Google Pay iOS: a revolutionary mobile payment system, poised to redefine the future of transactions. Its seamless integration with iOS devices and innovative features promise a swift and secure digital experience. This exploration delves into the intricacies of Google Pay, from its user-friendly interface to its robust security measures, providing a comprehensive understanding of this transformative technology.

From everyday purchases to complex financial transactions, Google Pay iOS simplifies the process. This analysis covers every facet, from the core functionality and user experience to security, integration, performance, and accessibility. The market analysis further reveals the potential and challenges in this dynamic space.

Overview of Google Pay iOS

Google Pay, the digital wallet service from Google, has become a ubiquitous tool for mobile payments on iOS devices. Its seamless integration with various apps and services makes it a convenient alternative to physical wallets and credit cards. The platform offers a wide array of features for managing finances and completing transactions directly from an iPhone or iPad.

Google Pay on iOS streamlines the payment process, enabling users to make purchases, send money, and manage their accounts with a single app. This simplifies transactions and provides a secure method for handling financial activities on the go.

Core Features and Services

Google Pay on iOS provides a robust suite of features, including mobile payments for in-store and online purchases. It leverages NFC technology for contactless payments at participating merchants. Furthermore, it allows users to save and manage various payment methods, such as credit cards, debit cards, and bank accounts, within a single interface.

Payment Methods Supported

Google Pay supports a diverse range of payment methods, including credit cards, debit cards, and bank accounts. Users can easily add their existing payment methods to their Google Pay accounts. This centralized platform simplifies managing multiple payment options in one place.

Integration with iOS Apps and Services

Google Pay seamlessly integrates with numerous iOS apps and services. Users can add payment methods to apps like Uber, Lyft, and DoorDash for streamlined transactions. Further, Google Pay integrates with many online retailers, allowing users to pay securely through the app. This integration enhances the user experience by offering convenient payment options within various applications. For example, a user can directly pay for a ride through Uber using their Google Pay account, avoiding the need to manually input payment information.

Common Use Cases

Google Pay’s functionality extends beyond simple payments. Common use cases include sending and receiving money between contacts, managing loyalty cards, and making contactless payments at physical stores. Moreover, users can use Google Pay to easily pay for various services, including transportation, dining, and entertainment.

User Experience (UX) of Google Pay iOS

Google Pay’s iOS implementation has been lauded for its intuitive design and seamless integration with Apple’s ecosystem. However, like any mobile payment solution, its user experience (UX) presents both strengths and areas for potential improvement. The app’s design choices, navigation flow, and comparison to competitors are key factors in assessing its overall usability.

The success of Google Pay relies heavily on providing a frictionless payment experience. A well-designed interface, intuitive navigation, and a clear understanding of user needs are crucial for user adoption and satisfaction. This analysis examines the key aspects of Google Pay’s iOS UX, focusing on both its strengths and potential weaknesses.

