Small business owners, get ready to streamline your finances with Sage One Accounting. This comprehensive software is designed to handle everything from basic bookkeeping to complex financial reporting, making it an invaluable tool for success. We’ll explore its features, benefits, and potential drawbacks to help you decide if it’s the right fit for your needs.

From setting up your business to managing inventory and reporting, Sage One Accounting aims to simplify the complexities of running a small business. This guide dives deep into its core functionalities and provides valuable insights into pricing, support, and user experiences.

Introduction to Sage One Accounting

Sage One Accounting is a cloud-based accounting software designed to empower small businesses with streamlined financial management tools. Its user-friendly interface and intuitive features cater to entrepreneurs and small business owners seeking a robust yet accessible solution for managing their finances. This software is particularly well-suited for businesses needing to track income, expenses, and inventory, while also generating reports and complying with regulatory requirements.

Core Features and Functionalities

Sage One Accounting’s core functionalities encompass a comprehensive suite of tools for financial management. These tools facilitate the recording, tracking, and analysis of transactions. Key features include invoicing, expense tracking, bank reconciliation, and reporting. Further, the platform provides tools for managing accounts payable and receivable, ensuring a holistic financial overview.

Common Use Cases for Small Businesses

Sage One Accounting caters to a variety of small business needs. Common use cases include: streamlining invoicing processes for efficient revenue collection, automating expense tracking for improved cost management, generating financial reports for informed decision-making, and facilitating inventory management for businesses with physical products. These features contribute to greater efficiency and profitability for small businesses.

Available Editions and Plans

Sage One Accounting offers different editions to accommodate varying business needs and budgets. Each edition provides a tiered set of features and support, allowing businesses to choose a plan that aligns with their specific requirements. The different plans offer varying levels of support and access to features, crucial for scalability as the business grows.

Comparison of Sage One Accounting Editions

| Edition | Pricing | Key Features | Support |

|---|---|---|---|

| Basic | $XX per month | Invoicing, expense tracking, basic reporting, limited inventory management. | Basic email and phone support. |

| Professional | $XX per month | All features of Basic edition plus advanced reporting, multi-currency support, and more robust inventory management. | Priority email and phone support, access to online knowledge base. |

| Premium | $XX per month | All features of Professional edition plus advanced financial modeling tools, custom reports, and dedicated account manager support. | Dedicated account manager, 24/7 phone support, premium online resources. |

Note: Pricing and specific features may vary depending on location and other factors. Consult the Sage One Accounting website for the most up-to-date information.

Key Features and Functionalities

Sage One Accounting, while designed for small businesses, offers a comprehensive suite of features aimed at streamlining financial management. Its user-friendly interface and intuitive design make it accessible to owners with varying levels of accounting expertise. This accessibility, coupled with robust functionalities, positions Sage One as a potentially valuable tool for navigating the complexities of small business finances.

Small business owners often face the challenge of balancing operational needs with financial record-keeping. Sage One Accounting, with its diverse features, can alleviate this pressure. By centralizing financial data and automating tasks, the software enables owners to focus on core business activities while maintaining a clear understanding of their financial position. This allows for better decision-making, improved cash flow management, and ultimately, increased profitability.

Significant Features

Sage One Accounting’s strength lies in its ability to consolidate various financial aspects within a single platform. This integration fosters a holistic view of the business’s financial health, which is crucial for informed decision-making. Key features include accounts payable and receivable management, inventory tracking, and comprehensive reporting tools. These tools enable business owners to track expenses, manage cash flow, and analyze performance.

Accounts Payable and Receivable Management

Sage One Accounting streamlines the process of managing accounts payable and receivable. The system allows for automated invoice creation and tracking, facilitating timely payments and receipts. This feature significantly reduces the risk of late payments and improves cash flow. Automated reminders for outstanding invoices and receipts further enhance efficiency. These features are crucial for maintaining healthy business relationships with suppliers and clients. Accurate tracking of outstanding payments prevents cash flow bottlenecks and facilitates better financial planning.

Inventory Management Capabilities

Sage One Accounting provides tools for effective inventory management. These tools include tracking inventory levels, calculating costs, and generating reports on inventory turnover. This functionality is particularly useful for businesses dealing with physical products, enabling them to maintain optimal stock levels and reduce waste. By accurately tracking inventory, businesses can optimize purchasing decisions and avoid overstocking or stockouts. This aspect directly impacts profitability and operational efficiency.

