The Google Wallet app for Android has become a cornerstone of mobile payments. This comprehensive exploration delves into its functionalities, user experience, security, and future potential. From seamless in-store transactions to secure online payments, we’ll uncover how this app fits into the evolving landscape of digital commerce.

This document examines the core features of the Google Wallet app, highlighting its strengths and weaknesses compared to competitors like Apple Pay and Samsung Pay. It provides a detailed overview of the user interface, security protocols, and integration capabilities, making it a valuable resource for anyone seeking a deeper understanding of this widely used mobile payment solution.

Overview of Google Wallet App for Android

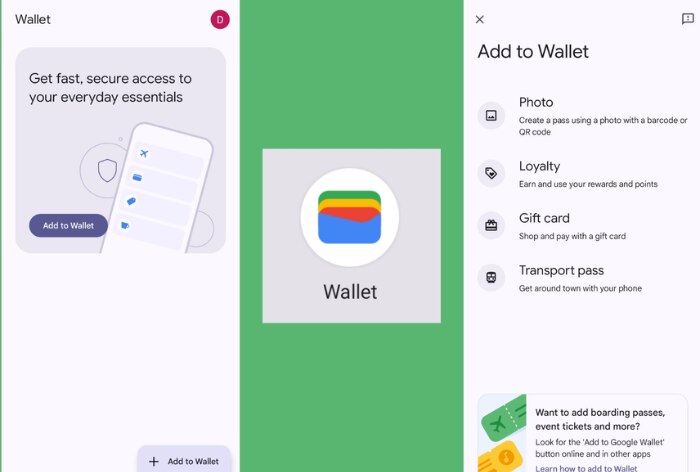

The Google Wallet app is a widely used mobile payment platform integrated into Android devices. It simplifies transactions and offers a convenient way to store payment information, loyalty cards, and other digital passes. It seamlessly integrates with other Google services, making it a valuable tool for everyday financial management.

The core function of Google Wallet is to facilitate secure and convenient mobile payments. Users can add various payment methods, including credit cards, debit cards, and digital wallets, to the app. This allows for quick and easy payment processing at compatible merchants. Beyond payment, it also serves as a digital repository for loyalty cards and other important information.

Core Features and Functionalities

Google Wallet provides a comprehensive suite of features designed to enhance the mobile payment experience. These features include secure storage of payment information, simplified payment processing at compatible locations, and the ability to store and manage digital loyalty cards. It also facilitates seamless integration with other Google services.

- Payment Methods: Users can add various payment methods, including credit cards, debit cards, and digital wallets, to the app. This enables users to quickly and easily make payments at participating merchants.

- Loyalty Cards: Google Wallet acts as a digital repository for loyalty cards, offering convenient access to rewards programs.

- Transit Cards: In many regions, Google Wallet supports transit cards, enabling users to easily pay for public transportation.

- Digital Passes: The app allows users to store digital passes, such as movie tickets or event tickets, for easy access and presentation.

- Secure Payment Processing: Google Wallet employs robust security measures to protect user data and financial information.

Benefits Compared to Other Mobile Payment Systems

Google Wallet’s advantages often stem from its integration with other Google services and its widespread acceptance among merchants. It offers a user-friendly experience and is compatible with a large number of payment terminals and locations.

- Widespread Merchant Acceptance: Google Wallet is accepted at many businesses and merchants, often exceeding the acceptance rate of other mobile payment systems.

- Seamless Integration with Google Services: The app seamlessly integrates with other Google services, providing a consistent user experience across different applications.

- User-Friendly Interface: The app’s interface is generally considered user-friendly and easy to navigate, leading to a smooth transaction process.

- Strong Security Measures: Google Wallet employs robust security protocols to safeguard user data and financial information.

Typical User Experience

The typical user experience involves adding payment methods, storing loyalty cards, and utilizing the app for payments at various merchants. The interface is designed to be intuitive and straightforward.

- Adding Payment Methods: Users typically add their credit or debit cards, or digital wallets to the app, following prompts and security measures.

