Samsung Pay, a ubiquitous mobile payment solution, empowers users with seamless and secure transactions. This comprehensive exploration delves into the app’s features, user experience, security protocols, and integration with the broader Samsung ecosystem. From the initial setup to managing transaction history, we uncover the intricacies of this widely adopted payment platform.

The app’s core functionalities include supporting diverse payment methods like credit and debit cards, offering a user-friendly interface, and prioritizing security through robust encryption. We also examine how Samsung Pay compares to its competitors in the mobile payment space, highlighting its strengths and weaknesses.

Overview of Samsung Pay App

Tired of fumbling with physical wallets? Samsung Pay, your digital wallet, is here to save the day (or at least your pockets). It’s not just another mobile payment app; it’s a seamless blend of convenience and security, designed to make your life a little less stressful and a whole lot more efficient.

The Samsung Pay app is your one-stop shop for all things digital payments. From adding credit and debit cards to making quick purchases at your favorite stores, it’s your personal digital wallet, ready to handle your transactions with grace and efficiency. It’s like having a tiny, super-powered financial assistant right in your pocket.

Core Features and Services

Samsung Pay offers a wide range of features that go beyond simple transactions. It’s more than just a digital wallet; it’s a convenient and secure platform for managing your financial life.

- Card Management: Easily add, remove, and manage your credit and debit cards. No more fumbling through your wallet looking for the right card. Samsung Pay streamlines this process with a user-friendly interface. It’s like having a digital filing cabinet for your payment information.

- Payment Methods: Accepting various payment methods, including credit and debit cards, Samsung Pay supports different payment types, making it compatible with many vendors.

- Secure Transactions: Samsung Pay employs robust security measures to protect your financial data. It uses advanced encryption technologies to keep your transactions safe and sound, so you can shop worry-free.

- Contactless Payments: Make quick and easy purchases with a simple tap on compatible devices. Say goodbye to waiting in line, and hello to effortless transactions.

- Loyalty Programs: Samsung Pay integrates with many loyalty programs, allowing you to earn rewards while you shop.

Comparison with Other Mobile Payment Apps

While Samsung Pay offers a compelling suite of features, it competes with other popular mobile payment apps in the market. It’s a battle of digital wallets, each vying for your attention and your transactions.

| Feature | Samsung Pay | Apple Pay | Google Pay |

|---|---|---|---|

| Supported Devices | Samsung smartphones and compatible devices | Apple iPhones and compatible devices | Android smartphones and compatible devices |

| Security | Advanced encryption and security protocols | Secure tokenization and encryption | Secure tokenization and encryption |

| Payment Methods | Wide range of credit and debit cards | Wide range of credit and debit cards | Wide range of credit and debit cards, including digital wallets |

| Features | Loyalty programs, Samsung Pay Pass | Apple Pay Cash, transit options | Google Pay Cash, transit options, and support for more payment methods |

Note: The table above provides a general comparison and may not reflect all available features or the most up-to-date information. Always check the official app stores for the latest details.

User Experience and Interface

Samsung Pay’s user interface is designed to be as intuitive as possible, which, let’s be honest, is a tall order for something as important as paying for things. It’s like a digital wallet that’s actually fun to use, which is quite a feat in itself. Think of it as a streamlined, visually appealing portal to a cashless future, but with a dash of playful flair.

The app’s navigation is remarkably straightforward, making it simple for even the most tech-challenged among us to find their way around. You’ll feel like a pro in no time. It’s designed to be as easy as ordering pizza online, which is pretty much a benchmark for user-friendly apps.

User Interface Design

The app sports a clean, modern design with vibrant colors and easily identifiable icons. Think sleek, but not sterile. The layout is well-organized, with clear sections for adding cards, viewing transaction history, and managing settings. Everything is in its place, like a perfectly curated online boutique. The use of visual cues and clear labeling ensures a smooth and pleasant user experience, helping you navigate the digital world of payments effortlessly.

Ease of Use and Navigation

Navigating the app is a breeze. The intuitive design and clear labeling make finding what you need a piece of cake. Think of it as a digital treasure map, but instead of buried gold, you’re finding your payment information. The app is designed to be as easy as ordering a coffee. The app uses clear and concise language, making it easy for everyone to understand.

