Self-employment presents unique financial challenges, requiring meticulous record-keeping and efficient management tools. This comprehensive guide delves into QuickBooks, a popular accounting software specifically designed for self-employed individuals. We’ll explore its functionalities, setup procedures, and tax implications, equipping you with the knowledge to effectively manage your finances and streamline your business operations.

From setting up your account and categorizing income and expenses to managing invoicing, generating reports, and understanding tax implications, this guide provides a structured approach to harnessing QuickBooks for optimal self-employment success. We’ll also address common QuickBooks issues and troubleshooting steps, ensuring a smooth user experience.

Introduction to QuickBooks for the Self-Employed

QuickBooks, a widely used accounting software, offers a streamlined solution for self-employed individuals to manage their finances efficiently. From tracking income and expenses to generating reports, QuickBooks empowers entrepreneurs to focus on their core business activities. Understanding the nuances of QuickBooks tailored for the self-employed is crucial for optimizing financial management and making informed business decisions.

QuickBooks, while a powerful tool, isn’t a one-size-fits-all solution. Its features, plans, and functionalities need to be evaluated against individual needs. Careful consideration of the advantages and disadvantages, alongside a clear understanding of the various QuickBooks plans, can help self-employed individuals make the right choice for their business structure.

Fundamental Functionalities of QuickBooks for the Self-Employed

QuickBooks offers a suite of features specifically designed to meet the accounting needs of self-employed individuals. These include robust invoicing capabilities, automatic expense tracking, and detailed financial reporting. This enables efficient monitoring of income and expenditures, facilitating better cash flow management.

Advantages of Using QuickBooks for Self-Employed Individuals

QuickBooks simplifies financial record-keeping, offering a centralized platform for managing invoices, payments, and expenses. It automates many accounting tasks, freeing up time for core business activities. The detailed financial reports provide insights into profitability and performance trends, allowing for informed decision-making.

Disadvantages of Using QuickBooks for Self-Employed Individuals

While QuickBooks offers numerous benefits, there are potential drawbacks. The software can be complex to navigate for individuals without accounting experience. Subscription fees can accumulate over time, and some features may not be essential for all self-employed individuals.

QuickBooks Plans and Suitability for Self-Employed Individuals

QuickBooks offers different plans catering to various needs and budgets. The “Self-Employed” plan, often a cost-effective choice, provides the essential tools for tracking income and expenses, managing invoices, and generating reports. For individuals with more complex needs or larger businesses, QuickBooks Online or other higher-tiered plans offer enhanced features, such as inventory management or advanced reporting tools.

Common Misconceptions about QuickBooks Usage for the Self-Employed

A common misconception is that QuickBooks is only for large businesses. This is incorrect; QuickBooks offers tailored plans specifically for self-employed individuals. Another misconception is that QuickBooks is overly complex. While it has many features, many self-employed individuals find it user-friendly with adequate training.

Comparison of QuickBooks Features for Different Business Types

The table below illustrates the suitability of QuickBooks features for different business types, such as freelance, consultant, and small business owners.

| Feature | Freelance | Consultant | Small Business |

|---|---|---|---|

| Invoicing | Essential for tracking client payments. | Crucial for professional billing. | Critical for managing multiple client projects. |

| Expense Tracking | Important for managing personal and business expenses. | Necessary for documenting professional travel and expenses. | Essential for controlling operational costs. |

| Reporting | Provides insights into income and expenses. | Offers detailed financial analysis for client presentations. | Allows for detailed profitability and performance tracking. |

| Inventory Management | Not usually needed, unless selling physical products. | Not usually needed. | Essential for tracking inventory and stock levels. |

Setting Up QuickBooks for Self-Employment

Navigating the world of self-employment often involves juggling numerous tasks. QuickBooks can streamline these processes, offering a robust platform for managing finances. Proper setup is crucial for accurate record-keeping, efficient tax preparation, and overall business success. This section details the essential steps involved in setting up your QuickBooks account, emphasizing the importance of accurate business structure selection and effective expense categorization.

Choosing the Right Business Structure

Selecting the appropriate business structure is paramount for legal and financial reasons. A sole proprietorship is a simple structure where the business and owner are not legally separate. Limited Liability Companies (LLCs) offer liability protection, separating personal assets from business debts. Choosing the correct structure ensures compliance with tax regulations and protects your personal assets. Consider consulting with a legal professional for personalized guidance.

