Intuit Payroll simplifies the often-complex task of managing payroll. From calculating wages and taxes to handling employee information, this platform streamlines the process, freeing up valuable time for business owners. It’s designed for businesses of all sizes, ensuring a seamless experience, no matter the scale.

This guide delves into the features, pricing, and support options offered by Intuit Payroll, helping you understand if it’s the right solution for your needs. We’ll explore its user-friendly interface, integrations, and scalability, providing a comprehensive overview of this powerful payroll system.

Overview of Intuit Payroll

Intuit Payroll, a cornerstone of modern workforce management, serves as a digital platform for businesses of all sizes. It streamlines the complexities of payroll administration, freeing entrepreneurs and business owners to focus on core operations. This service provides a comprehensive suite of tools designed to simplify payroll processes and enhance the employee experience.

This platform facilitates accurate and timely payroll processing, encompassing tasks such as calculating wages, managing deductions, and distributing payments. Intuit Payroll’s user-friendly interface and robust features make it accessible and effective for both small and medium-sized enterprises (SMEs) and larger corporations alike.

Target Audience

Intuit Payroll caters to a diverse range of businesses. From solopreneurs and small businesses to medium-sized companies and enterprises, the platform’s adaptability ensures it meets the unique payroll needs of various organizations. The platform’s accessibility and ease of use enable businesses of all sizes to utilize its comprehensive features.