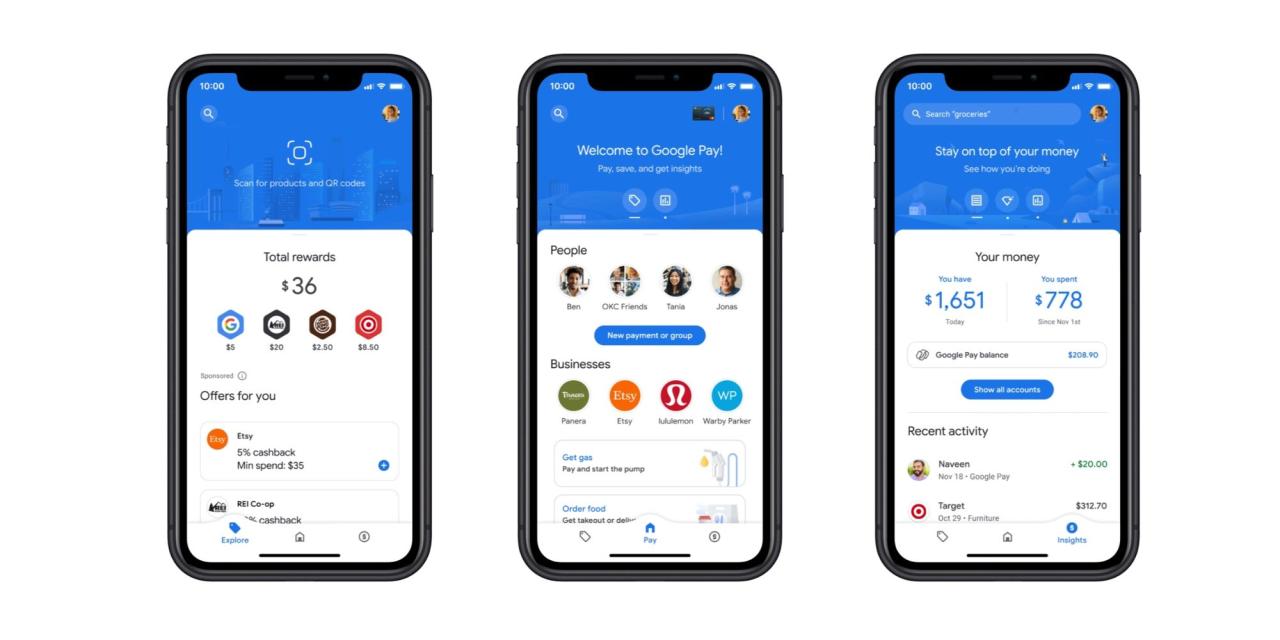

User Interface Design

Google Pay’s iOS interface prioritizes a clean and uncluttered aesthetic. Visual elements are generally well-organized, with clear categorization of payment methods, cards, and transactions. The use of color palettes and typography contributes to a visually appealing and consistent user experience. Key design elements, such as prominent buttons and easily navigable menus, enhance user interaction.

Key Design Elements and Impact on User Experience

Several key design elements significantly impact the user experience of Google Pay iOS. The prominent placement of buttons, for example, facilitates quick and straightforward actions. Clear visual cues, such as animated transitions and feedback mechanisms, enhance the user’s understanding of the app’s functionality. Similarly, the app’s use of recognizable icons and consistent branding contributes to a sense of familiarity and trust. Conversely, the use of overly complex or confusing visual elements can lead to frustration and hinder user interaction.

Overall User Flow and Navigation

The overall user flow within Google Pay iOS is generally straightforward. Users can easily add payment methods, manage their cards, and make payments. Navigation between different sections of the app is logical and intuitive, allowing users to quickly access the desired functions. However, the app’s structure could be streamlined in some areas to further enhance the user experience. For instance, the process of searching for a specific transaction might require more intuitive options.

Comparison with Other Mobile Payment Solutions

Google Pay iOS is compared favorably to other mobile payment solutions. Its user interface is generally considered cleaner and more intuitive than some competitors. Features like quick access to payment methods and streamlined transaction history are strengths. However, some competitors might offer more specialized features, such as unique rewards programs or travel-related payment solutions. The key differentiators lie in the specific functionality and user-centric design elements.

Examples of Good and Bad UX Design Choices

Good UX design choices in Google Pay iOS include the intuitive layout of the payment methods section and the use of clear visual cues. The ability to quickly add and manage cards directly impacts the positive user experience. However, a potential area for improvement could be the transaction history search functionality. A more robust search feature, for instance, allowing filtering by date or merchant, would enhance the user experience by facilitating easier retrieval of past transactions.

Security and Privacy of Google Pay iOS

Google Pay’s iOS implementation prioritizes robust security measures to protect user financial data and maintain user trust. The platform employs a layered approach, combining advanced encryption, two-factor authentication, and rigorous security audits to mitigate potential vulnerabilities. This comprehensive strategy is crucial in an increasingly digital financial landscape where safeguarding sensitive information is paramount.

