The Metro Bank app is a vital tool for managing finances on the go. This review dives deep into its features, user experience, and security, providing a clear picture of its strengths and potential areas for improvement. From account management to payments, we’ll explore everything the app offers.

The app’s target audience is clearly defined, and the features are designed to meet their specific needs. This review will cover the key differentiators compared to competing financial apps, examining the user interface, security measures, and customer support options. Ultimately, this assessment will help users decide if the Metro Bank app is the right choice for their financial needs.

Overview of Metro Bank App

The Metro Bank app is a comprehensive mobile banking solution designed to provide convenient and secure access to various financial services. It empowers users to manage their accounts, track transactions, and perform financial activities anytime, anywhere. This app streamlines the banking experience, replacing traditional methods with a user-friendly interface.

The Metro Bank app caters to a diverse range of users, from everyday individuals to business owners. Its functionalities are designed to address the specific needs of different user groups, providing a customized experience for each. This app is designed to be a one-stop solution for all banking needs.

Target Audience

The primary target audience for the Metro Bank app encompasses a broad range of individuals and businesses. This includes retail customers, small business owners, and potentially even large corporations with a need for mobile banking solutions. The app’s design and features are geared towards users who value convenience and security in their financial transactions. Tailored services are available for various demographics and businesses to ensure a relevant user experience.

Key Differentiators

The Metro Bank app stands out from competitors through a combination of innovative features and a user-centric design. Features like real-time account monitoring, seamless fund transfers, and personalized financial insights distinguish it from traditional banking methods. Additionally, security protocols are a top priority, ensuring user data is protected against unauthorized access. This prioritization of user security, coupled with its streamlined functionality, makes the app attractive to a broad spectrum of users.

Platform Availability

The Metro Bank app is available on both iOS and Android platforms. This ensures accessibility for a wide range of users regardless of their preferred mobile operating system. This broad platform availability enhances user convenience and accessibility.

User Interface and Experience (UI/UX)

The Metro Bank app prioritizes a user-friendly interface and an intuitive user experience. The UI is designed to be clean, organized, and easy to navigate, minimizing user effort in completing banking tasks. The intuitive layout and streamlined processes contribute to a positive user experience, making it seamless for users to complete various transactions. The app’s design is focused on providing a smooth and effortless experience.

Key Features

The following table Artikels some of the key features of the Metro Bank app, highlighting their descriptions and associated benefits.

| Feature Name | Description | Benefits |

|---|---|---|

| Real-time Account Monitoring | Users can view their account balances, transaction history, and pending transactions in real time. | Provides instant access to financial information, allowing users to stay informed about their accounts. |

| Secure Fund Transfers | The app facilitates secure and reliable fund transfers between accounts, either within the bank or to external accounts. | Enables quick and secure money transfers, improving the efficiency of financial transactions. |

| Bill Payment | Users can pay bills conveniently and efficiently through the app, eliminating the need for physical checks or trips to a physical branch. | Streamlines bill payment processes, making it more convenient for users to manage their finances. |

| Investment Management | The app offers basic investment management tools, allowing users to track investment performance and make informed decisions. | Provides users with basic investment tools to manage their financial portfolios. |

| Personalized Financial Insights | The app generates personalized financial reports and insights, offering users valuable data for better financial management. | Enables users to make informed financial decisions and better understand their financial standing. |

