Navigating the complexities of payroll can be daunting for any business, regardless of size. Zoho Payroll offers a comprehensive solution designed to simplify the entire process, from employee onboarding to payment distribution. This in-depth exploration delves into the features, benefits, and functionalities of Zoho Payroll, empowering businesses to optimize their payroll operations and focus on growth.

From meticulous employee information management to seamless integration with other business tools, Zoho Payroll provides a streamlined platform. This comprehensive guide covers everything from setting up payroll for new hires to generating insightful reports for informed decision-making. We’ll also examine Zoho Payroll’s security measures and compare it with competitors to help you understand its unique value proposition.

Zoho Payroll Overview

Zoho Payroll is a comprehensive cloud-based payroll solution designed to streamline the payroll process for businesses of various sizes. It provides a user-friendly platform for managing employee information, calculating salaries, and processing payments, enabling businesses to focus on core operations.

Zoho Payroll offers a wide range of functionalities to handle payroll tasks effectively. It caters to diverse business needs and offers flexible options for different business structures. This detailed overview explores the key features, target audience, and use cases of Zoho Payroll, while also comparing it with competitor solutions.

Purpose and Function

Zoho Payroll’s primary function is to automate and simplify the payroll process for businesses. It handles tasks such as calculating salaries, deductions, and taxes, generating pay stubs, and managing employee records. This automated approach minimizes errors, saves time, and reduces the administrative burden on payroll departments.

Key Features and Functionalities

Zoho Payroll encompasses a suite of features that facilitate efficient payroll management. These features include: employee data management, tax calculations, pay stub generation, direct deposit processing, and reporting and analytics. The platform also offers functionalities for managing leave and attendance, enabling businesses to track employee time effectively.

Target Audience

Zoho Payroll is suitable for a broad range of businesses, from small startups to medium-sized enterprises. Its user-friendly interface and customizable options cater to diverse business needs and structures. Businesses with varying employee counts can leverage the flexibility of Zoho Payroll.

Use Cases

Zoho Payroll finds applications in diverse business scenarios. These include: managing employee payroll across various locations, handling complex payroll scenarios, and enabling accurate and timely compensation for employees. The ability to track leave and attendance is a significant advantage, ensuring efficient workforce management.

Comparison with Competitor Payroll Services

| Feature | Zoho Payroll | Xero | QuickBooks |

|---|---|---|---|

| Ease of Use | Intuitive interface, user-friendly design. | Generally considered user-friendly, particularly for accounting professionals. | Intuitive interface, especially for familiar accounting software users. |

| Pricing | Pricing plans vary based on features and employee count. | Pricing structures vary based on features and usage. | Pricing plans vary based on features and usage. |

| Tax Compliance | Compliant with various local tax regulations. | Compliant with relevant tax regulations. | Compliant with tax regulations. |

| Reporting & Analytics | Comprehensive reporting and analytics tools. | Offers reporting tools, but might require additional setup for specific needs. | Comprehensive reporting tools for business financial insights. |

| Integration with Other Services | Integrates with other Zoho applications. | Integrates with other accounting and business applications. | Integrates with other accounting and business applications. |

Note: Pricing and specific features may vary depending on the chosen plan. It’s recommended to check the official websites for the most up-to-date information. Comparison of competitor products is for informational purposes only.

Payroll Management with Zoho

Zoho Payroll offers a streamlined approach to managing employee compensation and benefits, making the payroll process efficient and accurate. This comprehensive system empowers businesses of all sizes to handle payroll tasks with ease, regardless of the number of employees or complexity of compensation structures. The intuitive interface and robust features of Zoho Payroll enable organizations to focus on their core business activities while maintaining accurate and timely payroll processing.

Zoho Payroll provides a centralized platform for managing employee information, automating calculations, and distributing payments. It seamlessly integrates with other Zoho applications, facilitating a unified workspace for administrative tasks. The system’s user-friendly design minimizes errors and ensures compliance with local regulations. This automation feature significantly reduces the time and effort required for payroll processing, freeing up valuable resources.

