Small business owners, are you drowning in spreadsheets and tangled transactions? QuickBooks Desktop 2022 is your all-in-one solution to simplify accounting, boost efficiency, and gain valuable insights into your business performance. This comprehensive guide dives deep into its features, helping you make informed decisions about whether it’s the right fit for your needs.

From navigating the installation process to mastering advanced features like inventory management and payroll, we’ll cover everything you need to know. We’ll also compare it to competitors and discuss security best practices. Get ready to unlock the power of your business data!

Introduction to QuickBooks Desktop 2022

QuickBooks Desktop 2022 is a robust accounting software designed for small and medium-sized businesses. It provides a comprehensive suite of tools for managing finances, including invoicing, expense tracking, and reporting. This detailed overview delves into its core features, target users, key differences from previous versions, the installation process, and a comparison with other accounting software options.

Key Features of QuickBooks Desktop 2022

QuickBooks Desktop 2022 boasts an array of features to streamline business accounting. These features include improved inventory management, enhanced reporting capabilities, and seamless integration with other business applications. The software’s intuitive interface allows users to easily navigate and manage financial data.

Target User Base for QuickBooks Desktop 2022

QuickBooks Desktop 2022 is primarily targeted towards small business owners, bookkeepers, and accountants. This includes businesses of varying sizes and industries, focusing on those needing comprehensive accounting solutions for managing their financial transactions and reporting.

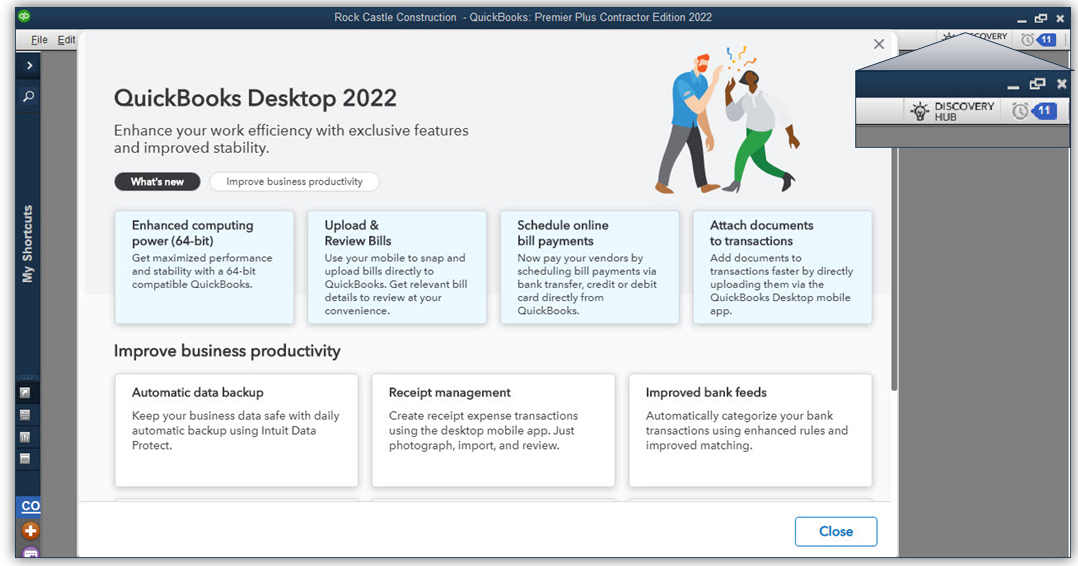

Differences Between QuickBooks Desktop 2022 and Previous Versions

QuickBooks Desktop 2022 introduces several enhancements compared to its predecessors. Notable improvements include: faster processing speeds, improved data security features, and more efficient reporting options. Specific changes vary, but overall, the aim is to provide a more user-friendly and robust accounting platform.