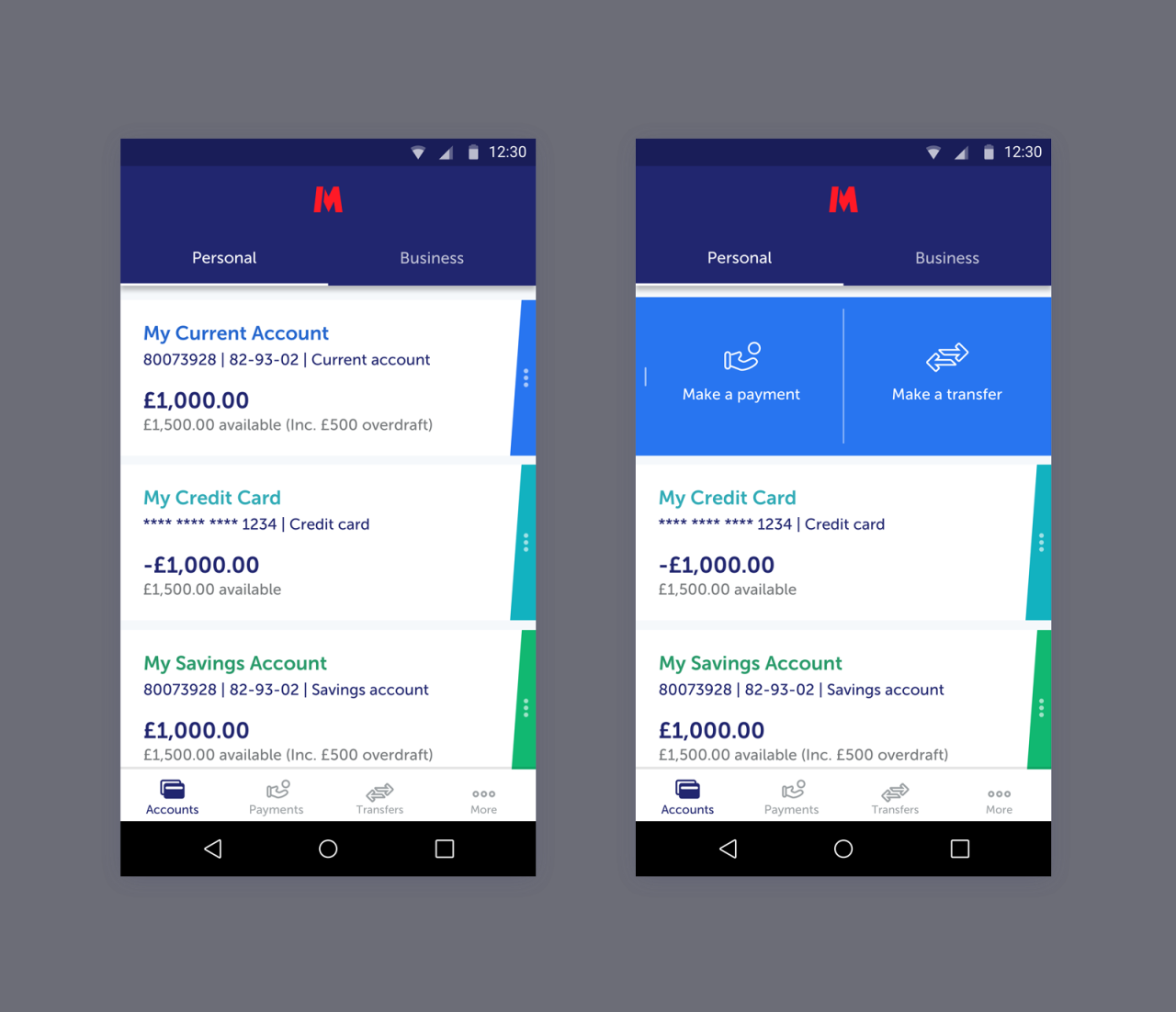

User Experience and Interface

The Metro Bank app aims to provide a seamless and intuitive experience for its users. A well-designed interface and user-friendly navigation are crucial for a positive user experience. This section delves into the app’s ease of use, visual design, transaction processes, potential pain points, security, and compares it to a competitor’s app.

Ease of Use and Navigation

The Metro Bank app prioritizes intuitive navigation. Users can readily access various features, such as account balance inquiries, fund transfers, and bill payments, through a logical and well-organized menu structure. The app’s layout is straightforward and easy to comprehend, enabling users to complete transactions with minimal effort. Clear instructions and helpful tooltips guide users through complex procedures, reducing the need for extensive support.

