QuickBooks, a powerful accounting software, empowers businesses of all sizes to navigate the complexities of financial management with ease. From meticulous record-keeping to insightful analysis, QuickBooks offers a robust suite of tools designed to streamline operations and unlock profitability. This exploration delves into the intricacies of QuickBooks, covering everything from its fundamental features to advanced functionalities, ensuring a comprehensive understanding for all users.

This guide will provide a thorough overview of QuickBooks, highlighting its versatile applications across various industries, from small businesses to non-profit organizations and retail establishments. We will also examine its security protocols and integration capabilities with other business tools, offering practical insights for optimal usage.

Introduction to QuickBooks

QuickBooks is a comprehensive accounting software suite designed for small businesses and self-employed individuals. It streamlines financial management tasks, from bookkeeping and invoicing to reporting and tax preparation. Its user-friendly interface and robust features make it a popular choice for managing finances efficiently.

The software offers a wide range of features to cater to different business needs, from basic bookkeeping to advanced financial analysis. This allows users to track income and expenses, generate invoices, manage customer relationships, and produce financial reports. This makes QuickBooks a valuable tool for business owners looking to improve their financial control.

QuickBooks Versions

Different versions of QuickBooks are available to cater to varying business needs and sizes. This ensures that businesses of all types and scales can find a suitable version to manage their financial information effectively. These versions vary in their features and pricing.

- QuickBooks Desktop: This version provides a robust, locally installed solution with a wide array of features for detailed financial management. It’s often preferred by businesses with more complex financial needs.

- QuickBooks Online: This cloud-based version offers a subscription-based access to accounting software. It’s user-friendly and accessible from anywhere with an internet connection. This version is ideal for small businesses or sole proprietors with basic accounting needs.

QuickBooks Features

QuickBooks provides a diverse set of features to address various accounting needs. These features streamline financial processes, ensuring accuracy and efficiency.

- Invoicing and Billing: QuickBooks allows businesses to create and send invoices, track payments, and manage outstanding balances efficiently. This feature simplifies the invoicing process, reducing errors and improving cash flow.

- Expense Tracking: Users can meticulously track expenses, categorize them, and generate reports to analyze spending patterns. This feature is vital for businesses to understand their cost structures and make informed financial decisions.

- Reporting and Analysis: QuickBooks generates various financial reports, including income statements, balance sheets, and cash flow statements. These reports provide insights into the financial health of the business, helping users make data-driven decisions.

Target Audience

QuickBooks is designed for small businesses, sole proprietors, and self-employed individuals. The software is suitable for a wide range of businesses with diverse financial needs. Its user-friendly interface makes it accessible to individuals with varying levels of accounting expertise.

- Small Businesses: QuickBooks can help small businesses manage their finances effectively, from tracking income and expenses to generating reports. This facilitates informed decision-making.

- Sole Proprietors: It helps sole proprietors organize their finances, manage invoices, and track income and expenses. This provides them with greater control over their financial operations.

- Self-Employed Individuals: QuickBooks assists self-employed individuals in managing their finances, tracking income and expenses, and generating reports.

QuickBooks Desktop vs. QuickBooks Online

This table compares the QuickBooks desktop and online versions based on key characteristics.

| Feature | QuickBooks Desktop | QuickBooks Online |

|---|---|---|

| Deployment | Locally installed | Cloud-based |

| Accessibility | Limited to the computer on which it is installed | Accessible from any device with internet connection |

| Cost | One-time purchase | Subscription-based |

| Features | Extensive features for complex accounting needs | Core accounting features with optional add-ons |

| Support | Typically involves a support contract or community forums | Online support and community resources |

