QuickBooks Online (QBO) is totally game-changing for small businesses. It’s like having a super-powered accountant in your pocket, handling everything from invoices to financial forecasting. This guide dives deep into QBO’s features, user experience, and more, so you can make the most of it.

We’ll cover everything from the different QBO editions and pricing models to the super-useful reporting and analytics tools. Plus, we’ll look at how QBO integrates with other business apps, so you can streamline your entire workflow. Getting a handle on QBO is totally doable—just keep reading!

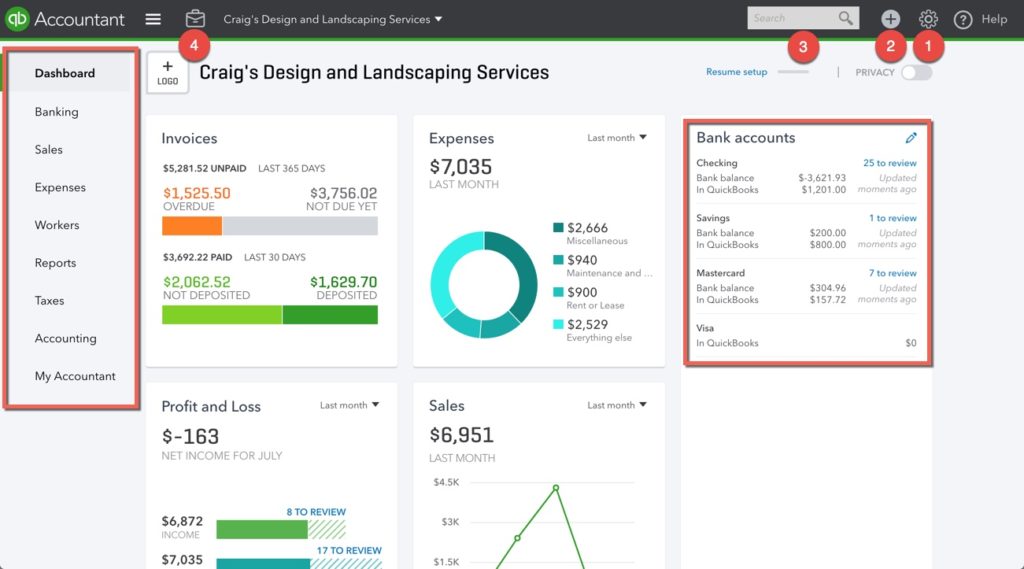

User Experience and Interface

QuickBooks Online (QBO) is a popular accounting software used by small businesses and entrepreneurs. Understanding its user experience and interface is crucial for efficient financial management. A smooth and intuitive QBO experience translates directly to time saved and reduced errors. This section delves into the details of QBO’s interface, navigation, potential pain points, and integration with other tools.

QBO’s interface is designed to be user-friendly, aiming to simplify complex accounting tasks. However, the effectiveness of the design depends heavily on the user’s familiarity with accounting principles and the specific tasks they need to accomplish. Different users may experience different levels of ease or frustration depending on their individual needs and the nature of their business operations.

QBO Interface Overview

QBO’s interface is primarily a web-based application. It utilizes a dashboard-style layout with prominent areas for key financial data, such as income, expenses, and balance sheets. Key features are organized into modules, allowing for easy access to specific functions like invoicing, expense tracking, and bank reconciliation. Navigating between modules is straightforward, usually accomplished through clear menu options or tabs. The design is generally clean and organized, although the layout might seem cluttered for users with extensive business needs.

Navigation and Feature Organization

QBO’s navigation is intuitive, using menus and sub-menus to access different functions. Features are grouped logically, reflecting common accounting workflows. For example, invoicing tools are grouped together, making it easy to create, send, and track invoices. However, a novice user might find the sheer number of options overwhelming. Users with specific needs, like complex inventory management or advanced reporting, might find certain features less accessible or well-organized.

