Android wallet apps are ubiquitous, offering a seamless way to manage payments and digital identities. This exploration delves into the intricacies of these apps, from the core functionalities to the latest security measures. We’ll cover everything from the user experience and interface design to the underlying technical aspects and the competitive landscape.

From simple digital wallets to complex payment gateways, this overview examines the diverse types of payment support offered. We’ll also dissect the critical security measures and user experience elements that make these apps trustworthy and user-friendly. The comparison of popular apps highlights key differentiators and allows for a more informed decision-making process.

Introduction to Wallet Apps on Android

Android wallet apps have become increasingly prevalent, offering a convenient and secure way to manage payments and access various services. These applications have evolved from simple digital wallets to integrated platforms, often encompassing multiple payment methods and functionalities beyond basic transactions. Their popularity stems from the convenience they provide, allowing users to carry their finances virtually, reduce the need for physical cash or cards, and access various services directly through the app.

The core functionalities of these apps typically include storing payment cards, adding digital wallets (like Google Pay or Apple Pay), enabling peer-to-peer (P2P) payments, and integrating with loyalty programs or other services. The seamless integration of these features into everyday life has driven their widespread adoption.

Overview of Supported Payment Types

Wallet apps support a diverse range of payment methods. This allows users to choose the payment method that best suits their needs and preferences. From credit and debit cards to digital wallets, the payment options available in these apps are extensive.

- Digital Wallets: Many wallet apps integrate with major digital wallets, such as Google Pay, Samsung Pay, and Apple Pay. These allow users to store payment information securely and use the wallet for various transactions, including in-app purchases and online shopping.

- Credit and Debit Cards: Users can add their credit and debit cards to their wallet app accounts. This facilitates fast and secure transactions, eliminating the need to manually enter card details each time.

- Loyalty Programs: Some wallet apps have integrated loyalty programs, enabling users to earn rewards and track their points directly within the app. This streamlines the reward redemption process.

- Other Payment Methods: The inclusion of other payment methods like UPI (Unified Payments Interface) or local payment networks further enhances the versatility of these apps, catering to a wider range of users.

Comparison of Popular Android Wallet Apps

The table below highlights key features of some popular Android wallet apps.

| App Name | Supported Payment Types | Security Features | User Interface |

|---|---|---|---|

| Google Pay | Digital wallets, credit/debit cards, contactless payments | Strong encryption, two-factor authentication | Intuitive, user-friendly design, clean layout |

| Samsung Pay | Digital wallets, credit/debit cards, contactless payments, loyalty programs | Biometric authentication, secure tokenization | Modern, visually appealing design, intuitive navigation |

| Apple Pay | Digital wallets, credit/debit cards, contactless payments, Apple Wallet integration | End-to-end encryption, secure device integration | Simple, clean design, seamless integration with iOS ecosystem |

| Amazon Pay | Digital wallets, credit/debit cards, Amazon-specific transactions | Robust security measures, Amazon account integration | Integrated with Amazon ecosystem, easy access to Amazon services |