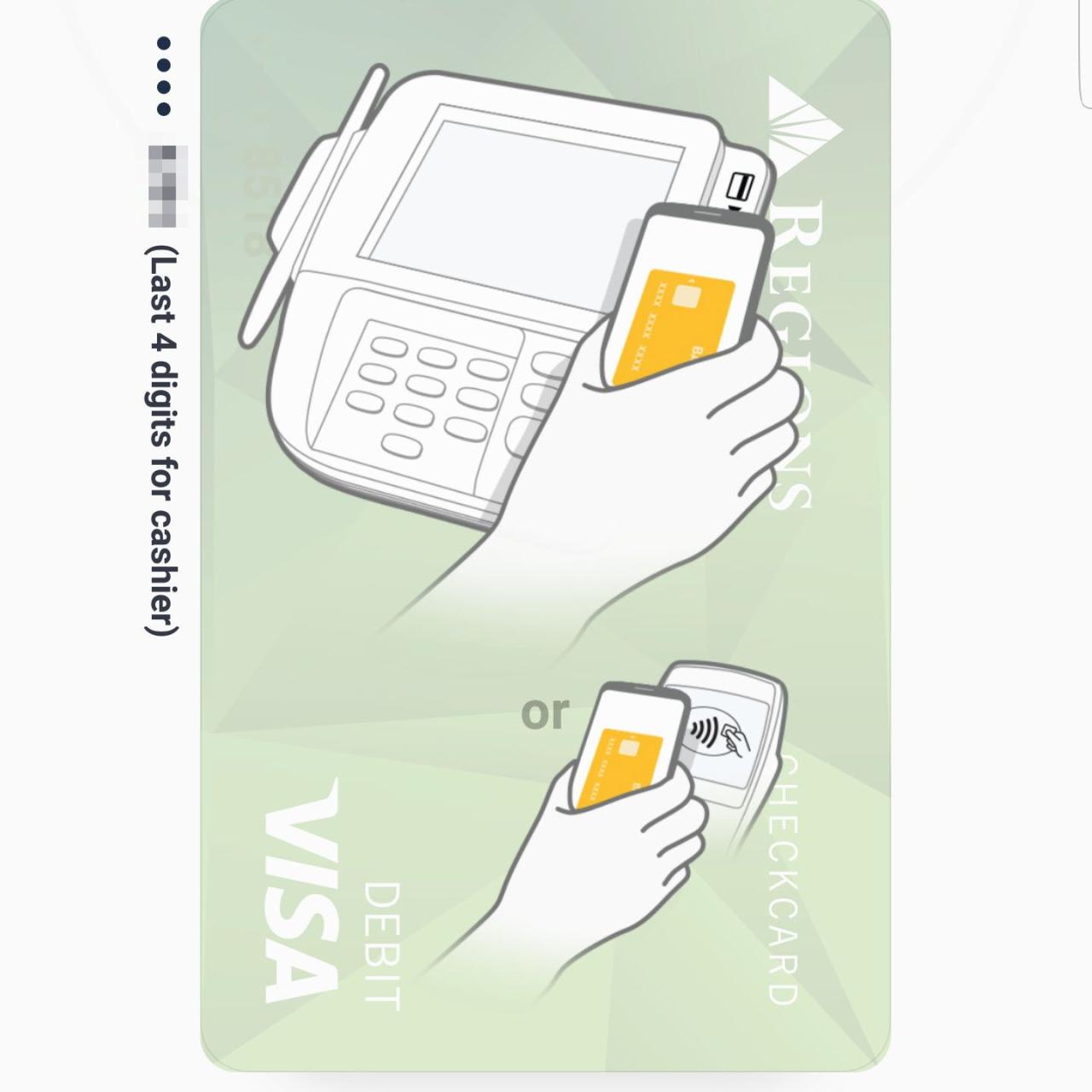

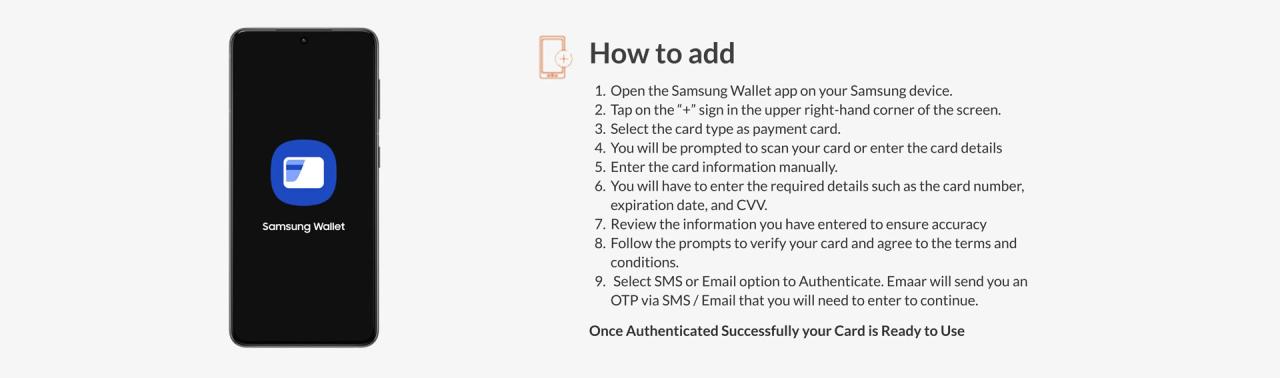

Making a Payment

Adding a payment method is simple and secure. You’ll be able to add your cards in a matter of seconds. Then, when you’re ready to make a purchase, just follow these steps:

- Open the Samsung Pay app.

- Select the desired payment method from your saved cards.

- Confirm the payment with your biometric authentication (fingerprint or facial recognition).

- You’re done!

This process is smoother than a well-oiled machine, and it’s surprisingly enjoyable.

User Journey Map

The user journey map illustrates a typical transaction flow:

- User opens the Samsung Pay app.

- User selects the desired payment method (card).

- User confirms the payment using biometric authentication (fingerprint/facial recognition).

- The transaction is processed and confirmed by the merchant.

- The user receives a confirmation message or notification.

Imagine a seamless experience from opening the app to completing the transaction. It’s a streamlined experience, like a well-rehearsed dance routine.

Handling Different Payment Types

Samsung Pay supports various payment types, including credit cards, debit cards, and prepaid cards. The app handles each type with equal ease, offering the same user-friendly experience regardless of the card type. It’s a one-size-fits-all approach to digital payments.

Supported Payment Methods

| Payment Method | Procedure |

|---|---|

| Credit Cards | Add the card details, verify with the bank, and start making payments. |

