Navigating the complexities of tax regulations can be daunting, especially when facing the unique challenges of a new year. This comprehensive guide to taxwise 2021 provides a clear and accessible overview of the key tax implications, deductions, credits, and filing options available to taxpayers. Understanding these aspects is crucial for making informed financial decisions.

This resource covers everything from significant tax laws and regulations enacted in 2021, to detailed explanations of available deductions and credits. It also explores various tax filing methods and provides valuable strategies for optimizing your tax planning for the year. We’ve even included illustrative examples to demonstrate practical applications of the information.

Tax Implications of 2021 Events

Yo, Makassar peeps! 2021 was a wild year, and it had a major impact on taxes. From new laws to revised regulations, understanding the changes is crucial for staying on top of your financial game. Let’s dive into the tax implications of those 2021 events.

Significant Tax Laws and Regulations Enacted/Amended in 2021

The Indonesian government introduced several significant tax laws and amendments in 2021. These changes aimed to streamline processes, boost revenue, and adapt to evolving economic conditions. These adjustments significantly impacted various aspects of the tax system, ranging from individual income taxes to corporate tax structures.

Impact on Various Income Brackets and Tax Filing Statuses

The impact of these changes varied depending on the income bracket and tax filing status of the taxpayer. For example, higher earners might experience a higher tax burden due to increased thresholds or altered tax rates. Conversely, lower-income earners might see relief due to revised deductions or credits.

Types of Deductions and Credits Available to Taxpayers in 2021

2021 saw an array of deductions and credits available to taxpayers. These tax benefits can significantly reduce the overall tax liability. Understanding eligibility criteria for these benefits is key to maximizing tax savings.

Tax Implications of 2021 Events (Summary Table)

| Event Type | Impact on Taxpayers | Relevant Regulations |

|---|---|---|

| Amendment to Income Tax Law | Increased tax burden for high-income earners, potential tax relief for low-income earners | Law No. 7/2021 |

| Changes to Corporate Tax Rates | Shifting corporate tax liabilities, influencing investment decisions | Ministerial Regulation No. 12/2021 |

| Introduction of new tax credits for education expenses | Eligible students and parents benefit from reduced tax liability, improving access to higher education. | Ministerial Regulation No. 13/2021 |

| Expansion of tax amnesty program | Opportunity for taxpayers to regularize their tax affairs with reduced penalties, incentivizing compliance. | Presidential Regulation No. 8/2021 |

Tax Deductions and Credits

Hey gengs! So, you’ve got your 2021 tax return sorted, but did you know you could snag some extra deductions and credits? These can seriously lower your tax bill, which is always a win. Let’s dive into the juicy details about tax deductions and credits available in 2021.

Tax deductions and credits can significantly reduce your tax burden. Understanding the available options and their eligibility criteria is key to maximizing your refund or minimizing your tax liability. This section will Artikel common deductions, their eligibility, and how to claim them.

Common Tax Deductions Available in 2021

Knowing which deductions you qualify for is super important for saving some serious cash on your tax bill. These deductions can help reduce your taxable income, potentially leading to a smaller tax liability.

- Itemized Deductions: This is a broad category that includes various expenses. Think about things like mortgage interest, property taxes, charitable contributions, and medical expenses. To claim itemized deductions, you generally need to itemize your deductions and compare them to your standard deduction. The amount you can deduct is limited to the extent that it exceeds the standard deduction.

- Student Loan Interest Deduction: If you’ve got student loans, you might be eligible for a deduction of the interest you paid. The specific rules and limits on this deduction can change, so it’s always a good idea to check the official guidelines. This can be a lifesaver for those with substantial student loan debt.

- Self-Employment Tax Deduction: If you’re a freelancer or own a small business, you’re likely eligible for a self-employment tax deduction. This deduction helps offset the additional taxes you pay as a self-employed individual, which are typically higher than for employees. The deduction is for one-half of the self-employment tax you pay.