QuickBooks Features and Functionality

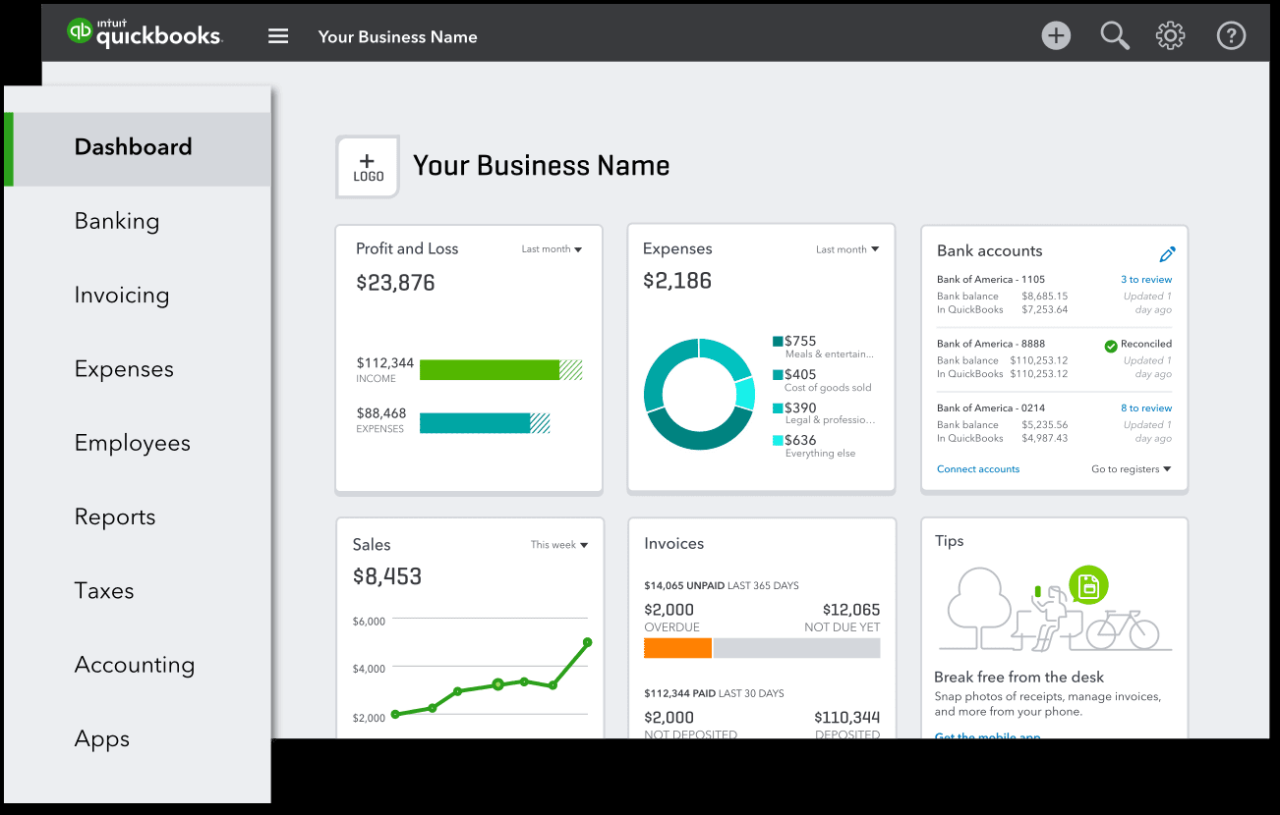

QuickBooks offers a comprehensive suite of tools designed to manage various aspects of a business, from accounting and inventory to customer relationships and reporting. Its intuitive interface and powerful features make it a popular choice for small and medium-sized businesses seeking a robust yet user-friendly solution. It simplifies complex financial tasks, empowering business owners with actionable insights.

QuickBooks’ accounting features cover the entire financial cycle, enabling businesses to accurately record transactions, track expenses, manage income, and generate financial statements. This functionality allows for efficient financial reporting and informed decision-making. The software automates many of these tasks, reducing manual effort and minimizing the risk of errors.

