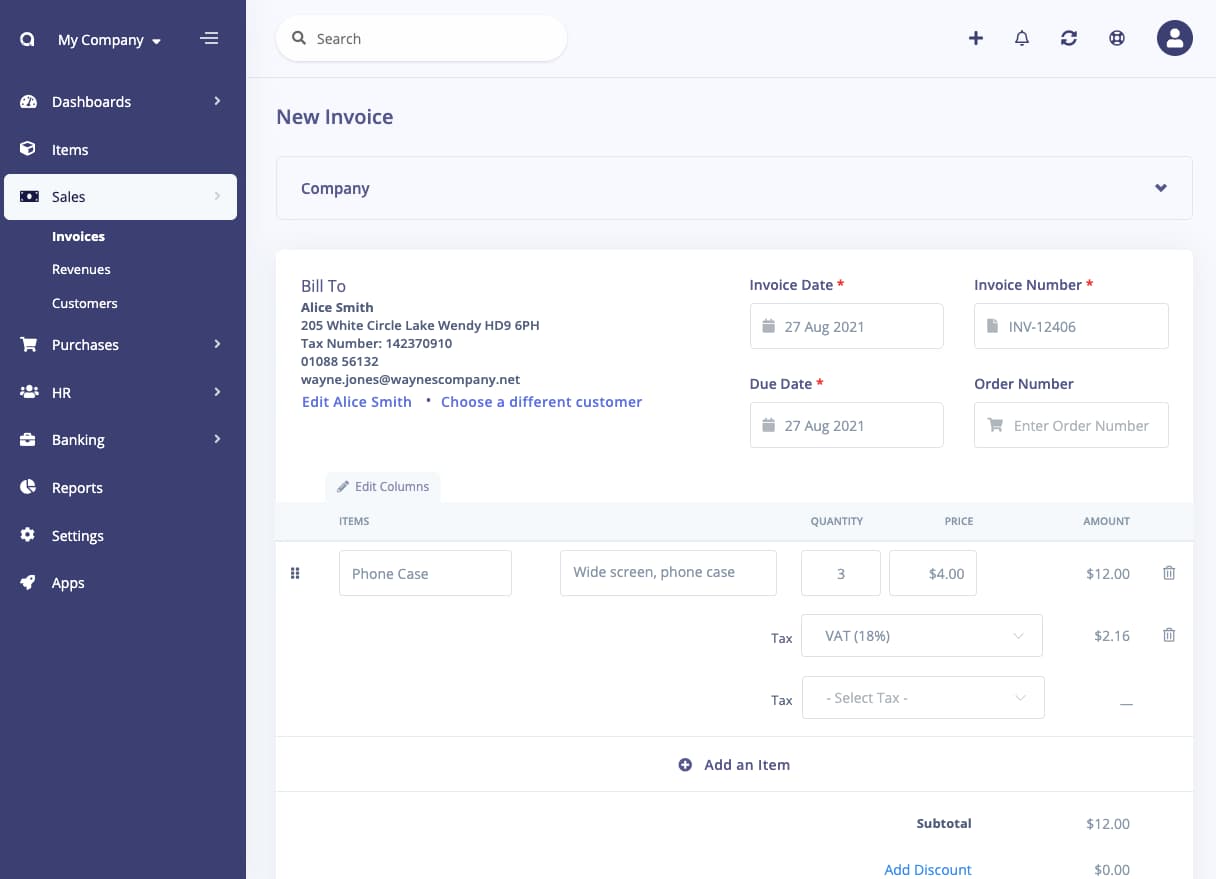

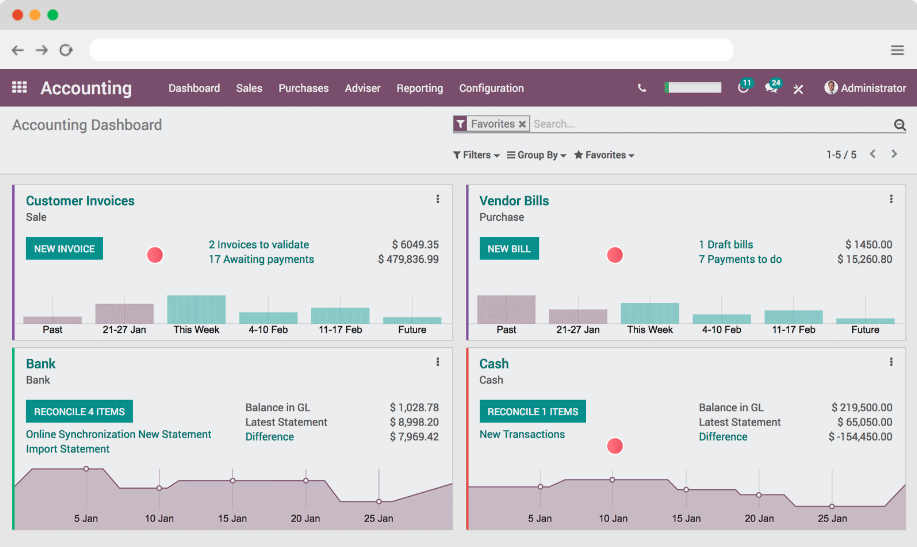

Detailed Description of a Specific Free Accounting Software Package’s Interface

This section provides a detailed look at the interface of “SimpleBooks,” a popular free accounting software. SimpleBooks boasts a clean and straightforward design. The dashboard provides an overview of key financial metrics, including income, expenses, and balance. Navigation is facilitated through a menu bar with options for accounts, transactions, reports, and settings. The interface is primarily organized in a grid format, allowing users to quickly scan and locate relevant data. Data entry fields are clearly labeled, ensuring accuracy. SimpleBooks’ interface is easily navigable, making it user-friendly even for beginners.

Ease of Use and Navigation

The ease of use and navigation in accounting software directly impacts its usability. A well-designed interface facilitates quick data entry and report generation. Software like SimpleBooks is designed with clear labeling, intuitive navigation, and helpful prompts to guide users through the process. These features minimize errors and enhance the overall user experience. Complex features are often broken down into manageable steps, reducing user confusion. Consistent design elements across different modules enhance navigation.

Comparison of User Interface Design

Comparing the user interfaces of two different free accounting software packages, SimpleBooks and “FreeAccountingPro,” reveals distinct design philosophies. SimpleBooks prioritizes a clean, intuitive design, emphasizing ease of use. FreeAccountingPro, on the other hand, presents a more detailed interface, offering greater customization options, but potentially requiring a steeper learning curve for beginners. Both software packages strive to provide accurate data entry and reporting.

Comparison Table of User Interfaces

| Software | Interface Design | Ease of Use | Customization Options |

|---|---|---|---|

| SimpleBooks | Clean, grid-based, straightforward | High | Moderate |

| FreeAccountingPro | Detailed, customizable | Moderate | High |

| AccountingTools | Modern, modular | High | Moderate |