Common User Pain Points

Users often experience frustration with QBO’s complexity when trying to manage a large volume of transactions or integrate with specific industry-specific software. Another significant issue is the learning curve, especially for those new to accounting software. Furthermore, a lack of clear and comprehensive documentation for advanced features or custom configurations can create challenges for users. These difficulties often result in wasted time searching for solutions and troubleshooting. Sometimes, users find the interface less intuitive when performing complex tasks, like advanced reporting or complex calculations.

User Flow for a Typical Transaction

A typical transaction flow in QBO involves several steps. First, the user records the transaction using a specific form or entry field, depending on the nature of the transaction. Next, the user reviews the recorded transaction for accuracy. If needed, the user can make adjustments to the transaction details. Finally, the user saves the transaction and proceeds to other tasks. The transaction’s data is automatically categorized and included in reports, simplifying the analysis of financial performance.

| Step | Action | Description |

|—|—|—|

| 1 | Input Transaction Data | Enter details of the transaction, including amount, date, description, and related accounts. |

| 2 | Review and Edit | Verify the accuracy of the transaction data. Make corrections if necessary. |

| 3 | Save Transaction | Finalize the transaction recording. |

| 4 | Generate Reports | Use QBO’s reporting features to analyze the transaction. |

Integration with Other Tools

QBO integrates with various business tools. These integrations can automate data transfer between QBO and other applications, streamlining workflow. For example, QBO can connect to payment gateways, allowing for automatic synchronization of transactions. Integrations with inventory management systems, CRM software, or marketing automation platforms are also possible. This seamless integration with other tools allows for efficient information flow between various parts of the business. A notable limitation is that the available integration options might vary based on the specific tool a business is using.

Key Features and Functionality

QuickBooks Online (QBO) offers a comprehensive suite of tools for managing various aspects of a business. Its user-friendly interface and intuitive navigation make it accessible to businesses of all sizes, from startups to established enterprises. This section dives into the core functionalities of QBO, focusing on its robust invoicing, expense tracking, inventory management, financial forecasting, and CRM capabilities.

Invoicing and Billing Capabilities

QBO streamlines the invoicing process, allowing businesses to create professional invoices quickly and easily. Features include automated invoice generation based on pre-defined templates, customizable due dates, and options for recurring billing. QBO integrates seamlessly with payment processors, facilitating smooth payment collection. This automated approach not only saves time but also reduces the risk of errors.

Expense Tracking and Reporting Features

QBO offers detailed expense tracking, allowing users to categorize and record expenses efficiently. The system provides various reporting options, enabling businesses to analyze spending patterns and identify areas for cost optimization. QBO’s reporting features generate insightful summaries and detailed breakdowns, making it easier to track budgets and make informed financial decisions. Users can easily categorize expenses into various accounts for accurate financial reporting.

Inventory Management Tools

QBO provides inventory management tools that help track stock levels, monitor sales, and manage inventory costs. The system allows businesses to set up different inventory costing methods (e.g., FIFO, LIFO, Weighted Average) for optimal accounting. This functionality enables businesses to accurately value their inventory and maintain precise records of stock on hand. Businesses can also use QBO’s inventory tools to forecast demand and optimize purchasing strategies.

Best Practices for Using QBO for Financial Forecasting

Leveraging QBO’s data for financial forecasting is crucial for strategic planning. Businesses should consistently input accurate financial data into QBO, ensuring data integrity for reliable projections. QBO reports and dashboards can be used to create forecasts, identifying trends, and extrapolating potential future performance. For example, a company can analyze past sales data to predict future revenue, considering seasonal fluctuations and market trends.

QBO’s Customer Relationship Management (CRM) Tools

QBO’s CRM tools facilitate relationship management with customers. The system allows businesses to store customer information, track interactions, and manage sales opportunities. Key features include contact management, task assignment, and reporting on customer interactions. This organized approach allows businesses to build stronger relationships with their customers, ultimately boosting sales and loyalty.

Integration and API

QuickBooks Online (QBO) shines as a powerful accounting platform precisely because of its robust integration capabilities. This allows businesses to seamlessly connect QBO with other crucial applications, streamlining workflows and improving overall efficiency. This is achieved through various avenues, including direct connections with financial institutions, partnerships with popular business tools, and a flexible API for custom integrations.