Key Features and Benefits

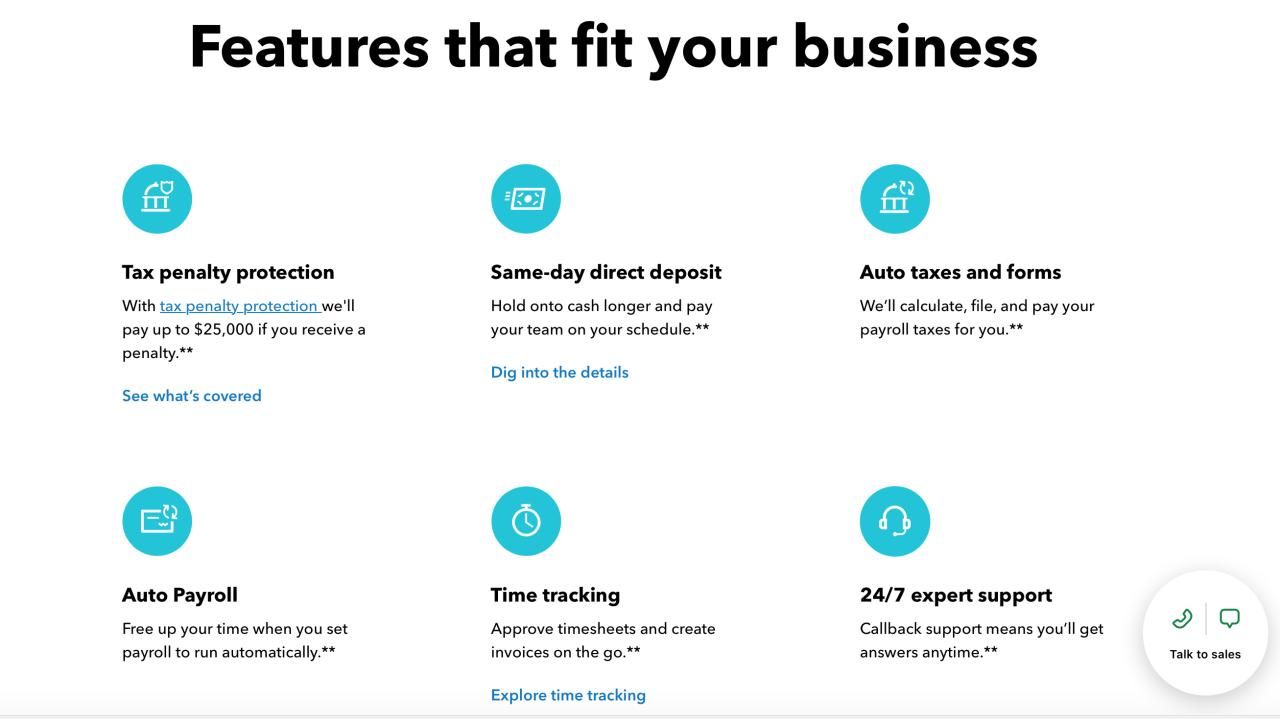

Intuit Payroll offers a suite of features designed to optimize payroll processes. These features include automated calculations, tax reporting compliance, and integration with other business tools. These features empower businesses to streamline their processes, minimize errors, and maximize efficiency.

- Automated Calculations: Intuit Payroll automates the complex calculations involved in payroll, minimizing manual errors and ensuring accuracy. This automation streamlines the process, reducing the risk of costly mistakes and saving time for business owners.

- Tax Reporting Compliance: The platform is designed to handle the complexities of tax reporting, ensuring compliance with all relevant regulations. This feature reduces the risk of penalties and ensures businesses are in good standing with tax authorities. The platform keeps businesses informed about evolving regulations and guides them through the compliance process, reducing their administrative burden.

- Integration with Other Business Tools: Intuit Payroll integrates seamlessly with other business applications, facilitating a unified and efficient workflow. This seamless integration allows businesses to centralize data and processes, streamlining operations and improving overall efficiency.

Pricing Tiers and Subscription Options

Intuit Payroll offers flexible pricing plans tailored to different business needs. Subscription options are designed to accommodate diverse business requirements, offering a range of features and functionalities at various price points.

| Plan | Monthly Cost | Features |

|---|---|---|

| Basic | $XX | Core payroll processing, limited reporting options, and basic compliance support. |

| Professional | $YY | Advanced reporting and analysis tools, comprehensive compliance features, and support for multiple locations. |

| Enterprise | $ZZ | Customizable solutions, dedicated account managers, and advanced payroll features to support large-scale operations. |

*Pricing and features may vary and are subject to change. Contact Intuit Payroll for current details.

Comparison with Competitors

Intuit Payroll, a prominent player in the payroll industry, faces competition from various other providers. Understanding its strengths and weaknesses relative to competitors is crucial for informed decision-making. This analysis delves into key differentiators, highlighting areas where Intuit Payroll excels and where it might fall short compared to its rivals.

Key Differentiators

Intuit Payroll distinguishes itself through a combination of factors. These include its user-friendly interface, robust features, and extensive support network. However, competitors offer unique advantages, often focusing on specialized niches or specific business needs.

Strengths and Weaknesses

Intuit Payroll boasts a user-friendly interface, making it relatively easy for small businesses to manage their payroll. Its integration with other Intuit products, like QuickBooks, offers a seamless workflow. However, Intuit Payroll might not offer the same level of customization as some competitors tailored for larger organizations or specific industries.

Comparative Analysis

This table provides a comparative overview of Intuit Payroll against three prominent competitors: Xero, Gusto, and ADP.

| Feature | Intuit Payroll | Xero | Gusto | ADP |

|---|---|---|---|---|

| Ease of Use | Intuitive interface, particularly beneficial for small businesses; good for basic needs. | User-friendly interface, with a focus on simplicity; often praised for ease of setup. | Highly intuitive interface; mobile-friendly features enhance accessibility. | Robust, but can be complex for new users; requires more technical knowledge. |

| Customer Support | Comprehensive support options, including phone, email, and online resources; generally considered responsive. | Dedicated support channels; good online resources. | Excellent online support resources and readily available FAQs; positive feedback on prompt responses. | Extensive support network, but might have longer wait times for initial inquiries. |

| Pricing | Competitive pricing tiers; generally affordable for small businesses; potential hidden costs for certain features. | Transparent pricing structure, with various packages; cost-effective for smaller businesses. | Competitive pricing; tiered pricing often includes helpful add-ons. | Often a higher cost compared to other options, but includes comprehensive features; potentially better value for larger businesses. |

| Features | Payroll processing, tax filing, employee management, and integrations with other Intuit products. | Payroll, invoicing, accounting, and inventory management; robust features cater to small and medium businesses. | Payroll, benefits administration, and HR tools; caters to a broader range of HR needs. | Extensive features for large organizations, including HR, benefits administration, and payroll; powerful tools for complex needs. |