Accounting Features

QuickBooks provides a wide range of accounting tools, facilitating the entire financial cycle. It enables businesses to record transactions, manage accounts payable and receivable, track expenses and income, and generate various financial statements. These statements include balance sheets, income statements, and cash flow statements, offering crucial insights into the financial health of the business. The software’s automation capabilities reduce the risk of human error and free up valuable time for other business activities.

Inventory Management Capabilities

QuickBooks’ inventory management features help businesses track their stock levels, monitor sales trends, and manage inventory costs effectively. It allows businesses to track inventory across multiple locations, ensuring accurate stock counts and preventing overstocking or stockouts. By streamlining the inventory process, QuickBooks can improve efficiency and profitability. Real-time insights into inventory levels empower businesses to make informed decisions regarding purchasing, pricing, and sales strategies.

Reporting and Analysis Tools

QuickBooks offers a suite of reporting and analysis tools that allow businesses to gain valuable insights into their financial performance. Customizable reports provide detailed information on key metrics, enabling businesses to track progress, identify areas for improvement, and make data-driven decisions. These reports allow for in-depth analysis of sales trends, profitability, and expenses. For example, a business might use QuickBooks reports to identify the best-selling products or services, or pinpoint areas where costs are disproportionately high.

Streamlining Business Operations

QuickBooks streamlines business operations by automating tasks and providing real-time data. This automation reduces manual effort, minimizing errors and freeing up time for other business activities. For example, automated invoicing and payment processing can significantly reduce the time and effort spent on these tasks. The software also facilitates seamless communication between different departments within a business, improving collaboration and efficiency. Automated bank reconciliation helps maintain accurate financial records.

Customer Relationship Management (CRM) Features

QuickBooks’ CRM features assist businesses in managing customer interactions and building stronger relationships. The software helps track customer information, manage contacts, and monitor sales interactions. It allows businesses to tailor their approach to individual customer needs, personalize communications, and foster loyalty.

| Feature | Description |

|---|---|

| Customer Tracking | Records customer information, including contact details, purchase history, and communication logs. |

| Contact Management | Organizes customer contacts and allows for easy searching and sorting. |

| Sales Tracking | Tracks sales interactions, including quotes, invoices, and payments. |

| Reporting | Provides reports on customer interactions, sales performance, and other relevant data. |

QuickBooks Implementation and Setup

Successfully implementing QuickBooks involves a structured approach to account setup, data import, integration, and data entry best practices. This meticulous process ensures smooth operations and accurate financial reporting, minimizing potential errors and maximizing efficiency. A well-configured QuickBooks system is a cornerstone of efficient business management.

The setup process for QuickBooks involves several key steps, from account creation to data integration and configuration. Proper setup ensures data integrity and efficient reporting. Data import allows you to quickly populate your QuickBooks system with existing information. Integration with other applications streamlines workflows. Finally, adhering to best practices for data entry is crucial for maintaining accuracy and consistency.

Setting Up a QuickBooks Account

Creating a QuickBooks account requires careful consideration of business type, preferences, and features. The process involves selecting a suitable QuickBooks plan, providing necessary business information, and completing the account setup. This step is fundamental to utilizing QuickBooks’ capabilities.

- Account Selection: Choose the QuickBooks plan best suited for your business size and needs, considering factors like number of users, features, and pricing. A tailored plan ensures optimal functionality without unnecessary expenses.

- Business Information: Accurate input of business details like name, address, contact information, and tax ID is vital. This data ensures accurate financial records and reporting.

- Account Setup: Complete the account setup by providing required financial information, such as bank account details and payment methods. This stage ensures seamless transaction processing.

Importing Data into QuickBooks

Importing data into QuickBooks allows for efficient transition from previous systems. This process saves significant time and effort, accelerating the setup process. Choosing the right import method ensures a smooth and accurate transfer of data.

- Choosing the Right Method: Select the appropriate import method based on the format of your existing data. Different formats require different import options. Common formats include CSV, Excel, and TXT files.