QBO’s integrations are not just about connecting software; they’re about creating a unified ecosystem for business operations. By linking QBO with other essential tools, businesses can eliminate data silos, automate tasks, and gain a holistic view of their financial health. This streamlined approach boosts productivity and reduces manual errors, making QBO a comprehensive solution for modern businesses.

Integration Options with QBO

QBO offers a multitude of integration options, allowing businesses to tailor their financial management system to their specific needs. These options enhance QBO’s functionality beyond accounting by connecting it with various other applications.

- Direct Bank Connections: QBO allows direct connections with various financial institutions. This facilitates automatic bank feeds, importing transactions, and reconciling accounts without manual input. This feature significantly reduces the time spent on manual data entry and minimizes the potential for errors, saving valuable time and resources.

- Third-Party Application Integrations: QBO seamlessly integrates with many popular business applications, including inventory management systems, CRM platforms, and e-commerce solutions. This interoperability allows businesses to synchronize data across different tools, improving data accuracy and streamlining workflows. For example, an e-commerce store can automatically transfer sales data to QBO for accurate financial reporting.

- Custom Integrations via API: QBO’s Application Programming Interface (API) enables developers to build custom integrations tailored to specific business needs. This flexibility allows for a deeper level of automation and customized workflows. Developers can create bespoke integrations that streamline processes not covered by existing third-party solutions.

Examples of Third-Party Integrations

QBO’s extensive ecosystem of third-party integrations showcases its versatility. These applications enhance QBO’s capabilities, allowing businesses to handle various tasks more efficiently.

- Inventory Management Systems: Many inventory management platforms integrate with QBO, automatically updating inventory levels and costs. This integration ensures accurate inventory valuations and simplifies order fulfillment. A popular example would be linking a retail store’s inventory management system to QBO for real-time inventory updates and cost tracking.

- Customer Relationship Management (CRM) Platforms: QBO integrates with various CRM systems, allowing businesses to track customer interactions and sales data within QBO. This integration helps businesses gain a holistic view of customer relationships and improve sales forecasting. A restaurant using QBO could link their CRM system to automate order processing and tracking sales by customer segment.

- E-commerce Platforms: E-commerce platforms like Shopify and WooCommerce seamlessly connect to QBO, automatically importing sales data, streamlining financial reporting, and managing transactions. This eliminates the need for manual data entry, saving time and resources.

Connecting to External Financial Institutions

The process of connecting QBO to external financial institutions is typically straightforward. Users typically log into their QBO account, navigate to the banking integration section, select their financial institution, and authorize the connection. This process involves providing QBO with necessary permissions to access account data. This authorization step ensures security and prevents unauthorized access to sensitive financial information.

Reporting and Analytics

QuickBooks Online (QBO) provides robust reporting and analytics features, empowering users to gain valuable insights into their financial performance. These tools enable informed decision-making, efficient resource allocation, and improved financial management. From generating standard financial reports to crafting custom analyses, QBO offers a comprehensive suite of tools to visualize and interpret financial data.

QBO’s reporting and analytics capabilities are designed to be accessible and user-friendly. The intuitive interface allows users to easily navigate various reports, customize data displays, and drill down into specific details. This accessibility fosters better understanding of financial trends and facilitates strategic planning.

Standard Financial Reports

QBO offers a suite of pre-built financial reports, categorized to cover different aspects of business operations. These reports are designed to give a quick overview of key financial metrics, allowing users to assess profitability, cash flow, and overall performance. Examples include balance sheets, income statements, and cash flow statements. These reports are essential for monitoring business health and identifying areas for improvement.

Custom Report Creation

QBO allows users to create customized reports beyond the standard offerings. This flexibility is crucial for tailoring reports to specific business needs and requirements. Users can select specific accounts, periods, and metrics to generate reports that directly address their questions and concerns. This customization allows for detailed analysis of unique business operations and patterns.