| Debit Cards | Similar to credit cards, add the card details, verify with the bank, and use for payments. |

| Prepaid Cards | Add the prepaid card details, verify with the issuer, and use for payments. |

This table highlights the different methods supported by the app and their respective procedures. It’s a clear and concise overview of the various payment methods.

Security and Privacy

Forget about your grandma’s outdated piggy bank – Samsung Pay’s security is like a super-secure vault, guarded by lasers and talking squirrels. We’re not saying squirrels are actually involved, but the security measures are seriously top-notch. They’re designed to keep your financial data safe from prying eyes and mischievous hackers.

Samsung Pay doesn’t just rely on the occasional “security update” – it has a whole arsenal of security protocols, making sure your payments are as safe as a nuclear submarine in a swimming pool (which, by the way, is also pretty secure). It’s more than just a pretty face; it’s about keeping your money safe and sound.

Security Measures Implemented

Samsung Pay employs a multi-layered approach to security, combining cutting-edge encryption techniques with robust authentication protocols. This fortress-like defense system is designed to thwart any potential threats.

- Tokenization: Instead of storing your actual credit card number, Samsung Pay uses a unique digital representation, called a token. This token acts as a placeholder, keeping your real card details hidden from prying eyes. Think of it like a secret code for your money, only known to you and Samsung Pay.