- Data Preparation: Prepare your data for import by ensuring accuracy and consistency in formatting. This step minimizes errors during the import process.

- Import Process: Follow the QuickBooks import wizard to guide the process. Pay close attention to data validation and error messages. Correcting any issues before the import concludes is crucial for data integrity.

Connecting QuickBooks to Other Business Applications

Integrating QuickBooks with other business applications automates workflows and enhances efficiency. Connecting these applications can streamline processes like inventory management, accounting, and customer relationship management.

- Identifying Compatible Applications: Research and identify compatible applications that integrate with QuickBooks. Compatibility ensures smooth data transfer and functionality.

- Connecting Applications: Follow the integration instructions provided by both QuickBooks and the third-party application. Detailed instructions will guide you through the setup process.

- Testing Integration: After the connection, thoroughly test the integration to ensure seamless data flow. Testing helps catch any unforeseen errors.

Best Practices for QuickBooks Data Entry

Adhering to best practices in data entry ensures accuracy and efficiency in QuickBooks. Consistency and attention to detail are key to maintaining accurate financial records.

- Accuracy and Consistency: Maintain accuracy and consistency in data entry by double-checking information and following defined formatting rules. This minimizes errors and ensures reliable financial reporting.

- Regular Backups: Regularly back up your QuickBooks data to prevent loss in case of system failures. Regular backups safeguard your business data.

- Data Validation: Utilize QuickBooks’ data validation features to identify potential errors. Validation minimizes errors during the process.

Prerequisites for QuickBooks Installation

Proper installation requires specific hardware and software requirements. Meeting these prerequisites ensures a smooth and error-free installation process.

| Requirement | Description |

|---|---|

| Operating System | Windows or macOS, specific versions depending on the QuickBooks version. |

| Processor | Minimum processor speed and RAM requirements vary by QuickBooks version. |

| Hard Drive Space | Sufficient hard drive space is necessary for installation and data storage. |

| Internet Connection | An internet connection is often required for updates and certain features. |

| Software Compatibility | Ensure all other software is compatible to prevent conflicts. |

QuickBooks for Specific Industries

QuickBooks, a popular accounting software, offers tailored features for various industries. Its adaptability and user-friendly interface make it a valuable tool for small businesses, non-profits, retail operations, and service providers. This section explores how QuickBooks caters to the unique needs of each industry.

QuickBooks for Small Businesses

QuickBooks excels at managing the financial aspects of small businesses. Its robust reporting tools help entrepreneurs track income, expenses, and cash flow effectively. Key features include invoicing, expense tracking, and inventory management, which are crucial for small business owners to stay organized and make informed decisions. For instance, a small bakery can use QuickBooks to manage ingredient costs, track sales of different pastries, and generate reports on profit margins.

QuickBooks for Non-Profit Organizations

QuickBooks can be adapted to meet the unique accounting needs of non-profit organizations. It supports tracking donations, grants, and expenses, enabling non-profits to maintain transparent financial records. Key functionalities include streamlined donation tracking, grant management, and reporting tailored for non-profit compliance.

QuickBooks Applications in Retail

QuickBooks offers comprehensive solutions for retail businesses. It helps manage inventory, track sales, and process payments efficiently. Features such as point-of-sale (POS) integration and inventory control allow retail businesses to streamline operations and optimize stock management. A clothing store, for example, can use QuickBooks to track inventory levels of different items, generate sales reports, and manage customer transactions.

QuickBooks Use in the Service Industry

QuickBooks provides essential tools for service-based businesses. It helps manage client billing, track project costs, and generate invoices. Features such as client management and time tracking are particularly valuable for service providers. For instance, a freelance graphic designer can use QuickBooks to track hours worked, manage client payments, and generate invoices.