Managing Employee Information

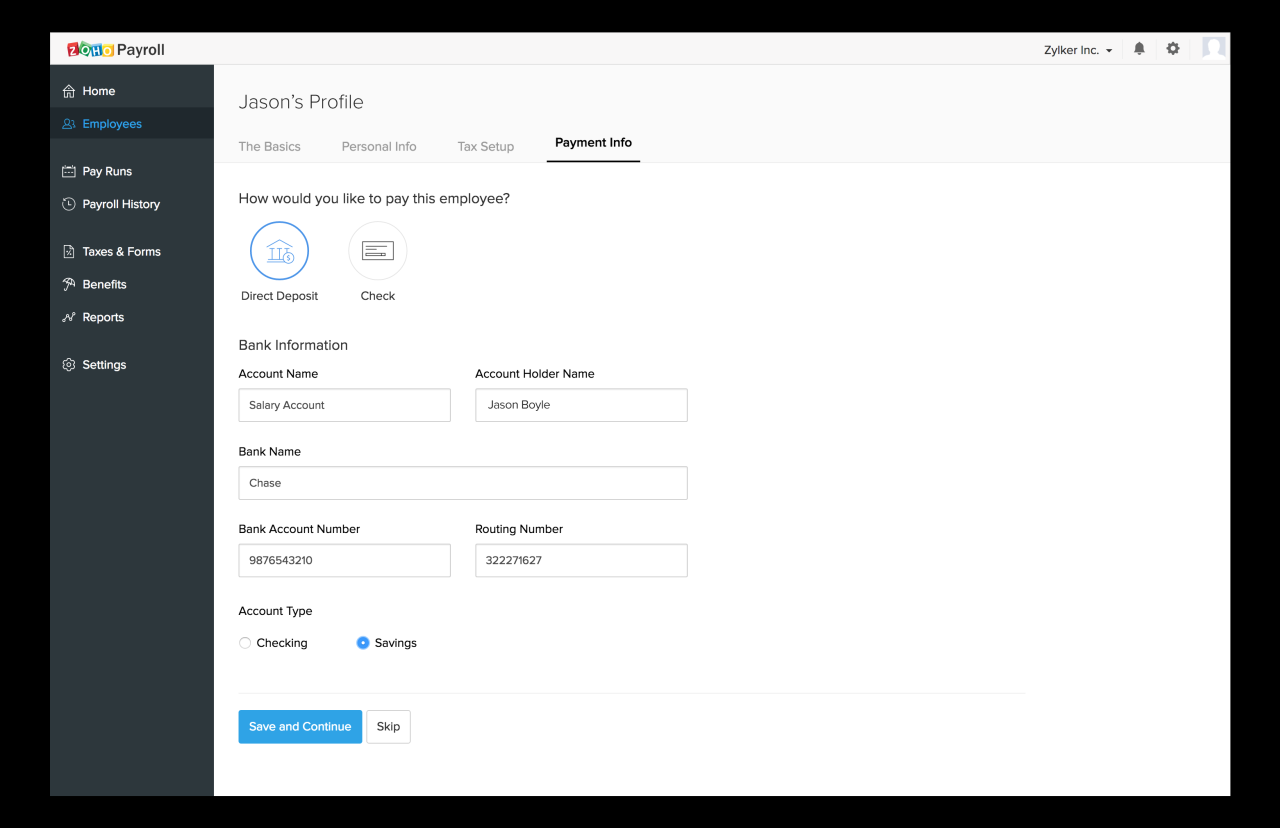

Zoho Payroll allows for comprehensive employee data management, encompassing details like salary information, benefits, and tax withholdings. This detailed data is organized and accessible within the system, allowing for easy modification and updates as needed. This feature ensures that payroll calculations are always accurate and reflect the most current employee data. The system facilitates secure storage and retrieval of sensitive employee information.

Setting Up Payroll for New Employees

The onboarding process for new employees is straightforward and efficient in Zoho Payroll. Administrators can easily input new employee details, including relevant personal information, tax information, and compensation data. This setup includes the specification of pay rates, deductions, and benefits applicable to the employee. The system’s design ensures data accuracy from the outset, minimizing the risk of errors in future payroll calculations.