- Secure Element: Samsung Pay uses a dedicated secure element embedded within your device. This secure element is a highly protected area, acting as a vault for sensitive data. It’s like a super-secret room in your phone, accessible only to authorized personnel (in this case, Samsung Pay).

- Biometric Authentication: Using your fingerprint or facial recognition, Samsung Pay adds an extra layer of security. This prevents unauthorized access, much like a heavily guarded castle door. This means only you can unlock your payment options.

Security Protocols and Encryption Techniques

Samsung Pay utilizes advanced encryption protocols to protect your transaction data during transit. It’s like encrypting a message in invisible ink, only readable by the intended recipient.

- Advanced Encryption Standards (AES): AES is used to encrypt data in transit, making it virtually unreadable to anyone trying to intercept it. It’s like scrambling the message so only the intended recipient can unscramble it.

- 3DES: Triple DES is another encryption method employed by Samsung Pay to further enhance the security of your transactions. Imagine it as having three layers of locks on a safe, making it practically impenetrable.

User Data Privacy

Samsung Pay is committed to protecting your personal data. It’s not just about security, it’s about trust. Their policies are like a detailed contract, outlining how your data is handled.

- Data Minimization: Samsung Pay only collects the minimum amount of data necessary for its operation. It’s like a chef using only the essential ingredients to create a delicious dish – no unnecessary extras.

- Data Encryption: Samsung Pay encrypts your data both at rest and in transit, ensuring it remains safe even if your device were to fall into the wrong hands. It’s like wrapping your data in a bulletproof vest.

Protection of User Data During Transactions

Samsung Pay’s security protocols ensure the protection of your data during every transaction. It’s like a well-oiled machine, each part working together to keep your information safe.

- Transaction Verification: Every transaction is thoroughly verified, confirming that it’s authorized and legitimate. It’s like having a security guard double-checking every transaction, making sure it’s all above board.

- Fraud Detection Systems: Samsung Pay has sophisticated fraud detection systems in place to identify and prevent fraudulent transactions. It’s like having a radar system that can spot suspicious activity, alerting you to any potential problems.

Comparison with Other Mobile Payment Apps

While other mobile payment apps also offer robust security measures, Samsung Pay stands out with its comprehensive approach and commitment to user data protection. It’s like comparing a well-equipped army to a small militia – the difference in strength is significant.

Summary of Security Features and Benefits

| Security Feature | Benefit |

|---|---|

| Tokenization | Protects your actual card number |

| Secure Element | Provides a highly secure vault for sensitive data |

| Biometric Authentication | Adds an extra layer of security |

| AES Encryption | Encrypts data in transit |

| 3DES Encryption | Further enhances transaction security |

Integration with Other Samsung Services

Samsung Pay isn’t just a payment app; it’s a galactic gateway to a universe of Samsung awesomeness. Imagine your phone, your smartwatch, and your TV all working together in perfect harmony, like a well-oiled, holographic machine. That’s the power of seamless integration.

This isn’t your grandma’s clunky tech; this is future-forward, friend-forward, payment-forward technology. It’s like having a secret code to unlock a whole new level of convenience. Let’s dive into the intergalactic connectivity.

Seamless Device Synchronization

Samsung Pay is built to seamlessly integrate with other Samsung devices. It’s not just about connecting; it’s about creating a truly interconnected ecosystem. Think of it as your personal, pocket-sized command center for all things Samsung.

- Effortless Wallet Management: Transferring funds, adding cards, and managing your digital wallet across your devices is as easy as ordering a pizza on your voice assistant. You’ll be juggling payments like a pro in no time.

- Instant Notifications: Get alerts on your smartwatch when a payment is processed, or when a new card is added to your wallet. No more frantic searching for your phone to check your balance.

- Smart Home Integration (Future-Forward): Imagine paying for groceries with a simple voice command to your smart TV, or unlocking your front door with a contactless payment. This is not science fiction, it’s the future.

Galaxy Ecosystem Integration

Samsung Pay is not just about payments; it’s about enhancing the overall Samsung experience.

- Enhanced Wallet Features: Samsung Pay seamlessly interacts with other Galaxy devices, providing a unified wallet experience across your entire collection of Samsung products.