Installation Process for QuickBooks Desktop 2022

The installation process for QuickBooks Desktop 2022 typically involves downloading the installation file from the Intuit website. The steps generally include running the installer, accepting the license agreement, selecting the installation location, and configuring the software. Potential issues during installation may include insufficient system resources, incompatible hardware, or corrupted installation files. Troubleshooting these issues often involves checking system requirements, ensuring sufficient storage space, and verifying file integrity. It is recommended to review the official QuickBooks Desktop 2022 installation guide for detailed instructions.

Comparison of QuickBooks Desktop 2022 with Other Accounting Software

| Feature | QuickBooks Desktop 2022 | Xero | FreshBooks | Sage 50 |

|---|---|---|---|---|

| Pricing | Subscription-based pricing | Subscription-based pricing | Subscription-based pricing | Subscription-based pricing |

| Features | Comprehensive accounting features | Robust accounting features | Simplified invoicing and billing | Detailed accounting and financial reporting |

| Ease of Use | Intuitive interface, user-friendly | Intuitive interface, user-friendly | Straightforward interface | User-friendly interface, robust reporting |

| Platform Compatibility | Windows-based | Web-based and desktop | Web-based | Windows-based |

This table provides a basic comparison. Each software option offers specific strengths and weaknesses, and the best choice depends on individual business needs and preferences.

Core Functionality of QuickBooks Desktop 2022

QuickBooks Desktop 2022 provides a comprehensive suite of tools for small and medium-sized businesses to manage their finances efficiently. It streamlines accounting processes, offering features for invoicing, billing, payments, customer relationship management, reporting, and budgeting. This detailed exploration will delve into the core functionalities of QuickBooks Desktop 2022, empowering users to maximize its potential.

QuickBooks Desktop 2022’s core strength lies in its ability to handle the entire financial cycle of a business. From initial sales to final reporting, the software provides a cohesive platform for managing every transaction. The software’s user-friendly interface makes it accessible to various skill levels, from novice to experienced accountants.

Invoicing, Billing, and Payments

QuickBooks Desktop 2022 facilitates the creation and management of invoices, bills, and payments. The software allows users to generate professional-looking invoices, specifying details like due dates, payment terms, and discounts. These invoices can be sent electronically or printed. Billing is streamlined through the automated generation of recurring invoices and the tracking of outstanding balances. Payment processing options within QuickBooks Desktop 2022 include handling credit card payments, checks, and other forms of payment. This feature ensures efficient cash flow management.

Customer and Vendor Relationship Management

QuickBooks Desktop 2022 offers robust tools for managing customer and vendor relationships. A dedicated customer and vendor database allows users to store contact information, transaction history, and other relevant details for each entity. This detailed information facilitates targeted communication and personalized service. Tracking past transactions and payment history provides valuable insight for building stronger business relationships.

Reporting and Analytics Capabilities

QuickBooks Desktop 2022 provides comprehensive reporting and analytics capabilities. The software generates various financial reports, including profit and loss statements, balance sheets, and cash flow statements. Users can customize these reports to meet specific needs and analyze key performance indicators (KPIs). Interactive dashboards display critical financial data in a clear and concise manner, enabling informed decision-making.

Budgeting

QuickBooks Desktop 2022 allows users to create and manage budgets. The software enables the establishment of budgets for different departments or categories, facilitating financial planning and control. Users can track actual expenses against budgeted amounts, identify variances, and make necessary adjustments. This feature empowers businesses to proactively manage their finances and stay within budget constraints. For instance, a company can set a budget for marketing expenses and monitor how closely actual spending aligns with the planned budget.

Reporting Options

| Report Type | Description |

|---|---|

| Profit & Loss Statement | Summarizes revenue and expenses over a specified period. |

| Balance Sheet | Provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. |

| Cash Flow Statement | Tracks the movement of cash into and out of a business over a period. |

| Customer Statement | Displays a customer’s outstanding invoices and payments. |

| Vendor Statement | Displays a vendor’s invoices and payments to the business. |

| Sales by Product/Service | Highlights sales performance for specific products or services. |

The table above showcases a selection of the various reporting options available in QuickBooks Desktop 2022. Each report type provides specific insights into different aspects of a business’s financial performance. Choosing the appropriate report type is crucial for effective financial analysis.