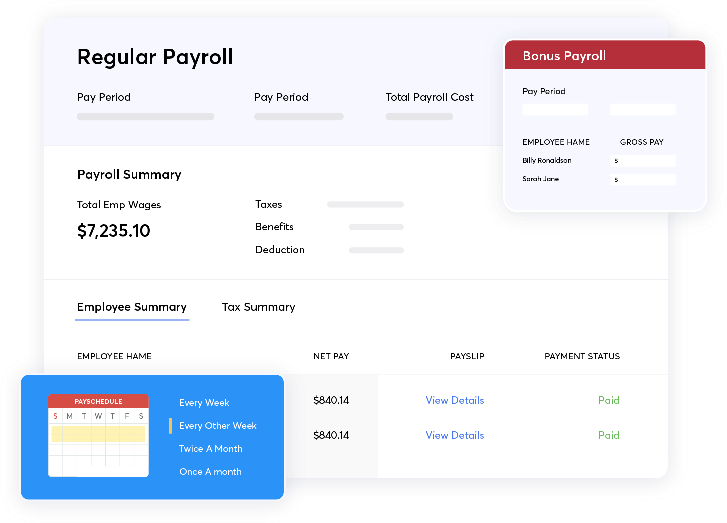

Processing Payroll for Different Pay Periods

Zoho Payroll enables the processing of payroll for various pay periods, such as bi-weekly, semi-monthly, or monthly. The system allows administrators to define the pay period parameters and schedule the payroll runs accordingly. Flexibility in pay periods ensures that the system can adapt to different business needs and employee schedules. Customizable options provide businesses with the tools to tailor payroll processing to their unique circumstances.

Calculating and Distributing Employee Salaries

Zoho Payroll automates the calculation of employee salaries, including deductions and taxes. The system ensures accurate calculations based on the pre-defined parameters for each employee. Payroll calculations are performed in a secure environment to maintain data integrity and confidentiality. Once calculations are complete, the system facilitates the distribution of payments to employees through various methods, such as direct deposit.

Zoho Payroll Process Flow

| Step | Description |

|---|---|

| Employee Onboarding | Inputting employee details, including compensation data and tax information. |

| Pay Period Setup | Defining the pay period parameters (e.g., start and end dates). |

| Payroll Calculation | Zoho Payroll automatically calculates salaries, deductions, and taxes based on predefined parameters. |

| Payment Processing | Distribution of employee salaries through various methods, such as direct deposit. |

| Reporting & Analysis | Generating reports on payroll data for analysis and compliance. |

Features and Benefits

Zoho Payroll offers a comprehensive suite of features designed to streamline payroll processes and enhance administrative efficiency for businesses of all sizes. This section explores the key features and benefits, focusing on how Zoho Payroll addresses specific needs for small and large enterprises, while also outlining pricing models for various business structures.

Zoho Payroll’s strength lies in its ability to simplify complex payroll tasks, from calculating salaries and deductions to managing tax compliance and generating reports. This ease of use translates into significant time savings and reduced administrative burden for businesses of all sizes, ultimately improving overall operational efficiency.

Key Features Addressing Business Needs

Zoho Payroll provides a robust set of features that cater to diverse business needs. These features empower businesses to manage payroll effectively, reduce errors, and ensure compliance with relevant regulations.

- Tax Compliance: Zoho Payroll integrates with various tax authorities, allowing businesses to effortlessly manage tax calculations and filings. This automated process reduces the risk of errors and ensures accurate and timely tax payments, keeping businesses compliant with regulations.

- Reporting and Analytics: Zoho Payroll provides comprehensive reporting tools, enabling businesses to track payroll data, analyze trends, and make informed decisions. These reports can be tailored to specific needs, offering valuable insights into employee compensation and overall payroll performance.