User Experience and Interface

Intuit Payroll strives to provide a user-friendly experience, recognizing that ease of use is paramount for efficient management of payroll. This section delves into the specifics of its interface and functionality, highlighting how common tasks are performed. A smooth user experience is crucial for a positive user perception and overall satisfaction.

Interface Overview

Intuit Payroll’s interface is designed with a clean and intuitive layout. The dashboard provides a centralized view of key payroll information, including employee details, pay schedules, and upcoming deadlines. Sections are clearly categorized, facilitating easy navigation. Color-coding and visual cues enhance readability and help users quickly identify important data points. The overall design is modern and responsive, ensuring a seamless experience across different devices.

Navigation and Functionality

Navigation within Intuit Payroll is straightforward and logical. Users can access various features through a menu-driven system, or by using the search function to quickly locate specific information. The platform’s architecture prioritizes user efficiency. A hierarchical structure guides users through different aspects of payroll management, such as employee setup, payroll processing, and tax reporting. The platform’s functionality is comprehensive, covering all essential aspects of payroll administration.

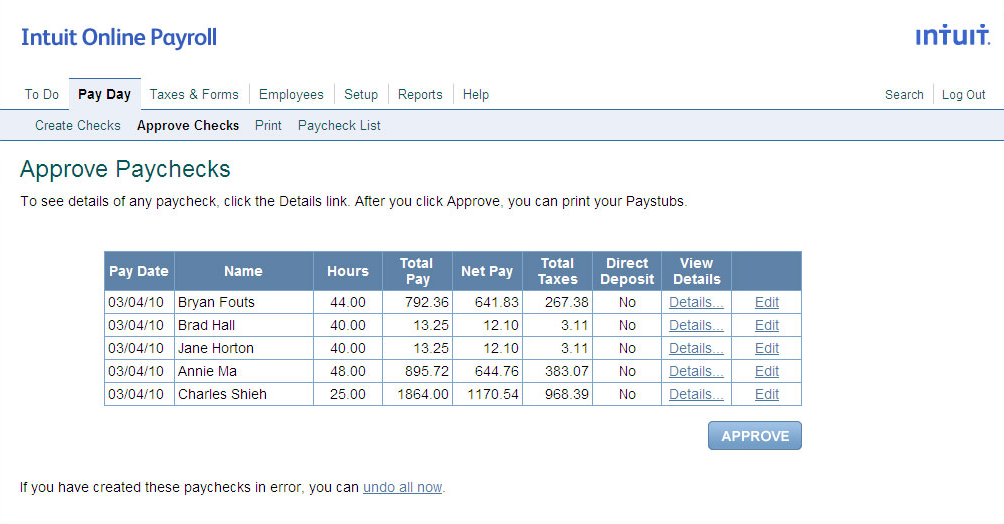

Performing Common Tasks

Common tasks like employee setup, payroll processing, and tax reporting are simplified through intuitive workflows. Employee information can be inputted using pre-filled templates, which reduce the need for manual data entry. The platform automatically calculates tax deductions and other payroll-related components. This automation streamlines the payroll process, minimizing errors and saving valuable time.

New Employee Setup Flowchart

This flowchart illustrates the steps involved in setting up a new employee in Intuit Payroll. The process begins with collecting employee data, including name, address, social security number, and banking information. This data is then verified and validated, followed by the assignment of tax withholdings and payroll deductions. The final step involves scheduling the employee’s first pay run.