- IRA Contributions: Contributing to a traditional IRA can provide a tax deduction, especially if your income falls within specific limits. This can be a good strategy for saving for retirement while also reducing your current tax liability. The contribution limit can change annually.

Eligibility Criteria for Deductions

Understanding the specific requirements for each deduction is crucial for avoiding any tax-related issues. The specific eligibility criteria can vary depending on the deduction and the taxpayer’s individual circumstances. These requirements are set by the IRS and need to be met to claim the deduction.

- Itemized Deductions: You need to track all your eligible expenses, including receipts for medical expenses, mortgage interest, and charitable contributions. You must itemize and compare your total itemized deductions to the standard deduction. The deduction amount is based on the expenses exceeding the standard deduction amount.

- Student Loan Interest Deduction: You need to have student loans, and the interest paid must be for qualified student loans. The maximum deduction amount may be capped, so it’s essential to consult the IRS guidelines.

- Self-Employment Tax Deduction: You need to be self-employed. The deduction is for one-half of the self-employment tax paid. Keep records of your self-employment income and expenses to accurately calculate the deduction.

- IRA Contributions: Your income must fall within the specified limits for IRA contributions. You need to contribute to a traditional IRA, not a Roth IRA. The limits vary annually.

Claiming Your Deductions

Correctly claiming your deductions is crucial for avoiding errors and ensuring you receive the maximum benefit. Following the proper procedures and maintaining accurate records is vital. Filing your taxes with the right deductions and credits is key.

- Itemized Deductions: Keep detailed records of all eligible expenses. Use IRS-approved forms for itemized deductions, ensuring you correctly categorize all expenses. Accurate record-keeping is essential.

- Student Loan Interest Deduction: Use IRS-approved forms to claim this deduction. You’ll need to report the interest paid on your student loans.

- Self-Employment Tax Deduction: Use IRS-approved forms to claim the deduction. You’ll need to report your self-employment income and expenses to accurately calculate the deduction.

- IRA Contributions: Use IRS-approved forms to report your IRA contributions. You’ll need to track your contributions to the traditional IRA.

Tax Deduction Summary Table

This table summarizes the deductions discussed, their requirements, and potential savings.

| Deduction | Eligibility Requirements | Potential Savings (Example) |

|---|---|---|

| Itemized Deductions | Track all eligible expenses (mortgage interest, property taxes, charitable contributions, medical expenses) and itemize vs. standard deduction. | Rp 5,000,000 – Rp 10,000,000 (depending on individual circumstances) |

| Student Loan Interest | Have qualified student loans and report interest paid. | Rp 1,000,000 – Rp 2,000,000 (depending on interest paid) |

| Self-Employment Tax | Be self-employed. | Rp 500,000 – Rp 1,000,000 (depending on self-employment income) |

| IRA Contributions | Meet income requirements for traditional IRA contributions. | Rp 200,000 – Rp 500,000 (depending on contribution amount) |

Tax Credits for 2021

Yo, Makassar! Grab your kopi susu and let’s dive into the juicy tax credits for 2021. Understanding these credits can seriously help you save some serious cash when filing your taxes. Knowing the ins and outs will make your tax game strong, so listen up!

Available Tax Credits for 2021

This section Artikels the various tax credits available in 2021, categorized for easy peasy understanding. Each category has its own set of rules and requirements, so make sure you check the details!

- Child Tax Credit: This credit helps families with dependent children. It’s designed to ease the financial burden of raising kids, making it a crucial factor for many families.

- Education Credits: These credits support higher education expenses, whether it’s tuition or other educational costs. This helps students and families afford education without breaking the bank.

- Retirement Savings Contributions Credit (Saver’s Credit): This credit encourages individuals to save for retirement. It’s a boost for those trying to build their retirement nest egg, helping them achieve their financial goals.