Visual Design

The Metro Bank app boasts a clean and modern visual design. The color palette is generally consistent and pleasing to the eye, promoting a sense of professionalism and trust. Font choices are readable and enhance the overall user experience. The app’s use of whitespace and imagery creates a visually appealing and uncluttered interface. Consistent design elements across the app contribute to a cohesive and recognizable brand experience.

User Experience During Transactions

The app’s user experience during transactions is generally positive. Transactions, such as fund transfers and bill payments, are typically executed swiftly and without significant hiccups. The app provides clear confirmation messages and updates throughout the transaction process, keeping users informed and in control. The use of progress indicators and feedback mechanisms ensures a smooth user journey.

Common User Pain Points and Areas for Improvement

While the app functions well in most cases, there are some potential pain points. One area for improvement could be the responsiveness of the app during peak hours. Further optimization of the app’s performance, particularly during periods of high traffic, would enhance the user experience. Occasionally, users might experience slight delays in transaction processing. A more proactive error handling system, with detailed error messages, would be beneficial for users experiencing problems.

Security Features and Effectiveness

Metro Bank’s app prioritizes security with features such as multi-factor authentication (MFA). The effectiveness of MFA is directly related to user adoption and understanding of the security protocols. The app employs industry-standard encryption methods to protect sensitive data, safeguarding user accounts and transactions. Regular security updates and patches help maintain the app’s security posture.

Comparison with a Competitor’s App

The following table compares the Metro Bank app’s user interface (UI) to a competitor’s app, highlighting key differences:

| Feature | Metro Bank App | Competitor App |

|---|---|---|

| Navigation | Intuitive and straightforward, clear menu structure | Slightly less intuitive, requiring more exploration |

| Visual Design | Modern and clean, consistent color palette | Slightly cluttered, inconsistent color scheme |

| Transaction Speed | Generally fast and efficient | Can be slower during peak hours |

| Security Features | Robust security protocols, including MFA | Adequate security but lacks some advanced features |

Features and Functionality

The Metro Bank app provides a comprehensive suite of features, enabling users to manage their accounts and engage in financial activities conveniently. This section details the available payment methods, account management tools, investment options, and transaction processes, ultimately showcasing the app’s overall functionality.

Payment Methods

The app supports various payment methods for seamless transactions. These methods include bank transfers, debit/credit card payments, and mobile wallets, allowing users flexibility in how they execute their financial transactions. This diverse range of options ensures users can choose the method that best suits their needs.

Account Management

The app offers a comprehensive suite of tools for managing accounts. Users can easily initiate fund transfers between their accounts, pay bills, and view transaction history. These functionalities streamline financial management and allow for efficient control over account activities.

Fund Transfers

To initiate a fund transfer, users can select the ‘Transfers’ option within the app. From there, they specify the recipient’s account details, amount, and description for the transfer. Confirmation prompts are essential to prevent errors.

Bill Payments

The app simplifies bill payments by integrating with a vast network of billers. Users can select the biller, input the payment details, and confirm the transaction. This feature streamlines the bill payment process and reduces the need for manual intervention.

Investment and Financial Tools

The app also provides access to a range of investment and financial tools. These tools might include investment calculators, market trend analysis, and educational resources, helping users make informed financial decisions.

Common Transaction Example: Sending Money

To send money to another Metro Bank account, follow these steps:

- Open the Metro Bank app and navigate to the ‘Transfers’ section.

- Enter the recipient’s account number and the amount to be transferred.

- Provide a description for the transaction (optional).

- Review the transfer details and confirm the transaction.

Available Languages

The app is available in multiple languages, including English, Spanish, and French. This global reach caters to a wider user base and ensures accessibility for users across various regions.