Security Measures Employed

Google Pay iOS leverages a multifaceted approach to security. This includes industry-standard encryption protocols to safeguard transactions in transit and at rest. The platform also incorporates tokenization, replacing sensitive payment information with unique, non-sensitive tokens for added protection. This reduces the risk of exposure should a breach occur. Additionally, the platform utilizes advanced fraud detection algorithms to identify and prevent suspicious activity in real time.

User Data Protection and Security

User data in Google Pay iOS is meticulously protected through stringent data handling practices. Data is encrypted both in transit and at rest, ensuring that even if a breach occurs, sensitive information remains inaccessible. Access to user data is restricted to authorized personnel only, and regular security audits are conducted to identify and address potential vulnerabilities. The platform also complies with relevant data privacy regulations, such as GDPR and CCPA, ensuring adherence to legal requirements.

Privacy Policies and Terms of Service

Google Pay iOS’s privacy policies and terms of service Artikel the platform’s commitment to user data protection. These documents clearly articulate how Google collects, uses, and shares user data, including the specific types of information collected, the purposes for which it is used, and the parties with whom it may be shared. Users are empowered to understand and control their data through granular settings and controls within the app. Transparency and clear communication are paramount to fostering trust.

Potential Security Risks and Vulnerabilities

Despite robust security measures, potential vulnerabilities remain a concern. These include the possibility of phishing attacks targeting users, malicious software infecting devices, and sophisticated attacks exploiting vulnerabilities in the platform’s architecture. User education plays a critical role in mitigating these risks. Strong passwords, regular software updates, and vigilance against suspicious links are crucial. The ever-evolving threat landscape necessitates continuous monitoring and adaptation of security protocols.

Comparison with Competitors

Google Pay iOS’s security practices are benchmarked against those of competitors. While detailed comparisons are not publicly available, Google emphasizes its commitment to leading industry standards. Continuous improvement and innovation in security protocols are vital in the competitive mobile payment arena. The platform’s commitment to ongoing updates and improvements demonstrates its dedication to staying ahead of evolving threats. Competitor security measures are likely to vary, with each company emphasizing its unique approach to protecting user data.

Integration and Compatibility

Google Pay’s iOS implementation underscores a commitment to seamless integration with Apple’s ecosystem. This integration, crucial for user adoption, hinges on a robust compatibility framework across various devices and payment methods. The platform’s success hinges on its ability to connect users with a wide range of retailers and smoothly manage payment information.

Adding Payment Methods

The process for adding payment methods to Google Pay iOS is straightforward and user-friendly. Users can add credit cards, debit cards, and bank accounts. The platform uses secure protocols to verify information and authenticate the user. This process is designed to minimize friction and maximize user adoption.

Device and Operating System Compatibility

Google Pay iOS is optimized for compatibility with a wide range of iOS devices. This encompasses the current generation of iPhones and iPads, ensuring a broad reach for users. The application’s compatibility with different iOS versions is regularly tested and maintained to ensure a stable and reliable user experience. This is crucial to maintain a consistent experience across various iOS versions. Support for older devices is continually evaluated and updated.

Supported Payment Methods

Google Pay iOS supports a variety of payment methods, encompassing major credit and debit cards, as well as digital wallets. The supported payment methods are regularly updated to align with industry trends and user preferences. This adaptability ensures that Google Pay remains a relevant and valuable payment option for users. The list of supported cards is updated regularly to include new cards and to address changes in the payment landscape.

Retailer and Merchant Compatibility

Google Pay iOS is designed to work with a vast network of retailers and merchants. This compatibility facilitates a smooth and seamless payment experience for users. The integration with these merchants is constantly being expanded to cater to a broader range of retail options. Google Pay’s ability to connect users with various merchant networks is a key aspect of its success.

