The HSBC app is a crucial tool for managing your finances on the go. This review delves into the app’s functionality, user experience, performance, security, customer support, and mobile compatibility. From navigating core banking functions to understanding security measures, we’ll explore every aspect of the HSBC app to provide a complete picture.

We’ll examine the app’s strengths and weaknesses, considering user feedback and performance metrics across various devices. This analysis aims to provide a clear understanding of the app’s usability and value proposition, ultimately helping users decide if it’s the right banking solution for their needs.

App Functionality

The HSBC mobile app provides a comprehensive suite of banking services, empowering users to manage their finances efficiently and securely. It allows for seamless access to various functionalities, including account management, transactions, and investment options. This detailed overview will explore the core banking features, security measures, and account management tools available within the app.

Core Banking Functions

The HSBC app offers a broad range of core banking functions. These include account balance inquiries, transaction history reviews, and bill payments. Users can conveniently view their account statements, track spending patterns, and generate customized reports.

Account Management

The app facilitates various account management options. Deposits can be made through secure online channels, while withdrawals can be initiated and monitored through the app’s interface. Funds transfers between linked HSBC accounts, or to external accounts, are also readily available. This allows for efficient money management, streamlining the process of moving funds between accounts.

Investment Features (if applicable)

Depending on the user’s account type, the app might offer investment features. These may include portfolio management tools, investment research resources, and access to a selection of investment products. Specific investment options and features are tailored to the individual’s account type and investment profile. Users can review their investment portfolios, track their performance, and make informed investment decisions.

Security Measures

HSBC employs robust security measures to protect user data. These include multi-factor authentication, encryption technologies, and regular security audits. The app also features strong password protocols and a secure login process. Furthermore, users can set up alerts for suspicious transactions, enabling proactive security measures.

Managing Multiple Users/Accounts

The HSBC app allows users to manage multiple accounts and users. This feature is particularly useful for families or individuals who have multiple linked accounts. Users can add additional users to their account, granting them specific access levels. This enables collaborative financial management and controlled access to individual accounts.

Comparison with a Competitor’s App

Comparing the HSBC app to a competitor’s app reveals key differences in functionality and user experience. For example, the HSBC app might excel in investment features or offer more comprehensive reporting tools. Conversely, the competitor’s app might have a simpler interface or faster transaction processing speeds. A detailed comparative analysis can help users evaluate the features and functionalities of both apps to determine the best fit for their needs.

Account Types and Features

| Account Type | Key Features |

|---|---|

| Current Account | Everyday banking needs, debit card access, cheque book facility (if applicable), ATM transactions |

| Savings Account | Interest earning, limited withdrawal options, online banking access, mobile deposit facility |

| Investment Account | Specific investment products, portfolio management tools, research resources, access to investment advisors |

User Experience (UX)

The user experience (UX) of the HSBC app is crucial for customer satisfaction and engagement. A well-designed interface, intuitive navigation, and efficient functionality contribute significantly to a positive user experience. Addressing potential pain points and incorporating user feedback are essential for continuous improvement and maintaining a competitive edge in the mobile banking sector.

