Understanding Xero pricing is crucial for any business considering this popular accounting software. This guide delves into Xero’s various pricing models, examining different tiers, features, and options. We’ll also compare Xero’s pricing against competitors, highlighting potential cost savings and value propositions.

From basic accounting to advanced features like inventory management, Xero’s pricing structure caters to businesses of all sizes and industries. We’ll dissect the specifics of each pricing plan, outlining the key features included and how they align with your business needs. This analysis will equip you with the knowledge to make an informed decision about Xero’s suitability for your organization.

Overview of Xero Pricing Models

Xero’s pricing structure is designed to cater to businesses of all sizes, offering flexible options and tiered features. Understanding the different plans is crucial for selecting the best fit for your specific needs and budget. This overview will detail the available pricing models, outlining key features and subscription options. From startups to established enterprises, Xero’s tiered approach provides a suitable solution.

Xero Pricing Tiers

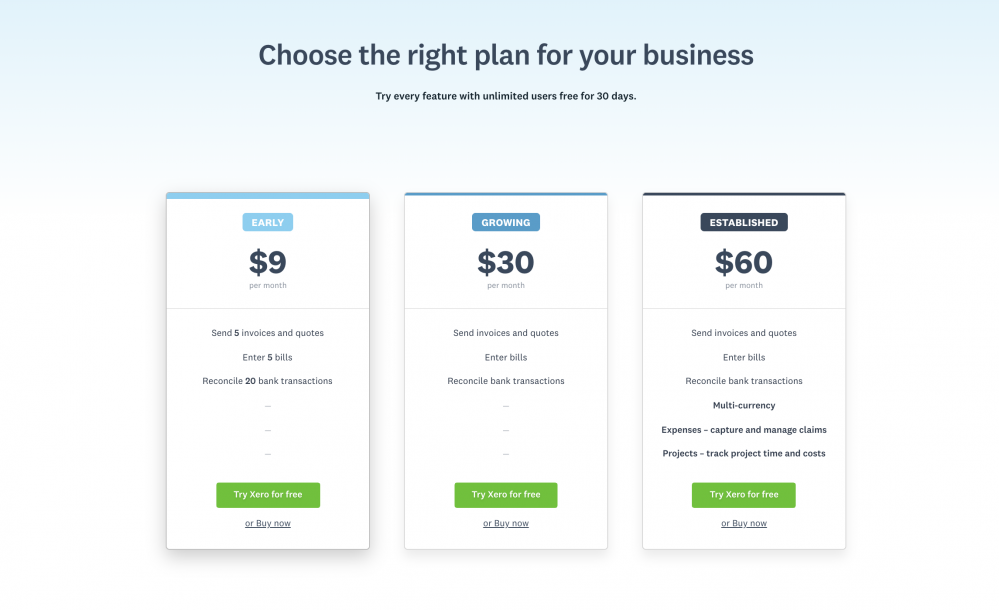

Xero’s pricing model is structured around three primary tiers: Basic, Standard, and Premium. Each tier offers a unique set of features and functionalities tailored to different business needs and complexities. The appropriate tier selection depends on the business’s size, the number of users, and the scope of accounting requirements.

Key Features of Each Tier

- Basic: This plan is ideal for small businesses with basic accounting needs. It typically includes features such as basic invoicing, expense tracking, and bank feeds. Suitable for sole proprietorships or small teams managing a limited number of transactions.

- Standard: The Standard plan expands on the Basic plan with advanced features. This includes features such as inventory management, reporting tools, and multi-currency support. It’s a good fit for growing businesses with more complex accounting requirements.

- Premium: The Premium plan offers the most comprehensive set of features, catering to large businesses and those with intricate accounting needs. It includes features such as advanced reporting, custom dashboards, and dedicated account management. It’s suitable for companies requiring more complex accounting solutions and significant reporting.

Subscription Options

Xero offers flexible subscription options to cater to diverse business needs and budgetary constraints. These subscriptions are usually on a monthly or annual basis, offering a predictable and manageable cost structure.

Pricing Examples for Different Business Sizes

Small businesses with simple needs might opt for the Basic plan, while larger companies with extensive operations and diverse transactions might benefit from the Premium plan. The pricing structure is designed to be adaptable and scalable, adjusting to changing business demands.