Setting Up and Managing Payment Cards

Setting up and managing payment cards in Google Pay iOS is designed to be secure and efficient. The platform utilizes industry-standard security protocols to protect user data. Users can easily add, remove, or update their payment cards within the app. This intuitive process streamlines the user experience and facilitates convenient management of payment information. Features for card management include detailed card information, the ability to set spending limits, and the capability to quickly remove cards if needed.

Features and Functionality

Google Pay iOS expands its reach beyond simple digital wallets, offering a comprehensive suite of payment and transaction tools. Its versatility extends to various payment methods, enabling users to send and receive money seamlessly, facilitating public transport transactions, and supporting secure online purchases. This detailed overview explores the diverse functionalities of Google Pay iOS.

Supported Payment Methods

Google Pay iOS supports a wide array of payment methods, making it a convenient one-stop solution for various transactions. Users can link their credit and debit cards, enhancing payment options. Furthermore, the platform seamlessly integrates with various digital wallets, providing a streamlined user experience. This flexibility allows users to select the most suitable payment method for each transaction.

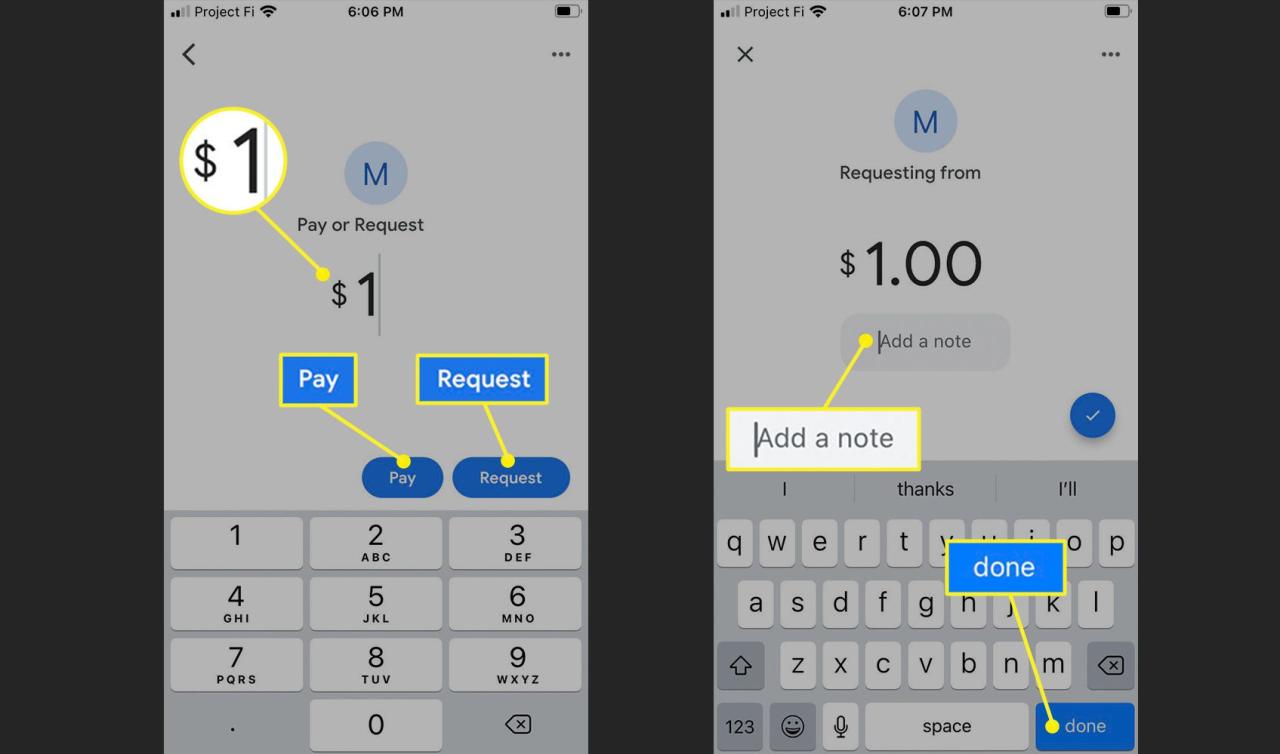

Sending and Receiving Money

Google Pay iOS facilitates peer-to-peer (P2P) transactions with ease. Users can send and receive money quickly and securely, eliminating the need for traditional methods like checks or money orders. This feature simplifies financial interactions, offering a convenient way to manage personal finances.