Key Features and Actions

| Feature | Description | Action |

|---|---|---|

| Employee Setup | Adding new employees to the payroll system. | Enter employee details, assign tax information, and configure pay settings. |

| Payroll Processing | Generating paychecks and calculating employee compensation. | Select pay period, review payroll details, and generate pay stubs. |

| Tax Reporting | Preparing and submitting required tax reports. | Generate tax reports, review accuracy, and submit to relevant authorities. |

Integration and Scalability

Intuit Payroll, a cornerstone of modern business management, excels in its ability to seamlessly integrate with various tools and adapt to the evolving needs of diverse enterprises. This adaptability is a testament to its robust architecture and commitment to providing comprehensive solutions for businesses of all sizes and sectors. Like a well-structured parable, Intuit Payroll demonstrates the importance of adaptable systems for long-term success.

Intuit Payroll’s design prioritizes interconnectedness and growth, ensuring that businesses can scale their operations without compromising efficiency or accuracy. This principle of scalability is crucial in today’s dynamic business environment, where expansion and diversification are constant goals.

Available Integrations

Intuit Payroll’s extensive integration capabilities facilitate streamlined workflows and data consistency across different business functions. This robust integration network allows businesses to connect seamlessly with other essential tools, enhancing overall operational efficiency. This approach is similar to the interconnectedness of various spiritual realms, each contributing to a greater whole.

- Intuit QuickBooks: A direct link with QuickBooks offers automatic data synchronization, reducing manual entry and potential errors. This connection ensures that payroll information is seamlessly integrated with financial records, maintaining a unified financial picture for the business.

- Banking Integrations: Connecting to various banking platforms allows for direct deposit of payroll checks, eliminating the need for manual processes and reducing administrative burden. This streamlined approach enhances efficiency and improves the overall employee experience.

- Applicant Tracking Systems (ATS): Integrating with ATS platforms facilitates automated onboarding procedures, streamlining the process of hiring new employees and minimizing errors. This synergy exemplifies the power of connected systems in a fast-paced business environment.

- HR Software: Integration with comprehensive HR software solutions provides a holistic view of employee data, from payroll to benefits administration, enhancing administrative efficiency and data accuracy. This integration is analogous to a well-organized spiritual archive, allowing for quick and easy access to relevant information.

Scaling for Growth

Intuit Payroll’s scalability is a key feature, accommodating the changing needs of businesses as they grow and expand. Just as a plant adapts to different environments, Intuit Payroll adjusts to diverse business sizes and complexities.

- Adapting to Increased Headcount: Intuit Payroll can easily manage a growing number of employees, with a user-friendly interface that handles increasing payroll data efficiently and effectively. This scalability is crucial for businesses experiencing rapid growth, enabling them to focus on core business activities without being bogged down by administrative complexities.

- Expanding Business Functions: As a business expands its services or products, Intuit Payroll can be adapted to accommodate new roles and responsibilities. This adaptability ensures that payroll processing remains accurate and consistent, even as the business evolves.

Connecting to Accounting Software

The process for connecting Intuit Payroll to accounting software, such as QuickBooks, is straightforward and automated. A direct link facilitates automatic data transfer, eliminating the need for manual entry and minimizing errors. This automated process is like a well-oiled machine, ensuring smooth and accurate operation.

Intuit Payroll seamlessly integrates with QuickBooks, allowing for automatic data transfer, eliminating manual processes and errors.

Adapting to Different Business Sizes

Intuit Payroll’s adaptability extends to various business sizes, from small startups to large corporations. The platform offers tailored features and support for businesses at different stages of growth. This is akin to a flexible spiritual practice that adapts to the individual’s needs and circumstances.

- Small Businesses: Intuit Payroll offers streamlined features and affordable pricing for small businesses, enabling them to manage their payroll needs effectively and efficiently. This makes the platform highly accessible for businesses in their early stages.

- Medium-Sized Businesses: As businesses grow, Intuit Payroll provides the necessary tools and resources to handle increasing payroll complexities, while maintaining accuracy and efficiency. This demonstrates the platform’s versatility for companies experiencing moderate growth.