Comparison Table of Xero Plans

| Plan Name | Monthly Fee | Key Features | Suitable for |

|---|---|---|---|

| Basic | $10 – $20 (approximate) | Basic invoicing, expense tracking, bank feeds, limited reporting | Sole proprietors, small teams, limited transactions |

| Standard | $25 – $50 (approximate) | Advanced invoicing, inventory management, multi-currency support, comprehensive reporting | Growing businesses, increasing transaction volume, more complex accounting needs |

| Premium | $75 – $150+ (approximate) | Advanced reporting, custom dashboards, dedicated account management, advanced inventory features, multiple users | Large businesses, intricate accounting, significant transaction volume, demanding reporting requirements |

Xero Pricing for Specific Industries

Xero’s adaptable pricing model allows businesses across diverse sectors to leverage its robust accounting features. Understanding the nuances of pricing for specific industries empowers businesses to select the most cost-effective solution tailored to their unique operational requirements. From the intricate accounting needs of professional services firms to the project-heavy demands of construction companies, Xero offers flexible plans and add-ons to support diverse business needs.

The varying pricing structures for different industries reflect the differing operational complexities and specific requirements within each sector. For example, a retail business will have different needs than a professional services firm, and a construction business will require unique features. Xero recognizes these differences and offers customized solutions to streamline operations and optimize financial management. The potential cost savings realized by adopting a suitable Xero plan can be significant, especially when considering the automation and efficiency gains.

Retail Industry Pricing

Retail businesses, characterized by high transaction volumes and inventory management needs, often find value in Xero’s plans designed for handling these complexities. The basic plan, typically, offers core accounting features, such as invoicing, expense tracking, and bank reconciliation, providing a foundation for managing cash flow and profitability. For businesses with substantial inventory management requirements, Xero’s inventory tracking add-on can be particularly beneficial. This add-on allows for accurate stock valuations, streamlining inventory control and ensuring efficient stock replenishment.

Professional Services Pricing

Professional service businesses, encompassing consultants, lawyers, and architects, often prioritize accurate invoicing and time tracking. Xero’s time tracking capabilities are essential for these businesses, enabling them to precisely document billable hours and generate accurate invoices. The ability to manage client relationships and track project progress further strengthens the plan’s value. In addition to the core plan, many professional services firms benefit from Xero’s integration with project management tools, which allows for comprehensive project tracking and cost management.

Construction Industry Pricing

Construction businesses frequently need to manage numerous projects and sub-contractors. Xero’s robust project management features enable construction companies to efficiently track costs, manage expenses, and monitor progress. The ability to handle multiple job sites and diverse financial transactions is crucial. A crucial add-on for construction businesses is the ability to manage subcontractors, ensuring accurate payment processing and efficient tracking of project progress. This helps construction companies streamline their operations and maintain strong financial control.

Pricing Comparison Table

| Industry | Typical Xero Plan | Potential Add-ons | Estimated Monthly Cost |

|---|---|---|---|

| Retail | Basic plan with inventory management | Point of Sale (POS) integration, inventory tracking | $30 – $75+ (depending on features and volume) |

| Professional Services | Plan with time tracking and invoicing | Project management integration, client relationship management (CRM) | $50 – $150+ (depending on user count and features) |

| Construction | Plan with project management capabilities | Subcontractor management, job costing, and progress tracking | $75 – $200+ (depending on project complexity and user count) |

Xero Pricing vs. Competitors

Xero’s pricing strategy, while often praised for its accessibility, necessitates a comparative analysis against competitors to fully understand its value proposition. A thorough evaluation reveals both strengths and weaknesses within Xero’s pricing tiers, enabling businesses to make informed decisions. Understanding how Xero’s pricing stacks up against competitors is crucial for determining its suitability for specific business needs and financial objectives.

A comprehensive comparison reveals that Xero’s pricing structure, while generally competitive, can vary significantly depending on the specific features required and the chosen subscription plan. Different competitors offer various add-on services and varying levels of support, further complicating a straightforward comparison. Therefore, careful consideration of the complete suite of features and support offered by each platform is paramount when evaluating Xero against its competitors.

Pricing Tier Value Proposition

Xero’s pricing tiers offer a spectrum of functionalities, ranging from basic accounting to advanced features like inventory management and payroll. The value proposition of each tier varies depending on the specific needs of the business. For example, a small business primarily focused on invoicing and basic financial tracking may find the entry-level tier sufficient, while a growing enterprise needing robust inventory control and reporting capabilities might require a more advanced tier.