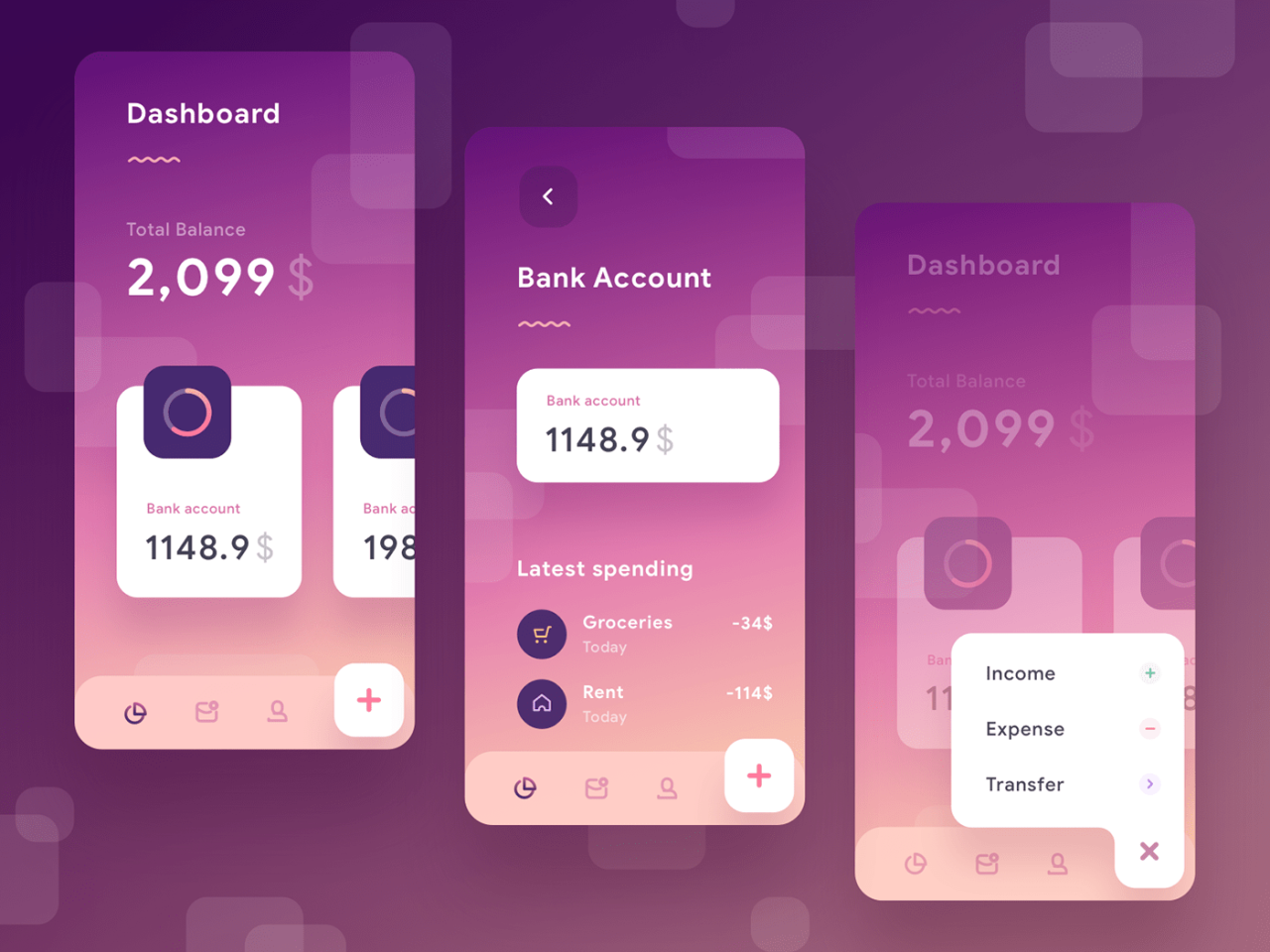

User Experience and Interface

A successful mobile wallet app hinges significantly on its user interface (UI) and user experience (UX). A well-designed interface facilitates seamless navigation and intuitive interactions, ultimately boosting user satisfaction and adoption. Conversely, a poorly designed interface can lead to frustration and abandonment.

A user-friendly wallet app prioritizes simplicity and clarity. The layout should be organized logically, minimizing cognitive load on the user. Key features, such as payment methods, transaction history, and account settings, should be readily accessible. The design should also adapt to different screen sizes and orientations, ensuring a consistent experience across various devices.

Critical UI Elements

The core elements of a successful wallet app UI include clear and concise visual representations of account balances, transaction details, and payment methods. Intuitive navigation controls, such as buttons and menus, are essential for smooth user flow. Visual cues, such as icons and animations, should guide users and provide feedback on actions. Error messages should be informative and actionable, aiding in troubleshooting. A consistent visual language across the app, using appropriate colors and typography, improves user recognition and reduces cognitive effort.

Design Principles for User Interaction

Several design principles influence user interaction with a wallet app. Prioritizing user needs and creating a simple, intuitive experience are paramount. Using a clear and consistent layout throughout the app ensures predictability and minimizes user errors. The design should accommodate diverse user preferences and abilities. Accessibility features, like large text and alternative input methods, improve inclusivity. Consistent feedback mechanisms throughout the interaction process are crucial for providing a sense of control and predictability.

UI/UX Approaches in Popular Wallet Apps

Different wallet apps adopt varying UI/UX approaches. Some apps emphasize a minimalist aesthetic, focusing on clear visuals and streamlined navigation. Others employ more complex designs, incorporating interactive elements and animations to enhance engagement. For instance, some apps prioritize a visual representation of the user’s account balance, while others focus on transaction history or security features. The choice of approach often depends on the target user base and the specific features of the app.