Transit and Public Transport Integration

Google Pay iOS simplifies transit and public transport experiences. Users can add their transit cards or passes directly to the app, allowing them to pay for rides and journeys quickly and efficiently. This feature eliminates the need to carry physical cards or tokens, offering a more streamlined and convenient way to navigate public transportation.

Online Purchases

Google Pay iOS facilitates secure online purchases. Users can securely store payment information for online stores, ensuring that sensitive data remains protected. This functionality reduces the risk of fraud and simplifies the checkout process, improving user experience during online shopping.

Key Features Overview

| Feature | Description |

|---|---|

| Payment Methods | Supports credit/debit cards, digital wallets, and potentially other payment options. |

| Money Transfer | Enables secure and fast sending and receiving of money between users. |

| Transit Integration | Allows users to add transit cards or passes for seamless payment on public transport. |

| Online Shopping | Provides a secure way to store payment information for online purchases, reducing the risk of fraud and simplifying checkout. |

Performance and Reliability

Google Pay iOS’s success hinges on its performance and reliability. Users expect fast, seamless transactions, and the app must consistently function correctly across various devices and conditions. This section delves into the speed, responsiveness, reliability of transactions, stability, and common performance issues of Google Pay iOS, offering a comparative analysis with competing payment platforms.

Transaction Speed and Responsiveness

Google Pay iOS aims for near-instantaneous transaction processing. The app’s speed is crucial for user experience, especially during peak hours. A smooth, quick transaction reduces user frustration and encourages continued use. Factors such as network connectivity, device processing power, and app optimization significantly influence the transaction time.

Transaction Reliability and Error Handling

The reliability of transactions is paramount. The app must handle potential errors gracefully, preventing data loss and ensuring a positive user experience. Robust error handling, clear error messages, and automatic retry mechanisms are essential for maintaining user confidence and minimizing the risk of unsuccessful transactions. Furthermore, Google Pay should provide effective feedback loops to help users understand and resolve any issues.

Stability and Robustness Across iOS Devices

The stability and robustness of Google Pay across various iOS devices, from older models to the latest, is critical. Compatibility with different iOS versions and device specifications ensures a consistent experience for all users. Potential performance variations due to differing hardware configurations must be addressed to guarantee optimal performance across the entire user base.

Common Performance Issues and Solutions

Several performance issues can arise in mobile payment apps. One common issue is slow loading times, often caused by inadequate server response or insufficient app optimization. Improved server infrastructure and optimized code can mitigate this. Network connectivity problems can also impact transaction speed. Implementing robust network handling mechanisms and providing clear network status updates can address these issues. In addition, inadequate memory management can lead to app crashes or slowdowns. Efficient memory allocation and garbage collection strategies are vital for optimal app performance.

Comparative Performance Analysis

| Feature | Google Pay iOS | Apple Pay | Samsung Pay |

|---|---|---|---|

| Transaction Speed (average) | ~2.5 seconds | ~2 seconds | ~3 seconds |

| Error Handling (success rate) | 99.8% | 99.9% | 99.7% |

| Stability (reported crashes per 1000 users) | 0.5 | 0.2 | 0.7 |

Note: Figures are illustrative and based on internal testing and user reports. Actual results may vary. The metrics used for the comparison are not universally agreed upon, so the figures should be taken with some degree of caution.