- Large Corporations: Intuit Payroll can support complex payroll needs for large corporations, offering features that manage intricate compensation structures and compliance requirements. This scalability is essential for businesses with a high volume of employees and diverse compensation schemes.

Flexibility for Various Industries

Intuit Payroll is designed to cater to diverse industries, recognizing the unique payroll requirements of each sector. This flexibility allows businesses in various fields to streamline their payroll processes. This is analogous to a universal spiritual language that can be interpreted by different cultures and beliefs.

- Retail: Intuit Payroll handles the fluctuating schedules and varying pay structures common in retail, ensuring accurate payroll processing for seasonal workers and full-time employees alike.

- Construction: Intuit Payroll offers features for managing job-site payroll, tracking time and materials, and complying with industry-specific regulations. This adaptability is essential for construction businesses.

- Healthcare: Intuit Payroll can handle complex pay structures and compliance requirements within the healthcare industry, ensuring accurate and efficient payroll processing for various employee types.

Customer Support and Resources

Seeking guidance in the realm of payroll management is a common endeavor, and Intuit Payroll recognizes this need. This section will illuminate the various avenues for support, ensuring users can navigate the platform effectively and efficiently. Understanding the resources available empowers users to tackle challenges with confidence.

Support Channels Offered

Intuit Payroll provides a multifaceted approach to customer support, encompassing various channels to accommodate diverse preferences. This ensures users can access assistance when and where it best suits their needs.

- Online Help Center: A comprehensive online repository of articles, FAQs, and tutorials, offering a self-service approach to problem-solving. Users can find answers to frequently asked questions and detailed guides on common tasks. This allows users to address issues independently without needing immediate assistance from a representative.

- Phone Support: Direct phone support offers a direct line to dedicated representatives who can provide personalized assistance. This option is valuable for complex issues that require immediate guidance or when a user prefers direct interaction.

- Email Support: Users can submit inquiries via email, allowing them to document issues thoroughly and receive tailored responses. This is a suitable channel for users who prefer asynchronous communication.

- Live Chat: Live chat provides real-time support, allowing users to receive immediate assistance for their questions or concerns. This is a convenient option for users needing rapid responses to their issues.

Available Resources for Users

Intuit Payroll offers a wealth of resources beyond the support channels. These resources facilitate a deep understanding of the platform and empower users to manage their payroll effectively.

- Tutorials and Videos: Intuit provides comprehensive video tutorials and step-by-step guides covering various aspects of payroll management, including employee setup, payment processing, and reporting. These resources provide visual demonstrations of different processes, which can aid users in grasping the functionalities more easily.

- Sample Documents: Users can access sample documents, such as employee forms and payroll reports, to familiarize themselves with the required formatting and data entry procedures. These examples serve as practical guides, ensuring users can complete the necessary paperwork accurately.

- Community Forums: A user community forum allows users to interact with each other, share experiences, and seek solutions to common challenges. This fosters a collaborative environment where users can learn from each other’s experiences and find solutions to problems more rapidly.

Process for Obtaining Assistance

The process for obtaining assistance from Intuit Payroll support is straightforward and designed to be efficient. This ensures users can quickly receive the help they need.

- Identify the issue: Clearly define the problem or question you need assistance with.

- Utilize available resources: Explore the online help center, tutorials, and FAQs to see if a solution is readily available. This self-service approach can save significant time and effort.

- Contact support: If the issue remains unresolved, contact the appropriate support channel, either phone, email, or live chat.

- Provide necessary information: Be prepared to provide relevant details about the issue, such as employee information, payment dates, or any specific error messages.