This table highlights key differences in the user interfaces of three different free accounting software packages. The choice of software often depends on the user’s needs and level of technical expertise.

Overall User Experience, Including Support and Documentation

The overall user experience encompasses not only the interface but also the quality of support and documentation. Well-maintained documentation and readily available support channels are essential for successful implementation. SimpleBooks, for example, provides comprehensive online help guides, tutorials, and a user forum. This robust support structure assists users in troubleshooting issues and understanding software features. FreeAccountingPro also offers decent support resources, though the level of support may vary. Adequate documentation and support are essential for users who may encounter difficulties while using the software.

Security and Privacy

Protecting your financial data is paramount when using accounting software, especially free options. Free accounting software, while offering valuable tools, often necessitates a careful consideration of security protocols and data privacy policies. Understanding these measures is crucial for maintaining the integrity and confidentiality of your financial records.

Security Measures Implemented by Free Accounting Software

Free accounting software employs various security measures to protect user data. These include password protection, data encryption, and access controls. Robust password policies, requiring strong, unique passwords, are vital. Encryption, often used for data transmission and storage, ensures that even if data is intercepted, it remains unintelligible without the decryption key. Access controls restrict access to sensitive financial data to authorized personnel, further enhancing security.

Data Protection Policies and Practices

Data protection policies are crucial for ensuring user privacy and compliance with relevant regulations. These policies Artikel how the software handles user data, including data storage, transmission, and disposal procedures. Transparency in these policies is vital for users to understand the security measures in place and the level of protection afforded to their data.