Financial Analysis with QBO Tools

QBO’s reporting tools enable a range of financial analyses. Users can track key performance indicators (KPIs) like revenue growth, cost reduction, and profit margins. These analyses can be further enhanced by filtering data by specific departments, products, or customers. Through trend analysis, QBO helps users understand the impact of various business decisions and identify areas where adjustments might be necessary. This helps in strategic planning, proactive decision-making, and optimized financial management. For example, by tracking sales trends, a business can adjust pricing strategies or marketing campaigns.

Key Financial Reports in QBO

QBO provides several key financial reports that are commonly used. These include:

- Balance Sheet: Provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It shows the financial position of the business.

- Income Statement: Summarizes a company’s revenues and expenses over a period of time, revealing profitability. It shows the financial performance of the business.

- Cash Flow Statement: Details the movement of cash into and out of a business over a period of time. It shows the liquidity of the business.

- Profit and Loss Statement: A crucial report that displays the revenue and expenses of a business over a given period. This helps assess profitability and identify areas where revenue or expenses can be improved.

Types of Reports in QBO

The following table Artikels the various types of reports available in QBO:

| Report Type | Description |

|---|---|

| Balance Sheet | A snapshot of a company’s assets, liabilities, and equity at a specific point in time. |

| Income Statement | Summarizes revenues and expenses over a period, showing profitability. |

| Cash Flow Statement | Details cash inflows and outflows over a period, demonstrating liquidity. |

| Profit & Loss Statement | Shows revenue and expenses over a period, indicating profitability. |

| Trial Balance | Lists all accounts and their balances, useful for verifying accounting records. |

| Sales Reports | Provides detailed sales data, helping analyze sales performance by product, customer, or other criteria. |

| Expense Reports | Details expenses by category or department, enabling cost analysis and control. |

Security and Compliance

QuickBooks Online (QBO) prioritizes the security of its users’ financial data. Robust security measures and adherence to strict compliance standards are essential for maintaining trust and protecting sensitive information. This focus on security extends to data protection, transaction security, and best practices for users. Understanding these aspects is crucial for leveraging QBO’s features confidently and securely.

QBO employs a multi-layered approach to security, combining advanced technologies with stringent compliance protocols. This ensures a secure environment for handling financial data and transactions, mitigating risks associated with unauthorized access and data breaches. This comprehensive strategy is paramount for building user trust and maintaining a high level of confidentiality.

QBO’s Security Measures and Data Protection

QBO utilizes industry-standard encryption protocols to protect data both in transit and at rest. This safeguards sensitive information from potential breaches and unauthorized access. QBO’s security measures are regularly audited and updated to maintain effectiveness against evolving threats. This proactive approach ensures the highest level of protection for user data.

Compliance Standards Adhered to by QBO

QBO adheres to various compliance standards, including but not limited to:

- PCI DSS (Payment Card Industry Data Security Standard): This standard mandates security measures for organizations handling credit card information. QBO’s adherence to PCI DSS ensures the secure processing of payments within the platform, protecting user financial details.

- GDPR (General Data Protection Regulation): This EU regulation Artikels data protection rights and obligations. QBO’s adherence to GDPR ensures compliance with regulations related to data collection, processing, and storage for users in the EU region.

- Other Relevant Industry Standards: QBO continuously monitors and updates its security protocols to meet other applicable industry standards relevant to financial data handling.

Security Best Practices for QBO Users

Implementing strong security practices is critical for mitigating risks and ensuring data protection.

- Strong Passwords: Use strong, unique passwords for your QBO account and other associated accounts. Avoid using easily guessed passwords. Employ a password manager for secure storage of multiple passwords.

- Two-Factor Authentication (2FA): Enabling 2FA adds an extra layer of security by requiring a second verification method (e.g., code sent to your phone) beyond your password.

- Regular Updates: Keep your QBO software and related applications updated to ensure you have the latest security patches and improvements.

- Suspicious Activity Reporting: Immediately report any suspicious activity, such as unusual login attempts or unauthorized access, to QBO support.

How QBO Protects User Data and Transactions

QBO employs various techniques to safeguard user data and transactions. These include secure server infrastructure, intrusion detection systems, and regular security audits.