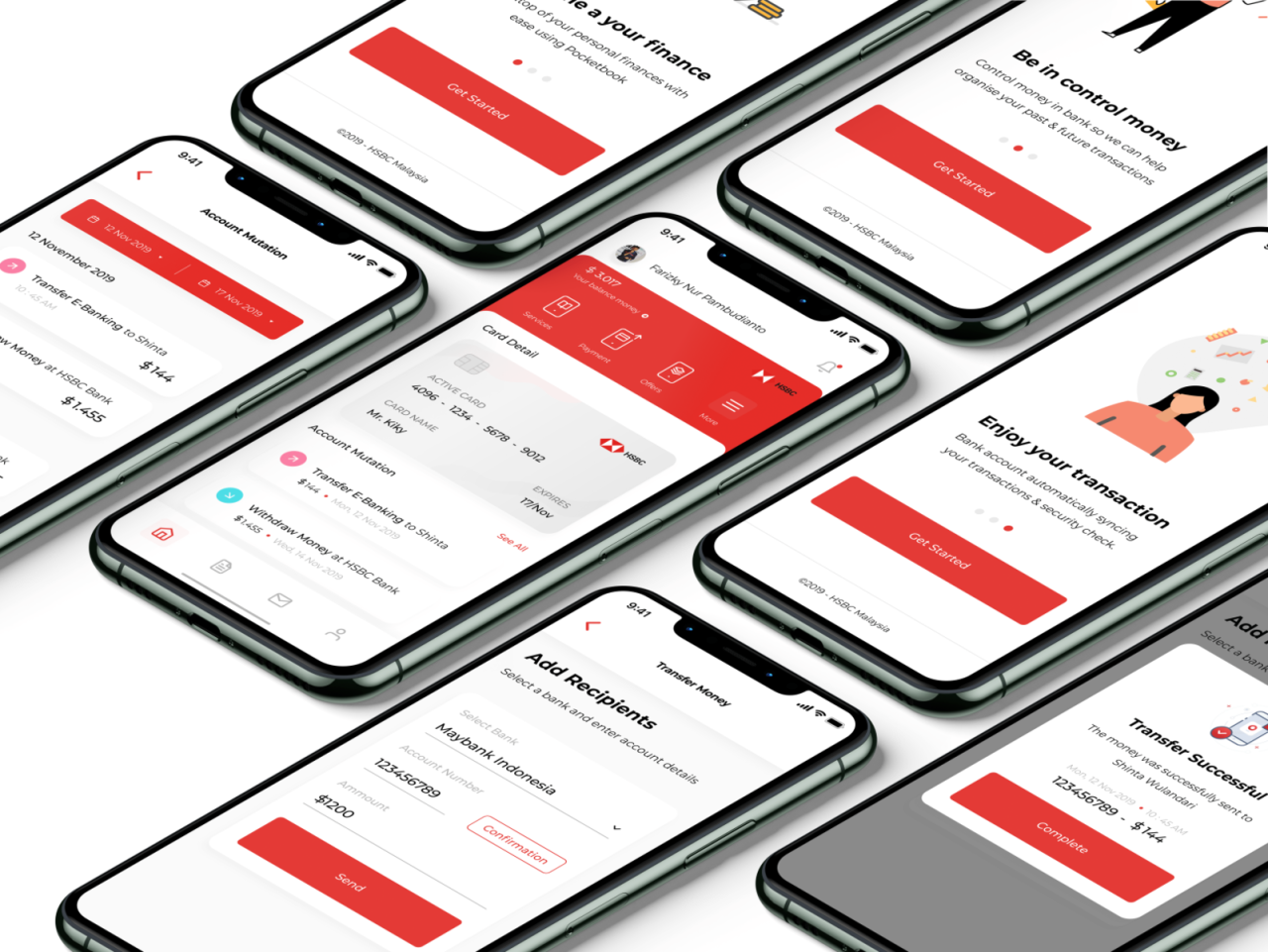

Overall Interface Design

The HSBC app’s interface is generally clean and well-organized, employing a consistent visual style across different screens. Color palettes and typography are used effectively to create a visually appealing and user-friendly environment. Icons are recognizable and intuitive, aiding users in quickly identifying different functionalities. The layout is adaptable to different screen sizes, though some minor adjustments may be required for optimal viewing on smaller devices.

Navigation Flow

The app’s navigation flow is primarily hierarchical, starting with a main menu screen. Users can navigate to different sections, such as accounts, payments, and investments, via clear and labeled icons or buttons. Subsequent screens are logically structured, allowing users to easily find the desired information or perform the required actions. However, some users may find the navigation slightly convoluted in a few areas, particularly when navigating between accounts and transactions. A more direct route for frequently used functions might improve efficiency.

Common User Pain Points

Several user pain points have been identified, primarily related to the app’s transaction history and account management features. Some users have reported difficulty filtering transaction records, leading to lengthy searches. Additionally, the process of updating account information, such as adding or removing beneficiaries, may be perceived as complex by some users. Finally, there are reported issues with the speed and reliability of the app, particularly during peak hours.

User Feedback

User feedback regarding the HSBC app is mixed. Positive comments highlight the app’s clean design and intuitive interface. However, negative feedback often centers around performance issues, slow loading times, and difficulties with certain features, like transferring funds between accounts. Some users have also suggested that the app could benefit from more detailed transaction descriptions.

