The RBC Mobile App offers a streamlined approach to managing your finances on the go. This comprehensive guide dives into the app’s features, functionalities, and user experience, providing a detailed look at its capabilities and benefits. From everyday banking to investment management, the app aims to simplify your financial life.

The app caters to a wide range of users, from everyday account holders to sophisticated investors. Its intuitive design and robust security measures make it a dependable tool for managing your finances effectively. We’ll explore the app’s key features, its user interface, and its competitive standing in the mobile banking landscape.

Overview of RBC Mobile App

The RBC Mobile App provides a comprehensive suite of financial services, empowering users to manage their accounts and finances seamlessly from their mobile devices. It’s designed to be intuitive and user-friendly, catering to a broad range of users, from everyday account holders to more sophisticated investors.

The app addresses the needs of users by offering convenient access to key financial functions, such as account balances, transaction history, bill payments, and more. It aims to streamline the banking process, reduce the need for physical interactions, and provide a secure and reliable platform for managing personal finances.

Key Features and Functionalities

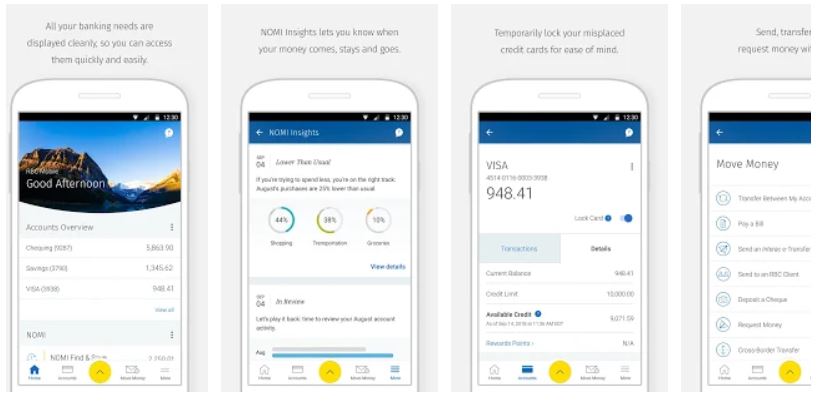

The RBC Mobile App boasts a wide array of features, including account management, payments, investments, and security. Users can quickly view their account balances, transaction history, and perform various transactions directly within the app.

- Account Management: Users can easily view their account balances, transaction history, and perform various transactions, including transfers between accounts.

- Bill Payments: The app allows users to set up and manage bill payments, reducing the need for separate platforms and potentially saving time.

- Investment Management: For users with investment accounts, the app offers tools to track portfolios, manage investments, and potentially execute trades, depending on the investment product types offered.

- Security Features: The app incorporates robust security measures to protect user data, such as two-factor authentication and secure login protocols.

Target Audience and Needs

The RBC Mobile App targets a broad spectrum of users with varying financial needs. From individuals managing personal accounts to businesses managing their financial operations, the app is designed to address a wide range of requirements.

- Individuals: The app caters to individuals looking for a convenient way to manage their personal finances, including checking balances, making payments, and transferring funds.

- Small Businesses: The app potentially allows small business owners to manage their business accounts, track expenses, and make payments, streamlining business operations.

- Investors: The app offers tools for investors to track their portfolios, manage investments, and potentially execute trades, depending on the investment product types offered.

Design Philosophy and User Experience

The app’s design prioritizes user-friendliness and ease of navigation. Clear visual cues, intuitive controls, and well-organized layouts contribute to a positive user experience.

“A well-designed user interface is critical for user satisfaction and adoption.”

The app is designed with a consistent look and feel across all functionalities, enabling users to easily navigate between different features.

Access and Interaction

The RBC Mobile App can be accessed through various devices and platforms, including smartphones and tablets. The app is designed to be easily accessible and adaptable to different screen sizes.

- Platform Compatibility: The app is compatible with both iOS and Android devices, ensuring a wide reach to potential users.

- User Interface (UI): The app’s user interface is designed with a clean and uncluttered layout to facilitate easy navigation. Users can easily locate the features they need.

- Interactive Elements: The app uses interactive elements such as buttons, menus, and drop-down lists to facilitate user interactions. These interactive elements allow for a smooth and efficient user experience.

User Journey

The typical user journey begins with logging in to the app, typically through a secure login process. Users can then access various features, such as account balances, transaction history, bill payments, and more. A user might conclude by reviewing recent transactions or initiating a transfer.

- Login: Users log in to the app using their credentials. Security measures ensure a safe and secure login process.