- Making Payments: When paying at a compatible merchant, the user selects their preferred payment method from the app and confirms the transaction.

- Using Loyalty Cards: At checkout, users can present their digital loyalty cards through the app, gaining access to rewards.

- Managing Information: Users can easily manage their stored payment methods, loyalty cards, and other information within the app.

Features and Functionality

Google Wallet’s functionality extends beyond simple payment processing, offering a comprehensive suite of features for managing various financial transactions and experiences. This section dives into the core functionalities, including payment comparisons, security protocols, and practical transaction processes.

Payment Feature Comparison

A comparative analysis of Google Wallet’s payment capabilities alongside prominent competitors like Apple Pay and Samsung Pay reveals distinct strengths and weaknesses. This table Artikels key features for easy comparison.

| Feature | Google Wallet | Apple Pay | Samsung Pay |

|---|---|---|---|

| Contactless Payments | Supports NFC-enabled devices for tap-and-go transactions | Uses NFC technology for seamless in-store payments | Offers NFC for in-store transactions and tap-to-pay |

| Payment Types | Accepts credit cards, debit cards, and digital wallets | Primarily supports credit and debit cards | Supports credit cards, debit cards, and various digital wallets |

| Transit Support | Integrates with transit systems in many areas | Offers transit support in certain regions | Integrates with transit systems in some regions |

| Loyalty Programs | Facilitates linking loyalty cards and programs | Integrates with some loyalty programs | Supports linking loyalty cards and programs |

Security Measures

Google Wallet prioritizes the security of user data and transactions. Robust security measures are implemented to safeguard user information. These measures include encryption, two-factor authentication (2FA), and regular security audits. Google Wallet utilizes advanced encryption protocols to protect sensitive financial data during transmission and storage. Furthermore, 2FA adds an extra layer of protection by requiring a secondary verification method beyond a password.

Adding Payment Methods

Adding payment methods to Google Wallet is a straightforward process. Users can add cards by inputting the card details manually, or by linking existing bank accounts.

- Open the Google Wallet app and navigate to the payment methods section.

- Tap the “Add card” or “Add payment method” option.

- Enter the required card details, such as the card number, expiration date, and CVV.

- Review the entered information and confirm the addition.

In-Store Transactions

Using Google Wallet for in-store transactions is simple and efficient.

- Open the Google Wallet app and ensure the desired payment method is selected.

- Present your device to the payment terminal and authorize the transaction.

- Confirm the transaction in the Google Wallet app if prompted.

Online Transactions

Google Wallet facilitates secure online transactions. Users can add their cards to a website’s payment portal and use Google Wallet to complete the transaction securely. This eliminates the need to manually enter card details each time.

User Experience and Interface

The user experience (UX) of the Google Wallet app is crucial for its success. A well-designed interface fosters ease of use, encourages user engagement, and ultimately, drives adoption. A smooth and intuitive experience keeps users returning and utilizing the app’s features effectively.

The app’s design should be both visually appealing and functional, ensuring that all key elements are easily accessible and understandable. A seamless transition between different sections and features is essential. Potential pain points and areas for improvement in the current interface should be addressed proactively. Comparison with competitor apps can provide valuable insights into best practices and areas where Google Wallet can excel.