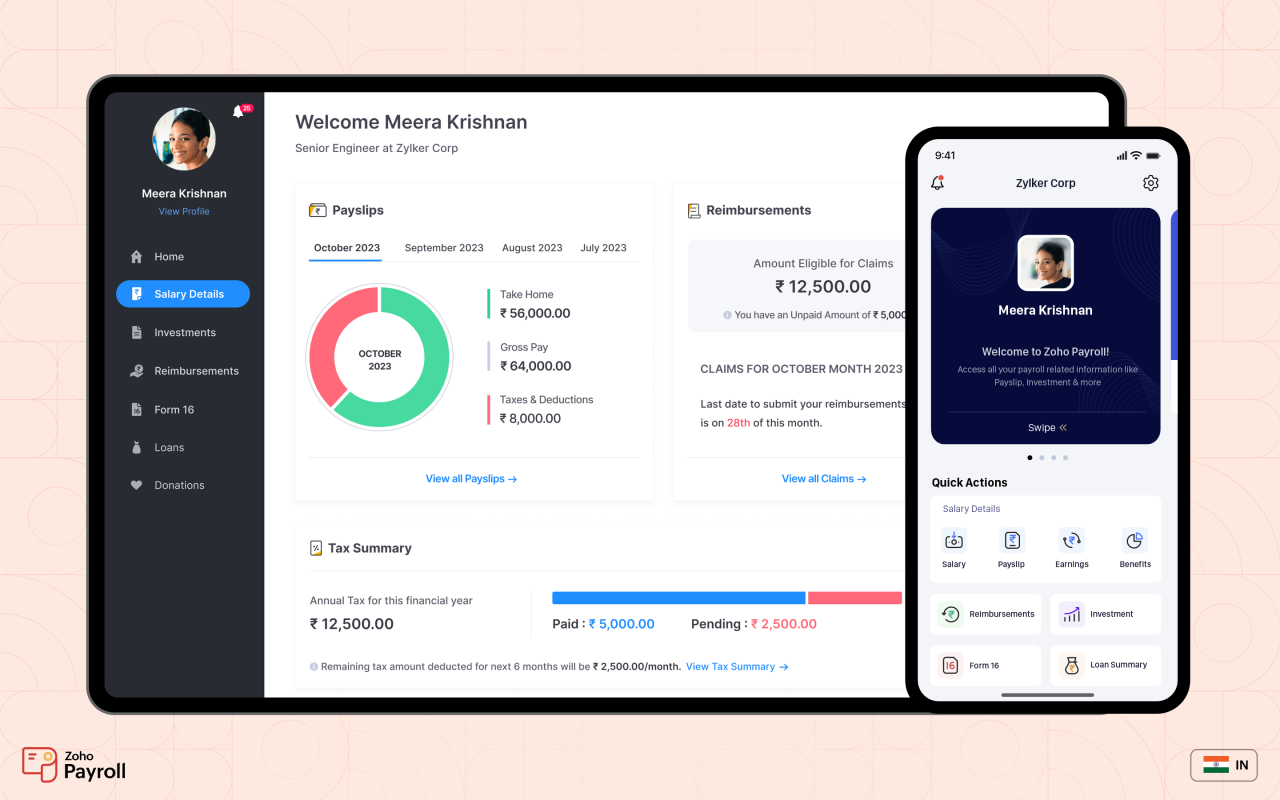

- Employee Self-Service: This feature allows employees to access and manage their payroll information online, such as pay stubs and tax forms. This streamlines communication and reduces the administrative burden on HR teams.

- Integration Capabilities: Zoho Payroll integrates seamlessly with other Zoho applications, such as Zoho Books and Zoho CRM, facilitating a unified platform for managing business operations.

Benefits for Small Businesses

Zoho Payroll’s user-friendly interface and affordable pricing make it an ideal solution for small businesses. The software’s intuitive design minimizes the learning curve, enabling businesses to quickly adopt the system and reap its benefits.

- Cost-Effectiveness: Zoho Payroll offers competitive pricing plans tailored for small business budgets, making it an accessible and cost-effective solution.

- Ease of Use: The software’s intuitive design simplifies payroll management, reducing the need for extensive training and expertise.

- Time Savings: Automation of tasks like calculating salaries and generating reports saves valuable time for small business owners and HR personnel.

Benefits for Larger Businesses

Zoho Payroll’s scalability and advanced features cater to the specific needs of larger organizations.

- Scalability: Zoho Payroll can adapt to growing workforce sizes and increasing payroll complexity as the business expands.

- Enhanced Reporting and Analytics: Detailed reporting capabilities allow large businesses to gain deeper insights into payroll data, aiding in strategic decision-making.

- Advanced Compliance Management: The system’s robust features ensure compliance with complex regulations, reducing the risk of penalties and maintaining a positive reputation.

Pricing Models and Plans

Zoho Payroll offers flexible pricing plans to cater to various business needs and sizes. The pricing model is structured to offer value and accessibility.

| Plan | Features | Pricing |

|---|---|---|

| Basic | Essential payroll features, limited reporting, and basic integrations. | Affordable, starting from [insert price range] per month. |

| Professional | Comprehensive payroll management, advanced reporting, and more integrations. | Mid-range pricing, starting from [insert price range] per month. |

| Enterprise | Extensive features, dedicated support, custom integrations, and enhanced reporting tailored to large enterprises. | Competitive pricing, available upon request. |

Pricing plans and features are subject to change. Please consult the official Zoho Payroll website for the most up-to-date information.