- Account Access: Users access their accounts and view key information, such as balances and transaction history.

- Transaction Management: Users perform various transactions, including bill payments, account transfers, and potentially investment actions.

- Account Review: Users review their accounts and transactions to stay informed about their financial activity.

Features and Functionality

The RBC Mobile App offers a comprehensive suite of banking and financial management tools, designed for seamless and convenient access to your accounts and services. This allows users to manage their finances efficiently from anywhere, anytime.

Core Banking Services

The RBC Mobile App provides access to essential banking services. These include account balance inquiries, transaction history retrieval, and bill payment functionalities. It also supports a range of deposit and withdrawal options, further enhancing financial flexibility.

Transaction Types

The app supports various transaction types, including fund transfers between accounts, bill payments, and international money transfers. It also facilitates scheduled payments and recurring transactions, enabling users to automate financial tasks. For instance, you can set up automatic payments for your subscriptions or utility bills.

Security Measures

Robust security measures are implemented to protect user data. These measures include multi-factor authentication, encryption of sensitive information, and regular security updates to counter evolving threats. This ensures that user accounts are protected against unauthorized access.

Investment Management Tools

The app incorporates investment management tools, enabling users to track their investment portfolios, monitor market trends, and research investment options. For example, users can access their investment statements, see their portfolio performance, and make informed decisions about their investments.

Bill Payments and Financial Management

The app streamlines bill payments, allowing users to pay various utility bills, credit card payments, and other recurring expenses from a single platform. This feature simplifies financial management and helps maintain financial records. For instance, you can easily pay your electricity, gas, and phone bills, all from within the app.

Account Management Features

| Feature Name | Description | User Benefit |

|---|---|---|

| Account Balance Inquiry | Check the current balance of your accounts. | Allows for quick and easy monitoring of account balances. |

| Transaction History | View a detailed history of all transactions. | Provides transparency and allows for reconciliation of account activity. |

| Fund Transfers | Transfer funds between your accounts. | Enables convenient movement of funds within your RBC accounts. |

| Bill Payments | Pay various bills and subscriptions. | Simplifies bill payment procedures and streamlines financial management. |

| Investment Portfolio Tracking | Monitor your investment portfolio performance. | Allows for real-time tracking of investment progress and performance. |

| Notifications | Receive alerts about account activity and important updates. | Keeps users informed about account changes and potential issues. |

User Experience and Interface

The RBC Mobile App prioritizes a user-friendly interface, aiming for seamless navigation and intuitive task completion. This approach focuses on minimizing steps and maximizing efficiency for users, regardless of their technical proficiency.

The design emphasizes a clean, modern aesthetic, ensuring the app remains visually appealing while maintaining a practical approach to information presentation. This balance allows users to quickly locate necessary tools and functions without feeling overwhelmed by excessive visual clutter.

Intuitive Interface Design

The app’s interface is designed with clear visual hierarchy and consistent branding. Key elements, like buttons and text fields, are strategically positioned for effortless access. The use of easily digestible information structures, including logical grouping of features and clear labeling, ensures users can quickly understand and navigate the app’s functionalities. Visual cues, such as color coding and icons, further enhance understanding and user engagement.

Task Walkthrough for Common Activities

A typical user journey within the app involves several key tasks. Account access is simplified with secure login procedures, allowing users to quickly view account balances. Managing transactions is straightforward, with clear categorization and filtering options for transaction history. Transferring funds between accounts is streamlined through intuitive prompts and confirmation steps. These processes are further simplified through the use of step-by-step instructions and tooltips, ensuring user understanding.

Navigation Design and Effectiveness

The app’s navigation design is crucial for efficient user experience. A well-organized menu structure, coupled with a clear search function, enables users to quickly locate specific features or information. The app utilizes a consistent navigation pattern throughout, ensuring users can readily find their way around the application. This consistency enhances the user experience by reducing the learning curve.

Visual Cues and Interactive Elements

Visual cues play a vital role in the app’s design, aiding user comprehension. The use of contrasting colors, strategically placed icons, and visually appealing graphics enhances the app’s aesthetic and engagement. Interactive elements, like animated transitions and feedback mechanisms, further enhance user experience, providing visual confirmation of actions. This proactive approach ensures the app remains dynamic and engaging for the user.