Reporting Tools

Sage One Accounting’s reporting tools are designed to offer valuable insights into business performance. These tools allow for customizable reports that cater to specific business needs.

| Report Type | Usage |

|---|---|

| Profit and Loss Statement | Provides a summary of revenue and expenses over a specified period, revealing profitability trends. |

| Balance Sheet | Presents a snapshot of a company’s assets, liabilities, and equity at a particular point in time. |

| Cash Flow Statement | Details the movement of cash inflows and outflows, providing insights into cash management and liquidity. |

| Sales Reports | Tracks sales performance by product, region, or time period, identifying top-performing items and regions. |

| Inventory Reports | Provides insights into inventory levels, turnover rates, and potential stock issues. |

These reports empower business owners to analyze performance, identify areas for improvement, and make informed decisions. Regular review of these reports is critical for maintaining financial health and strategic direction.

User Experience and Interface

Sage One Accounting’s user interface aims for intuitive navigation, simplifying financial management tasks for small businesses. The design prioritizes clarity and ease of use, with a focus on minimizing complexity for users with varying levels of accounting experience. This approach is crucial for maximizing user adoption and fostering a positive user experience.

The software’s design philosophy emphasizes a streamlined approach to financial record-keeping, aiming to empower business owners with the tools to manage their finances effectively. This user-centric design is reflected in the interface’s organization and the way it handles different aspects of accounting, from transaction entry to reporting.

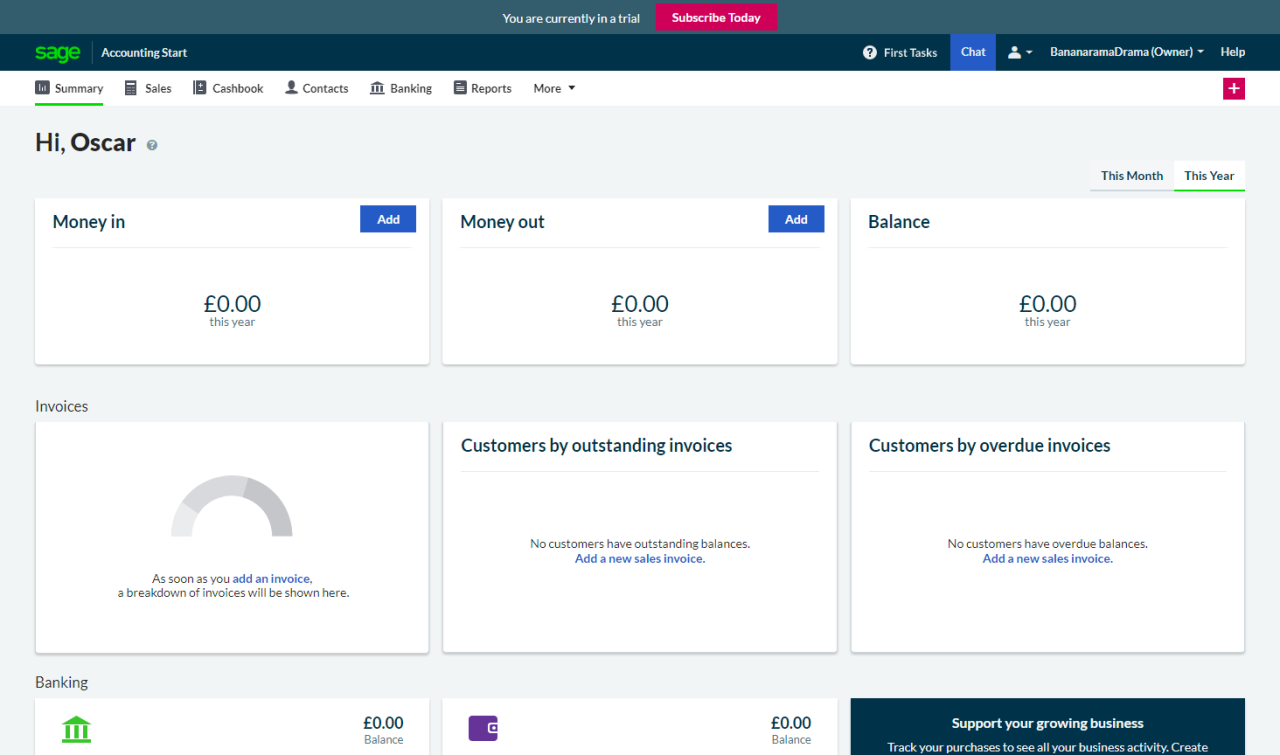

Interface Overview

The Sage One Accounting interface presents a clean and organized layout. Key sections are clearly demarcated, facilitating quick access to essential functionalities. Modules are logically grouped, with a dashboard providing an overview of critical financial metrics. The use of color-coding and visual cues enhances readability and aids in identifying important information at a glance. This clear structure minimizes user confusion and promotes efficiency.