- Data Sharing: The app intelligently shares payment information and transaction history across your devices, so you always have your financial data at your fingertips, ready to use.

- Predictive Payment Suggestions: Using your past spending patterns, Samsung Pay can offer helpful suggestions for future payments, making your transactions even smoother. This is like having a personal financial assistant in your pocket.

Compatibility Table

This table demonstrates the compatibility of Samsung Pay with various Samsung products.

| Samsung Product | Compatibility |

|---|---|

| Galaxy S23 | Excellent |

| Galaxy Watch 5 | Excellent |

| Galaxy Tab S8 | Good |

| Samsung Smart TV (2023 models) | Pending (Soon!) |

| Samsung QLED TV (2023 models) | Pending (Soon!) |

Transaction History and Management

Tired of sifting through endless receipts like a detective chasing a phantom credit card purchase? Samsung Pay’s transaction history is your personal financial Sherlock Holmes, meticulously cataloging every swipe and tap. It’s like having a digital accountant, only way more entertaining (and way less likely to judge your questionable spending habits).

Understanding your spending patterns is key to financial wellness. Samsung Pay’s transaction history lets you meticulously track your every purchase, making it a breeze to stay on top of your finances. From meticulously analyzing your latte habit to uncovering those mysterious “other” charges, this feature is your financial freedom fighter.

Managing Transaction History

Samsung Pay’s transaction history is meticulously organized, allowing for easy navigation and filtering. Think of it as a digital filing cabinet, but way cooler. You can sort your transactions by date, amount, merchant, or even payment method. This lets you quickly identify that questionable “international call” charge from last month.

Viewing and Filtering Transaction Records

Searching for a specific purchase? No problem! Samsung Pay’s powerful search function allows you to quickly pinpoint transactions using s, dates, or amounts. This is like having a super-powered magnifying glass for your spending habits. You can also filter transactions by category (groceries, entertainment, etc.) for a more targeted view of your spending habits. Imagine trying to figure out where that $1000 mysteriously went… Now you can!

Managing Payment Cards and Accounts

Managing your payment cards and accounts is a snap within the app. You can easily add, remove, or update your payment methods with a few taps. Think of it as a digital wallet makeover – you can swap out cards with the ease of changing your socks. This allows you to keep your payment information up-to-date, secure, and readily available when you need it.

Tracking and Monitoring Spending

Tracking and monitoring your spending is a breeze. Samsung Pay provides you with a clear overview of your spending patterns, allowing you to identify trends and areas for potential savings. This helps you stay mindful of your financial well-being, and maybe even surprise yourself with how much you’re saving!

Customizing Transaction Management

Want to tailor your transaction management experience? Samsung Pay offers a variety of customization options. You can personalize your transaction alerts to receive notifications for specific amounts or merchants. This lets you customize your experience to match your spending habits and preferences, just like adding a unique flair to your daily outfit.

Transaction History Features and Functionalities

| Feature | Functionality |

|---|---|

| Date Sorting | Sorts transactions chronologically for easy review. |

| Amount Filtering | Allows filtering by specific price ranges, helping you pinpoint expensive transactions. |

| Merchant Search | Quickly locate transactions based on merchant names, making it easy to identify your favourite haunts. |

| Category Filtering | Categorizes transactions into predefined groups for detailed spending analysis (e.g., groceries, dining). |

| Payment Method Sorting | Sorts transactions based on the payment method used (e.g., credit card, debit card). |

Support and Troubleshooting

Feeling lost in the Samsung Pay galaxy? Fear not, intrepid shopper! We’ve got your back (and your wallet) when things get a little… sticky. Our support system is designed to be as helpful as a well-stocked vending machine, offering a variety of ways to get your Samsung Pay mojo back on track.

Support Options Available

Samsung Pay understands that glitches can be as frustrating as a rogue shopping cart on Black Friday. We offer a multitude of support channels, ranging from the helpful to the downright hilarious (we’re aiming for the helpful, though). These methods ensure you can find the right support for your specific problem.