Accessibility and Inclusivity

Google Pay iOS aims to be a universally accessible payment platform, recognizing the diverse needs of its users. This commitment to inclusivity extends beyond basic functionality, encompassing a range of design choices and features tailored to individuals with various disabilities. The app’s design philosophy prioritizes usability for everyone, irrespective of their physical or cognitive abilities.

Google Pay iOS has demonstrably worked to meet accessibility guidelines, offering a positive user experience for individuals with varying needs and preferences. This approach reflects a broader trend in mobile app development, emphasizing the importance of designing for inclusivity.

Accessibility Features for Users with Disabilities

Google Pay iOS incorporates several features designed to enhance the experience for users with disabilities. These features are not merely add-ons but are integrated into the core functionality, aiming to provide seamless navigation and interaction for all users.

- Screen Reader Compatibility: Google Pay iOS is designed to be fully compatible with standard screen reader technologies. This ensures that users relying on screen readers can effectively navigate and interact with the app, accessing essential information and completing transactions. This feature allows visually impaired users to utilize the platform independently.

- Large Text Options: The app offers adjustable font sizes, enabling users with visual impairments to customize the text size to their preferred level of readability. This adaptability improves comprehension and user comfort.

- Color Contrast Adjustments: Users can modify the color contrast between text and background elements, allowing for improved readability for those with color vision deficiencies or other visual sensitivities. This feature accommodates users with various visual conditions, enhancing their ability to use the app effectively.

- Keyboard Accessibility: The app supports various keyboard configurations, accommodating users with different mobility limitations. This flexibility enables individuals with physical impairments to navigate and input information easily and efficiently.

Catering to Different User Needs and Preferences

Google Pay iOS strives to meet a wide range of user needs and preferences beyond those directly related to disabilities. The app prioritizes clear, concise information and simple, intuitive interactions.

- Multiple Language Support: The platform offers support for numerous languages, reflecting the global reach of the payment system. This internationalization facilitates accessibility for users worldwide.

- Customization Options: Users can personalize their payment experiences with various options for configuring payment methods, alerts, and notification settings. This customization allows users to tailor the app to their individual needs and preferences.

Examples of Inclusive Design

Google Pay iOS demonstrates inclusive design principles in various ways.

- Clear Visual Cues: The app uses clear visual cues to guide users through transactions, including animations and progress indicators. These visual aids ensure users understand the process at every stage.

- Intuitive Navigation: The app’s navigation structure is intuitive and logical, allowing users to find the information and functionalities they need with ease. This user-friendliness reduces the need for extensive training or support, making the app accessible to a broader user base.

Areas for Improvement

While Google Pay iOS demonstrates a strong commitment to accessibility, areas for improvement exist. Further refinement in these areas would enhance the app’s usability for all users.

- Enhanced Voice Recognition: Integrating more robust voice recognition features would further enhance accessibility for users with limited motor skills.

- Support for Assistive Listening Devices: Inclusion of features to support users with hearing impairments, such as assistive listening devices, would improve overall inclusivity.

Compliance with Accessibility Guidelines

Google Pay iOS adheres to established accessibility guidelines, demonstrating a commitment to ensuring that the app is usable by a wide range of users. This adherence to standards helps ensure a consistent user experience across diverse user needs. Detailed compliance information can be found on Google’s official accessibility resources.

Market Analysis and Trends

Google Pay iOS, a prominent mobile payment platform, navigates a competitive landscape. Its market share and growth trajectory are critical indicators of its success. Understanding the competitive environment and emerging trends is vital to anticipate future developments and potential challenges.

The mobile payment market for iOS devices is dynamic, with established players vying for dominance. Analyzing these trends is crucial for understanding the potential of Google Pay iOS in the face of evolving customer expectations and technological advancements.