Accessibility Features

The HSBC app incorporates several accessibility features to accommodate users with disabilities. These features include adjustable font sizes, high contrast modes, and voice-over navigation. However, further improvements are possible, such as incorporating screen reader compatibility for users with visual impairments. Additionally, users with limited mobility may benefit from more streamlined controls.

Screen Size Layouts

| Screen Size | Layout |

|---|---|

| Small (e.g., mobile phone) | A simplified layout with fewer options displayed on the initial screen, prioritizing key functions. Icons are larger and more prominent. |

| Medium (e.g., tablet) | A more comprehensive layout, showing more options and allowing for more detailed information to be presented simultaneously. |

| Large (e.g., desktop) | A full-screen layout, providing maximum information and options to the user. |

Usability Comparison with Competitors

Compared to competitor apps, the HSBC app demonstrates a generally good level of usability. While navigation and interface design are generally intuitive, competitors may offer more streamlined experiences for certain tasks, such as fund transfers or account aggregations. The app’s strengths lie in its comprehensive feature set, though this sometimes leads to a somewhat complex navigation structure.

App Performance

The HSBC app’s performance is crucial for user satisfaction and retention. This section details the app’s speed, responsiveness, stability under various network conditions, common issues, user reports, troubleshooting steps, and a breakdown of error messages. A smooth and reliable user experience is paramount for a positive user perception of the app.

The app’s performance is rigorously tested under various conditions, including different network speeds, device types, and transaction volumes. Real-world user feedback is analyzed to identify areas for improvement. Performance issues are tracked and addressed promptly.

Transaction Speed and Responsiveness

The HSBC app is designed to be fast and responsive during transactions. Average transaction completion times are typically under 10 seconds, depending on the complexity of the transaction and network conditions. Users should experience minimal delays during account access, fund transfers, and bill payments. Optimization efforts focus on minimizing loading times and ensuring a smooth user flow throughout the transaction process.

Stability Under Various Network Conditions

The app is built to maintain stability across different network environments. Extensive testing ensures reliable operation on various network types, including Wi-Fi, cellular data, and even limited connectivity scenarios. While network conditions can influence transaction speed, the app is designed to provide a consistent experience, displaying appropriate feedback and preventing crashes under various conditions. Users should experience minimal disruption even with fluctuating network strength.

Common Performance Issues

Common issues reported include slow loading times during account access, intermittent connection problems, and occasional transaction failures. These issues are often temporary and resolve themselves, or can be resolved through troubleshooting.

User Reports Regarding App Performance

User reports often cite slow loading times as a major concern, particularly during peak usage periods. Other reported issues include the app freezing or crashing, particularly during high-volume transactions or complex processes. Data analysis indicates that these occurrences are typically isolated incidents rather than widespread issues. A significant number of positive feedback reports highlight the app’s generally smooth and stable performance.

Troubleshooting Common App Performance Issues

Troubleshooting steps include checking network connectivity, ensuring sufficient device battery life, and clearing app cache and data. Restarting the device is often a quick fix for temporary issues. In more complex cases, contacting HSBC support is recommended.

Common App Error Messages and Potential Causes

| Error Message | Potential Cause |

|---|---|

| “Network connection lost” | Weak or unstable network signal, temporary network outage, or mobile data issues. |

| “Transaction failed” | Insufficient funds, invalid input data, temporary server issues, or issues with the target account. |

| “App not responding” | High resource usage, conflicting apps, device overheating, or outdated device software. |

| “App is crashing” | Software bugs, incompatibility with the current device operating system, or corrupted app files. |

| “Server error” | Temporary server overload, or technical issues with the HSBC server. |

Security & Fraud Prevention

The HSBC app prioritizes user security, implementing robust measures to safeguard sensitive financial data and prevent unauthorized access. This comprehensive approach ensures a secure and reliable platform for users to manage their accounts.

HSBC employs a multi-layered security architecture to protect user accounts, utilizing advanced encryption technologies and constant monitoring to mitigate potential threats. This proactive approach minimizes risks and ensures the safety of user information.

Security Measures to Protect User Data

HSBC employs various security measures to protect user data, including encryption, multi-factor authentication, and regular security audits. These methods work together to create a strong barrier against unauthorized access and fraudulent activity.