Comparative Analysis of Pricing Structures

Different competitors offer distinct pricing models, often based on user count, transaction volume, or a combination of both. The choice of pricing model impacts the overall cost and scalability of the system. Understanding the underlying cost structure of each competitor’s pricing model is vital for assessing its long-term financial implications.

Strengths and Weaknesses of Xero Pricing

Xero’s pricing structure generally offers a balanced approach, striking a reasonable compromise between affordability and functionality. One strength is its user-friendly interface, making it accessible to a wider range of businesses, regardless of technical expertise. However, a potential weakness lies in the limitations of certain add-on features, which might require additional costs and potentially higher subscription tiers for comprehensive functionalities. The scalability of Xero’s pricing tiers needs careful consideration for businesses experiencing rapid growth.

Xero Pricing Benefits for Specific Business Types

Xero’s pricing structure caters to various business types, from sole proprietorships to small and medium-sized enterprises (SMEs). The flexibility in choosing subscription plans allows businesses to adapt their accounting needs based on their current operational requirements and anticipated future growth. For instance, a freelance contractor might find Xero’s basic plan ideal, while a growing retail business might opt for a plan with enhanced inventory management tools. Xero’s pricing is particularly beneficial for businesses that prioritize ease of use and accessibility without significant upfront investment.

Summary Table of Pricing Comparisons

| Feature | Xero | Competitor A | Competitor B |

|---|---|---|---|

| Basic Accounting | Starting at $12/month | $15/month | $10/month |

| Inventory Management | Available as an add-on, starting at $20/month | Integrated in higher tier, starting at $40/month | Separate module, starting at $15/month |

| Payroll | Available as an add-on, starting at $10/month | Integrated in higher tier, starting at $30/month | Separate module, starting at $25/month |

| Support | 24/7 phone and email support | 24/7 chat support | Email support only |

Xero Pricing and Features

Xero’s pricing model is meticulously designed to cater to diverse business needs and scales. It offers tiered subscription plans, each progressively unlocking a wider array of features. Understanding this relationship between features and pricing is crucial for businesses seeking the optimal solution for their operational requirements. The pricing tiers are not simply about cost; they represent varying levels of functionality and support, tailored to specific business sizes and operational demands.

Xero’s pricing structure is fundamentally adaptable, dynamically adjusting to the number of users actively utilizing the platform. This allows businesses to scale their subscription seamlessly as their needs evolve. This flexibility is a key differentiator in the market, offering a robust and scalable solution for growth-oriented companies. Premium add-ons and services further enhance the platform’s functionality, providing businesses with specialized tools for specific needs.

Relationship Between Features and Pricing

Xero’s pricing tiers are directly correlated with the breadth and depth of features offered. A basic plan might primarily focus on fundamental accounting tasks, while a premium plan unlocks advanced functionalities like inventory management and custom reporting. This tiered structure enables businesses to choose a plan that aligns with their current needs and anticipated growth trajectory.

Features Offered in Each Pricing Tier

The value proposition of each pricing tier is distinct. The basic tier often provides essential functionalities such as invoicing, expense tracking, and basic reporting. Mid-tier plans typically encompass advanced features like inventory management, sales forecasting, and more comprehensive reporting capabilities. Premium tiers offer the most comprehensive set of tools, including advanced financial modeling, custom dashboards, and potentially dedicated support personnel. The choice of plan should be guided by the specific requirements of the business, ensuring a balanced approach between cost and functionality.

User-Based Pricing Adaptation

Xero’s pricing often scales proportionally with the number of users accessing the platform. Businesses with larger teams require more robust access and sharing features, and Xero’s pricing reflects this requirement. This user-based pricing allows businesses to effortlessly manage their increasing workforce needs without facing substantial cost escalations. The precise pricing structure will vary depending on the specific plan and the number of users.

Pricing of Premium Add-ons and Services

Xero offers various premium add-ons and services to extend the core functionality of its platform. These may include custom integrations, dedicated account management, or advanced reporting tools. The pricing for these add-ons typically depends on the specific service requested, and is often tailored to the unique needs of the business. Pricing for these services is usually transparent, allowing businesses to readily assess the cost-benefit relationship.