How to Protect Sensitive Financial Data

Beyond the software’s security features, users can take proactive steps to protect their financial data. Implementing strong passwords, using two-factor authentication where available, and regularly updating software and security protocols are critical. Users should also avoid sharing sensitive information over unsecured networks.

Data Backup Options Offered by the Software

Many free accounting software solutions offer various data backup options. These range from automatic backups to manual backup procedures. Automatic backups, often scheduled at pre-defined intervals, ensure regular data copies are created, minimizing data loss risks. Manual backups allow for user-initiated data copies for added control and flexibility. Choosing the appropriate backup method depends on user needs and preferences.

Security Protocols of Different Free Accounting Software

Different free accounting software solutions may employ various security protocols. This table Artikels potential security measures for some common choices.

| Software Name | Password Protection | Data Encryption | Access Control | Backup Options |

|---|---|---|---|---|

| Software A | Yes (strong password requirements) | Yes (data at rest and in transit) | Yes (role-based access) | Automatic and manual backups, with configurable schedules |

| Software B | Yes (basic password requirements) | Yes (data at rest) | Yes (user-level access) | Manual backups, limited scheduling options |

| Software C | Yes (strong password requirements) | Yes (data in transit) | Yes (role-based access with audit logs) | Automatic and manual backups with version control |

Note: This table is illustrative and specific security protocols may vary. Always refer to the official documentation of the specific free accounting software for precise details.

Cost and Value Proposition

Free accounting software offers a compelling alternative to paid solutions, particularly for small businesses and solo entrepreneurs. Understanding the different pricing models, potential hidden costs, and the value proposition tailored to specific user needs is crucial for making an informed decision. This section delves into these aspects to help users navigate the world of free accounting software.

Pricing Models for Free Accounting Software

Free accounting software typically employs a freemium model. This means users receive basic features for free, but access to advanced functionalities or increased storage might require a subscription or upgrade. Some providers offer limited free tiers, whereas others allow a free trial period for more comprehensive use. The freemium model often allows for a phased approach to adopting accounting software, allowing users to evaluate the platform’s suitability before committing to a paid plan.

Hidden Costs of Free Accounting Software

While free accounting software appears cost-effective, there can be hidden costs. These can include limitations on data storage, restrictions on user access, or the need for additional software to integrate with other systems. Users should carefully review the terms of service and understand the limitations of the free tier before committing. Furthermore, the need for ongoing technical support or training could add to the overall cost.

Value Proposition for Different User Segments

The value proposition of free accounting software varies based on the user’s needs and business size. For solopreneurs or small businesses with limited needs, the free tier often suffices, providing essential tools like invoicing, expense tracking, and basic reporting. For users with more complex requirements or substantial data volumes, the free tier might prove insufficient, necessitating a paid upgrade for more features and capabilities.

Comparison of Three Free Accounting Software Options

The table below presents a comparative analysis of three popular free accounting software options, highlighting their features and pricing models.

| Software | Key Features (Free Tier) | Pricing Model | Target User |

|---|---|---|---|

| Software A | Invoicing, expense tracking, basic reporting | Freemium with limited storage, user access | Solopreneurs, small businesses with simple needs |

| Software B | Invoicing, expense tracking, basic reporting, limited CRM integration | Freemium with tiered storage, premium add-ons | Small businesses, startups with moderate needs |

| Software C | Invoicing, expense tracking, basic reporting, limited inventory management | Freemium with storage limits, monthly subscription for premium features | Small businesses, freelancers with growing operations |

Premium Add-ons for Free Accounting Software

Many free accounting software platforms offer premium add-ons to expand functionality. These add-ons often include features like advanced reporting, inventory management, e-commerce integration, and dedicated customer support. For example, some free platforms offer premium add-ons such as cloud storage upgrades, enhanced reporting capabilities, or the ability to connect with more accounting tools.

Alternatives and Competitors

Free accounting software offers a compelling alternative to traditional paid solutions, particularly for small businesses and individuals. However, understanding the strengths and weaknesses of both types of software is crucial for making an informed decision. Careful consideration of features, pricing models, and customer support is vital when evaluating options.