Categorizing Income and Expenses

Effective categorization of income and expenses in QuickBooks is vital for generating insightful financial reports. Categorize income based on its source, such as consulting fees, freelance work, or sales. Expenses should be meticulously classified according to their nature—rent, utilities, office supplies, marketing, etc. Consistent categorization enables accurate financial analysis and tax reporting.

Tracking Business Expenses

Mileage tracking is a critical aspect of self-employment accounting. Utilize QuickBooks to meticulously record business mileage, which is often deductible. Other crucial business-related expenses, including office supplies, marketing materials, and software subscriptions, should also be meticulously tracked. This detailed record-keeping will streamline your tax preparation process.

Linking Bank Accounts to QuickBooks

Linking your bank accounts to QuickBooks is a straightforward process, enabling automatic import of transactions. Follow these steps: (1) Log into your QuickBooks account. (2) Navigate to the banking section. (3) Select the bank account to connect. (4) Authorize QuickBooks to access your bank data. If you encounter issues, ensure that your bank is supported by QuickBooks and verify that the account is correctly identified. Troubleshooting common errors often involves checking your internet connection, verifying your bank account details, or contacting QuickBooks support.

Expense Categorization Table

| Category | Description | Example |

|—|—|—|

| Rent | Payments for office space or workspace | Monthly rent for office space |

| Utilities | Payments for electricity, water, gas | Electricity bills, internet bills |

| Office Supplies | Purchases of office equipment or materials | Printer ink, paper, pens |

| Marketing | Expenses related to promoting your business | Advertising costs, social media ads |

| Software Subscriptions | Fees for software applications | QuickBooks subscription, accounting software |

| Travel | Expenses related to business travel | Airfare, hotel costs, transportation |

| Professional Fees | Expenses for professional services | Accountant fees, lawyer fees |

| Equipment | Purchases of business equipment | Computer, printer, furniture |

| Supplies | Purchases of materials used in your business | Raw materials, packaging materials |

Managing Finances with QuickBooks

Mastering your finances as a self-employed individual is crucial for success. QuickBooks provides a powerful platform to track income, expenses, and overall financial health. This section will guide you through accurate financial management within QuickBooks, focusing on key aspects for self-employed professionals.

Precise tracking of income and expenses is fundamental to financial well-being. By meticulously recording all transactions, you gain a clear understanding of your financial performance. This knowledge allows for informed decision-making, strategic planning, and ultimately, achieving your financial goals.

Tracking Income and Expenses Accurately

Accurate income and expense tracking is the cornerstone of financial success. QuickBooks offers intuitive tools to record every transaction, ensuring you have a comprehensive view of your financial activity. This allows for a clear picture of your profitability and areas for improvement.

Recording Invoices and Payments

Recording invoices and payments is a crucial aspect of managing finances within QuickBooks. This process involves meticulously documenting the details of each transaction, including client name, invoice date, amount, and payment method. For example, if you provide consulting services, each invoice should clearly state the service rendered, the date, and the agreed-upon fee. Payments received should be recorded promptly with the corresponding invoice number to maintain a clear audit trail. This detailed approach ensures accurate accounting and prevents potential discrepancies.

Maintaining Detailed Records of All Transactions

Maintaining meticulous records of all transactions is vital for accurate financial reporting and tax compliance. Detailed records provide a historical account of your financial activity, allowing for easier analysis and understanding of trends. This comprehensive record-keeping is crucial for preparing accurate tax returns and for identifying potential financial issues early on. Every transaction, whether large or small, should be documented. This detailed approach provides a complete picture of your financial activity.

Comparing Invoicing Methods and QuickBooks Integration

Various invoicing methods exist, each with its own advantages and disadvantages. QuickBooks seamlessly integrates with many invoicing methods, allowing for automatic data transfer and streamlining the entire process. For example, some methods include email invoicing, online invoicing platforms, and traditional paper invoicing. The integration varies depending on the chosen method, but QuickBooks provides tools to efficiently manage invoices regardless of the invoicing method used.

Generating Reports in QuickBooks

QuickBooks offers a comprehensive suite of reports to provide insights into your financial performance. These reports are essential for monitoring key metrics, identifying trends, and making informed decisions. Using these reports, you can effectively track your income and expenses, analyze profitability, and make strategic adjustments as needed. Reports also allow for comprehensive analysis of your financial position and performance.