Comparison of QuickBooks Suitability for Various Industries

| Industry | QuickBooks Suitability | Key Features |

|---|---|---|

| Small Businesses | High | Invoicing, expense tracking, inventory management, reporting |

| Non-Profit Organizations | Medium | Donation tracking, grant management, reporting for non-profit compliance |

| Retail | High | Inventory control, point-of-sale (POS) integration, sales tracking, customer management |

| Service Industry | Medium-High | Client billing, project costing, time tracking, invoice generation |

QuickBooks Troubleshooting and Support

QuickBooks, while a powerful tool, can occasionally present challenges. This section details common errors, their solutions, and how to access various support channels to resolve issues efficiently. Proper troubleshooting can save time and frustration, ensuring smooth accounting operations.

Common QuickBooks Errors and Solutions

QuickBooks encounters various errors due to system incompatibility, data entry mistakes, or software glitches. Understanding the source of these errors is crucial to resolving them promptly. Below are some common issues and their solutions.

- Error: “File is locked.” This error often arises when multiple users attempt to access the same file simultaneously. Closing the file in all open applications and retrying the operation often resolves the issue. If the error persists, ensure that no other program is accessing the file.

- Error: “Cannot connect to the server.” This typically indicates a network connectivity problem or a server-side issue. Verify your internet connection, and check for any network outages. If the problem persists, contact your internet service provider or the server administrator.

- Error: “Invalid data.” This usually signals a discrepancy in the data format. Carefully review the data entry, ensuring accuracy in numbers, dates, and other details. Correct any errors in the input data to resolve this issue.

Resolving Data Entry Issues

Data entry errors are a frequent cause of QuickBooks problems. A thorough review of the input data is crucial for identifying and correcting these issues.

- Data Validation Regularly validate data input using built-in QuickBooks tools or external data validation software. Ensure data integrity by employing automated checks.

- Data Cleaning If inconsistencies are identified, data cleaning techniques such as data transformation or data standardization can help improve data quality and accuracy.

- Reviewing Input Double-check each data entry, paying close attention to numbers, dates, and descriptions. Correct any errors promptly to avoid propagating mistakes.

Contacting QuickBooks Support

Several avenues exist for contacting QuickBooks support. Choosing the appropriate method ensures swift resolution of your issue.

- Online Help Resources QuickBooks offers comprehensive online help resources including FAQs, tutorials, and troubleshooting guides.

- Phone Support Direct support from QuickBooks representatives is available via phone. This allows for real-time assistance.

- Community Forums Engage with other QuickBooks users in online forums for solutions to similar problems.

Utilizing QuickBooks Online Help Resources

QuickBooks provides extensive online help resources to address various issues. Leveraging these resources can save time and effort.

- Search Function Utilize the search function to find specific answers or solutions quickly.

- Video Tutorials Watch instructional videos to understand complex procedures or resolve specific errors.

- Knowledge Base Articles Consult the knowledge base for detailed information on various aspects of QuickBooks.

QuickBooks Support Options

The following table Artikels the available QuickBooks support options, highlighting their benefits and drawbacks.

| Support Option | Description | Pros | Cons |

|---|---|---|---|

| Online Help | QuickBooks online help resources | Convenient, readily available, free | May not offer immediate solutions, sometimes requires more effort to find specific answers. |

| Phone Support | Direct support from QuickBooks representatives | Real-time assistance, tailored solutions | May incur charges, wait times may be longer. |

| Community Forums | Discussion forum with other users | Shared solutions, broad community perspective | May not always be up-to-date, solutions may not always be correct. |

QuickBooks Alternatives and Competitors

QuickBooks, while a popular accounting software, isn’t the only option available. Numerous alternatives cater to various business needs and budgets, offering unique features and functionalities. Understanding these alternatives is crucial for businesses seeking the best fit for their operations.

Alternative Software Options

Several software options can replace or supplement QuickBooks, each with its own strengths and weaknesses. These alternatives cater to different business sizes, industry sectors, and specific needs, such as inventory management or e-commerce integration. Choosing the right alternative depends on a business’s particular requirements.