Integration and Customization

Zoho Payroll’s flexibility extends beyond its core functionality, enabling seamless integration with other crucial business applications and customizable settings tailored to specific company needs. This adaptability ensures a streamlined workflow and optimized resource management. This section details the various integration and customization options available within Zoho Payroll.

Zoho Payroll offers a range of integration possibilities, encompassing both Zoho applications and third-party software. This robust connectivity allows for data flow between various systems, reducing manual entry and improving data accuracy. Customization options further enhance the platform’s adaptability, empowering businesses to tailor the software to their unique workflows and operational requirements.

Zoho Application Integrations

Zoho Payroll seamlessly integrates with other Zoho applications, facilitating a unified platform for comprehensive business management. This integrated approach simplifies data transfer and automates various processes, enhancing overall efficiency. Data consistency and reduced errors are key benefits of this streamlined integration.

- Zoho Books integration allows for automated bank reconciliation and streamlined financial reporting, directly linking payroll data with accounting records. This connection streamlines financial management, improving the accuracy and timeliness of financial reports.

- Zoho CRM integration enables better tracking of employee data and interactions, improving communication and support.

- Zoho Recruit integration streamlines the hiring process by connecting payroll data to employee records, streamlining onboarding and reducing manual data entry.

- Zoho Inventory and Zoho Projects integrations are also possible, enabling seamless data flow between different business functions, enhancing operational efficiency.

Third-Party Software Integrations

Zoho Payroll supports integrations with a variety of third-party software solutions. This adaptability allows businesses to maintain existing systems while benefiting from Zoho Payroll’s features. This connectivity enhances data flow between disparate systems, improving data accuracy and reducing manual data entry.

- Integration with accounting software like Xero, QuickBooks, and Sage can be achieved, ensuring a consistent financial record and avoiding manual data entry.

- HRIS (Human Resource Information Systems) platforms, such as BambooHR or Gusto, can be integrated to improve data synchronization and maintain comprehensive employee records.

- Payroll tax providers and other financial service providers can be integrated to automate and manage tax calculations and deductions.

Customization Options

Zoho Payroll provides various customization options to adapt to specific business requirements. These options are designed to accommodate diverse workflows and specific needs. Customization enables tailored configurations that improve productivity and meet unique business demands.

- Payroll Settings: Businesses can modify tax rules, payment methods, and other payroll-related parameters to align with local regulations and company policies. These adjustments enhance accuracy and efficiency in managing payroll procedures.

- Report Customization: Users can design custom reports to meet specific reporting needs. This enables a deeper analysis of payroll data to improve decision-making and track performance.

- User Role Permissions: Access levels can be customized to define the specific tasks and functionalities that different users can access. This enables a secure and controlled environment, protecting sensitive data and ensuring compliance.

Customization Levels by User Role

The level of customization available depends on the user role within Zoho Payroll. Administrators typically have the most extensive control, while other roles have specific permissions based on their responsibilities. This system allows for a clear segregation of duties and ensures that only authorized personnel can access and modify critical data.

- Administrators have comprehensive control over the platform, including customizing payroll settings, configuring integrations, and defining user roles.

- Payroll Managers have the ability to manage payroll processing and report generation based on predefined roles and responsibilities.

- Employees can access and view their payroll information, but customization options are limited to personal settings, such as payment methods or direct deposit details.

Examples of Integrations

- Connecting Zoho Payroll with Zoho Books allows for automated bank reconciliations, reducing manual data entry and improving financial reporting accuracy.

- Integrating Zoho Payroll with Xero, a popular accounting software, ensures consistent financial records, streamlining the entire financial management process.

- A connection between Zoho Payroll and a third-party HRIS system can help keep employee records synchronized, reducing errors and streamlining administrative tasks.

Integration Table

| Category | Zoho Application | Third-Party Software |

|---|---|---|

| Accounting | Zoho Books | Xero, QuickBooks, Sage |

| HR | Zoho Recruit | BambooHR, Gusto |

| CRM | Zoho CRM | Salesforce (via API) |

| Other | Zoho Inventory, Zoho Projects | Various other business applications |

Reporting and Analysis

Zoho Payroll provides comprehensive reporting and analysis tools, enabling users to gain valuable insights into their payroll data. This detailed overview will highlight the various report types available, demonstrate how to generate reports, and showcase methods for analyzing payroll information to optimize efficiency and decision-making.