Financial Reports in QuickBooks

This table Artikels various financial reports available in QuickBooks for self-employed individuals.

| Report Name | Purpose | Typical Use Cases |

|---|---|---|

| Profit and Loss Statement | Shows your business’s profitability over a specific period. | Analyzing revenue, costs, and net income; identifying areas of potential improvement. |

| Balance Sheet | Provides a snapshot of your business’s financial position at a specific point in time. | Assessing assets, liabilities, and equity; evaluating overall financial health. |

| Cash Flow Statement | Tracks the movement of cash in and out of your business over a specific period. | Monitoring cash flow; planning for future expenses; identifying potential cash flow issues. |

| Customer Transaction Detail | Provides detailed information about individual customer transactions. | Analyzing customer spending habits; identifying high-value customers; managing outstanding invoices. |

| Vendor Transaction Detail | Provides detailed information about individual vendor transactions. | Managing supplier relationships; negotiating better pricing; ensuring timely payments. |

Taxes and QuickBooks for the Self-Employed

Navigating the complexities of self-employment taxes can be daunting. QuickBooks, however, provides a robust platform to manage these crucial financial aspects, simplifying the process and ensuring accurate record-keeping. This section will delve into the critical role of QuickBooks in handling tax obligations for the self-employed.

Understanding the tax implications is fundamental to effective financial management. Self-employed individuals face unique tax responsibilities compared to traditional employees. These responsibilities often involve quarterly estimated tax payments, self-employment tax, and meticulous record-keeping. QuickBooks streamlines this process, enabling efficient tax preparation and minimizing potential errors.

Significance of Tax Implications for Self-Employed Individuals

Self-employed individuals are responsible for both paying and withholding income taxes. This includes Social Security and Medicare taxes, which are typically handled by employers for traditional employees. Self-employment tax covers these components, and it’s essential to accurately calculate and pay these taxes to avoid penalties. Incorrect calculations or missed payments can lead to significant financial burdens.

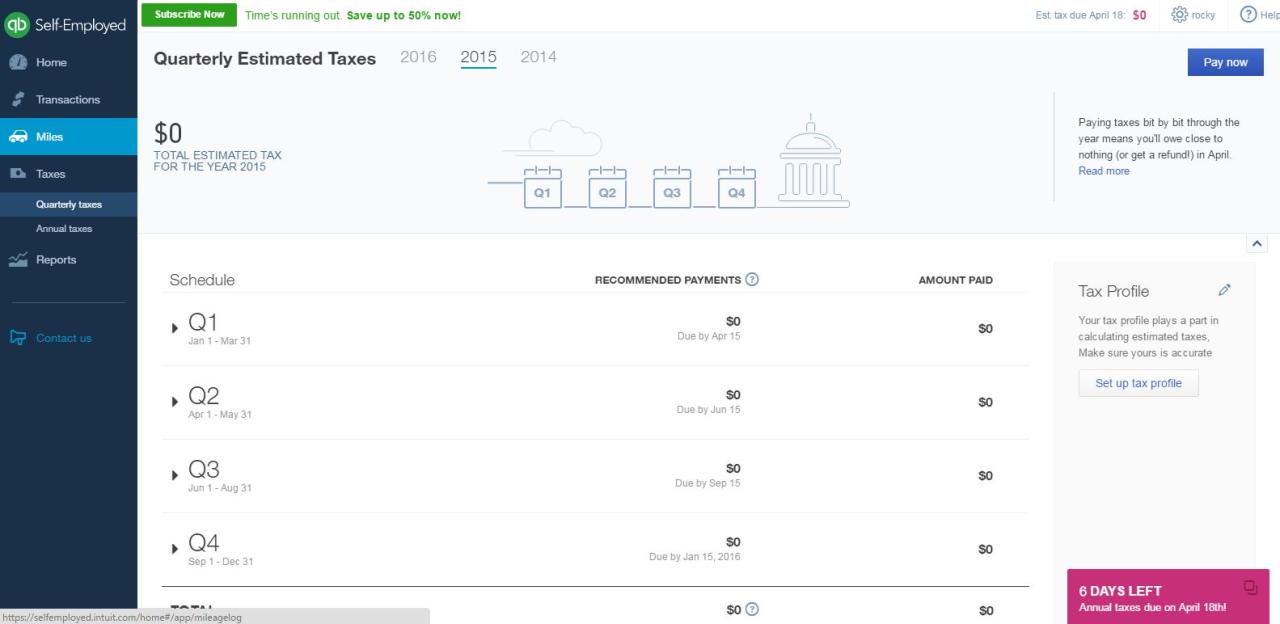

How QuickBooks Helps in Calculating Estimated Taxes

QuickBooks offers tools to calculate and track estimated taxes. By inputting income and expenses, QuickBooks can automatically estimate the amount of taxes owed. This feature ensures timely payments and prevents potential penalties for underpayment. For example, if a freelancer’s income fluctuates throughout the year, QuickBooks can help them project their estimated tax liability, ensuring they meet their quarterly obligations.