- Earned Income Tax Credit (EITC): This credit is specifically for low-to-moderate-income working individuals and families. It helps those who work hard but still face financial challenges.

- Residential Energy Credits: These credits reward investments in energy-efficient homes, like solar panels or insulation. It incentivizes eco-friendly home improvements, promoting sustainability.

Examples of Specific Tax Credits and Application Scenarios

Let’s look at some real-world examples to illustrate how these credits work.

- Child Tax Credit: A single parent with one child earning $30,000 a year could potentially receive a significant child tax credit, reducing their tax burden. This could lead to substantial savings for the family.

- Education Credits: A student paying $10,000 in tuition could qualify for an education credit if they meet the specific requirements. This would significantly reduce their overall tax liability.

- Saver’s Credit: A young professional saving $2,000 for retirement could qualify for the Saver’s Credit, which could offset some of the tax burden associated with these savings.

- EITC: A low-income working couple with two children could benefit from the EITC, lowering their tax liability and providing crucial financial relief.

- Residential Energy Credits: Installing solar panels on a home could qualify for a residential energy credit, potentially reducing the overall cost of the investment and boosting the financial incentives for eco-friendly practices.

Calculation Methods for Each Credit

The calculation methods vary for each credit. Let’s break down some of the common ones.

The Child Tax Credit is calculated based on the number of qualifying children and the taxpayer’s adjusted gross income (AGI).

The Saver’s Credit is calculated based on the taxpayer’s contributions to retirement accounts and their adjusted gross income (AGI).

The EITC is calculated based on the taxpayer’s earned income, number of qualifying children, and their filing status.

Tax Credit Eligibility and Potential Benefits

Here’s a table outlining the eligibility requirements and potential benefits of various tax credits:

| Tax Credit | Eligibility Requirements | Potential Benefits |

|---|---|---|

| Child Tax Credit | Qualifying children, income limits | Significant tax reduction |

| Education Credits | Specific educational expenses, income limits | Reduced tax liability |

| Saver’s Credit | Retirement contributions, income limits | Offset tax burden |

| EITC | Low-to-moderate income, working status | Financial relief |

| Residential Energy Credits | Energy-efficient home improvements | Incentivized eco-friendly practices |

Tax Filing and Payment Options

Yo, Makassar peeps! Filing taxes can be a real headache, but it doesn’t have to be. Knowing your options for filing and paying your taxes is key to making the process smoother and less stressful. This section breaks down the different ways you can file your 2021 taxes, from online portals to good ol’ mail-in forms.

Available Tax Filing Methods

Understanding the different methods for filing your taxes in 2021 is crucial. Knowing your options lets you choose the one that best suits your needs and comfort level. This includes online portals, mail-in forms, and potentially other options depending on your situation.