Comparison with QuickBooks Competitors

Comparing QuickBooks to its competitors involves examining key features, pricing models, and user experiences. Direct comparisons often highlight the strengths and weaknesses of each option. Consideration should be given to the specific needs of the business, including industry-specific requirements.

Advantages and Disadvantages of QuickBooks Alternatives

QuickBooks alternatives offer diverse advantages, such as specialized features for specific industries or integration with other business tools. However, they may not always match the breadth of functionality or user base support of QuickBooks. The choice often hinges on whether the added value of a specific alternative outweighs the potential loss of familiarity or support.

Popular QuickBooks Competitors

Popular competitors to QuickBooks include Xero, Zoho Books, Sage, FreshBooks, and Wave. Each offers unique advantages and may be better suited to particular business needs or preferences. Businesses should carefully evaluate these options against their individual needs.

Comparison Table: QuickBooks vs. Competitors

| Feature | QuickBooks | Xero | Zoho Books | Sage | FreshBooks |

|---|---|---|---|---|---|

| Pricing | Tiered pricing, often based on features and transaction volume | Tiered pricing, with options for different business sizes | Flexible pricing plans, often with monthly fees | Tiered pricing, offering various plans for different needs | Subscription-based pricing, usually with a monthly fee |

| Ease of Use | Generally user-friendly, with intuitive interface | Highly intuitive interface, suitable for both beginners and experienced users | Straightforward interface, user-friendly and easy to navigate | Intuitive interface, with a focus on efficiency and user-friendliness | Simple interface, easy to use for smaller businesses |

| Features | Comprehensive accounting features, including invoicing, expense tracking, and reporting | Robust accounting features, including inventory management, and reporting | Includes features like invoicing, expense tracking, and project management | Broad range of features, including financial management, payroll, and inventory | Focuses on invoicing and expense tracking, with limited advanced features |

| Integration | Integrates with various other business software | Integrates well with other business tools | Integrates with several business apps, including email marketing and project management tools | Integrates with other accounting and business software solutions | Limited integration options, primarily with other accounting tools |

| Support | Extensive support resources, including online help, phone support, and community forums | Offers comprehensive support options | Offers various support options, including online resources and phone support | Provides extensive support resources and community support | Support options available, though potentially less extensive than some competitors |

QuickBooks Security and Data Protection

QuickBooks, a powerful accounting software, is vulnerable to security threats if not properly protected. Robust security measures are crucial for safeguarding sensitive financial data and maintaining the integrity of your business records. This section details the essential security protocols and best practices for protecting your QuickBooks data.

Protecting your QuickBooks data is paramount. Implementing strong security measures minimizes the risk of unauthorized access, data breaches, and financial losses. By adhering to these protocols, you can maintain the confidentiality and integrity of your financial information.

Security Measures Implemented in QuickBooks

QuickBooks employs several security measures to protect your data. These include user authentication, access controls, and data encryption. Properly configured user accounts, with strong passwords, restrict access to sensitive financial information.

Protecting QuickBooks Data from Unauthorized Access

Robust password management is a cornerstone of data security. Employing strong, unique passwords for each QuickBooks user account is essential. Regularly changing passwords and enabling multi-factor authentication further enhance security. Implementing strong access controls to limit user permissions is equally important. Restricting access to only necessary data and functions for each user role helps prevent unauthorized modification or viewing of sensitive information.

Importance of Regular Backups in QuickBooks

Regular backups are vital for data recovery in case of system failures, accidental deletions, or cyberattacks. Regular backups, preferably offsite, protect against data loss and ensure business continuity. Implementing a scheduled backup routine, and verifying the integrity of backups, are key components of this practice. Frequent backups minimize the potential for data loss and allow for swift restoration in case of unforeseen events.