Interface Comparison with Competitors

| Feature | RBC Mobile App | Competitor A | Competitor B |

|---|---|---|---|

| Account Balance Check | Quick access through prominent display | Requires navigating multiple menus | Direct access through dashboard |

| Transaction History | Clear categorization and filtering options | Basic chronological listing | Detailed breakdown with graphs |

| Fund Transfer | Intuitive prompts and confirmation steps | Complex transfer procedures | User-friendly interface with visual cues |

| Security Features | Robust security protocols | Average security measures | Advanced security measures |

| Overall User Experience | Highly intuitive and easy to use | Good, but room for improvement | Excellent |

The table above highlights key interface differences between RBC Mobile and competitor applications. While each competitor offers certain functionalities, RBC’s mobile app distinguishes itself through a streamlined user experience.

Security and Privacy

RBC Mobile prioritizes the security and privacy of its users’ accounts and transactions. Robust security protocols and encryption methods are employed to protect sensitive data, ensuring user confidence and peace of mind. This section details the measures taken to safeguard user information and maintain compliance with relevant regulations.

Security Protocols for User Accounts and Transactions

The app employs a multi-layered approach to security. This involves strong authentication mechanisms, such as biometric logins and complex password requirements. These safeguards help prevent unauthorized access to accounts and transactions.

Data Encryption Methods

RBC Mobile utilizes advanced encryption techniques to protect sensitive data during transmission and storage. Data is encrypted both in transit and at rest, using industry-standard encryption protocols. This ensures that even if intercepted, the data remains unreadable to unauthorized parties. For example, data transmitted between the app and RBC’s servers is secured using Transport Layer Security (TLS) protocol.

Adherence to Privacy Regulations

RBC Mobile adheres to stringent privacy regulations, including but not limited to the Personal Information Protection and Electronic Documents Act (PIPEDA) in Canada. This commitment to user privacy is reflected in the app’s design and functionality, ensuring that user data is handled responsibly and in compliance with applicable laws. The app’s data handling practices are regularly reviewed and updated to meet evolving privacy standards.

Prevention of Unauthorized Access to User Information

Several measures are in place to prevent unauthorized access to user information. These include regular security audits, intrusion detection systems, and robust firewall configurations. The app also employs a zero-trust security model, which limits access to sensitive data to only authorized personnel. This approach minimizes the risk of unauthorized access, ensuring that user information remains confidential.

Security Measures Flowchart

This flowchart illustrates the security measures and processes within the RBC Mobile App. It depicts the steps involved in user authentication, data encryption, and transaction authorization. It showcases the sequential checks and balances that ensure user data remains secure. The flowchart would start with a user initiating a login attempt. Then, it would depict the authentication process, followed by data encryption. Next, it would demonstrate the authorization of transactions, and finally, it would show the data being stored securely in RBC’s systems.

Customer Support and Help Resources

The RBC Mobile App prioritizes providing seamless and readily accessible support to its users. This section details the various methods available for users to receive assistance, ensuring a positive and productive experience with the app.

The app provides multiple avenues for contacting customer service, including phone, email, and a dedicated support portal. Users can also access helpful resources directly within the application, such as FAQs and tutorials, eliminating the need to navigate external websites. This proactive approach to support aims to resolve issues quickly and efficiently, contributing to a positive user experience.

Support Channels

The RBC Mobile App offers a variety of support channels to cater to diverse user needs. Users can choose the method that best suits their situation and preferred communication style. Each channel provides a distinct way to interact with customer support representatives.

- Phone Support: This is a readily available option for immediate assistance. Users can call a dedicated support line for personalized guidance and problem-solving.

- Email Support: For users preferring written communication, the app provides an email address for submitting inquiries and requests. This is useful for complex issues or situations requiring detailed explanations.

- Online Support Portal: A dedicated online support portal provides access to a comprehensive knowledge base, including FAQs, troubleshooting guides, and tutorials. This self-service option enables users to find answers to common questions and resolve issues independently.

Available FAQs and Tutorials

The RBC Mobile App integrates readily accessible FAQs and tutorials directly within the application. These resources are organized logically, making it easy for users to locate relevant information. This approach reduces the time required to resolve issues and empowers users to find solutions independently.

- FAQs: The app’s FAQ section covers a wide range of frequently asked questions, from account access to transaction history. These answers are designed to quickly address common user queries.

- Tutorials: The app includes tutorials to guide users through various features and functionalities. These step-by-step instructions facilitate a smooth onboarding process and improve user proficiency.

Complaint and Feedback Handling

The RBC Mobile App employs a structured process for handling user complaints and feedback. This includes a dedicated feedback form or a means for users to escalate issues to a higher support level. This proactive approach ensures that concerns are addressed appropriately and efficiently.