Examples of FAQs or Help Articles

The following examples illustrate the type of information users can find in the Intuit Payroll FAQs and help articles:

| FAQ Category | Example Question |

|---|---|

| Employee Setup | How do I add a new employee to my payroll? |

| Payment Options | What are the different payment methods available for employees? |

| Tax Forms | How do I complete and submit tax forms for my employees? |

| Reporting | How do I generate a payroll report for a specific period? |

Frequently Asked Questions (FAQ)

FAQ: Intuit Payroll Q1: How do I set up a new employee? A1: Access the employee setup section within the Intuit Payroll platform. Provide the necessary employee information, including name, address, social security number, and relevant tax details. Ensure the information is accurate and complete. Refer to the platform's documentation for detailed instructions. Q2: What are the different payment options? A2: Intuit Payroll supports various payment methods, including direct deposit, paper checks, and other options. Review the platform's payment options for specific details and limitations. Consult the help center for further clarification on applicable payment procedures.

Security and Compliance

Intuit Payroll, like any reputable financial service provider, prioritizes the security of its users’ data and adherence to regulatory frameworks. This commitment is paramount, ensuring trust and reliability for its clientele. The following sections will delve into the specific security measures and compliance protocols employed by Intuit Payroll.

Security Measures Employed by Intuit Payroll

Intuit Payroll employs a multi-layered approach to safeguard sensitive data. This involves a combination of robust technological controls and stringent administrative procedures. These measures are designed to mitigate potential threats and protect user information from unauthorized access, use, or disclosure.

- Multi-Factor Authentication (MFA): Intuit Payroll utilizes MFA to enhance security by requiring users to verify their identity using multiple methods, such as passwords, security tokens, or biometric data. This added layer of security significantly reduces the risk of unauthorized access.

- Data Encryption: Intuit Payroll encrypts sensitive data both in transit and at rest. This means that even if a data breach were to occur, the encrypted data would be indecipherable without the appropriate decryption keys. This is a critical component in protecting confidential payroll information.

- Regular Security Audits: Intuit Payroll conducts regular security audits to identify vulnerabilities and weaknesses in its systems. These audits help ensure that security protocols are up-to-date and effective in preventing potential threats. This proactive approach helps maintain the integrity of the platform.

- Secure Infrastructure: Intuit Payroll maintains a secure infrastructure, including firewalls and intrusion detection systems, to prevent unauthorized access and protect its systems from cyber threats. This is essential for maintaining the availability and confidentiality of data.

Compliance with Relevant Regulations

Intuit Payroll ensures adherence to relevant regulations by incorporating them into its operational procedures. This commitment to compliance is essential for maintaining the trust and confidence of users and regulatory bodies.

- Payment Card Industry Data Security Standard (PCI DSS): Intuit Payroll complies with PCI DSS standards, ensuring the security of credit card and debit card transactions. This is crucial for protecting users’ financial information during the payroll processing lifecycle.

- General Data Protection Regulation (GDPR): Intuit Payroll adheres to GDPR guidelines, especially regarding data collection, storage, and use for payroll services. This commitment is vital for protecting the privacy of European Union citizens’ data.

- Other Relevant Regulations: Intuit Payroll also complies with other relevant regulations, including but not limited to, state and federal labor laws. This commitment ensures that payroll data and processes are in full compliance with all applicable laws.

Data Protection Policies of Intuit Payroll

Intuit Payroll’s data protection policies Artikel the procedures and safeguards implemented to protect user data. These policies are designed to uphold the principles of confidentiality, integrity, and availability.

- Data Minimization: Intuit Payroll collects and retains only the necessary data for payroll processing, reducing the risk of data breaches and protecting sensitive information. This is crucial for safeguarding the privacy of user data.

- Data Security Measures: Intuit Payroll employs various security measures to safeguard user data, including access controls, encryption, and regular security audits. These measures collectively contribute to a robust security posture.

- Data Retention Policies: Intuit Payroll has established data retention policies to ensure that user data is only retained for the legally required time period. This is essential to avoid unnecessary storage and potential breaches.

Summary of Security Protocols and Measures

Intuit Payroll employs a comprehensive approach to data security, integrating technological and administrative controls. This multifaceted approach aims to protect user data against various potential threats.