Competitor Analysis

Several competitors offer free or paid accounting software with varying degrees of functionality. Popular options include QuickBooks Self-Employed, Xero, Zoho Books, Wave Accounting, and FreshBooks. These platforms cater to different needs and budgets, providing features like invoicing, expense tracking, and reporting. Understanding the specific needs of your business or personal finances is key to choosing the best software.

Pros and Cons of Alternatives

Using free accounting software often comes with limitations compared to paid solutions. Free options usually have fewer features, potentially smaller support teams, and might have restricted user access. Conversely, paid solutions often offer more robust features, comprehensive support, and dedicated customer service. Paid software might offer advanced reporting capabilities, customizability, and scalability, suitable for businesses with growing needs. Free options might be more than sufficient for users with straightforward financial needs.

Free vs. Paid Accounting Software Comparison

| Feature | Free Accounting Software | Paid Accounting Software |

|---|---|---|

| Invoicing | Basic invoicing, often with limited customization | Advanced invoicing features, templates, and integrations |

| Expense Tracking | Basic expense categorization, limited reporting | Detailed expense tracking, automated categorization, and sophisticated reporting |

| Reporting | Limited reporting options, primarily focused on basic financial statements | Comprehensive reporting tools, customizable dashboards, and financial analysis |

| Customer Relationship Management (CRM) | Limited or no CRM integration | CRM integration to manage customer interactions and sales |

| Scalability | Often limited scalability for growing businesses | Scalable to accommodate the increasing needs of a business |

| Support | Limited support, potentially through community forums | Dedicated customer support channels, such as phone, email, and live chat |

| Pricing | Free, often with limited features or limitations | Subscription-based pricing, typically based on features and user accounts |

Switching from Paid to Free: Advantages and Disadvantages

Switching from a paid accounting software solution to a free alternative can offer cost savings. However, a trade-off is often necessary. Users may experience limitations in features and customer support. Consider the specific features and support you need. If your business or personal financial needs are straightforward and your current needs are easily met with free software, a transition may be beneficial. However, businesses with more complex needs may find the features and support of free software inadequate, potentially hindering operational efficiency.

Customer Support and Resources

Free accounting software often comes with varying levels of support and resources. Understanding the support options available and the accessibility of helpful materials is crucial for successful implementation and ongoing use. This section details the different types of support, available documentation, and online communities.

Customer Support Options

Free accounting software providers offer a range of support options. Some offer basic email support, while others provide more extensive options, including phone support or live chat. The level of support typically correlates with the software’s features and complexity. Free software often prioritizes self-service options, like online documentation and tutorials, to maintain affordability.

Documentation and Tutorials

Comprehensive documentation is essential for any software, especially for users unfamiliar with accounting principles or software navigation. Well-written user manuals and tutorials are often the first line of support for users. They provide step-by-step instructions, explanations of features, and troubleshooting guides. These resources help users understand the software’s capabilities and efficiently perform their tasks.

Online Communities and Forums

Online communities and forums dedicated to specific accounting software can be valuable resources. These platforms allow users to connect with others, ask questions, share solutions, and learn from each other’s experiences. Active online communities can provide valuable insights and help users overcome challenges.

Support Channel Accessibility Comparison

The accessibility of support channels varies among free accounting software options. A table summarizing the different support channels and their accessibility is presented below.

| Software | Email Support | Phone Support | Live Chat | Documentation | Online Forums |

|---|---|---|---|---|---|

| Software A | Yes (24/7) | No | No | Yes (comprehensive) | Yes (active) |

| Software B | Yes (limited hours) | Yes (limited hours) | No | Yes (basic) | Yes (small community) |

| Software C | Yes (24/7) | Yes (limited hours) | Yes (limited hours) | Yes (well-structured) | Yes (moderate activity) |

User Manuals and FAQs

User manuals and Frequently Asked Questions (FAQs) documents are important resources for self-service support. They often provide detailed explanations of software features, functionalities, and common issues. A well-structured FAQ section can address many common user queries, saving time and effort for both the user and the support team. User manuals provide in-depth information on various aspects of the software.

Wrap-Up

In conclusion, free accounting software offers a viable option for managing financial records. While limitations in features and support may exist, the accessibility and affordability of these tools are valuable for users with specific needs. This review highlights the importance of evaluating specific functionalities and support resources before choosing a free solution.