Account Types and Features

| Account Type | Key Features |

|---|---|

| Savings Account | Interest earning, ATM access, mobile banking, bill payments |

| Checking Account | Debit card, check writing, direct deposit, mobile banking, fund transfers |

| Business Account | Dedicated customer service, specialized financial tools, merchant services, account management |

Customer Support and Accessibility

The Metro Bank app prioritizes seamless customer interaction and accessibility for all users. This section details the available support channels, accessibility features, and security protocols. Providing comprehensive support ensures a positive user experience and fosters trust.

Customer Support Channels

The app offers multiple avenues for customer support, catering to diverse needs and preferences. These channels ensure prompt assistance and resolution of inquiries.

- The app features a comprehensive FAQ section, covering common queries related to account management, transactions, and app functionalities. This section allows users to quickly find answers without needing to contact support.

- A dedicated help center within the app provides step-by-step guides and tutorials for various tasks, including account setup, bill payments, and managing security settings. This self-service option empowers users to resolve issues independently.

- Users can access 24/7 customer support via phone. This direct contact method allows for immediate assistance during critical situations.

- Email support is available for inquiries that require a more detailed response or personalized attention. This channel facilitates complex issue resolution and detailed explanations.

Accessibility Features

The Metro Bank app is designed with accessibility in mind, aiming to provide a positive experience for all users. The app incorporates features to accommodate various needs.

- The app’s interface is optimized for various screen sizes and devices, ensuring a consistent and functional experience across different platforms.

- The app’s text is presented in clear and legible fonts, with sufficient contrast to ensure readability for users with visual impairments. The font sizes are adjustable, providing customization to the user’s preferences.

- Users can customize the app’s color scheme and font sizes for enhanced readability and visual comfort. This personalization feature caters to individual preferences and visual needs.

- Audio descriptions and screen readers are supported, enabling users with visual impairments to navigate and interact with the app effectively. This ensures accessibility for a wider user base.

Reporting Issues and Contacting Support

A straightforward process for reporting issues or contacting support is essential for maintaining a positive user experience. A user-friendly interface helps users navigate this process smoothly.

- Users can report issues or request assistance through a dedicated in-app support form. This form guides users through the process, prompting them for necessary details to facilitate prompt resolution.

- The support form provides options to categorize issues, which streamlines the resolution process and ensures the right team handles the inquiry. This helps expedite the resolution time and avoids misdirection.

- The app includes clear instructions on how to submit support requests, ensuring that users understand the process and can easily initiate contact. This minimizes user confusion and ensures prompt attention to their concerns.

Available FAQs and Help Sections

The app provides a wealth of resources for quick solutions and guidance. These resources minimize the need for external assistance and facilitate a smoother user experience.

- The app’s FAQ section contains a wide range of answers to frequently asked questions, offering readily available solutions for common issues.

- A comprehensive help center guides users through various aspects of the app’s functionality, including detailed instructions for account management, transaction processing, and security protocols.

Security Protocols and Data Privacy

Robust security protocols and data privacy measures are paramount to user trust and confidence. These measures ensure that user data is protected.

Data security and privacy are paramount. The app utilizes industry-standard encryption protocols to safeguard sensitive information.

- The app employs industry-standard encryption to protect user data during transmission and storage.

- Regular security audits are conducted to identify and mitigate potential vulnerabilities, ensuring that user data remains secure.

- The app adheres to stringent data privacy regulations to safeguard user information.

Support Channels Contact Information

The following table Artikels the various support channels available and their respective contact information.

| Support Channel | Contact Information |

|---|---|

| Phone Support | 1-800-METRO-BANK |

| Email Support | [email protected] |

| In-App Support Form | Available within the app |

Market Position and Competition

Metro Bank’s app aims to establish a strong presence in the competitive financial app market. Understanding its position relative to competitors is crucial for assessing its potential for growth and market share. This section analyzes Metro Bank’s app’s standing, its pricing model, marketing strategies, direct competitors, and key differentiators.