- Secure Server Infrastructure: QBO utilizes secure servers with robust security measures to protect data from unauthorized access and breaches.

- Transaction Security: QBO utilizes industry-standard encryption to secure financial transactions, preventing unauthorized access to sensitive financial information during transfer and processing.

- Data Backup and Recovery: QBO maintains regular backups of user data to ensure data integrity and facilitate recovery in case of data loss.

Comparison of QBO’s Security Features to Other Accounting Software

QBO’s security features are robust and comparable to those of other leading accounting software providers. However, specific features and their implementation may vary. Detailed comparisons of security features across various accounting software are available from independent security reviews and third-party reports.

Support and Learning Resources

Navigating QuickBooks Online (QBO) can sometimes feel overwhelming, especially for new users. Fortunately, QBO provides comprehensive support and learning resources to help users get the most out of the software. This section will explore the various avenues available for assistance and skill development.

QBO’s support network extends beyond just troubleshooting; it’s a robust system designed to empower users at every stage of their QBO journey. From beginner tutorials to in-depth guides, the resources cater to a wide range of skill levels and needs.

Support Options Available for QBO Users

QBO offers a diverse array of support options, ensuring users can find the assistance they need, whether it’s immediate help or a more in-depth learning experience. Users can choose the method that best suits their situation and learning style.

Learning Resources for Using QBO

QBO provides a wealth of learning resources to equip users with the knowledge and skills necessary to effectively use the software. These resources range from basic tutorials to advanced guides, catering to a broad spectrum of needs and skill levels.

Online Tutorials and Documentation

QBO’s website features extensive online documentation, including video tutorials, step-by-step guides, and FAQs. These resources are frequently updated to reflect the latest software features and functionalities. These tutorials and documentation are designed to be easy to follow, covering everything from basic setup to advanced financial reporting. Many tutorials are organized by task or feature, allowing users to easily find the specific information they need. Examples include video demonstrations of setting up accounts, processing transactions, and generating reports. These resources often incorporate visual aids and practical examples to enhance understanding.

QBO Support Channels

QBO offers various support channels to cater to different needs and preferences. These channels range from self-service options to direct assistance from QBO’s support team. This allows users to find the support method that best suits their situation.

Support Channels Summary

This table summarizes QBO’s different support channels and their contact information.

| Channel | Contact Information |

|---|---|

| Phone Support | A dedicated phone line for QBO users. Contact information is available on the QBO website. |

| Email Support | An email address for submitting support requests. Contact information is available on the QBO website. |

| Online Chat Support | Real-time chat support with QBO’s support team, available during specific hours. Contact information is available on the QBO website. |

| Knowledge Base | Comprehensive online documentation, tutorials, and FAQs accessible through the QBO website. |

Mobile Access and Features

QuickBooks Online (QBO) recognizes the importance of mobile access in today’s business environment. Its mobile application empowers users to manage their finances on the go, whether checking invoices, tracking expenses, or making payments. This accessibility streamlines workflows, allowing businesses to remain agile and responsive.

QBO’s mobile app provides a streamlined, user-friendly interface that mirrors the desktop experience, enabling users to perform many key tasks without needing a desktop computer. This enhances efficiency and productivity by allowing access to critical information anytime, anywhere.

QBO Mobile Application Features

The QBO mobile application offers a comprehensive suite of features, designed to facilitate seamless financial management. These features are crucial for business owners and managers who need immediate access to their data and operational insights.

Key Functionality in the Mobile App

The mobile app provides access to critical data, including invoices, bills, expense reports, and bank transactions. Users can review and approve transactions, making payments, and manage their business financials in real time.

Example Accounting Task Simplification

The mobile app simplifies various accounting tasks. For instance, a business owner can instantly review and approve vendor invoices on their phone, eliminating delays in payment processing. Additionally, employees can record expenses directly from their mobile devices, streamlining the expense reporting process and saving time.