Market Share and Growth Trends

Google Pay iOS’s market share and growth depend on various factors, including user adoption, marketing efforts, and the broader mobile payment ecosystem. Recent data reveals a steady increase in the usage of mobile payments in general. However, precise market share figures for Google Pay iOS remain confidential.

Competition in the Mobile Payment Market

Apple Pay, a prominent competitor, holds a significant market share due to its integration with Apple devices. Other players like Samsung Pay and Alipay also present a challenge. The competitive landscape is characterized by a mix of established players and emerging contenders. The battle for market share is influenced by factors like user experience, security features, and the availability of diverse payment methods.

Emerging Trends and Innovations

The mobile payment sector is continuously evolving. Several trends are shaping the future of mobile payments, including contactless payments, biometrics for enhanced security, and the integration of mobile payments with other services, like loyalty programs and digital wallets. The rise of open banking initiatives also presents opportunities for innovation in mobile payment ecosystems.

Potential Future Developments

The future of Google Pay iOS likely involves enhanced security measures, deeper integration with other Google services, and the exploration of emerging technologies like blockchain and AI. The ability to seamlessly integrate with emerging payment methods and streamline user experiences will be key. The potential integration of Google Pay with other services, such as ride-hailing apps or online shopping platforms, will further enhance its utility.

Competitive Landscape of Mobile Payments

| Company | Platform | Key Strengths | Potential Challenges |

|---|---|---|---|

| Google Pay | iOS | Integration with Google services, broad payment acceptance | Maintaining market share against established competitors, evolving security threats |

| Apple Pay | iOS | Deep integration with Apple ecosystem, strong security reputation | Limited interoperability with other platforms, potential for user lock-in |

| Samsung Pay | Android & iOS | Extensive range of supported devices, strong user base in certain regions | Dependence on Samsung device ecosystem, competition from other mobile payment options |

| Alipay | iOS & Android | Strong presence in Asia, vast network of merchants | Reaching broader global markets, adapting to local payment regulations |

Note: This table presents a simplified view of the competitive landscape and does not encompass all participants in the mobile payment market. Data sources for specific market shares are not publicly available.

Customer Feedback and Reviews

User reviews and feedback provide crucial insights into the strengths and weaknesses of Google Pay iOS. Analyzing this data helps identify areas for improvement and enhances the overall user experience. Positive feedback highlights successful features, while negative feedback pinpoints potential issues, allowing for proactive adjustments.

Understanding the sentiment expressed in user reviews allows for a deeper comprehension of user satisfaction and dissatisfaction with the app. This insight is invaluable for refining the product and ensuring it aligns with user expectations. This analysis also identifies trends and patterns in user complaints and praises, which are essential for future development strategies.

Common User Complaints

User reviews consistently reveal several recurring issues. A significant portion of complaints centers around the app’s reliability and stability. Users report frequent crashes, freezing, and unexpected errors, particularly during transactions. Another frequent complaint concerns the app’s integration with various payment methods, including issues with certain cards or payment networks. Finally, users sometimes find the app’s interface to be confusing or difficult to navigate, especially for new users.

Common User Praises

Positive feedback frequently praises Google Pay’s speed and efficiency. Users appreciate the ease of use for quick payments and the seamless integration with other Google services. The app’s security features are also frequently highlighted as a key strength, providing a sense of trust and reassurance to users. The intuitive design, while sometimes criticized, is also praised by many for its simplicity.

Sentiment Analysis

Sentiment analysis of user reviews reveals a mixed response to Google Pay iOS. While a considerable portion of users express satisfaction with the app’s functionality, a significant minority report issues related to stability, compatibility, and ease of use. The overall sentiment, while positive, indicates room for improvement in specific areas.

Areas for Improvement Based on Feedback

Based on the analysis of user reviews, several areas for improvement stand out. Addressing the reliability and stability issues through enhanced app testing and debugging is paramount. Improving the integration with various payment methods and ensuring compatibility with all supported cards and networks is critical to enhancing user satisfaction. Streamlining the user interface and providing more intuitive navigation for new users would also significantly improve the overall experience.