Advanced Features and Capabilities

QuickBooks Desktop 2022 goes beyond basic accounting, offering robust tools for managing complex business operations. This section delves into the advanced features, including inventory management, payroll processing, bank reconciliation, and integration with other business applications. Understanding these capabilities can significantly enhance a business’s operational efficiency and profitability.

Inventory Management

Inventory management in QuickBooks Desktop 2022 provides a comprehensive solution for tracking and managing stock levels. Businesses can monitor inventory movement, costs, and sales performance to optimize their inventory control strategies. Accurate inventory tracking helps avoid stockouts and overstocking, minimizing costs and maximizing profitability. This functionality is particularly valuable for businesses with significant product lines or fluctuating demand. The system allows for various costing methods (FIFO, LIFO, weighted average), enabling businesses to select the method best suited to their accounting needs.

Payroll Processing

QuickBooks Desktop 2022’s payroll capabilities handle the complexities of employee compensation. It streamlines the process of calculating salaries, taxes, and deductions, ensuring compliance with all relevant regulations. This feature includes functions for setting up employee records, processing paychecks, and generating reports. The software also helps in managing employee benefits and deductions, reducing the administrative burden on the business.

Bank Reconciliation

Accurate bank reconciliation is crucial for financial health. QuickBooks Desktop 2022 facilitates bank reconciliation by allowing users to match transactions from their bank statements with entries in the accounting software. This feature helps identify discrepancies and ensures the accuracy of financial records. Regular reconciliation helps maintain financial controls, prevent errors, and provides an up-to-date view of the business’s financial position.

Integration with Other Applications

QuickBooks Desktop 2022 can integrate with other business applications through various methods, such as APIs and third-party add-ons. This integration allows businesses to seamlessly share data between different systems, reducing manual data entry and improving data accuracy. For example, integration with e-commerce platforms can automatically update inventory levels and sales data in QuickBooks.

Performance with Large Datasets

QuickBooks Desktop 2022’s performance with large datasets depends on several factors, including system configuration and the specific data volume. While QuickBooks Desktop is designed for smaller to medium-sized businesses, its robust architecture can handle substantial amounts of data. However, for exceptionally large datasets, the performance might be slower than specialized enterprise resource planning (ERP) solutions. Comparing performance requires careful consideration of the specific needs and scale of the business.

System Requirements

| Component | Requirement |

|---|---|

| Operating System | Windows 10 (64-bit) or Windows 11 (64-bit) |

| Processor | Intel Core i3 or equivalent |

| RAM | 8 GB |

| Hard Disk Space | 2 GB available space |

| Display | 1024 x 768 resolution |

Troubleshooting and Support

Navigating software can sometimes lead to unexpected hurdles. QuickBooks Desktop 2022, while powerful, isn’t immune to occasional glitches. This section details common problems and their solutions, providing resources for swift resolution. Knowing how to troubleshoot issues effectively can save significant time and frustration.

Common Problems and Solutions

QuickBooks Desktop 2022 users often encounter issues related to data connectivity, file corruption, or application conflicts. Understanding the root causes and implementing appropriate solutions is key to a smooth workflow.

- Connectivity Issues: Problems connecting to the internet or company file can stem from network configurations, firewall settings, or outdated drivers. Verify your internet connection and ensure QuickBooks has the necessary permissions. Check for network conflicts or restrictions that might be preventing access. Ensure your firewall allows QuickBooks to communicate properly.

- File Corruption: Accidental power outages or software malfunctions can lead to corrupted company files. Backing up your data regularly is crucial to mitigate the risk of data loss. If a file is corrupted, try repairing it through QuickBooks’ built-in tools. Consider restoring from a recent backup if necessary.

- Application Conflicts: Other programs running simultaneously can sometimes conflict with QuickBooks. Close any unnecessary programs that might be consuming system resources or interfering with QuickBooks’ operations. Ensure sufficient system resources are available for QuickBooks to run smoothly.