- Data Encryption: All sensitive data transmitted between the app and HSBC’s servers is encrypted using industry-standard protocols, like TLS/SSL. This prevents unauthorized interception of information during transit.

- Multi-Factor Authentication (MFA): Users are prompted for multiple verification steps (e.g., OTPs, biometric authentication) before accessing sensitive account information. This adds an extra layer of security beyond just a password.

- Regular Security Audits: HSBC conducts regular security audits to identify and address potential vulnerabilities in the app’s infrastructure and functionality. This proactive approach ensures the ongoing effectiveness of the security measures.

- Secure Code Development Practices: The app development process adheres to stringent security protocols, which are constantly reviewed and improved to address emerging threats. This safeguards the app’s code from vulnerabilities that malicious actors could exploit.

Account Safeguarding from Unauthorized Access

Robust account security measures are in place to prevent unauthorized access. These measures are designed to deter and detect potential threats, minimizing the risk of fraudulent activity.

- Strong Password Policies: Users are encouraged to create strong, unique passwords for their HSBC accounts. This practice helps prevent unauthorized access if a password is compromised.

- Suspicious Activity Monitoring: The app continuously monitors user activity for unusual patterns that could indicate unauthorized access attempts. This includes transaction amounts, frequency, and locations.

- Real-Time Fraud Detection System: An advanced fraud detection system flags potentially fraudulent transactions in real-time, minimizing the potential for financial losses.

Procedures for Reporting Suspicious Activities

Users are empowered to report suspicious activities to HSBC immediately. A clear reporting process ensures prompt investigation and resolution of potential issues.

- In-App Reporting Mechanism: The app provides a dedicated reporting mechanism for users to report suspicious activities. This includes details like transaction information and specific concerns.

- Customer Service Channels: Users can also report suspicious activities through various customer service channels, such as phone, email, or online chat. This allows for flexible reporting methods to meet user needs.

- Prompt Investigation: HSBC investigates all reported suspicious activities promptly, ensuring swift action to mitigate potential harm.

Account Recovery and Verification

In case of account loss or theft, a well-defined recovery process guides users through the necessary steps. A verified identity is crucial to ensure the account is returned to the rightful owner.

- Verification Process: The account recovery process involves multiple verification steps, such as providing supporting documents, answering security questions, or completing identity verification procedures.

- Customer Support Assistance: HSBC’s customer support team assists users throughout the account recovery process. This ensures a smooth and efficient recovery experience.

- Security Question & Answer System: The recovery process often relies on a security question and answer system to verify the user’s identity.

Summary of Security Features

| Security Feature | Description |

|---|---|

| Data Encryption | Sensitive data is encrypted during transmission. |

| Multi-Factor Authentication | Requires multiple verification steps for access. |

| Regular Security Audits | Proactive identification and resolution of vulnerabilities. |

| Secure Code Development | Adherence to stringent security protocols. |

| Suspicious Activity Monitoring | Real-time detection of unusual activity patterns. |

| Fraud Detection System | Flags potentially fraudulent transactions. |

| In-App Reporting | Dedicated mechanism for reporting suspicious activities. |

| Account Recovery | Well-defined process for recovering lost or stolen accounts. |

Customer Support

Ensuring a positive user experience hinges on readily available and effective customer support. This section details the various avenues for HSBC app users to reach out for assistance, evaluates the app’s built-in help resources, and examines user feedback to pinpoint areas for improvement in customer support processes.

Contacting HSBC Customer Support

The HSBC app provides multiple channels for users to connect with customer support. These channels ensure accessibility and cater to different user preferences.

- The app’s in-app help section offers a comprehensive library of FAQs and tutorials. This self-service option allows users to find answers to common queries without needing to contact a representative.

- Users can also reach out via phone to dedicated customer support agents. This method provides immediate assistance and is suitable for complex issues requiring personalized guidance.

- Email is another option for users to submit inquiries. This channel allows for detailed explanations and documentation of the problem, making it effective for issues that require more context.

- A dedicated chat function on the app facilitates instant communication with support agents. This option is particularly useful for time-sensitive queries or issues requiring immediate resolution.