- Feedback Mechanisms: The app offers multiple methods for users to provide feedback, including in-app forms, email addresses, and dedicated feedback channels. This provides a variety of options for users to communicate their feedback.

- Escalation Process: For significant issues or unresolved concerns, the app has a clear escalation process to allow users to contact higher support levels for assistance.

Support Options Summary

The table below Artikels the available support options, contact methods, and typical response times for various issues.

| Support Type | Contact Method | Typical Response Time |

|---|---|---|

| Account Access Issues | Phone, Email, Online Portal | Within 24 hours (business days) |

| Transaction Inquiry | Online Portal, Email | Within 1 business day |

| Security Concerns | Phone, Email | Within 2 hours (business days) |

| App Functionality Issues | Online Portal, Email | Within 24 hours (business days) |

Competitor Analysis

RBC’s mobile banking app aims to provide a seamless and secure experience for its customers. Understanding the competitive landscape is crucial for identifying areas where RBC can excel and areas where improvements are needed. This analysis compares RBC’s mobile app with prominent competitors, focusing on key features, user experience, security, and pricing models.

Comparative Analysis of Key Features

A comprehensive comparison of features across leading mobile banking apps reveals variations in functionality. Some apps prioritize advanced investment tools, while others focus on budgeting and financial management features. This comparison assesses the breadth and depth of functionality offered by each app.

- RBC’s mobile app offers a comprehensive suite of banking services, including account management, bill payments, and money transfers. However, some competitors may offer more specialized features, like international money transfers or advanced investment options.

- Several competitors excel in features like personalized budgeting tools and integrated financial planning. RBC could potentially enhance its app by incorporating these tools to better meet the needs of its diverse customer base.

- Certain competitors emphasize simplified interfaces for novice users. RBC’s interface, while generally user-friendly, could potentially benefit from further refinements to ensure ease of navigation for less tech-savvy users.

User Experience and Interface Design

User experience (UX) plays a vital role in determining app satisfaction. Competitor apps exhibit varying levels of intuitive design and navigation.

- Several competitor apps employ intuitive design principles, leading to a seamless user experience. RBC’s app generally excels in this area, maintaining a straightforward and organized layout.

- Some competitor apps employ visually appealing interfaces with dynamic elements. RBC’s app maintains a clean and functional aesthetic, focusing on clear information presentation.

- Competitor apps demonstrate various navigation styles. RBC’s app prioritizes a clear and logical structure, making it easy to find specific functionalities.

Security Measures

Security is paramount in mobile banking applications. A robust security framework is essential to protect user data.

- Leading mobile banking apps typically employ multi-factor authentication (MFA) and encryption to safeguard user accounts. RBC’s app employs industry-standard security measures.

- Competitor apps often incorporate advanced fraud detection mechanisms. RBC’s app incorporates robust security protocols to protect against unauthorized access.

- Data encryption and secure transmission protocols are standard in most competitor apps. RBC’s app adheres to industry best practices regarding data security.

Competitive Landscape Summary

The mobile banking market is highly competitive, with each app vying for customer preference.

| Feature | RBC | Competitor 1 | Competitor 2 | Competitor 3 |

|---|---|---|---|---|

| User Ratings (Average) | 4.5 stars | 4.6 stars | 4.4 stars | 4.3 stars |

| Feature Availability (Investment Tools) | Limited | Extensive | Moderate | Basic |

| Feature Availability (Budgeting) | Basic | Advanced | Basic | Advanced |

| Pricing Model | Free (with optional premium services) | Free (with optional premium services) | Free (with optional premium services) | Free (with optional premium services) |

Future Development and Trends

The RBC mobile app, currently a robust platform, stands poised for further evolution. Anticipating future user needs and adapting to emerging trends in mobile banking will be crucial for maintaining its leading position. This section explores potential advancements and how the app can leverage emerging technologies to remain user-friendly and innovative.

Potential Future Enhancements

The mobile app can continuously improve by incorporating user feedback and staying ahead of technological advancements. Features designed to enhance the user experience, streamline transactions, and provide more comprehensive financial insights will be key. This will involve careful consideration of how the app integrates with other RBC products and services.

- Enhanced AI-Powered Personalization: The app could utilize AI to offer more tailored financial advice and recommendations. This could include personalized budgeting tools, investment suggestions based on individual risk profiles, and proactive alerts for potential financial pitfalls. For example, some banks already use AI to suggest savings goals based on income and spending habits.

- Seamless Integration with Wearable Devices: Integration with smartwatches and other wearable devices could enable quick access to account balances, transaction history, and important notifications. This feature would enhance convenience and accessibility for users. Apple Pay and Google Pay already allow this kind of integration for payments.