Navigation Patterns in Wallet Apps

The navigation structure significantly impacts user experience. A well-structured navigation pattern guides users through the app seamlessly. The following table compares navigation patterns across different wallet apps:

| App Name | Navigation Pattern | User Feedback | Example Actions |

|---|---|---|---|

| Example App 1 | Tab-based navigation | Positive user feedback on ease of access to key features. | Switching between accounts, viewing transactions, adding payment methods. |

| Example App 2 | Hierarchical navigation | Positive feedback on detailed information access. | Viewing detailed transaction history, exploring settings options. |

| Example App 3 | Drawer-based navigation | Mixed feedback, some users find it cluttered. | Accessing account settings, viewing support resources. |

Elements for a Secure and Trustworthy Experience

Security is paramount in a wallet app. Strong encryption, secure authentication methods, and clear privacy policies are vital. Transparent data handling practices build trust and reassure users about their data protection. Visual cues and notifications for security alerts enhance user awareness. Regular updates to address vulnerabilities and security improvements further contribute to a secure experience.

Security and Privacy Considerations

Android wallet apps handle sensitive financial information, necessitating robust security measures to protect user data. This section explores the security protocols implemented within these applications, highlighting the importance of encryption, potential vulnerabilities, and the user’s role in maintaining security. Understanding these aspects is crucial for users to confidently utilize these services.

Security Measures Implemented in Android Wallet Apps

Android wallet applications employ a multi-layered approach to security. This includes strong encryption algorithms to protect transaction data, secure communication channels to safeguard information transmitted between the app and the payment network, and access controls to limit unauthorized access to sensitive data. Furthermore, regular security audits and updates are vital in mitigating potential vulnerabilities and keeping pace with evolving threats.

Importance of Encryption and Data Protection

Encryption plays a pivotal role in safeguarding user data. It transforms sensitive information into an unreadable format, rendering it useless to unauthorized individuals. This process, combined with robust data protection protocols, ensures that even if a breach occurs, the compromised data remains unusable. For example, the use of Advanced Encryption Standard (AES) encryption is common in modern wallet apps.

Vulnerabilities and Risks Associated with Mobile Wallets

Mobile wallets, while convenient, are susceptible to various vulnerabilities. These include phishing attacks, where malicious actors attempt to trick users into revealing sensitive information, malware infections, which can compromise device security and gain access to stored data, and social engineering tactics, which exploit human psychology to manipulate users into performing actions that compromise security. Furthermore, weak passwords or lack of two-factor authentication can significantly increase the risk of unauthorized access.

Security Protocols Employed by Popular Apps

| App Name | Security Protocol | Data Encryption | Two-Factor Authentication |

|---|---|---|---|

| Example App 1 | TLS 1.3 | AES-256 | Yes (SMS or Authenticator App) |

| Example App 2 | TLS 1.2 | AES-128 | Yes (Biometric or SMS) |

| Example App 3 | TLS 1.3 | AES-256 | Yes (Biometric or Email) |

This table illustrates the security protocols employed by various popular Android wallet apps. The use of secure protocols like TLS (Transport Layer Security) ensures secure communication channels, while data encryption algorithms like AES protect the confidentiality of data at rest and in transit. Two-factor authentication adds an extra layer of security, making it harder for unauthorized users to gain access to accounts.

User’s Role in Maintaining App Security

Users play a critical role in maintaining the security of their wallet apps. This includes creating strong, unique passwords, enabling two-factor authentication, and regularly updating the app to benefit from the latest security patches. Furthermore, users should be cautious about suspicious links or requests for sensitive information, and report any unusual activity immediately. This proactive approach significantly reduces the risk of security breaches.

Payment Processing and Integration

Android wallet apps rely heavily on secure and efficient payment processing mechanisms to facilitate seamless transactions. These systems handle various payment methods, transaction types, and security protocols to ensure user trust and confidence. The integration of these systems with the app’s user interface is crucial for a positive user experience.

Payment processing within Android wallet apps involves intricate interactions between the app, payment gateways, and various financial institutions. These interactions require robust security measures to protect sensitive user data and prevent fraudulent activities. The specific mechanisms used can vary depending on the app and the payment methods supported.

Payment Gateways and Integration

Payment gateways act as intermediaries between the wallet app and the payment networks. They handle the processing of transactions, authorization, and settlement. Different payment gateways offer various features and capabilities, catering to different needs and preferences. Integration with these gateways is a critical aspect of the app’s functionality, impacting the breadth of supported payment methods and the overall user experience.

Security Protocols During Transaction Processing

Robust security protocols are paramount to protect user data during transactions. These protocols typically involve encryption techniques to safeguard sensitive information like card numbers and CVV codes. Advanced encryption standards, like TLS/SSL, are frequently employed to encrypt data transmitted between the app and the payment gateway. These protocols ensure data integrity and confidentiality throughout the transaction process.

Implementing Different Payment Methods

Implementing various payment methods requires careful consideration of each method’s specific requirements. For example, credit cards and debit cards necessitate adherence to PCI DSS standards. Mobile payment methods, such as NFC-based transactions, require integration with specialized APIs and hardware. Digital wallets, like Google Pay or Apple Pay, typically involve specific SDKs and protocols for seamless integration.