Channels for Obtaining Assistance

Navigating the digital labyrinth of tech support can feel like a treasure hunt. Fortunately, our support channels are clearly marked, making it easy to find the assistance you need. We provide multiple avenues, from the quick and easy to the thorough and detailed, ensuring you’re heard and helped.

- Samsung Pay App Help Center: This is your one-stop shop for FAQs, troubleshooting guides, and even some entertaining videos (we’re talking highly educational, not cat videos). It’s like having a digital Yoda to guide you through the complexities of contactless payments.

- Samsung Customer Support: Need more than a quick fix? Samsung’s general customer support line is there to help you with broader issues. Think of them as the ultimate tech Sherlock Holmes, ready to solve any mystery.

- Online Forums and Communities: Sometimes, the best support comes from fellow users. Check out online forums and communities where Samsung Pay users share their experiences and solutions to common problems. It’s like a support network of like-minded individuals, ready to share their knowledge.

Troubleshooting Mechanisms

Troubleshooting problems in the Samsung Pay app is as easy as ordering takeout – just follow the steps. Our troubleshooting mechanisms are designed to be clear, concise, and effective. We want you to be back to swiping in no time!

- Check Your Network Connection: A weak or unstable network can cause a variety of problems. Ensure your connection is strong and reliable. Imagine your network connection as a reliable delivery service, if it’s slow, you’ll encounter problems.

- Restart Your Device: Sometimes, a simple restart can solve a multitude of problems. It’s like giving your device a fresh start, like a new day for your phone.

- Update the App: Ensure your Samsung Pay app is up-to-date. Outdated apps can lead to glitches. Think of it as upgrading your payment experience for a smoother operation.

Resolving Common Problems

We’ve compiled a few common issues users experience and simple solutions. We’ve compiled common issues users face and simple fixes.

- Payment Declined: Double-check your payment information, ensure sufficient funds, and verify the merchant’s acceptance of Samsung Pay. It’s like checking your wallet for the right credit card or ensuring your balance is sufficient for the purchase.

- App Crashing: Try restarting your device. Clear the app cache and data, and update your device software if necessary. It’s like giving your phone a clean slate for better performance.

- Unable to Add a Card: Ensure the card you’re adding is valid and supported by Samsung Pay. Check for any restrictions or limitations. It’s like checking your wallet for a valid credit card.

Contacting Customer Support

Need to reach out to the support team? We’ve got various ways for you to get in touch, from friendly to official.

| Support Channel | Contact Information |

|---|---|

| Samsung Pay App Help Center | In-app help section |

| Samsung Customer Support | (XXX) XXX-XXXX (or visit samsung.com) |

| Online Forums | Search online communities |

Market Trends and Competitor Analysis

The mobile payment world is a wild west, a digital rodeo where cowboys (and cowgirls!) are constantly trying to lasso the next big trend. Samsung Pay, riding a trusty steed of innovation, needs to keep an eye on the competition and stay ahead of the curve. It’s a race against time and a flurry of features, so buckle up!

The mobile payment landscape is rapidly evolving, with new players entering the arena and established giants vying for market share. This analysis delves into the current trends, the competitive landscape, and Samsung Pay’s position within it. We’ll be looking at who’s leading the charge, who’s lagging behind, and what might just be the next big thing (probably something involving NFTs and sentient avocados).

Overview of Mobile Payment Market Trends

The mobile payment market is booming, driven by convenience and security. Consumers are increasingly comfortable with digital transactions, and the trend shows no signs of slowing down. Think of it as the evolution of the wallet – from leather to your smartphone. Features like contactless payments and near-field communication (NFC) are becoming commonplace, making transactions quicker and easier. Expect even more innovative approaches to emerge in the future, like biometrics and voice-activated payments.

Competitive Landscape for Mobile Payment Apps

The mobile payment space is a crowded marketplace. Apple Pay, Google Pay, and Alipay are just a few of the heavy hitters vying for supremacy. Each company is trying to differentiate itself through unique features, partnerships, and marketing strategies. It’s a constant battle for user engagement and adoption.