Types of Reports Available

Zoho Payroll offers a diverse range of reports categorized to suit various needs. These reports encompass crucial aspects of payroll processing, including employee pay details, tax withholdings, and overall payroll summaries. Navigating through these reports allows for a clear understanding of payroll operations, streamlining decision-making and ensuring compliance.

Generating Reports on Employee Pay Details

To generate reports on employee pay details, users can access predefined templates or create customized reports. These reports typically include essential information such as gross pay, deductions, net pay, and any applicable benefits. This information is presented in a structured format, facilitating easy review and analysis.

Generating Reports on Tax Withholdings

Zoho Payroll’s tax withholding reports offer a detailed breakdown of taxes deducted from employee paychecks. These reports typically include details of tax amounts, applicable tax rates, and relevant tax codes. They enable users to easily track tax liabilities and ensure compliance with relevant regulations.

Generating Reports on Other Payroll Information

Beyond employee pay and tax withholdings, Zoho Payroll offers reports encompassing various aspects of payroll administration. These reports might include leave balances, attendance records, and payroll processing history. This comprehensive view of payroll data provides valuable insights into overall payroll management and potential areas for improvement.

Creating Customized Reports

Zoho Payroll empowers users to create customized reports based on specific analysis needs. This customization feature allows for the selection of specific parameters, criteria, and fields to generate reports tailored to particular business requirements. This flexibility ensures users can focus on the precise data points pertinent to their analysis.

Analyzing Payroll Data

Various analysis methods can be employed using Zoho Payroll reports. Users can identify trends, patterns, and anomalies in payroll data. For example, a report on employee overtime pay might highlight trends in overtime hours worked, allowing managers to assess workload distribution and optimize staffing levels. Similarly, reports on payroll costs can help identify areas for cost reduction and efficiency improvement.

Table of Different Report Types

| Report Type | Use Cases |

|---|---|

| Employee Pay Summary | Provides a comprehensive overview of individual employee pay details, including gross pay, deductions, and net pay. |

| Tax Summary | Offers a detailed breakdown of taxes withheld from employee paychecks, aiding in tax compliance and analysis. |

| Payroll Summary | Provides an overview of the overall payroll processing, encompassing total payroll costs, employee counts, and other key metrics. |

| Leave Balance Report | Tracks and analyzes employee leave balances, facilitating leave management and identifying potential leave-related issues. |

| Custom Report | Enables the creation of reports tailored to specific business needs, allowing for detailed analysis of particular data points. |

Security and Compliance

Zoho Payroll prioritizes the security and confidentiality of employee data, adhering to stringent security protocols and relevant compliance regulations. This ensures the smooth and reliable operation of payroll processes while maintaining trust and upholding legal requirements.

Security Measures Employed by Zoho Payroll

Zoho Payroll employs a multi-layered approach to safeguard sensitive employee data. This includes robust encryption methods for data transmission and storage, access controls with varying user permissions, and regular security audits to identify and address vulnerabilities. These measures are designed to protect against unauthorized access, data breaches, and other security threats.

Compliance with Payroll Regulations

Zoho Payroll is designed to comply with a range of payroll regulations, ensuring accuracy and adherence to tax laws and other relevant guidelines. This includes the ability to handle various tax deductions, reporting requirements, and payment deadlines according to the specific jurisdictions where employees are located.

Common Payroll Regulations Addressed by Zoho Payroll

Zoho Payroll addresses a broad spectrum of payroll regulations. These regulations cover tax calculations, deductions, and reporting requirements, ensuring that payroll processing aligns with the laws of different regions and countries. The software offers configurable settings to adjust to varying regulatory frameworks, ensuring compliance with local standards.

- Federal and state income tax withholding

- Social Security and Medicare taxes

- Unemployment insurance contributions

- Workers’ compensation regulations

- Other legally mandated deductions and reporting requirements

Security Features of Zoho Payroll

Zoho Payroll integrates various security features to protect sensitive data and maintain the integrity of payroll records. These features include role-based access control, multi-factor authentication, and regular security updates to mitigate potential threats.