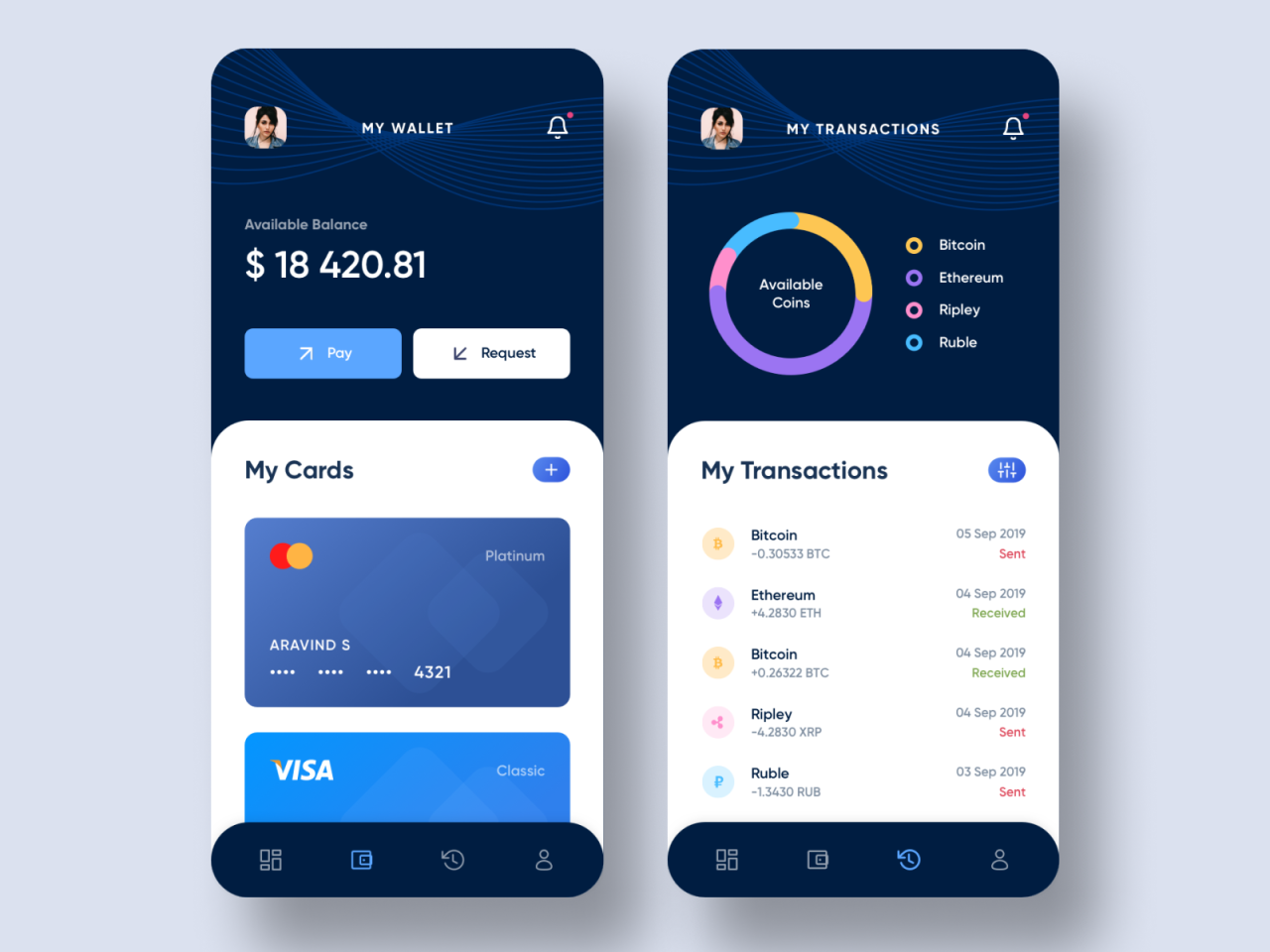

User Interface Mockup

A mockup of the Google Wallet app’s interface would show the main screen displaying a clean and organized layout. Key elements, such as payment cards, transit passes, loyalty cards, and digital gift cards, would be prominently featured. A clear visual hierarchy would guide users through the app’s functionalities, with easy-to-understand icons and labels. The app’s color scheme should be consistent and visually appealing, while maintaining a modern and user-friendly aesthetic. The screen layout would also accommodate various screen sizes and orientations for optimal usability across different Android devices.

Potential Pain Points and Areas for Improvement

One potential pain point could be the complexity of managing multiple payment methods within the app. A streamlined process for adding and removing cards, as well as managing their associated details, would enhance the user experience. Another potential issue could be the lack of clear visual cues for transaction confirmations and notifications. Improved visual feedback mechanisms and clear notification prompts would greatly improve the user experience. Users might also struggle to locate specific cards or features within the app, particularly with a large number of cards stored. An intuitive search function and clear navigation structure are vital for addressing this.