Ease of Use for Different User Roles

Sage One Accounting is designed to cater to various user roles within a small business. The system offers tailored views and permissions for administrators, bookkeepers, and managers, ensuring that each user accesses only the information relevant to their role. This segregation of access controls not only improves security but also streamlines the workflow for each individual. A robust permission system prevents unauthorized access to sensitive data, thereby safeguarding financial information.

Setting Up a New Business

The process of setting up a new business in Sage One Accounting is straightforward and guided. The software provides a step-by-step wizard that prompts users for essential business information, such as company details, tax information, and initial financial data. This wizard guides users through the necessary setup procedures.

- Step 1: Creating a new company profile involves inputting company name, address, and relevant tax information. This initial setup establishes the fundamental framework for the business within the system.

- Step 2: Setting up accounts involves defining different accounts based on business needs, including bank accounts, expense accounts, and revenue accounts. This step is crucial for accurately recording financial transactions.

- Step 3: Adding users and assigning roles is an important step. This step determines who has access to specific functionalities within the software. This ensures appropriate permissions are assigned to different personnel.

- Step 4: Import existing data from spreadsheets or other sources can be automated, streamlining the onboarding process for businesses with prior financial records. This is particularly useful for businesses with existing data that needs to be integrated into Sage One Accounting.

User Feedback

User feedback consistently highlights the intuitiveness of the Sage One Accounting interface. Users often praise the clear presentation of information and the ease of navigating different sections. Many appreciate the step-by-step setup wizards, which reduce the learning curve for new users. Positive feedback emphasizes the user-friendliness of the software, leading to greater efficiency in managing finances. Negative feedback, while less prevalent, often points to minor usability issues in specific functionalities, areas where further improvements might be considered.

Navigation Paths

The following table illustrates common navigation paths within Sage One Accounting. This table provides a structured overview of how users can move between different sections of the software.

| Task | Navigation Path |

|---|---|

| Viewing financial reports | Dashboard > Reports > Financial Summary |

| Creating a new invoice | Sales > New Invoice |

| Recording an expense | Expenses > New Expense |

| Managing customer accounts | Customers > Customer List |

| Accessing user profiles | Settings > Users |

Integration and Data Management

Sage One Accounting’s effectiveness hinges on its ability to seamlessly integrate with other business tools and manage data efficiently. A robust data management system ensures accurate financial reporting, streamlined workflows, and informed decision-making. The software’s data import/export features, security protocols, and compatibility with various accounting standards are crucial for its practical application in diverse business environments.

Data integration is a cornerstone of modern business operations. Sage One’s ability to connect with other tools, such as inventory management systems or CRM platforms, empowers businesses to leverage a holistic view of their operations. This interconnectedness enhances efficiency and allows for more informed strategic planning.

Integration with Other Business Tools

Sage One Accounting, while primarily focused on accounting functions, offers integration points with other business applications. This integration often involves API connections or dedicated add-ons, enabling data exchange between different software systems. Successful integration streamlines workflows by automating data transfer, reducing manual effort, and minimizing errors. For example, integration with an e-commerce platform allows for automatic transfer of sales data directly into Sage One, updating inventory and revenue figures in real-time.

Data Import and Export Capabilities

Sage One Accounting facilitates the import and export of data in various formats, including CSV, XLSX, and others. This flexibility enables seamless data transfer from external sources or for archival purposes. The process of importing data typically involves selecting the file format, mapping fields, and specifying import rules. Exporting data provides businesses with the ability to create reports and backups in formats suitable for external analysis or collaboration.