Accessing Online Support Resources

QuickBooks offers a comprehensive support portal with valuable information. Leveraging these resources can provide solutions to common problems and guide users through various situations.

- QuickBooks Support Website: The official QuickBooks website provides detailed documentation, FAQs, and troubleshooting articles. Search for specific errors or issues for readily available solutions. The support website is a valuable resource for self-help.

- Knowledge Base Articles: Extensive articles address a wide range of technical issues, from installation problems to data import errors. This repository of knowledge base articles often provides step-by-step guides to resolving problems.

- Online Forums: Engaging with the QuickBooks community through online forums can expose users to solutions shared by other users. Sharing experiences and seeking guidance from others can be a helpful troubleshooting method.

Contacting QuickBooks Desktop 2022 Technical Support

If self-help efforts prove insufficient, contacting QuickBooks technical support can offer personalized assistance. Different methods exist for reaching support, and choosing the appropriate one is important.

- Phone Support: Direct phone support allows for real-time interaction with a support representative. Phone support is often helpful when users require immediate assistance or personalized guidance.

- Online Chat Support: QuickBooks often offers online chat support for immediate solutions to common issues. Chat support can be a fast and efficient way to receive assistance for specific problems.

- Email Support: Email support allows users to submit detailed descriptions of issues and receive responses from a support representative. Email is useful for issues requiring comprehensive explanations.

Frequently Asked Questions (FAQs)

This table summarizes common questions and answers related to QuickBooks Desktop 2022.

| Question | Answer |

|---|---|

| How do I back up my QuickBooks company file? | Regular backups are crucial. Use QuickBooks’ built-in backup features or external tools to create regular backups of your company data. |

| What are the system requirements for QuickBooks Desktop 2022? | Specific system requirements are available on the QuickBooks website. These vary depending on the version of QuickBooks and the intended functionality. |

| How do I update QuickBooks Desktop 2022? | Check the QuickBooks website for updates. Follow the instructions to update your software to the latest version. |

Alternatives and Competitors

QuickBooks Desktop 2022, while a robust accounting solution, isn’t the only option for businesses. Understanding alternative platforms and their strengths and weaknesses is crucial for informed decision-making. A careful evaluation of competitors can reveal more suitable options for specific needs and budgets. This section explores popular alternatives, highlighting their key features, pricing models, and decision-making factors.

Choosing the right accounting software is a critical business decision. Evaluating alternatives helps businesses identify the best fit for their operational requirements, scalability, and specific industry needs. Different solutions cater to varying business sizes, complexities, and technological preferences. Comparing QuickBooks Desktop 2022 with its competitors helps pinpoint the ideal match.

Popular Alternatives to QuickBooks Desktop 2022

Several powerful alternatives exist for businesses seeking accounting solutions beyond QuickBooks Desktop 2022. These options cater to various business sizes and operational needs, offering distinct features and pricing models.

- Xero: A cloud-based accounting software, Xero excels in its user-friendly interface and intuitive design. It’s particularly well-suited for small to medium-sized businesses. Its strength lies in its ease of use and comprehensive reporting features. However, it might not offer the same level of customization as QuickBooks Desktop for more complex accounting needs.

- FreshBooks: This platform is designed primarily for freelancers and small businesses. Its focus on invoicing and project management makes it ideal for those needing streamlined invoicing and client tracking. While its features are targeted, it may lack the comprehensive financial management tools found in QuickBooks Desktop for more involved financial operations.

- Zoho Books: A robust cloud-based solution, Zoho Books offers a complete suite of accounting tools. It is particularly useful for businesses that require more advanced features for inventory management and financial reporting. The platform’s strength is in its adaptability to different business models. However, it may be a more complex solution for simpler accounting needs.

- Wave Accounting: A free option for small businesses, Wave Accounting provides a straightforward approach to basic accounting. Its strengths are its simplicity and ease of use, which make it attractive for startups and businesses with limited accounting expertise. However, its limitations in advanced features might not be sufficient for complex accounting scenarios or rapid growth.