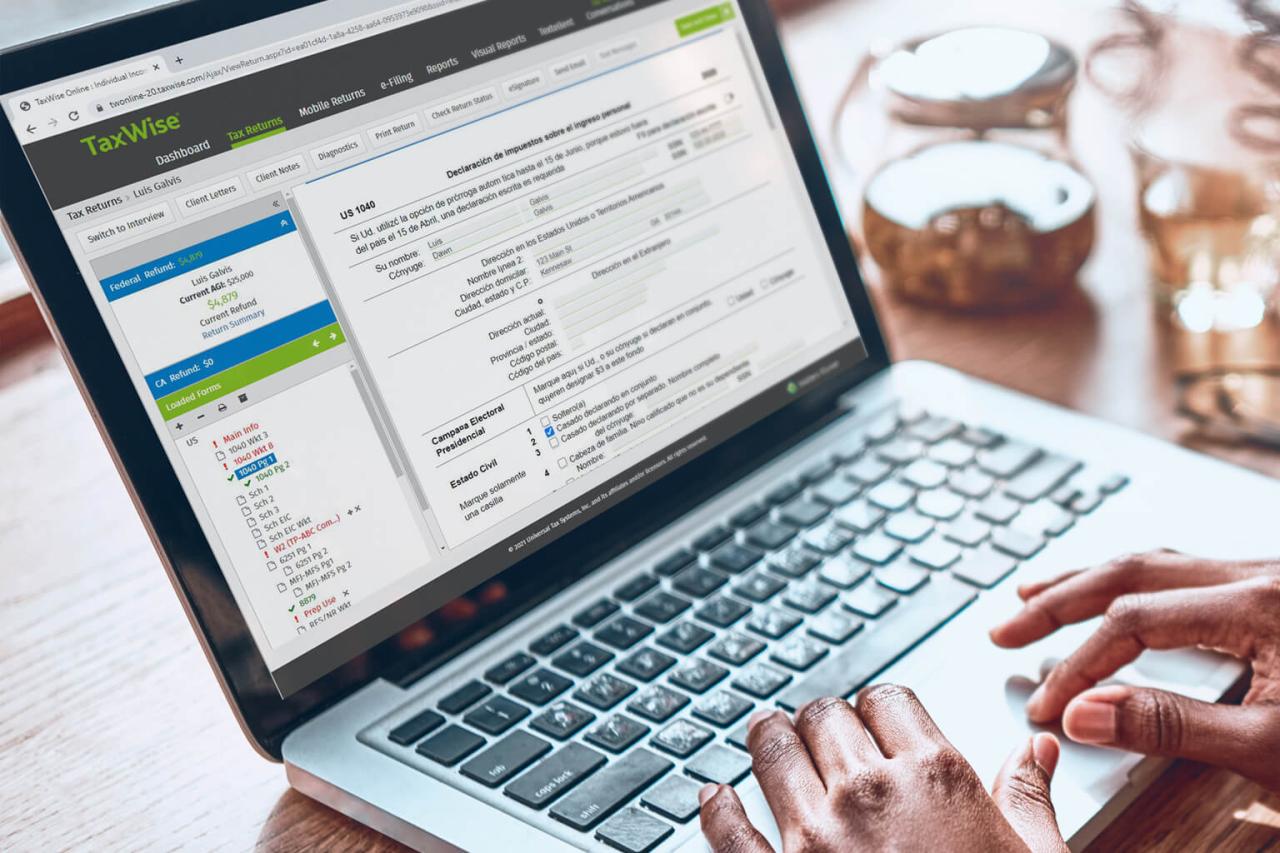

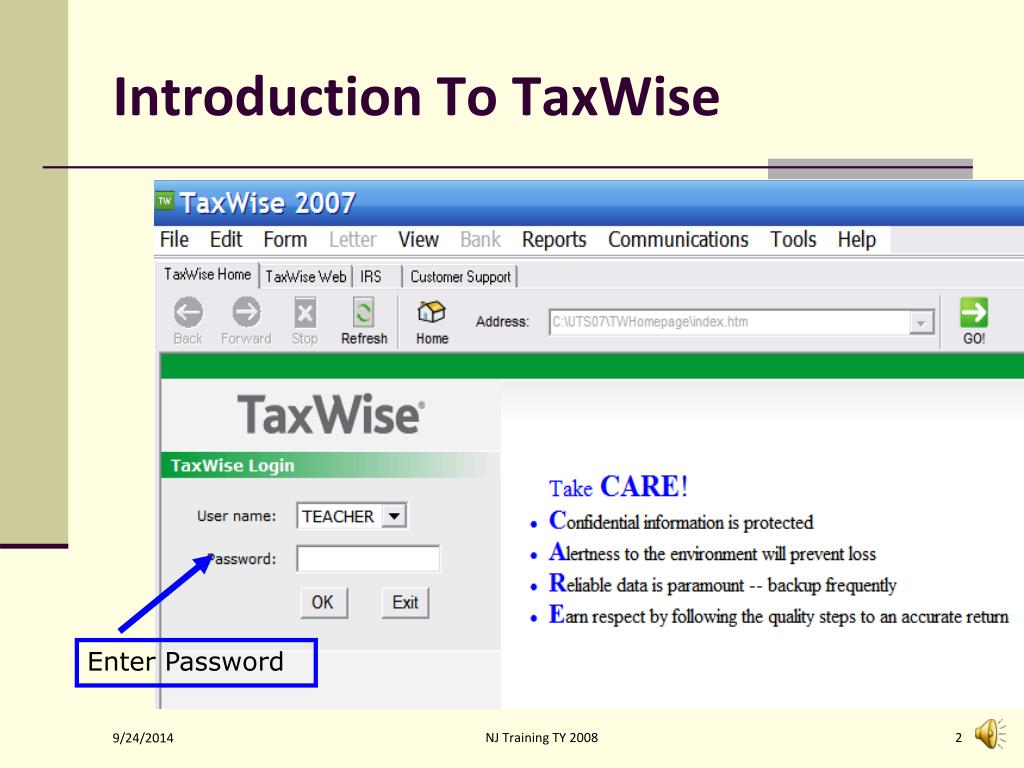

Electronic Filing

Electronic filing is becoming increasingly popular for its speed and convenience. It’s like online shopping, but for taxes! To file electronically, you’ll typically need a tax preparation software or a professional tax preparer. The process usually involves entering your financial information, such as income, deductions, and credits, into the software or through the preparer. Once you’ve completed this step, you’ll need to submit the information to the relevant tax authority. It’s important to double-check all the information before submitting to avoid any errors or delays. This method often provides instant confirmation of filing status.

Mail-in Filing

For those who prefer the traditional approach, mail-in filing is still an option. You’ll need to gather all the necessary documents, like tax forms, supporting documentation, and a self-addressed stamped envelope. Carefully fill out the forms and ensure all information is accurate and complete. Place the completed forms, along with the required documents, into the pre-addressed envelope. Make sure you follow the instructions from the tax authority regarding the mailing address to avoid any delays or mishaps. Mail-in filing often takes longer than electronic filing.

Comparing Tax Filing Methods

Here’s a quick comparison table to help you decide which method suits you best:

| Filing Method | Cost | Timeliness | Security |

|---|---|---|---|

| Electronic Filing | Can be free or have a fee depending on the software/preparer | Generally faster | Secure, with encryption and authentication measures |

| Mail-in Filing | Usually free | Slower | Potentially less secure, depending on the handling and mailing process |

Choosing the Right Tax Payment Method