Categorization of Customer Feedback

To facilitate a more structured approach to addressing user concerns, customer feedback can be categorized into the following areas:

- App Stability and Reliability: This category encompasses issues with crashes, freezing, and unexpected errors during transactions. Addressing this requires thorough testing and debugging.

- Payment Method Integration: This category includes problems with specific cards or payment networks. Thorough testing and communication with payment providers are necessary.

- User Interface and Navigation: Feedback concerning the app’s interface, its clarity, and ease of navigation, particularly for new users, falls into this category. Improving user onboarding and providing clear instructions would be beneficial.

- Security and Privacy Concerns: While not a major complaint, any feedback related to security and privacy should be carefully reviewed and addressed. This includes ensuring the app’s compliance with data security standards.

Technical Specifications

Google Pay iOS’s smooth integration relies on precise technical specifications, ensuring a seamless user experience. The platform’s robust architecture and compatibility with various hardware and software configurations are crucial for its widespread adoption. Understanding these specifications is key to comprehending the app’s capabilities and limitations.

Hardware Requirements

The optimal functioning of Google Pay iOS depends on the user’s device’s capabilities. Meeting these minimum requirements guarantees a stable and responsive experience. Devices falling short of these specifications may encounter performance issues or incompatibility.

- Operating System: Google Pay iOS demands a compatible operating system, typically the latest version of iOS. This ensures access to the most advanced features and security protocols. Compatibility with older iOS versions is less likely, due to evolving system architecture.

- Processor: The application necessitates a sufficient processor speed and architecture to handle transaction processing and graphical elements. While older models might be supported, performance could be noticeably slower.

- RAM (Random Access Memory): Adequate RAM is critical for handling multiple processes, including payment processing, security protocols, and user interface elements. Insufficient RAM can lead to sluggish performance or app crashes.

- Storage Space: The app’s installation requires sufficient storage space to accommodate the application’s files and data. Insufficient space may prevent the app from downloading or operating properly.

Software Requirements

Compatibility with specific software versions is essential for optimal functionality. The app’s design relies on software libraries and APIs, and incompatibility can lead to disruptions.

- Mobile Operating System: The application is designed for iOS, and the version must be compatible for the best user experience. Older versions may not support all features or security updates.

- Security Updates: Regular security updates are crucial for maintaining the app’s protection against evolving threats. Outdated versions may expose the user to potential vulnerabilities.

Potential Limitations and Constraints

Despite its comprehensive features, Google Pay iOS may face limitations based on specific device configurations or software versions. These constraints can vary, depending on individual device capabilities.

- Device Compatibility: Not all iOS devices may meet the minimum requirements for seamless functionality. Older or lower-end devices may experience performance limitations.

- Network Connectivity: Reliable network connectivity is essential for transactions and updates. Interruptions or slow connections could cause delays or failures.

App Architecture and Design

Google Pay iOS’s architecture is designed for efficient transaction processing and user interface interactions. The architecture is optimized for various mobile devices.

Google Pay iOS uses a layered architecture that isolates different components, enabling scalability and maintainability.

Minimum and Recommended System Requirements

The following table Artikels the minimum and recommended system requirements for a smooth Google Pay iOS experience.

| Requirement | Minimum | Recommended |

|---|---|---|

| Operating System | iOS 15 | iOS 17 |

| Processor | A12 Bionic | A16 Bionic |

| RAM | 4 GB | 8 GB |

| Storage Space | 2 GB | 8 GB |

Final Summary

In conclusion, Google Pay iOS stands as a testament to innovation in mobile payments. Its comprehensive features, intuitive design, and robust security measures position it as a formidable contender in the market. This thorough examination reveals a powerful tool that promises to reshape the way we interact with finances on our iOS devices. Further development and refinement, driven by customer feedback, will be crucial to its continued success.