Use of QuickBooks for Tracking Self-Employment Tax

QuickBooks’ meticulous record-keeping capabilities allow for accurate tracking of self-employment tax. This involves meticulously documenting all income and expenses related to self-employment activities. The software can automatically calculate the self-employment tax liability based on the entered data, providing a clear picture of the tax burden. This crucial function empowers self-employed individuals to stay compliant and avoid any potential tax discrepancies.

Essential Tax Forms and Their Connection to QuickBooks

Accurate record-keeping and timely submission of tax forms are critical for self-employed individuals. QuickBooks facilitates this by providing connections to essential tax forms. This includes Schedule C (Profit or Loss from Business), Schedule SE (Self-Employment Tax), and Form 1040 (U.S. Individual Income Tax Return). These forms require specific data points, and QuickBooks can export data directly into these forms, simplifying the process.

- Schedule C: This form details business income and expenses. QuickBooks’s categorization of transactions allows for seamless transfer of data to Schedule C, reducing manual entry errors.

- Schedule SE: This form calculates self-employment tax. QuickBooks’ automated calculations ensure accuracy and facilitate the direct export of the required data for this form.

- Form 1040: This form consolidates the entire tax picture. QuickBooks allows for the export of necessary information from various parts of the financial records, enabling a streamlined preparation of Form 1040.

Exporting Data from QuickBooks for Tax Filing

A key advantage of QuickBooks is its ability to export financial data for tax filing. This feature allows for the seamless transfer of information to tax preparation software or directly to tax forms. The data exported is accurate and reliable, ensuring that tax returns are prepared with precision. For example, a freelancer can export their income and expense data from QuickBooks to their tax software, saving considerable time and reducing the risk of errors.

Comparison of Tax Software Options for Self-Employed Individuals with QuickBooks

| Software | Features | Pricing |

|---|---|---|

| QuickBooks Self-Employed | Integrated tax tools, estimated tax calculations, and automatic data export. | Various pricing plans, including options for self-employed individuals. |

| TaxAct | User-friendly interface, extensive tax form support, and options for various tax situations. | Subscription-based pricing, often with tiered options. |

| H&R Block | Comprehensive tax preparation tools, including support for self-employment, and extensive customer support. | Subscription-based pricing with varying tiers. |

Utilizing QuickBooks Tools and Features

QuickBooks offers a wealth of tools beyond basic bookkeeping, empowering self-employed individuals to streamline their operations and gain valuable insights. From managing inventory and client relationships to tracking projects and generating insightful reports, QuickBooks can significantly enhance your business efficiency. This section delves into the practical application of these tools for the self-employed.

The powerful features of QuickBooks transcend simple accounting. Leveraging inventory management, CRM, invoicing, payment processing, project tracking, and comprehensive reporting, self-employed individuals can gain a clear and accurate picture of their business performance, enabling better decision-making and growth.

Inventory Management

Managing inventory is crucial for self-employed individuals, particularly those involved in selling products. QuickBooks’ inventory management tools allow you to track stock levels, costs, and sales. This functionality helps prevent stockouts and overstocking, ensuring optimal inventory levels to maximize profitability. Accurate inventory tracking allows you to anticipate future needs and make informed decisions about ordering and pricing.

Customer Relationship Management (CRM)

QuickBooks’ CRM features enable self-employed individuals to nurture relationships with clients and prospects. This includes storing contact information, tracking communication history, and managing sales opportunities. Effective CRM helps build stronger client relationships, leading to increased loyalty and repeat business.

Creating and Sending Invoices

QuickBooks streamlines the invoicing process. It allows you to create professional-looking invoices with detailed descriptions of services or products, due dates, and payment terms. Sending invoices through QuickBooks is efficient, saving time and reducing the risk of errors compared to manual methods. Automated reminders for outstanding invoices further enhance cash flow management.

Payment Processing Options

QuickBooks integrates with various payment processors, allowing you to accept payments from clients seamlessly. Options include credit cards, debit cards, and online payment platforms. The integration simplifies the payment process, reduces manual data entry, and offers insights into transaction details. This automation improves the overall payment collection efficiency.

Project Tracking and Time Management

For self-employed professionals, project tracking is essential. QuickBooks enables you to monitor project progress, track time spent on specific tasks, and manage budgets. This feature offers valuable insights into project timelines and resource allocation. Detailed time tracking facilitates accurate billing and project costing, enhancing profitability.