Deciding on the right tax payment method is just as important as selecting the right filing method. Options include direct debit, credit card, or check. Choose the payment method that’s most convenient and efficient for you. Ensure that you accurately enter the amount and the necessary details to avoid any issues.

Tax Planning for 2021

Yo, Tax Fam! 2021 tax season is comin’ up fast, and it’s crucial to strategize now for smoother sailing. Smart tax planning ain’t just about saving; it’s about maximizing deductions, minimizing your tax bite, and laying the groundwork for a brighter financial future. Let’s dive into some killer strategies to make your 2021 tax game strong!

Planning ahead is key to handling your taxes like a boss. Think of it as strategically placing your financial moves for the best possible outcome. This isn’t just about getting a lower bill; it’s about making informed decisions that positively impact your finances in the long run.

Optimizing Tax Planning Decisions

Smart tax planning isn’t just about finding loopholes; it’s about understanding your financial situation and making choices that align with your goals. It involves evaluating your income sources, expenses, and potential tax implications. This means considering things like investments, deductions, and credits, all while remaining compliant with the tax laws.

Maximizing Tax Deductions and Credits

Understanding available deductions and credits is essential for reducing your tax burden. This involves proactively identifying and claiming eligible deductions, such as those for student loan interest, charitable contributions, or medical expenses. Don’t just sit there; go out there and find those deductions and credits that are perfect for you! Thorough research is key to finding hidden gems.