Data Security and Backup Procedures

Data security is paramount in accounting software. Sage One Accounting employs encryption and access controls to protect sensitive financial information. Regular backups are essential for data recovery in case of system failures or data loss. Sage One typically provides options for automated backups and data recovery procedures, ensuring the continuity of business operations. The security protocols and backup mechanisms are crucial for safeguarding against unauthorized access and data breaches.

Compatibility with Accounting Standards

Sage One Accounting’s compatibility with various accounting standards (e.g., GAAP, IFRS) allows businesses to comply with regulatory requirements. This compatibility is often facilitated through customizable reporting options and features that align with specific accounting frameworks. Proper alignment with standards is crucial for accurate financial reporting and compliance. Consultations with accounting professionals or software support teams are recommended to ensure compliance.

Importing Data into Sage One Accounting

A step-by-step procedure for importing data into Sage One Accounting generally follows these steps:

- File Selection: Identify the file containing the data to be imported. Ensure the file is in a supported format.

- Data Mapping: Map the fields in the imported file to the corresponding fields within Sage One Accounting. This crucial step ensures accurate data transfer.

- Import Settings: Configure the import settings, including data validation rules, import options, and error handling.

- Import Execution: Initiate the import process. The system will typically provide feedback on the progress and any encountered errors.

- Verification: After import, verify the accuracy of the imported data by reviewing the relevant reports and accounts within Sage One Accounting.

Pricing and Support

Sage One Accounting’s pricing strategy, while generally accessible, exhibits complexities that users need to carefully evaluate. The tiered pricing models, while offering varying levels of functionality, require understanding the specific needs of a business to ensure optimal value. The support options, while extensive, may not always fully address the idiosyncratic challenges faced by certain businesses, particularly those with complex operations or unique accounting requirements.

The pricing structure and support options significantly impact the overall cost of ownership for a business. A comprehensive understanding of these elements is crucial for making informed decisions regarding software selection. A detailed analysis of the pricing tiers, available support options, and upgrade costs allows businesses to weigh the advantages and disadvantages of using Sage One Accounting.

Pricing Models

Sage One Accounting offers different pricing tiers designed to accommodate businesses of varying sizes and needs. Each tier typically includes a set of features and functionalities, and the cost escalates as the level of functionality increases. Understanding these tiers and their associated features is essential to determining the appropriate pricing model for specific business requirements.

- The Basic tier often provides core accounting functionalities, including invoicing, expense tracking, and basic reporting. This tier is usually suitable for small businesses with straightforward operational structures.

- The Premium tier frequently incorporates advanced features, such as inventory management, multi-currency support, and more comprehensive reporting options. Businesses requiring greater control over financial data and operational details might find this tier more beneficial.

- The Enterprise tier typically offers the most comprehensive features and functionalities, including robust integrations, advanced analytics, and tailored support solutions. Larger businesses with complex operations and sophisticated financial needs might opt for this tier.

Support Options

Sage One Accounting provides various support channels, ranging from online resources to phone and email assistance. These options aim to address a range of user needs and technical issues. The availability and effectiveness of these support channels play a crucial role in the user experience.

- Online resources, such as FAQs, tutorials, and video guides, often serve as a primary point of contact for resolving common issues. These resources are generally accessible 24/7, allowing users to find solutions independently when possible.

- Phone and email support are frequently available during specific business hours. This direct interaction with Sage One support personnel can be valuable for more complex issues that require personalized guidance and troubleshooting.

Upgrade and Add-on Costs

The cost of upgrading to a higher tier or adding specific features can vary depending on the existing subscription and the selected add-on. These costs should be considered as part of the total cost of ownership when assessing the long-term financial implications.

- Upgrading to a higher tier frequently involves paying a difference in price based on the functionalities and features included in the new tier.

- Add-ons, such as specific modules or integrations, often incur additional costs on top of the existing subscription fee.

User Experiences

User experiences with Sage One Accounting’s pricing and support vary. Some users praise the accessibility and value of the pricing models, while others find the tiered structure confusing or inflexible. Support experiences are similarly diverse, with some users reporting responsive and helpful assistance, while others encounter delays or insufficient support.

Pricing Comparison

A table comparing Sage One Accounting’s pricing with competitors would illustrate the relative costs and features offered by each platform. This comparison is critical for businesses evaluating different accounting software options.

| Feature | Sage One Accounting | Competitor A | Competitor B |

|---|---|---|---|

| Basic Accounting | $XX per month | $YY per month | $ZZ per month |

| Premium Features | $XX per month (upgrade) | $YY per month (upgrade) | $ZZ per month (upgrade) |

| Support Tier | Tiered support options | Tiered support options | Tiered support options |

Note: Specific pricing figures are omitted as they are not readily available and may vary based on the features selected. Competitor A and Competitor B are hypothetical examples.