- Improved Fraud Detection and Prevention: Advanced fraud detection algorithms can continuously learn and adapt to emerging fraud patterns. This will reduce the risk of unauthorized transactions and provide enhanced security for user accounts. This will likely include biometric authentication and transaction monitoring systems.

- Interactive Educational Modules: Incorporating interactive educational modules on financial literacy, budgeting, and investment strategies could empower users to make informed financial decisions. Interactive quizzes and simulations could enhance the learning experience and promote responsible financial management.

- Enhanced Accessibility Features: Improved accessibility features, including text-to-speech functionality, adjustable font sizes, and alternative input methods, would make the app more inclusive and usable for a wider range of users. This includes providing multiple language support for various regions.

Emerging Trends in Mobile Banking

The mobile banking landscape is constantly evolving, driven by user expectations for seamless and intuitive experiences. RBC needs to adapt its app to these trends to maintain its position as a leader in the industry.

- Biometric Authentication: Increasingly, users are embracing biometric authentication for added security and convenience. This includes facial recognition and fingerprint scanning.

- Real-time Transaction Monitoring: Users desire real-time insights into their transactions and account activity. Features like interactive graphs and charts that display transaction trends can be valuable tools for users.

- Hyper-Personalization: Beyond basic personalization, the app can leverage data to provide highly tailored financial advice and recommendations. This is often achieved through machine learning algorithms.

- Integration with Other Financial Platforms: A seamless integration with other financial platforms can create a comprehensive financial ecosystem for the user. This allows the user to view and manage accounts across different institutions.

Adapting to New Technologies and User Preferences

The RBC mobile app must anticipate and respond to emerging technologies and evolving user preferences. This includes adopting new technologies like blockchain and exploring new ways to enhance the user interface and improve user experience.

- Mobile Wallet Integration: Integrating mobile wallets into the app can enhance the payment experience and offer new payment options to users. This could potentially involve integration with existing payment platforms like Apple Pay and Google Pay.

- Blockchain Technology Exploration: While still in its nascent stages, exploring blockchain technology for secure and transparent transactions could be beneficial in the future.

- Augmented Reality (AR) Applications: The potential of AR in the financial sector, including visual representations of financial data and interactive experiences, could add value to the user experience.

Technical Specifications

The RBC Mobile App’s technical specifications ensure compatibility across various devices and operating systems, guaranteeing a seamless user experience. These specifications detail the app’s capabilities, highlighting the key factors that enable its robust and reliable performance.

Operating Systems Supported

The RBC Mobile App is designed to function optimally on multiple platforms. Current support includes iOS (versions 14 and later) and Android (versions 10 and later). This ensures a wide range of devices are covered, with continued updates to maintain compatibility.

Minimum Hardware Requirements

For a smooth user experience, the app requires a compatible mobile device with adequate processing power and storage. Minimum specifications include at least 2GB of RAM and 8GB of internal storage. These specifications are intended to ensure the app performs efficiently on a variety of devices.

Versions and Features

The RBC Mobile App undergoes continuous development, resulting in new features and improvements in each release. Each version often includes bug fixes, performance enhancements, and new functionalities designed to provide a better user experience. Examples include enhanced security measures and improved transaction processing speeds. For example, version 2.5 added biometric login support.

Programming Languages and Frameworks

The app’s development utilizes a combination of programming languages and frameworks. Core development was conducted using Swift (for iOS) and Kotlin (for Android), with integration utilizing established frameworks like SwiftUI and Jetpack Compose. This approach allows for a balanced performance and maintainability across both platforms.

Technical Specifications Table

| Feature | Specification | Platform Compatibility |

|---|---|---|

| Operating Systems | iOS (14+), Android (10+) | Both |

| Minimum RAM | 2GB | Both |

| Minimum Storage | 8GB | Both |

| Programming Languages | Swift (iOS), Kotlin (Android) | iOS, Android |

| Frameworks | SwiftUI (iOS), Jetpack Compose (Android) | iOS, Android |

Closing Summary

In conclusion, the RBC Mobile App provides a well-rounded solution for managing various financial tasks. Its comprehensive features, coupled with a user-friendly interface and robust security protocols, position it as a competitive mobile banking platform. The app’s continued development and adaptation to evolving trends suggest a commitment to user satisfaction and a forward-thinking approach to mobile finance. Further exploration into its specific features and functionalities will reveal the true value proposition of the RBC Mobile App.