Real-Time Data Updates

The mobile app provides real-time data updates, ensuring users always have access to the most current information. This is crucial for making informed decisions and managing cash flow effectively. This real-time access allows for prompt responses to changing market conditions and customer needs.

Customizable Dashboards

Users can customize their dashboards to display the most relevant information, such as key performance indicators (KPIs) and recent transactions. This personalization ensures that the user interface aligns with specific business needs and goals.

Payment Processing Capabilities

The mobile app supports payment processing, allowing users to receive and make payments quickly and efficiently. This capability enhances business operations, facilitating quick response to customers and streamlining cash flow. Users can initiate and manage payments directly through the app.

Integration with Other QBO Features

The QBO mobile app integrates seamlessly with other QBO features, such as invoicing, expense tracking, and bank reconciliation. This integration ensures a unified experience across all QBO platforms, whether desktop or mobile. Data flows seamlessly between the mobile app and other QBO functions.

Pricing and Plans

QuickBooks Online (QBO) offers flexible pricing plans tailored to various business needs and sizes. Understanding these plans is crucial for choosing the right solution for your company. Different features and functionalities are bundled with different pricing tiers, ensuring that businesses can access the tools they require without unnecessary costs.

QBO’s pricing structure is designed to be scalable, allowing businesses to upgrade or downgrade plans as their needs evolve. This adaptability is a significant advantage, allowing businesses to optimize their financial management resources.

Pricing Plan Details

QBO offers several pricing plans, each with varying levels of features and functionalities. These plans are designed to cater to different business sizes and requirements. This detailed overview clarifies the options available and the specific benefits of each.

- Basic Plan: This plan is suitable for small businesses with limited needs. It typically includes essential features for basic accounting, invoicing, and reporting. The core features allow for streamlined bookkeeping and financial management, providing a foundation for growth.

- Plus Plan: This plan builds upon the Basic plan, adding advanced features like inventory management, sales tax handling, and multi-currency support. It’s a more comprehensive solution for businesses that require more functionality and sophistication in their accounting processes. This plan caters to a broader range of business needs.

- Premium Plan: This plan provides the most extensive features and functionalities, including advanced reporting tools, financial forecasting, and dedicated customer support. It’s tailored for larger businesses and organizations with more complex financial requirements and reporting demands. The premium plan delivers comprehensive accounting solutions.

Features Included in Each Plan

Each pricing plan offers a specific set of features and functionalities. These features help users manage their finances effectively.

| Plan | Invoicing | Inventory Management | Multi-Currency | Sales Tax | Reporting |

|---|---|---|---|---|---|

| Basic | Yes | No | No | Yes | Basic |

| Plus | Yes | Yes | Yes | Yes | Advanced |

| Premium | Yes | Yes | Yes | Yes | Advanced, customizable |

Pricing Plan Comparison

The table above illustrates the key differences in features between the three plans. It’s important to carefully evaluate your specific needs before choosing a plan. A detailed comparison highlights the unique characteristics of each tier.

Factors Influencing Plan Choice

Several factors influence the selection of a QBO pricing plan. Business size, required features, and anticipated growth are crucial considerations. User needs and future requirements play a critical role in determining the appropriate plan.

- Number of users: The number of users accessing the QBO system will impact the appropriate plan choice. Larger teams may require a plan that accommodates multiple users.

- Monthly transactions: The volume of transactions handled each month will influence the chosen plan. Higher transaction volumes might require a plan with more capacity.

- Specific features: The need for specific features like inventory management or multi-currency support will guide the plan selection. Businesses with inventory management needs may choose a plan that supports this.

Comparison with Competitors’ Plans

Comparing QBO’s pricing with competitors’ plans is essential for making an informed decision. Competitor pricing structures vary, and QBO’s value proposition should be assessed in relation to its competitors’ offerings.

Closure

So, QBO is more than just accounting software; it’s a powerful tool to help your business thrive. We’ve explored its core functionalities, user experience, and integration capabilities, highlighting the advantages of using QBO for everything from invoicing to financial forecasting. Ultimately, mastering QBO empowers you to make data-driven decisions, optimize your business processes, and unlock significant growth potential.