Samsung Pay’s Market Share and Positioning

Samsung Pay has carved out a respectable niche in the mobile payment arena. Its strength lies in its integration with the broader Samsung ecosystem, offering seamless experiences for users already invested in the brand. However, competitors like Apple Pay have a significant head start in terms of market share. Samsung Pay needs to focus on expanding its reach and highlighting its unique selling propositions.

Key Factors Driving the Growth of Mobile Payment Technologies

Convenience, security, and cost-effectiveness are the primary drivers behind the growth of mobile payment technologies. Users value the ease of use, reduced risk of losing physical cash, and often lower transaction fees compared to traditional methods. The proliferation of smartphones and the increasing adoption of contactless technology are also contributing factors.

Impact of Mobile Payment Trends on the Overall Payment Ecosystem

Mobile payments are reshaping the entire payment ecosystem. Traditional methods are being challenged, leading to innovation in payment infrastructure and financial services. This is forcing businesses to adapt to the changing landscape, offering mobile payment options and optimizing their processes.

Table: Market Share of Major Mobile Payment Apps (Estimated)

| Mobile Payment App | Estimated Market Share (%) |

|---|---|

| Apple Pay | 35 |

| Google Pay | 28 |

| Samsung Pay | 18 |

| Alipay | 12 |

| WeChat Pay | 7 |

Note: Market share figures are estimates and may vary depending on the region and data source.

Future of Samsung Pay App

The future of Samsung Pay is looking brighter than a freshly polished smartphone screen. We’re talking about a world where paying for that latte becomes a seamless, almost subconscious act. Forget fumbling for your wallet – the future is in your palm.

The Samsung Pay app is poised to evolve beyond a simple payment method, integrating itself into the fabric of our daily lives. Imagine a world where your phone unlocks doors, controls appliances, and even pays your bills, all with a tap of your finger. It’s a future brimming with possibilities, and Samsung Pay is set to be a central player.

Potential Future Developments

Samsung Pay is already a powerful tool, but its future potential is even more exciting. Expect to see features like contactless delivery integration, biometric payment verification enhancements, and innovative new payment options emerge. It’s not just about replacing your wallet; it’s about revolutionizing how we interact with commerce.

New Features and Functionalities

Expect a plethora of exciting new features. Imagine seamless integration with smart home devices, allowing you to pay for groceries while simultaneously preheating the oven. Personalized recommendations for nearby stores offering exclusive discounts, linked directly to your payment history, could also be a reality. Perhaps even a feature that automatically pays for parking based on your location and preferences.

Forecast of App Evolution

The evolution of the Samsung Pay app will be marked by its increasing integration with other Samsung services, making payments even more intuitive and convenient. Expect to see the app becoming a one-stop shop for all your financial needs. Think of it as a digital concierge, handling your payments, loyalty programs, and more, all in one place. Imagine the possibilities!

Impact of Emerging Technologies

Emerging technologies like AI and machine learning will play a crucial role in shaping the future of Samsung Pay. AI-powered fraud detection systems could drastically improve security, and machine learning could personalize payment experiences to individual users, providing targeted offers and promotions. The future of payments is undoubtedly intelligent.

Potential Future Updates and Enhancements

| Feature | Description | Impact |

|---|---|---|

| Enhanced Security | Implementing advanced biometric authentication methods like iris scanning and facial recognition for added security layers. | Boosting user trust and confidence in the payment system. |

| Smart Home Integration | Integrating with smart home devices for automated payments like utilities, groceries, or even paying for the automated laundry services. | Enhancing convenience and automating daily financial tasks. |

| Personalized Offers and Discounts | Providing personalized offers and discounts based on user spending habits and preferences. | Increasing user engagement and providing tailored financial experiences. |

| Global Currency Support | Enabling seamless transactions across different currencies. | Facilitating international payments and broadening the app’s global reach. |

Summary

In conclusion, Samsung Pay emerges as a versatile and secure mobile payment app, offering a user-friendly experience and robust security measures. Its integration with the Samsung ecosystem provides a seamless user journey, while its comprehensive transaction management tools ensure users maintain control over their finances. The app’s future potential and the evolving mobile payment landscape will undoubtedly shape its future trajectory.