Best Practices for QuickBooks Data Security

Implementing strong passwords and multi-factor authentication is essential for protecting QuickBooks data. Regularly updating QuickBooks to the latest version patches security vulnerabilities. Avoid using publicly accessible Wi-Fi networks for QuickBooks access to prevent unauthorized access. Adhering to these best practices minimizes the risk of data breaches and ensures the confidentiality and integrity of your financial data.

Security Protocols for QuickBooks

| Security Protocol | Description | Implementation |

|---|---|---|

| Strong Passwords | Employing complex, unique passwords for each user account. | Use a password manager or a strong password generator. Require complex passwords (uppercase, lowercase, numbers, symbols). |

| Multi-Factor Authentication | Adding an extra layer of security beyond passwords. | Enable MFA where available. |

| Access Controls | Limiting user permissions to only necessary data and functions. | Assign roles with appropriate permissions. |

| Regular Backups | Creating regular backups of your QuickBooks data. | Schedule automated backups and verify their integrity. Consider offsite backups for added protection. |

| Software Updates | Keeping QuickBooks updated to the latest version. | Regularly check for and apply security patches. |

| Secure Network | Avoid using public Wi-Fi for QuickBooks access. | Use a secure network connection (VPN) for remote access. |

QuickBooks Integration with Other Tools

QuickBooks offers robust integration capabilities, allowing businesses to connect their accounting data with other essential tools. This seamless integration streamlines workflows, reduces manual data entry, and provides a comprehensive view of the entire business operation. This interconnectedness is crucial for businesses looking to optimize their processes and gain actionable insights.

Accounting Software Integration

QuickBooks integrates with various accounting software applications. This integration facilitates the exchange of financial data, enabling businesses to maintain a consistent record of transactions across multiple systems. The result is a more accurate and up-to-date financial picture. This integration often simplifies reconciliation processes and reduces the risk of errors.

CRM System Integration

QuickBooks can be integrated with Customer Relationship Management (CRM) systems. This connection allows for a more complete understanding of customer interactions. By linking customer data from the CRM with financial transactions in QuickBooks, businesses gain insights into sales performance, revenue generation, and profitability associated with specific clients. This holistic view of customer relationships and financial data enables more informed business decisions.

QuickBooks and E-commerce Platforms

Several e-commerce platforms seamlessly integrate with QuickBooks. This integration enables automated data transfer, reducing manual effort and improving accuracy. For example, orders placed through online stores are automatically synced with QuickBooks, enabling businesses to track sales, manage inventory, and generate invoices. This automation streamlines the entire process, from order processing to payment collection.

Integration with Payment Processors

QuickBooks can be connected to various payment processors. This integration allows for automated recording of transactions, simplifying the reconciliation process. For example, payments received from customers via credit cards, debit cards, or other payment methods can be automatically imported into QuickBooks. This feature streamlines the reconciliation process, ensuring accurate financial records and minimizing manual intervention.

QuickBooks Integration Options

| Integration Type | Description | Benefits |

|---|---|---|

| Accounting Software | Facilitates data exchange between QuickBooks and other accounting software. | Consistent record of transactions, accurate financial picture, simplified reconciliation. |

| CRM Systems | Connects customer data from CRM systems to financial transactions in QuickBooks. | Holistic view of customer relationships, informed business decisions, insights into sales performance. |

| E-commerce Platforms | Enables automated data transfer between e-commerce platforms and QuickBooks. | Reduces manual effort, improves accuracy, streamlined order processing and payment collection. |

| Payment Processors | Connects QuickBooks to various payment processors for automated transaction recording. | Automated recording of transactions, simplified reconciliation, accurate financial records. |

Closing Notes

In conclusion, QuickBooks emerges as a versatile and comprehensive solution for managing finances. Its adaptability across diverse industries and user-friendly interface make it a powerful asset for businesses seeking streamlined operations and insightful financial reporting. This guide has presented a thorough understanding of QuickBooks, from its core functionalities to advanced applications, ensuring informed decision-making for any user.