Strengths and Weaknesses of Alternative Platforms

Each alternative platform possesses specific advantages and disadvantages. Understanding these contrasts helps businesses select the best solution.

- Xero: Strengths include its user-friendly interface, robust reporting, and seamless integration with other cloud-based services. Weaknesses include potentially limited customization options compared to QuickBooks Desktop for complex financial operations.

- FreshBooks: Strengths are its excellent invoicing and project management tools, making it ideal for freelancers and small businesses. Weaknesses include a narrower scope of financial management features compared to solutions designed for more complex accounting.

- Zoho Books: Strengths include comprehensive features for inventory management and financial reporting. Weaknesses may arise for simpler accounting needs, as the platform’s complexity might be overkill.

- Wave Accounting: Strengths include its free option for basic accounting. Weaknesses include limitations in advanced features and support for more extensive financial operations.

Decision-Making Process

Selecting between QuickBooks Desktop 2022 and its competitors involves considering factors like business size, complexity of financial operations, and desired features. No one-size-fits-all answer exists.

- Consider the scale of your business operations. Larger enterprises with intricate financial needs might require the customization and advanced features offered by QuickBooks Desktop. Smaller businesses may find alternatives like Xero or Wave Accounting more suitable.

- Assess your existing accounting procedures and workflows. Analyze the level of integration with other business tools and systems.

- Compare the pricing models of each solution. Consider the cost-effectiveness in relation to your budget and the features required.

- Evaluate the user-friendliness and technical support available with each option.

Pricing Models and Comparison

The pricing structures vary considerably between QuickBooks Desktop 2022 and alternative platforms. This table summarizes the general pricing models of several alternatives.

| Software | Pricing Model | Typical Cost |

|---|---|---|

| QuickBooks Desktop 2022 | One-time purchase | $400 – $600+ |

| Xero | Subscription-based | $40-$100+ per month |

| FreshBooks | Subscription-based | $15-$60+ per month |

| Zoho Books | Subscription-based | $25-$150+ per month |

| Wave Accounting | Free (with limitations) | Free or tiered paid options |

Security and Data Management

QuickBooks Desktop 2022 prioritizes the security of your financial data. Robust security measures and clear data management strategies are crucial for protecting your business’s financial health. Understanding these aspects ensures smooth operations and compliance with financial regulations.

QuickBooks Desktop 2022 employs various security protocols to safeguard your sensitive financial information. These protocols, combined with proper data management techniques, form a comprehensive defense against potential threats. Following these guidelines helps maintain the integrity and confidentiality of your financial records.

Security Measures in QuickBooks Desktop 2022

QuickBooks Desktop 2022 utilizes encryption to protect data during transmission and storage. This means that sensitive information is encoded, making it unreadable to unauthorized parties. The specific encryption methods and their effectiveness are crucial components of the security infrastructure. Implementing strong passwords and multi-factor authentication adds further layers of protection. This approach is essential for safeguarding sensitive data.

Data Backup and Recovery Strategies

Regular data backups are essential for mitigating data loss. A robust backup strategy is critical for restoring data in case of unforeseen events, such as hardware failure or malware attacks. Implementing a consistent backup routine, involving regular offsite backups, protects against data loss and ensures business continuity.

QuickBooks Desktop 2022 allows for automatic or manual backup schedules. Using external hard drives or cloud-based storage solutions provides additional security layers. These external backups serve as crucial recovery points.

Importance of Secure Password Management

Strong passwords are a fundamental security measure. Using complex, unique passwords for your QuickBooks Desktop account and related systems is critical. This prevents unauthorized access to your financial data. Employing a password manager can further strengthen password security. Consider using a combination of uppercase and lowercase letters, numbers, and symbols in your passwords. The use of a robust password management system is crucial for enhanced security.