App Help Section Effectiveness

The HSBC app’s built-in help section is designed to be a primary resource for users. Its effectiveness is judged by its comprehensiveness, ease of navigation, and the clarity of information presented. Users can search for specific topics or browse through categories to find answers quickly. The section should contain clear and concise explanations of common app functionalities, error messages, and troubleshooting steps.

User Feedback on Customer Support

User feedback on HSBC app customer support is generally positive, highlighting the quick response times and helpfulness of support agents. Many users appreciate the availability of multiple contact methods. However, some users have reported instances where their inquiries were not resolved efficiently, or that the information provided in the help section was not entirely satisfactory for their needs. These insights suggest areas for improvement in the support system, such as refining the app’s help section to address a wider range of queries.

Areas for Improvement in Customer Support

Based on user feedback and internal data, certain areas can be targeted for improvement in HSBC app customer support. These areas include enhancing the app’s help section by incorporating more detailed tutorials, addressing specific user pain points, and streamlining the resolution process for more complex issues. Additionally, actively soliciting user feedback through surveys and feedback forms can offer valuable insights into areas needing attention.

Response Time of Customer Support Inquiries

The response time for customer support inquiries varies depending on the complexity of the issue and the chosen communication channel. Generally, the response time for basic inquiries through the app’s help section or chat function is swift, often within a few minutes. More complex issues may require a slightly longer response time, typically within 24 hours. Real-world examples demonstrate that the response time aligns with industry benchmarks for similar financial applications.

Available Customer Support Channels

| Channel | Description |

|---|---|

| In-App Help | Comprehensive FAQs, tutorials, and troubleshooting steps within the app. |

| Phone | Direct contact with support agents for personalized assistance. |

| Detailed explanations and documentation of the issue. | |

| Chat | Instant communication with support agents for time-sensitive queries. |

Mobile Device Compatibility

The HSBC app prioritizes seamless access across a range of mobile devices. This ensures customers can manage their finances efficiently, regardless of their preferred platform or device. Compatibility is a critical aspect of user experience, impacting both initial adoption and long-term satisfaction.

Supported Operating Systems

The HSBC app is optimized for both iOS and Android devices, offering a consistent user experience across platforms. This ensures customers can access their accounts and perform transactions with ease, regardless of the mobile operating system they use. Support for both iOS and Android devices demonstrates the app’s commitment to a broad customer base.

Minimum Hardware Requirements

To ensure smooth performance, the HSBC app requires a minimum level of hardware capability. This encompasses processor speed, RAM capacity, and storage space, ensuring the app functions correctly and without undue delays. The precise specifications are readily available on the app’s download page.

Performance Comparison Across Devices

App performance varies based on device specifications. High-end devices generally offer a smoother and faster experience. Lower-end devices may experience slightly longer loading times and potentially reduced responsiveness. Optimization techniques are employed to mitigate performance discrepancies across devices.

User-Reported Compatibility Issues

While the HSBC app is designed for broad compatibility, some users have reported minor compatibility issues. These typically involve specific device models or operating system versions. The support team is actively monitoring and addressing such reports, ensuring a high level of functionality for all users.

Optimization for Different Screen Sizes and Resolutions

The app’s design adapts to various screen sizes and resolutions. This dynamic responsiveness ensures that the app interface remains clear and intuitive, regardless of the user’s device. The app employs responsive design principles, adjusting layouts and elements to fit different screen sizes.

Performance Comparison Table

| Device | Operating System | Processor | RAM (GB) | Screen Size | Performance Rating |

|---|---|---|---|---|---|

| iPhone 14 Pro Max | iOS 17 | A16 Bionic | 6 | 6.7 inches | Excellent |

| Samsung Galaxy S23 Ultra | Android 14 | Qualcomm Snapdragon 8 Gen 2 | 12 | 6.8 inches | Excellent |

| Google Pixel 7 | Android 14 | Google Tensor G2 | 8 | 6.3 inches | Good |

| Motorola Edge 30 | Android 13 | Snapdragon 778G+ | 6 | 6.7 inches | Fair |

Final Review

In conclusion, the HSBC app offers a comprehensive suite of banking services, but its usability and performance vary depending on individual needs and preferences. While the app excels in certain areas, areas for improvement exist in user experience and customer support. Ultimately, users should weigh the app’s strengths against their specific financial goals and priorities to determine its suitability.