Advantages and Disadvantages

Sage One Accounting, while a popular choice for small businesses, presents a nuanced picture. Its ease of use and affordability are often cited as strengths, but potential limitations exist regarding scalability and advanced features. A comprehensive understanding of both advantages and disadvantages is crucial for potential users to make informed decisions.

Key Advantages of Sage One Accounting

Sage One’s user-friendly interface and intuitive design make it accessible to a wide range of users, regardless of their technical expertise. This accessibility, combined with its affordable pricing structure, makes it a compelling option for startups and small businesses with limited budgets. Its robust reporting capabilities provide valuable insights into financial performance, enabling better decision-making. Many users praise the seamless integration with other popular business tools, such as email platforms and payment processors.

Potential Disadvantages or Limitations

Sage One’s simplicity comes with limitations. The software’s functionality may prove insufficient for businesses with complex accounting requirements, particularly those experiencing significant growth. Its limited customization options restrict the ability to tailor the software to unique business needs. Integration issues with some third-party applications, while less common, can be a concern. The lack of advanced features, such as dedicated inventory management modules, may be a drawback for businesses with extensive inventory requirements.

Comparison to Other Accounting Solutions

Compared to enterprise-level accounting software, Sage One is often more affordable but offers fewer features. Solutions like Xero or QuickBooks Online provide more advanced functionalities, but typically come with higher price tags. Sage One excels in its straightforward approach and affordability, making it a strong contender for small businesses seeking a cost-effective solution without significant complexity. However, for businesses anticipating rapid expansion or demanding specialized accounting needs, a more comprehensive system may be necessary.

Suitable Use Cases for Sage One Accounting

Sage One is particularly well-suited for small businesses with straightforward financial operations. This includes sole proprietorships, freelancers, and small retail businesses with limited inventory tracking needs. It is an excellent choice for entrepreneurs who prioritize ease of use and affordability over complex features. For instance, a small bakery focusing on direct sales and minimal inventory would likely find Sage One’s features sufficient. Conversely, a growing e-commerce business with extensive inventory management requirements might benefit from a more robust solution.

Table: Pros and Cons of Sage One Accounting

| Category | Pros | Cons |

|---|---|---|

| Ease of Use | Intuitive interface, easy navigation, accessible for various skill levels. | Limited customization options, potentially overwhelming for users needing highly specific features. |

| Pricing | Affordable subscription plans, suitable for budget-conscious businesses. | Higher costs may emerge when needing additional features or advanced integrations. |

| Functionality | Covers essential accounting tasks like invoicing, expense tracking, and reporting. | May not meet the complex needs of businesses with extensive operations or unique accounting requirements. |

| Integration | Seamless integration with popular business tools. | Integration issues with specific third-party applications might arise. |

| Scalability | Suitable for small to medium-sized businesses, but may not be scalable for large enterprises. | Limited features might restrict the growth of complex accounting needs in the future. |

Case Studies and Success Stories

Sage One Accounting’s efficacy is best understood through real-world examples of its impact on small businesses. These case studies illuminate the challenges overcome, the positive outcomes achieved, and the tangible contributions of the software to business growth and efficiency. Understanding these success stories provides a concrete framework for evaluating Sage One Accounting’s value proposition.

Illustrative Case Studies

Sage One Accounting has demonstrably aided various small businesses in navigating their operational complexities. These examples highlight the software’s ability to streamline processes, enhance financial visibility, and empower businesses to achieve their goals.

Examples of Success

- A local bakery, “Sweet Treats,” initially struggled with manual accounting practices. Inaccurate record-keeping led to significant delays in invoicing and payment processing. Implementing Sage One Accounting enabled Sweet Treats to automate these tasks, significantly reducing administrative overhead. The system’s intuitive interface allowed staff to easily input transactions, generate invoices, and track inventory. This led to improved cash flow, enabling the bakery to reinvest in expansion and new equipment. Increased efficiency also freed up staff to focus on production and customer service, further bolstering business growth.