Protecting Your QuickBooks Desktop System from Cyber Threats

Regularly updating QuickBooks Desktop 2022 and its associated software is essential for patching security vulnerabilities. This proactive approach helps to mitigate potential cyber threats. Staying informed about current security threats and adopting best practices for network security can protect your system. Using reputable antivirus software and firewalls adds another layer of defense.

Security Protocols Summary

| Security Protocol | Description |

|---|---|

| Data Encryption | Encodes sensitive data during transmission and storage. |

| Regular Backups | Essential for restoring data in case of data loss. |

| Strong Passwords | Use unique, complex passwords for all QuickBooks accounts. |

| Software Updates | Regularly update QuickBooks and associated software to patch vulnerabilities. |

| Antivirus and Firewall | Install and maintain reputable antivirus and firewall software. |

Practical Use Cases

QuickBooks Desktop 2022 empowers businesses of all sizes to streamline their financial operations. Its intuitive interface and robust features make it a versatile tool for managing various aspects of accounting, from invoicing and expense tracking to reporting and analysis. This section explores the diverse applications of QuickBooks Desktop 2022 across various business types.

This section details practical use cases of QuickBooks Desktop 2022, illustrating how it enhances efficiency and profitability in diverse business environments. From small startups to established enterprises, QuickBooks Desktop 2022 offers a flexible solution for financial management.

Retail Businesses

Retail businesses leverage QuickBooks Desktop 2022 to efficiently manage inventory, track sales, and generate accurate reports. Real-time data on sales trends, inventory levels, and customer purchasing patterns empower retailers to make informed decisions about stock replenishment and pricing strategies. QuickBooks Desktop 2022 facilitates automated invoicing and payment processing, reducing manual work and enhancing cash flow. For instance, a clothing boutique can use QuickBooks Desktop 2022 to manage sales of different garments, track inventory movement, and generate reports on best-selling items, aiding in inventory optimization.

Service-Based Businesses

Service-based businesses, such as consulting firms and freelance contractors, utilize QuickBooks Desktop 2022 to manage client invoices, track expenses, and monitor income. Its invoicing features automate the process of sending invoices and tracking payments, ensuring timely collection and efficient cash flow management. QuickBooks Desktop 2022 allows service providers to categorize expenses based on client projects, providing a clear view of profitability per engagement. For example, a web design company can use QuickBooks Desktop 2022 to bill clients for completed projects, track project expenses, and generate reports on project profitability.

Construction Companies

Construction companies benefit from QuickBooks Desktop 2022 by managing project costs, tracking materials, and generating accurate financial reports. The software enables accurate tracking of expenses, including labor, materials, and equipment. This granular level of control aids in forecasting project costs and ensuring profitability. For instance, a construction firm can use QuickBooks Desktop 2022 to record costs for individual jobs, track the progress of each project, and ensure that each project is profitable.

Restaurant Businesses

Restaurants can utilize QuickBooks Desktop 2022 to manage point-of-sale (POS) transactions, track inventory, and generate detailed financial reports. QuickBooks Desktop 2022 allows restaurants to track food costs, manage inventory levels, and analyze sales trends to optimize profitability. This feature allows restaurants to quickly identify areas for cost reduction and increase profitability. For example, a restaurant can use QuickBooks Desktop 2022 to record sales from each table, track inventory usage, and generate reports on food costs and revenue.

Comparative Analysis of Business Types

| Business Type | Typical Use Cases |

|---|---|

| Retail | Inventory management, sales tracking, reporting, automated invoicing |

| Service-Based | Client invoicing, expense tracking, project profitability analysis |

| Construction | Project cost management, material tracking, financial reporting |

| Restaurant | POS transactions, inventory management, cost analysis, sales reporting |

Final Summary

QuickBooks Desktop 2022 offers a robust suite of tools for small businesses, empowering you to streamline operations and make data-driven decisions. Whether you’re a seasoned accountant or just starting out, this guide equips you with the knowledge to maximize the software’s potential. Ultimately, choosing the right accounting software is a crucial step for any business. We hope this guide helps you confidently choose QuickBooks Desktop 2022 or a suitable alternative for your business.