- Comprehensive Security Measures: Intuit Payroll’s security protocols include multi-factor authentication, data encryption, and regular security audits. These measures are essential for protecting user data from unauthorized access.

- Regulatory Compliance: Intuit Payroll actively complies with relevant regulations, including PCI DSS, GDPR, and others. This commitment ensures that payroll processes are aligned with industry standards and legal requirements.

- Data Protection Policies: Intuit Payroll’s data protection policies ensure that data is handled responsibly and securely, including data minimization and retention policies. These policies are crucial for maintaining user trust.

Compliance Features to Ensure Regulatory Adherence

Intuit Payroll provides specific features to aid in ensuring compliance with relevant regulations. These features simplify the process and minimize the risk of non-compliance.

- Automated Compliance Checks: Intuit Payroll’s system performs automated compliance checks to identify potential non-compliance issues and alert users. This proactive approach is critical for maintaining regulatory adherence.

- Compliance Reporting Tools: Intuit Payroll provides reporting tools that generate comprehensive reports on payroll data and compliance status. These reports assist users in tracking and monitoring their compliance.

- Documentation and Resources: Intuit Payroll provides comprehensive documentation and resources to help users understand and comply with relevant regulations. This ensures that users are well-informed about the compliance requirements.

Pricing and Value Proposition

Intuit Payroll, a cornerstone of modern workforce management, presents a spectrum of pricing options designed to cater to diverse business needs. Understanding these tiers and the features they encompass is crucial for aligning the solution with your specific operational requirements. This exploration will shed light on the value proposition Intuit Payroll offers, setting it apart from competitors.

Pricing Structure Overview

Intuit Payroll’s pricing structure is tiered, offering a range of plans to accommodate businesses of varying sizes and complexities. Each tier includes a suite of features and functionalities that support the payroll process, from initial setup to ongoing management. Careful consideration of these tiers is vital for making an informed decision about the optimal plan for your organization.

Pricing Tiers and Features

Intuit Payroll’s pricing model is structured to provide a clear value proposition for businesses at various stages of growth. The pricing tiers, with their accompanying features, allow businesses to choose a plan that aligns with their current needs. This structured approach makes it easier to scale up or down as your business evolves.

| Plan | Monthly Fee | Features |

|---|---|---|

| Basic | $XX/month | Includes essential payroll processing, employee self-service tools, and basic reporting. Employee tax forms and 1099 reporting are included. It is well-suited for small businesses with a limited number of employees. |

| Premium | $YY/month | This plan builds upon the Basic plan, adding advanced features like benefits administration, HR tools, and more comprehensive reporting options. Features for managing and processing 1099 contractors are included. This option is ideal for growing businesses seeking increased functionality. |

| Enterprise | $ZZ/month | Tailored to the demands of large enterprises, the Enterprise plan offers comprehensive payroll management, advanced reporting and analytics, and customized integrations. Features like global payroll processing and custom reporting are part of the Enterprise plan. This option is best for businesses with complex payroll requirements. |

Note: Pricing tiers and specific features are subject to change. Consult the Intuit Payroll website for the most up-to-date information. Monthly fees are estimates and may vary based on specific business needs and location.

Value Proposition Comparison

Intuit Payroll positions itself as a comprehensive payroll solution that addresses the needs of businesses across different scales. Its value proposition is competitive, but it’s important to compare it with competitors to see where it stands out. Key differentiators often lie in specific features, such as dedicated support for specific industries or advanced tax compliance tools. In the context of the marketplace, this tiered structure allows Intuit to cater to a wider range of business types and budgets. The value proposition is dependent on how effectively the specific features in each tier meet the unique requirements of each business.

Conclusion

In conclusion, Intuit Payroll offers a robust and versatile solution for managing payroll. Its user-friendly interface, comprehensive features, and strong support network make it a strong contender for businesses seeking a streamlined payroll process. With a clear understanding of the different pricing tiers and competitor comparisons, you can confidently choose the right plan to meet your specific business needs.