Comparison with Competitor Apps

A comparison with competitor apps reveals that some competitors provide more detailed transaction history views, offering users greater transparency and control over their spending. Furthermore, certain competitors’ interfaces offer more intuitive methods for managing rewards programs and loyalty cards, allowing users to track and redeem points more easily. Examining these features can inform design choices and identify potential enhancements to Google Wallet’s interface.

Accessibility Features

The app should incorporate accessibility features for users with disabilities. This includes adjustable font sizes, high contrast themes, and alternative text descriptions for images and icons. Voiceover support for screen readers and alternative input methods for users with limited dexterity are essential for inclusivity. The app should adhere to accessibility guidelines and standards to ensure usability for all users. This also includes considerations for users with visual impairments, hearing impairments, and cognitive disabilities.

Possible Improvements Based on User Feedback

Based on user feedback, incorporating a more intuitive search function for locating specific cards or transactions would significantly improve the user experience. Users might also benefit from a more streamlined process for adding and managing payment methods, as well as enhanced visual cues for transactions and notifications. Further improvements could include a dedicated section for managing loyalty programs, offering users a more efficient way to track and redeem points. Detailed information about payment methods and transactions, as well as clear guidelines for usage, should be prominently displayed.

Integration and Compatibility

Google Wallet seamlessly integrates with a wide array of merchants and services, enhancing the user experience and offering a convenient payment solution. Its compatibility across various platforms and devices ensures a smooth and reliable experience for users, regardless of their preferred devices or payment preferences.

The app’s integration with other Google services provides a cohesive ecosystem, simplifying transactions and improving overall user experience. Its ability to integrate with other payment systems allows for flexibility and expands user options.

Merchant and Retailer Compatibility

Google Wallet supports a vast network of merchants and retailers, offering users a broad range of payment options. This extensive network is constantly expanding, incorporating new stores and businesses. Users can expect a consistently high level of compatibility across a significant portion of the retail landscape.

Google Service Integration

Google Wallet seamlessly integrates with other Google services, such as Google Pay, Google Play, and the Google Assistant. This integration streamlines payment processes, allowing users to access their payment information and make transactions directly through other Google platforms. This cohesive approach provides a convenient user experience.

Integration with Other Payment Apps or Platforms

Google Wallet supports integration with various payment apps and platforms, enabling a broader range of payment options for users. This flexibility allows users to utilize different payment methods, enhancing convenience. However, the specific integration capabilities might vary depending on the supported payment app or platform.

Troubleshooting Compatibility Issues

Google Wallet provides support resources for troubleshooting compatibility issues. Users can access help articles, FAQs, or contact customer support to address any problems encountered during transactions or use. The support resources are designed to efficiently assist users in resolving compatibility issues.

Supported Devices and Operating Systems

Google Wallet is compatible with a wide array of devices and operating systems, ensuring a broad range of users can access the app. The compatibility list encompasses both mobile phones and tablets, covering the most popular operating systems. Users can find the specific list of compatible devices and operating systems on the Google Wallet support website.

Security and Privacy

Google Wallet prioritizes user data security and privacy, employing robust measures to safeguard sensitive information. This commitment extends to all aspects of the platform, from transaction processing to data storage. User trust is paramount in the mobile payment ecosystem, and Google Wallet’s approach reflects this crucial element.

Security Measures

Google Wallet employs a multi-layered security approach to protect user data. This includes encryption, which scrambles sensitive information to make it unreadable to unauthorized parties. Furthermore, Google Wallet utilizes strong authentication methods, such as two-factor authentication, to verify user identity and prevent unauthorized access.

- Encryption: All transactions are encrypted using industry-standard protocols to protect sensitive data during transmission. This ensures that even if intercepted, the information remains unreadable.

- Authentication: Robust authentication methods, like password protection and two-factor authentication, are implemented to verify user identity and control access to accounts.