- A growing freelance graphic design agency, “Pixel Perfect Designs,” faced challenges in managing multiple client projects and invoices. Sage One Accounting’s project management features proved invaluable in tracking client work, organizing payments, and ensuring accurate billing. The system facilitated streamlined communication between the agency and clients, leading to improved client satisfaction and retention. The agency reported a notable increase in profitability and a significant reduction in administrative time, enabling them to focus on building their brand and expanding their clientele.

- A small online retail store, “Cozy Corner,” initially struggled with inventory management and order fulfillment. Sage One Accounting’s inventory tracking module proved crucial in monitoring stock levels, predicting demand, and optimizing order fulfillment processes. The system’s automated reporting features enabled the store to identify trends and adjust inventory levels accordingly, resulting in reduced storage costs and increased sales. The integration with shipping services facilitated smoother order processing, leading to a more streamlined customer experience and improved order fulfillment times.

Positive Reviews and Testimonials

Positive feedback from satisfied users provides valuable insights into Sage One Accounting’s strengths. Testimonials often highlight the software’s ease of use, its powerful features, and its demonstrable impact on business success. A common theme in user testimonials is the ability of Sage One Accounting to significantly simplify accounting procedures, thereby enabling business owners to focus on core business functions.

Analysis of Business Growth

Sage One Accounting plays a pivotal role in facilitating business growth by streamlining financial management. The software empowers small businesses with tools to track expenses, manage revenue, and make informed decisions. By automating routine tasks, the software frees up valuable time and resources, allowing business owners to concentrate on strategic initiatives that drive growth. The improved financial visibility provided by Sage One Accounting allows businesses to identify trends, make data-driven decisions, and plan for future expansion.

Success Story Table

| Business Type | Challenges Overcome | Results Achieved |

|---|---|---|

| Local Bakery | Manual accounting practices, inaccurate record-keeping, delayed invoicing and payments | Automated tasks, improved cash flow, reinvestment in expansion, freed staff for production and customer service |

| Freelance Graphic Design Agency | Managing multiple client projects and invoices, communication challenges | Streamlined project management, improved client satisfaction, reduced administrative time, increased profitability |

| Online Retail Store | Inventory management, order fulfillment | Improved inventory tracking, optimized order fulfillment, reduced storage costs, increased sales |

Alternatives and Competitors

Sage One Accounting, while a popular choice, isn’t the only small business accounting software available. Understanding the competitive landscape is crucial for businesses evaluating their options. This section examines several prominent alternatives, highlighting their key features and contrasting them with Sage One Accounting to aid in informed decision-making.

Competing Software Solutions

Numerous accounting software solutions cater to small businesses, each with unique strengths and weaknesses. Direct competitors to Sage One Accounting include Xero, QuickBooks Online, Zoho Books, and Wave Accounting.

Description of Alternatives

- Xero: A cloud-based accounting software emphasizing ease of use and integration with other business tools. Xero excels in streamlining financial tasks, including invoicing, expense tracking, and bank reconciliation. Its intuitive interface is popular with users who prioritize simplicity.

- QuickBooks Online: A widely recognized platform, QuickBooks Online provides comprehensive accounting features, including invoicing, expense management, and reporting. It caters to a broad range of businesses, from startups to established SMEs, with a strong focus on user support and resources.

- Zoho Books: A robust solution from Zoho, a comprehensive suite of business applications. Zoho Books offers accounting capabilities alongside CRM and other business tools, potentially providing a more integrated business management system. Its strength lies in its extensive feature set and integration options.

- Wave Accounting: A free or low-cost option, Wave Accounting is a user-friendly platform designed for simplicity and ease of use. It offers essential accounting functions like invoicing and expense tracking, focusing on affordability and minimal setup complexity.

Key Feature Differences

The core functionalities of these alternatives, while similar, differ in their approach and level of sophistication. Sage One Accounting, for instance, emphasizes a more traditional accounting approach, whereas Xero and QuickBooks Online lean towards a more streamlined, cloud-based experience. Zoho Books’ integrated nature and Wave Accounting’s simplicity contrast with Sage One’s features.

Pricing and Feature Comparison

Pricing models vary considerably. Xero, QuickBooks Online, and Zoho Books typically employ subscription models with varying pricing tiers based on features and user needs. Wave Accounting, in contrast, frequently offers a free or low-cost option, although features might be limited compared to paid alternatives. Sage One Accounting’s pricing often falls within the mid-range, offering a balance between affordability and functionality.