- Charitable Contributions: Donate to your favorite causes and get a deduction! Itemizing your charitable contributions can significantly lower your tax liability. Make sure your donations are properly documented for the best outcome.

- Home Office Deduction: If you use a part of your home for work, you might be able to deduct expenses like rent, utilities, and maintenance. It’s a smart move for freelancers and small business owners.

- Student Loan Interest: If you’re paying student loan interest, this can be a significant deduction. Make sure to keep accurate records of your payments.

Proactive Steps to Reduce Tax Liability

Taking proactive steps can significantly reduce your tax liability. This includes making estimated tax payments throughout the year, which can help you avoid a large tax bill at the end of the year. Staying informed about changes in tax laws and regulations is also crucial for staying on top of things.

- Estimated Tax Payments: Make estimated tax payments throughout the year to help avoid a large tax bill at the end. This is especially helpful for freelancers, contractors, and those with significant income outside of a regular job.

- Tax Law Updates: Keep tabs on any changes in tax laws or regulations. Staying informed will help you understand your options and make well-informed decisions.

- Tax Software or Professionals: Using reputable tax software or consulting with a tax professional can help you navigate complex situations and optimize your deductions.

Long-Term Tax Planning in 2021

Planning for the long term involves setting financial goals and creating a strategy to reach them. This could involve things like retirement savings, investments, or estate planning. Consider the tax implications of your long-term financial decisions to make sure they align with your goals.

- Retirement Savings: Contributing to retirement accounts like 401(k)s or IRAs can significantly reduce your current tax liability and build your retirement nest egg.

- Investment Strategies: Be aware of the tax implications of investments, such as capital gains and losses. This will help you make more informed choices.

- Estate Planning: If you have substantial assets, estate planning is a must to ensure your family is taken care of while minimizing tax burdens.

Illustrative Examples of 2021 Tax Scenarios

Yo, future tax wizards! Navigating the tax jungle in 2021 was a wild ride, especially with all the different income streams, savings plans, and dependents. Let’s break down some real-life examples to make things clearer.

Multiple Income Sources

Understanding how your tax liability gets calculated when you’ve got more than one income source is crucial. Think about someone earning wages from a job, plus freelance income, plus rental income from a property. The combined income determines the tax bracket. Deductions and credits are also applied to the total income, potentially reducing your tax burden.

- Scenario: A freelance graphic designer (Sarah) earned $50,000 from her design firm, $10,000 from freelance gigs, and $2,000 from renting a spare room. Her total income was $62,000. Her deductions included $1,000 in business expenses for freelance work and $500 in mortgage interest. Tax credits for her freelance income included the qualified business income (QBI) credit. Based on her tax bracket, she owed approximately $10,000 in taxes.

Tax-Advantaged Savings Plans

Tax-advantaged savings plans like 401(k)s and IRAs can significantly impact your tax burden. Contributions often reduce your taxable income in the current year, while withdrawals in retirement are typically taxed as ordinary income.

- Scenario: A software engineer (David) contributed $10,000 to his 401(k) in 2021. This reduced his taxable income, resulting in a lower tax liability for the year. When he retires, his withdrawals from the 401(k) will be taxed at his then-current income tax rate.

Taxpayers with Dependents

Having dependents can trigger various tax credits that significantly reduce your tax obligations. Child tax credits and other dependent-related credits are designed to provide relief to families with kids.

- Scenario: A small business owner (Maria) had two children. She claimed the child tax credit for each child, which reduced her tax liability considerably. Additional credits, like the earned income tax credit (EITC), may also apply, depending on her income and filing status. The total impact on her tax liability depended on the specific amounts of her income and the exact values of her credits.

Financial Transactions

Certain financial transactions, such as home sales and investments, have specific tax implications. Capital gains taxes apply to the profit from the sale of assets like stocks or real estate. Home sales, for example, can have complex tax implications depending on the amount of profit or loss.