Competitive Landscape

The financial app market is highly competitive, with established players and newer entrants vying for user attention. Direct competition includes both large national banks and fintech companies specializing in mobile banking. The market is characterized by a range of features, pricing models, and user experiences. Analyzing this landscape helps Metro Bank tailor its strategy for maximum impact.

Direct Competitors

Metro Bank faces competition from established banks with strong mobile banking apps, as well as from innovative fintech companies offering digital-first financial services. Some prominent direct competitors include:

- National Bank A

- National Bank B

- FinTech Company X

- FinTech Company Y

Pricing and Fees

Metro Bank’s app pricing structure is crucial for its market position. This includes details about transaction fees, monthly or annual subscription fees, and any additional charges. A clear and transparent pricing model is essential for attracting and retaining customers.

Market Share and Position

Metro Bank’s app market share within the financial app industry is a key metric for evaluating its success. This is influenced by factors such as user acquisition, retention, and overall customer satisfaction. A strong market share indicates a successful approach in capturing a portion of the market.

Marketing Strategies

Metro Bank’s marketing strategies for its app are crucial for driving user acquisition and engagement. This includes online advertising, partnerships with other businesses, social media campaigns, and collaborations with influencers. Effective marketing can lead to a substantial increase in user base.

Differentiation from Competitors

Metro Bank’s app distinguishes itself from competitors through specific features and value propositions. The table below highlights key differentiators:

| Feature | Metro Bank App | Competitor A | Competitor B |

|---|---|---|---|

| Transaction Speed | Generally fast and efficient transactions, particularly for account-to-account transfers. | Average transaction speed; some delays reported during peak hours. | Fast transaction speed, known for its streamlined user interface. |

| Security Features | Multi-factor authentication and robust encryption measures are employed. | Basic security protocols are in place. | Advanced security measures and fraud detection systems. |

| Customer Support | Available 24/7 via phone and chat. | Limited support hours; primarily email-based support. | 24/7 customer support via multiple channels. |

| User Interface (UI) | Intuitive and easy-to-navigate design. | Average UI design; some users find it confusing. | Modern and user-friendly UI. |

Security and Privacy

The Metro Bank app prioritizes the security and privacy of its users’ sensitive financial data. Robust security protocols and data encryption methods are in place to safeguard user accounts and transactions. User data protection is a paramount concern, and the app adheres to stringent industry standards and regulations.

Security Protocols and Data Encryption

The Metro Bank app employs industry-standard encryption methods to protect user data during transmission and storage. This includes Advanced Encryption Standard (AES) encryption, which converts sensitive information into an unreadable format. Data is encrypted both in transit and at rest, ensuring that unauthorized access is highly improbable. This is further enhanced by secure network protocols, ensuring the integrity of communication channels between the app and the bank’s servers.

Data Protection Measures

To protect user data, the Metro Bank app employs multi-layered security measures. These include regular security audits and penetration testing to identify and address potential vulnerabilities. Access controls are meticulously implemented to restrict access to sensitive data to authorized personnel only. The app employs intrusion detection systems to monitor for malicious activity and respond to threats in real-time. Furthermore, user accounts are protected with strong passwords, and user activity is monitored for unusual patterns that could indicate fraudulent behavior.

Compliance with Regulations

The Metro Bank app adheres to all relevant financial regulations, including but not limited to the Payment Card Industry Data Security Standard (PCI DSS). This ensures that user data is handled in compliance with the highest industry standards for security and privacy. The app’s security practices are reviewed and updated regularly to reflect evolving industry best practices and regulatory requirements.

Security Policies

The Metro Bank app’s security policies are clearly defined and accessible to users. These policies Artikel the procedures for handling security incidents, protecting user data, and complying with relevant regulations. The policies cover password management, account security, and responsible use of the app’s features. Users are encouraged to review these policies to understand their responsibilities in maintaining account security.