Summary Table of Features and Pricing Tiers

| Feature | Pricing Tier | Description |

|---|---|---|

| Invoicing | Basic | Generate and send invoices, track payments, and manage customer relationships. |

| Inventory Tracking | Premium | Manage inventory levels, track costs, and automate inventory reordering. |

| Custom Reports | Premium | Generate customized financial reports to gain deep insights into business performance. |

| Multi-Currency Support | Premium | Manage transactions and accounts in multiple currencies. |

| Dedicated Account Manager | Premium Plus | Access to personalized support and guidance from a dedicated account manager. |

Xero Pricing and Payment Options

Xero’s pricing structure is designed to be flexible and adaptable to various business needs. Understanding the payment options, discounts, and subscription management is crucial for businesses looking to leverage Xero’s accounting and financial management tools. This section delves into the details of how Xero facilitates these transactions, empowering users to make informed decisions.

Xero provides a range of payment methods to suit different preferences and business models. These options are complemented by various discounts and promotional offers, allowing users to optimize their financial commitment to Xero. This section will Artikel these features, allowing you to plan your subscription effectively.

Available Payment Methods

Xero accepts multiple payment methods for its subscription plans. This flexibility allows users to choose the option that best suits their current financial practices. Businesses can opt for a variety of secure methods to pay their Xero subscription fees.

- Credit Cards: Xero supports a wide range of major credit cards, including Visa, Mastercard, American Express, and Discover. This is a popular option for businesses already using credit cards for other transactions.

- Direct Debit: For recurring payments, Xero offers direct debit. This method automatically deducts the subscription fee from a designated bank account on a predetermined schedule. This streamlined process is efficient and reduces manual effort.

- Other Payment Options (as applicable): Xero may offer other payment methods in specific regions or circumstances. For example, certain payment processors or local banking options might be supported.

Discounts and Promotional Offers

Xero occasionally provides discounts and promotional offers to new or existing customers. These incentives can significantly reduce the cost of the subscription and are worth investigating for potential savings.

- Introductory Offers: New customers often benefit from introductory discounts or free trial periods. These can be a great way to try Xero without a significant financial commitment.

- Referral Programs: Xero might offer referral discounts for customers who refer new clients. These encourage word-of-mouth marketing and can result in cost savings for both the referrer and the new user.

- Volume Discounts: For businesses with multiple users or a large number of accounts, Xero may offer volume discounts on their subscription plans. This can be a valuable consideration for larger organizations.

Payment Cycles

Xero’s payment cycles are typically aligned with the subscription period. This means payments are generally processed monthly or annually, depending on the chosen plan. Businesses should ensure they have sufficient funds in their account to cover the subscription cost on the scheduled payment date.

- Subscription Period Alignment: The payment cycle is synchronized with the subscription period, usually monthly or annually. The billing date and frequency are clearly communicated at the time of subscription.

- Automated Payments: Direct debit payments are typically automated, meaning payments are automatically processed on the scheduled billing date. This removes the need for manual intervention and keeps the subscription active.

Cancellation and Upgrade Procedures

Xero provides clear instructions for canceling or upgrading subscriptions. It’s important to follow these procedures to avoid any disruption to your account or any unexpected charges. Knowing these processes is crucial for managing your Xero subscription effectively.

- Cancellation Process: Xero usually provides an online portal or dedicated customer support channels for canceling subscriptions. Specific procedures for cancellation may vary depending on the type of subscription.

- Upgrade Process: The upgrade process often involves selecting the desired plan and confirming the change through Xero’s online platform. The system will handle the necessary adjustments to the subscription fees and plan features.

Illustrative Table of Payment Options and Costs

This table provides a general overview of payment options and associated costs. Actual costs may vary based on the chosen plan and any applicable discounts.

| Payment Method | Description | Associated Costs |

|---|---|---|

| Credit Card | Visa, Mastercard, American Express, Discover | Subscription fee as per chosen plan. |

| Direct Debit | Automated deduction from bank account | Subscription fee as per chosen plan. |

Final Conclusion

In conclusion, Xero’s pricing strategy offers a range of options, from basic to premium plans, tailored to different business needs and sizes. By understanding the features included in each tier and comparing Xero’s pricing with competitors, you can determine if Xero aligns with your budget and operational requirements. Ultimately, careful consideration of your specific needs and the potential value offered by Xero’s various features is paramount in making the right choice.