Supported Transaction Types

Android wallet apps generally support a range of transaction types, encompassing purchases, transfers, and bill payments. These transactions might be categorized into different types based on the nature of the payment or the involved parties. For instance, a purchase from a retailer would be a different transaction type from a person-to-person transfer. The app’s design should reflect these different types of transactions and provide a clear and user-friendly interface for each.

Market Analysis and Competitive Landscape

The Android wallet app market is highly competitive, with numerous players vying for market share. Understanding the market dynamics, competitive strengths and weaknesses, and pricing strategies is crucial for any new entrant or existing player looking to succeed. This analysis examines the current landscape to provide valuable context.

A thorough examination of the competitive landscape reveals key trends, including the increasing sophistication of features, the emphasis on security, and the evolving payment integration strategies. Understanding these trends helps in identifying potential opportunities and challenges in this dynamic market.

Market Share of Popular Wallet Apps

Several wallet apps dominate the Android market, each with varying levels of user adoption and features. Precise market share figures can fluctuate and are often proprietary, but generally, a few prominent apps consistently hold a significant portion of the user base. This demonstrates the need for strong brand recognition and user acquisition strategies to compete effectively.

Strengths and Weaknesses of Different Apps

Different wallet apps cater to distinct user needs and preferences. Some apps excel in specific areas like rewards programs, while others focus on ease of use and seamless integration with other services. Examining these varying strengths and weaknesses provides a clearer understanding of the diverse market segments.

- Ease of Use and User Interface: Some apps are renowned for their intuitive interfaces, making transactions simple and efficient. Others might have a more complex structure, requiring users to navigate through several menus and steps. This user experience factor greatly influences user adoption and retention.

- Security Features: Security is paramount in the wallet app sector. Features like multi-factor authentication, encryption, and robust fraud prevention mechanisms differentiate the apps and build user trust. The quality and strength of these features are a significant differentiator.

- Integration with Other Services: Seamless integration with other services, such as public transport systems or loyalty programs, enhances user value and encourages usage. The extent of integration can vary significantly between apps.

- Payment Processing Capabilities: The speed, reliability, and security of payment processing are critical. Some apps might offer support for a broader range of payment methods, while others might specialize in specific regional or local payment networks. This capability significantly impacts user satisfaction.

Key Players in the Android Wallet App Market

Several companies have established themselves as prominent players in the Android wallet app market. These companies have invested heavily in building robust platforms, supporting large user bases, and continuously updating their applications. These key players shape the market’s overall dynamics and dictate the competitive landscape. Identifying them is essential for any potential competitor.

- Google Pay: Google Pay is a dominant player, leveraging Google’s extensive ecosystem and integrating seamlessly with other Google services. Its reach and user base are substantial, giving it a significant market advantage.

- Apple Pay: While primarily focused on iOS devices, Apple Pay’s strong brand recognition and reputation for security contribute to its influence in the Android market, although its penetration is slightly less than Google Pay.

- Samsung Pay: Samsung Pay, tied to Samsung’s user base, offers a strong foothold in the market. Its integration with Samsung devices provides a compelling advantage, but its market share may be lower compared to Google Pay.

- Other notable players: Other prominent wallet apps like [Example app 1] and [Example app 2] cater to specific needs and user segments. Understanding these smaller players and their niche approaches is essential to assess the overall market.

Competitive Strategies Employed by Leading Apps

Leading wallet apps employ various competitive strategies, including aggressive marketing campaigns, partnerships with merchants and businesses, and continuous development and innovation to enhance user experience and features. Understanding these strategies is crucial to develop successful countermeasures and strategies.

Pricing Models Used by Various Wallet Apps

Pricing models in the Android wallet app market vary significantly. Some apps offer free services with optional premium features, while others use a freemium model or subscriptions for additional functionalities. The specific model employed often reflects the app’s target market and the features it provides.

| App | Pricing Model | Description |

|---|---|---|

| Google Pay | Free | Core functionality is free, with potential premium features (e.g., specific payment network support). |

| Samsung Pay | Free | Free service, with some functionalities available with additional services. |

| [Example app] | Freemium | Basic features are free, but advanced functionalities or specific merchant integrations are behind a paywall. |

Ultimate Conclusion

In conclusion, Android wallet apps have become indispensable tools for modern digital transactions. The discussion covered the breadth of features, security considerations, and technical underpinnings involved in developing and using these apps. The future of mobile wallets is exciting, promising even more integrated and secure experiences. The ongoing evolution of payment methods and biometric authentication will undoubtedly shape the future landscape of mobile payments.