Two-Factor Authentication Setup

Setting up two-factor authentication (2FA) adds an extra layer of security to your Metro Bank account. This significantly reduces the risk of unauthorized access, even if a hacker obtains your password. Follow these steps:

- Open the Metro Bank app and navigate to the “Security” section.

- Select “Two-Factor Authentication.”

- Choose your preferred authentication method, such as a mobile authenticator app or SMS messages.

- Follow the on-screen prompts to complete the setup process. You’ll receive a verification code.

- Enter the code into the app to confirm the setup.

Security Features and Privacy Policies Summary

| Security Feature | Description |

|---|---|

| Data Encryption | Uses AES encryption to protect user data in transit and at rest. |

| Access Controls | Restricts access to sensitive data to authorized personnel only. |

| Security Audits | Regularly conducts security audits and penetration testing to identify vulnerabilities. |

| Regulatory Compliance | Adheres to all relevant financial regulations, including PCI DSS. |

| Two-Factor Authentication | Adds an extra layer of security to user accounts. |

App Updates and Future Trends

The Metro Bank app continuously evolves to meet the changing needs of its users and the ever-evolving digital landscape. Recent updates have focused on enhancing user experience, streamlining processes, and incorporating new functionalities. Looking ahead, the app is poised to integrate innovative technologies and address emerging user expectations.

Recent Updates and Their Impact

Metro Bank has consistently rolled out updates to improve app performance, user interface, and security. These improvements have resulted in a more intuitive navigation, faster loading times, and a more streamlined experience for users. Enhanced security features, such as improved two-factor authentication methods and advanced encryption protocols, have also been implemented.

Future Trends and Potential Improvements

Several trends suggest potential improvements for the Metro Bank app. Integration of biometric authentication, like facial recognition or fingerprint scanning, is likely to gain prominence, enhancing security and convenience. Furthermore, the app could benefit from advanced personalization features, tailored to individual user preferences and transaction patterns, providing a more bespoke experience. The incorporation of artificial intelligence (AI) to automate tasks and provide proactive support could significantly improve user interaction. For instance, AI-powered chatbots could address common queries and resolve simple issues without human intervention. This approach aligns with the broader trend of AI adoption across financial institutions.

User Feedback and Improvement Suggestions

User feedback plays a crucial role in shaping the direction of app development. Suggestions for improvements often revolve around enhancing specific functionalities, such as faster transaction processing times or more detailed transaction histories. A significant portion of feedback also emphasizes the need for improved accessibility features, such as larger font sizes and better color contrast. User feedback has consistently highlighted the need for clearer and more concise instructions and prompts, leading to a more intuitive and less error-prone user experience.

New Features Planned for the Future

Several new features are planned for future app iterations. One key area is expanding mobile payment integration to include more payment options, enabling seamless integration with various digital wallets. The incorporation of investment tools or robo-advisory features is also a possibility, catering to users seeking investment options within the app. Improved budgeting and financial planning tools could be integrated to help users manage their finances more effectively.

Table of Recent App Updates and Their Impact

| Update | Impact on User Experience |

|---|---|

| Enhanced Security Protocols | Improved user trust and confidence in app security; reduced risk of unauthorized access. |

| Streamlined Transaction Flow | Faster transaction processing times; more efficient handling of financial operations. |

| Improved User Interface | More intuitive navigation; enhanced visual appeal; easier access to essential functionalities. |

| Accessibility Enhancements | Improved usability for users with disabilities; wider user base can now use the app comfortably. |

Ultimate Conclusion

In conclusion, the Metro Bank app presents a well-rounded financial management solution. While it excels in certain areas, like ease of use and intuitive navigation, opportunities for enhancement exist in areas like customer support accessibility and competitive pricing. This review has thoroughly examined the app’s functionalities, security protocols, and user experience, ultimately providing a comprehensive understanding of its strengths and weaknesses. The app’s future success will depend on its ability to adapt to evolving market trends and address user feedback.