Reporting Features

QuickBooks offers comprehensive reporting capabilities tailored for self-employed individuals. These reports provide insights into key financial metrics, including sales performance, profitability, and expenses. Customizable reports can be generated to address specific business needs, allowing you to analyze trends, identify areas for improvement, and make data-driven decisions.

QuickBooks Tools Overview

| Tool | Description | Application for Self-Employed Individuals |

|---|---|---|

| Inventory Management | Tracks stock levels, costs, and sales. | Optimizes stock, avoids overstocking/stockouts, improves decision-making. |

| CRM | Manages client information, communication, and sales opportunities. | Builds stronger client relationships, enhances loyalty, increases repeat business. |

| Invoicing | Creates professional invoices, tracks payments. | Streamlines invoicing process, reduces errors, improves cash flow. |

| Payment Processing | Integrates with payment processors for secure online payments. | Simplifies payment process, automates collection, improves efficiency. |

| Project Tracking | Monitors project progress, tracks time, manages budgets. | Provides insights into project timelines, resource allocation, and billing. |

| Reporting | Generates customizable reports on key financial metrics. | Analyzes trends, identifies areas for improvement, facilitates data-driven decisions. |

Troubleshooting Common QuickBooks Issues for the Self-Employed

Navigating the complexities of QuickBooks can sometimes feel overwhelming, especially for the self-employed. This section will address common problems encountered by self-employed users, providing practical solutions and steps to resolve them efficiently. Understanding these issues and their solutions empowers you to maintain a smooth and accurate financial record-keeping process.

Common QuickBooks issues for self-employed individuals stem from various factors, including data entry errors, system glitches, and software updates. By identifying the root cause and applying the appropriate troubleshooting steps, these problems can be effectively resolved, preventing significant disruptions to your business operations.

Common QuickBooks Errors and Their Solutions

QuickBooks, while a powerful tool, can occasionally present errors. Understanding these errors and their resolutions is crucial for maintaining smooth financial management. The table below details typical QuickBooks issues and corresponding solutions.

| QuickBooks Issue | Possible Solution |

|---|---|

| Incorrect data entry | Double-check all data entries for accuracy. Verify inputting correct dates, amounts, and categories. Use QuickBooks’ data validation features to spot potential issues. If errors persist, contact QuickBooks support for assistance. |

| Connection issues | Ensure a stable internet connection. Verify your internet speed and try troubleshooting any network problems. Restart your computer and router. If the issue persists, check for any firewall restrictions blocking QuickBooks access. |

| Software update problems | Check for available updates. Download and install any necessary updates to resolve potential compatibility issues. Ensure you have the most current version for optimal performance and security. |

| File corruption or loss | Regularly back up your QuickBooks data. Employ cloud-based backup services for enhanced security and accessibility. If corruption occurs, attempt to restore from a backup. Contact QuickBooks support for advanced recovery options. |

| Unexpected program crashes | Close all other programs running on your computer. Ensure your computer has adequate RAM and processing power. Run QuickBooks as an administrator. If crashes persist, update your computer’s drivers. |

| Difficulty accessing certain features | Ensure you have the appropriate user permissions and access rights. Verify your user role and contact QuickBooks support if access issues persist. Review the user manual for specific feature restrictions. |

Contacting QuickBooks Support

QuickBooks offers various support channels for assistance. These channels include phone support, online chat, and the QuickBooks community forum. These resources can be invaluable when encountering complex issues or requiring expert guidance.

When contacting support, be prepared to provide specific details about the problem, including error messages, steps taken, and relevant dates and times. The more information you provide, the faster and more efficiently support personnel can diagnose and resolve the issue.

Data Recovery Steps

Losing QuickBooks data can be a significant setback for the self-employed. Implementing proper data backup procedures and understanding recovery options is crucial.

Before attempting any recovery steps, immediately stop using QuickBooks to prevent further data corruption. Use the backup copies you have made to restore the affected files. If backups are unavailable, explore QuickBooks’ data recovery tools. Contacting QuickBooks support is recommended for specialized data recovery procedures.

Final Thoughts

In conclusion, QuickBooks offers a robust platform for self-employed individuals to manage their finances, track income and expenses, generate reports, and comply with tax obligations. This guide has provided a comprehensive overview of its functionalities, from setup and financial management to tax considerations and troubleshooting. By understanding the intricacies of QuickBooks, self-employed individuals can unlock its potential to streamline their operations and enhance their overall financial well-being.