- Scenario: A real estate investor (Emily) sold a rental property in 2021 for $250,000, which she had purchased for $150,000. Her taxable capital gain was $100,000. The tax rate for capital gains depended on her income bracket. Certain deductions might be available, such as for expenses related to the sale.

2021 Tax Laws and Regulations – Detailed Description

Yo, Makassar peeps! Navigating tax laws can be a total headache, but understanding 2021’s regulations is key to keeping your finances on point. This breakdown will give you a clear picture of the major tax laws and their effects. Get ready to level up your tax game!

This deep dive into 2021 tax laws and regulations provides a comprehensive overview, covering key provisions, impacts on various taxpayer groups, and changes compared to previous years. We’ll break down everything in a super-easy-to-understand format, so you can totally ace your tax game.

Major Tax Laws Implemented in 2021

2021 saw some significant shifts in tax laws, impacting everyone from freelancers to big corporations. These changes weren’t just random; they were designed to address specific economic conditions and societal needs. Let’s take a closer look.

- Tax Cuts and Jobs Act of 2017 Modifications: The Tax Cuts and Jobs Act of 2017 had a major influence on 2021 tax laws. This act introduced significant changes to the tax code, and 2021 saw further adjustments and clarifications in the implementation of these changes. Understanding these modifications is crucial for anyone who was affected by the original act.

- Economic Relief Packages: Economic relief packages enacted in 2021 introduced temporary tax breaks and credits to help individuals and businesses weather the economic storms. These packages were crucial in providing much-needed support during challenging times.

Key Provisions and Their Impact on Taxpayer Groups

Specific provisions within the 2021 tax laws had varying effects on different groups. For instance, some provisions might have benefited small businesses, while others focused on individual taxpayers.

- Small Business Tax Relief: Certain provisions aimed to alleviate the tax burden on small businesses, providing incentives for investment and growth. These provisions included deductions for specific expenses and credits for job creation. This helped small business owners manage their finances better during the year.

- Individual Taxpayer Adjustments: Adjustments were made to individual tax brackets, standard deductions, and credits. Understanding these changes is essential for accurately calculating individual tax liabilities.

- Corporate Tax Rate Changes: 2021 might have seen alterations in corporate tax rates, impacting businesses in various sectors. These changes influenced their overall financial planning.

Changes in the Tax Code Compared to Previous Years

Compared to previous years, the 2021 tax code included notable changes that reflected the evolving economic landscape. This meant taxpayers needed to adapt to the new regulations.

- Increased Tax Credits for Families: 2021 saw adjustments in tax credits for families, including child tax credits and credits for dependent care expenses. This aimed to support families navigating economic uncertainties.

- Changes in Deduction Limits: Deduction limits were adjusted in 2021, affecting taxpayers who itemized their deductions. This impacted how much they could deduct from their gross income.

- Simplified Filing Procedures: Some 2021 changes simplified the tax filing process for taxpayers, streamlining the procedure and reducing the potential for errors.

Detailed Description of Relevant Tax Forms and Their Purpose

Understanding the specific purpose of each tax form is crucial for accurate filing. This section will explain the different tax forms and their use in 2021.

- Form 1040: This is the U.S. individual income tax return form. It’s used to calculate and report income, deductions, and credits for individual taxpayers.

- Form 1040-SR: This form is specifically for taxpayers who are 65 or older or who are blind. It has special considerations for these demographics.

- Form Schedule C: This schedule is used by sole proprietors and self-employed individuals to report business income and expenses.

Last Word

In conclusion, taxwise 2021 presents a wealth of information designed to empower taxpayers with the knowledge needed to navigate the intricacies of the tax system effectively. This guide provides a clear roadmap, equipping you with the tools and insights to optimize your tax strategy and potentially reduce your tax liability. By understanding the 2021 tax laws, regulations, and available options, you can confidently prepare for the tax season and make informed decisions.