- Secure Storage: User data is stored securely on Google’s servers using advanced security measures to prevent unauthorized access. This includes access controls, intrusion detection systems, and regular security audits.

Data Privacy Policies

Google Wallet adheres to strict data privacy policies Artikeld in Google’s broader privacy terms. These policies clearly define how user data is collected, used, and protected. Transparency is key, and users are informed about the types of data collected and how it is utilized.

- Data Minimization: Google Wallet collects only the necessary data for its services, avoiding the collection of excessive or unnecessary information. This principle minimizes the potential risk of data breaches and protects user privacy.

- Purpose Limitation: Collected data is used solely for the purposes Artikeld in Google Wallet’s privacy policy. This prevents the misuse of user data for unrelated activities.

- Data Security: Google Wallet employs comprehensive security measures to protect user data from unauthorized access, use, disclosure, alteration, or destruction. This includes physical security, access controls, and data encryption.

Transaction Security

Protecting user transactions is critical. Google Wallet utilizes secure payment networks and employs robust security protocols to ensure that all transactions are processed securely and efficiently. These protocols prevent fraudulent activities and protect users from financial loss.

- Secure Payment Networks: Google Wallet integrates with secure payment networks, like Visa and Mastercard, to ensure that transactions are processed securely and in compliance with industry standards.

- Fraud Prevention: Advanced fraud detection systems are in place to identify and prevent potential fraudulent activities. These systems monitor transactions for suspicious patterns and flags potential threats.

- Transaction Monitoring: Google Wallet continuously monitors transactions for any irregularities. This proactive approach allows for quick identification and mitigation of any potential risks.

Comparison with Other Apps

Google Wallet’s security features compare favorably to those of other mobile payment apps. Google consistently invests in advanced security technologies and adheres to strict industry standards.

- Robust Encryption: Google Wallet’s encryption methods are comparable to industry best practices and are continuously updated to reflect the latest security advancements.

- Multi-Factor Authentication: The implementation of two-factor authentication provides an extra layer of security beyond basic password protection.

- Comprehensive Privacy Policies: Google’s comprehensive privacy policies are regularly reviewed and updated to ensure compliance with evolving privacy regulations and user expectations.

Use Cases and Scenarios

Google Wallet offers a versatile platform for managing various financial transactions and services, seamlessly integrating into daily life. Its adaptability extends across numerous sectors, from everyday purchases to specialized needs, making it a valuable tool for users globally.

This section details the diverse use cases of Google Wallet, showcasing its applicability in diverse scenarios, from transportation to payments, and its potential impact in emerging markets. Specific examples will highlight the practicality and effectiveness of Google Wallet’s functionality.

Common Use Cases for Google Wallet

Google Wallet facilitates convenient payment processing for a wide array of transactions. Its integration with various platforms and services makes it a valuable tool for users.

- Transportation: Google Wallet is extensively used for transit fare payment, offering users a quick and easy way to board public transportation. The integration with transit agencies provides a streamlined process for commuters, minimizing the need for physical tickets or passes. This eliminates the need to carry cash or separate transit cards, simplifying the travel experience. The ease of adding transit cards to Google Wallet is also crucial for users.

- Shopping: Google Wallet simplifies in-store and online purchases. Users can easily add credit or debit cards to their digital wallet for quick and secure checkout. This is especially beneficial for online shopping, as it reduces the need to enter card details each time. In-store transactions can be facilitated with mobile payments, eliminating the need for physical cards.

- Dining: Google Wallet allows users to pay for meals at restaurants, cafes, and other dining establishments. The system enables quick and contactless payments, which is particularly beneficial for quick service restaurants. The convenience of using Google Wallet for dining reduces the time spent on transactions, enhancing the overall dining experience.

- Bill Payments: Google Wallet can be utilized to pay utility bills, subscriptions, and other recurring expenses. This streamlines the bill payment process, eliminating the need for separate portals or applications. Automated reminders and payment scheduling features further enhance the user experience.