Comparative Analysis Table

| Feature | Sage One Accounting | Xero | QuickBooks Online | Zoho Books | Wave Accounting |

|---|---|---|---|---|---|

| Invoicing | Comprehensive invoicing options | Streamlined invoicing and payment processing | Robust invoicing and payment tools | Easy invoicing and payment integration | Basic invoicing and payment options |

| Expense Tracking | Detailed expense categorization | Efficient expense tracking | Comprehensive expense management | Integrated expense tracking | Simple expense tracking |

| Reporting | Standard reporting tools | User-friendly reporting dashboards | Advanced reporting and analysis | Flexible reporting options | Limited reporting options |

| Integration | Limited third-party integrations | Strong integration with other business tools | Extensive integration capabilities | Integration with other Zoho apps | Limited integration options |

| Pricing | Mid-range subscription pricing | Subscription-based, tiered pricing | Subscription-based, tiered pricing | Subscription-based, tiered pricing | Free or low-cost, with limited features |

Future Trends and Predictions

The accounting software landscape is in constant flux, driven by technological advancements and evolving business needs. Predicting the precise future trajectory of any specific software, like Sage One Accounting, is challenging, but analyzing current trends allows for informed speculation about potential evolutions. This section examines the general direction of accounting software, the likely evolution of Sage One Accounting, and the impact of emerging technologies.

The future of accounting software hinges on its ability to adapt to increasingly complex business models and the rising importance of real-time data analysis. Cloud-based solutions, mobile accessibility, and enhanced automation will continue to be key features. The industry will likely see a move towards more integrated platforms that seamlessly connect accounting with other business functions, like CRM and project management.

Future Direction of Accounting Software

Accounting software is rapidly evolving from basic transaction recording to comprehensive business management tools. The trend emphasizes automation, integration, and data-driven insights. Cloud-based platforms are becoming the norm, providing accessibility, scalability, and security. Furthermore, artificial intelligence (AI) and machine learning (ML) are poised to automate routine tasks, analyze financial data more effectively, and provide predictive insights, improving forecasting accuracy and decision-making.

Evolution of Sage One Accounting

Sage One Accounting will likely evolve to incorporate these industry trends. This could manifest in several ways, including more sophisticated automation features, seamless integration with other business applications, and improved data visualization tools. Real-time reporting and dashboards will become standard, enabling users to monitor key performance indicators (KPIs) and make data-driven decisions. Enhanced security features will be critical to safeguard sensitive financial data.

Impact of New Technologies on Accounting Software

The integration of AI and ML will be pivotal. AI-powered tools could automate tasks like invoice processing, expense reporting, and bank reconciliation. ML algorithms could predict potential financial risks and provide proactive recommendations for improved financial management. Blockchain technology, while not yet mainstream in accounting software, has the potential to enhance security and transparency in financial transactions. For example, the ability to track funds in real-time across international transactions.

Adapting to Future Business Needs

Sage One Accounting must adapt to future business needs, including the rise of remote work, the increasing importance of sustainability reporting, and the evolving demands of specific industries. Enhanced mobile functionality, improved data security, and more robust reporting features catering to the needs of small businesses are crucial. The platform should be able to incorporate emerging sustainability metrics into financial reporting and potentially offer industry-specific features.

Potential Future Features of Sage One Accounting

| Feature Category | Potential Future Feature | Rationale |

|---|---|---|

| Automation | AI-powered invoice processing and expense categorization | Automates routine tasks, increasing efficiency and reducing errors. |

| Integration | Seamless integration with e-commerce platforms | Streamlines the flow of transactions from online sales to accounting records. |

| Reporting & Analysis | Predictive analytics dashboards | Provides proactive insights for improved decision-making. |

| Security | Multi-factor authentication and enhanced data encryption | Protects sensitive financial data in a growingly digital world. |

| Compliance | Automated compliance reporting for specific industries | Simplifies the process of meeting regulatory requirements. |

Final Review

In conclusion, Sage One Accounting presents a compelling solution for small businesses seeking a robust and user-friendly accounting system. While specific advantages and disadvantages will vary based on individual business needs, the software’s comprehensive features and affordability make it a strong contender. Ultimately, the decision to adopt Sage One Accounting depends on careful consideration of your business requirements and a thorough evaluation of alternatives.