Google Wallet in Emerging Markets

The accessibility and ease of use of Google Wallet are particularly beneficial in emerging markets where financial infrastructure may be less developed. Its capacity for mobile payments can significantly improve access to financial services for unbanked and underbanked populations.

- Financial Inclusion: Google Wallet can facilitate financial inclusion by providing a secure and accessible platform for individuals to conduct transactions, even in areas with limited access to traditional banking services. This is particularly useful in regions where physical cash is the dominant form of payment.

- Microtransactions: Google Wallet can enable microtransactions, facilitating small-value transactions that are common in developing economies. This functionality enables seamless payments for everyday goods and services.

- Local Businesses: The ability to accept mobile payments through Google Wallet can help small businesses in emerging markets gain access to a wider customer base and improve transaction efficiency. This can help increase revenue and stimulate economic activity.

Payment Types Supported by Google Wallet

Google Wallet supports a range of payment methods, catering to various user needs. This flexibility enhances its value as a payment platform.

- Credit Cards: Users can add their credit cards to Google Wallet for secure and convenient online and in-store purchases. This integration eliminates the need to manually enter credit card details each time.

- Debit Cards: Adding debit cards to Google Wallet allows users to make quick and secure payments, mirroring the functionality offered for credit cards. This is particularly useful for everyday transactions.

- Digital Wallets: Integration with other digital wallets allows users to manage their funds across multiple platforms. This flexibility facilitates seamless transactions and enhances the overall user experience.

Future Trends and Innovations

The Google Wallet app, a cornerstone of mobile payment solutions, is poised for continued evolution. Its future trajectory will likely be shaped by the ongoing development of emerging technologies and the evolving needs of users. This section explores potential future features, updates, and innovative applications, providing a glimpse into the potential direction of mobile payments.

Potential Future Features and Updates

The Google Wallet app will likely incorporate enhanced security features, such as biometrics-based authentication and advanced fraud detection algorithms, in response to growing concerns about digital security. This will improve user trust and confidence in the platform. Improved integration with other Google services and devices will be a priority, allowing seamless transactions across various platforms and enhancing user experience. Furthermore, the app will likely offer personalized recommendations for payment options based on user spending habits and preferences.

Evolution in Response to Emerging Technologies

The increasing prevalence of contactless payments and the advancement of Near Field Communication (NFC) technology will likely lead to further integration of Google Wallet into everyday life. Imagine using your phone to pay for groceries, fuel, or even public transportation with just a tap. This integration will streamline transactions and offer a more convenient experience for users.

Future Direction of Mobile Payments

The future of mobile payments will likely see a greater emphasis on real-time payments, allowing for immediate fund transfers and reduced processing times. This evolution will significantly impact businesses and consumers alike, enabling faster transactions and more streamlined commerce. Moreover, the use of mobile wallets will likely extend beyond simple transactions, incorporating features like loyalty programs, digital coupons, and personalized offers.

Innovative Applications of Google Wallet

The app’s future potential extends beyond traditional payment methods. Imagine using Google Wallet to access and manage digital tickets for events, concerts, and even transportation. Integration with health records and prescriptions could provide a secure and convenient way to manage healthcare information, streamlining interactions with medical providers. Further, integrating with loyalty programs and digital coupons could provide personalized rewards and discounts, enhancing the user experience.

Emerging Trends in Mobile Payment Technologies

Several emerging trends will influence the evolution of Google Wallet. The rising popularity of mobile-first payment solutions, the increasing adoption of blockchain technology for secure transactions, and the integration of AI for fraud detection and personalization are key drivers. Furthermore, the continued advancement of biometrics will enhance the security and accessibility of mobile payment systems. These technologies will be crucial to the future of Google Wallet.

Last Recap

In conclusion, Google Wallet for Android provides a robust and versatile mobile payment solution. Its features, security measures, and user experience are carefully considered, although areas for improvement always exist. As mobile payment technologies continue to evolve, Google Wallet’s adaptability and integration capabilities will be key to its continued success.