- Data Encryption: Zoho Payroll utilizes advanced encryption protocols to safeguard data during transmission and storage, protecting it from unauthorized access.

- Access Control: User access is restricted based on predefined roles and permissions, limiting access to sensitive information to authorized personnel only.

- Regular Security Audits: Zoho Payroll undergoes regular security audits to identify and address potential vulnerabilities, ensuring the highest level of data protection.

- Multi-Factor Authentication (MFA): Zoho Payroll supports MFA, requiring multiple verification steps to log in, further strengthening security measures.

Security Measures and Their Purpose

| Security Measure | Purpose |

|---|---|

| Data Encryption | Protects sensitive data during transmission and storage, preventing unauthorized access. |

| Access Control | Limits access to sensitive information based on predefined roles and permissions, safeguarding data from unauthorized personnel. |

| Regular Security Audits | Identifies and mitigates potential security vulnerabilities, ensuring the highest level of data protection. |

| Multi-Factor Authentication (MFA) | Adds an extra layer of security by requiring multiple verification steps during login, enhancing protection against unauthorized access. |

Support and Resources

Zoho Payroll prioritizes user satisfaction and offers comprehensive support to ensure a smooth experience. This section details the various support channels and resources available to help users navigate the platform and resolve any issues that may arise. Detailed explanations of common problems and their solutions are provided to aid users in independently resolving issues.

Support Options Available

Zoho Payroll provides multiple support channels to cater to diverse user needs. These channels offer various avenues for assistance, ranging from self-service resources to direct contact with support agents. This ensures users can find the help they need, regardless of their preferred method.

- Self-Service Resources: Zoho Payroll offers a wealth of helpful documentation, tutorials, and FAQs. These resources provide step-by-step guides, troubleshooting tips, and explanations for common tasks and procedures. By utilizing these resources, users can often find solutions to their queries without needing to contact support.

- Knowledge Base: The Zoho Payroll knowledge base is a valuable repository of information. Users can search for answers to specific questions or explore topics related to payroll processes, system features, and troubleshooting. This comprehensive resource is regularly updated to maintain accuracy and relevance.

- Community Forums: A vibrant community forum enables users to connect with peers and share experiences. This platform facilitates collaborative problem-solving, allowing users to benefit from the collective knowledge and expertise of the community. Users can ask questions, share best practices, and provide feedback.

- Direct Support: For more complex issues or when self-service resources are insufficient, users can contact Zoho Payroll’s dedicated support team through various channels, including email, phone, or live chat. This direct support option ensures users receive personalized assistance from experienced professionals.

Accessing Helpful Resources and Tutorials

Accessing helpful resources and tutorials is straightforward. Users can find a wealth of information through the Zoho Payroll website. This includes dedicated support pages, detailed documentation, and interactive tutorials. A user-friendly interface ensures easy navigation.

- Dedicated Support Pages: The Zoho Payroll website features dedicated support pages containing FAQs, troubleshooting guides, and detailed explanations of specific features. These resources are categorized for easy access and navigation.

- Online Tutorials: Interactive tutorials provide step-by-step instructions for performing various tasks, including setting up payroll, processing payments, and generating reports. These tutorials are designed to help users quickly learn and understand the platform.

- Documentation: Comprehensive documentation covers every aspect of Zoho Payroll, from basic functionalities to advanced configurations. Users can refer to these detailed guides to gain a deeper understanding of the platform.

Common User Issues and Solutions

Users often encounter common issues, such as incorrect deductions, payment errors, or difficulty accessing specific features. Zoho Payroll addresses these concerns with effective solutions.

- Incorrect Deductions: A common issue is incorrect deduction calculations. Zoho Payroll provides clear guidelines and error-checking tools to help users identify and rectify these errors. This typically involves reviewing employee data, deduction rules, and confirming the accuracy of input parameters.

- Payment Errors: Errors in payments are another frequent issue. Zoho Payroll facilitates the tracking and resolution of payment discrepancies. This often involves detailed reconciliation processes and verification of payment information to pinpoint and resolve the error.

- Feature Access Issues: Some users might experience difficulty accessing specific features. Zoho Payroll’s comprehensive documentation and tutorials offer solutions to these access problems. These resources typically involve verifying user permissions, confirming required installations, or addressing any system configuration issues.

Resources for Learning About Zoho Payroll

Learning about Zoho Payroll is facilitated by various resources. Users can enhance their understanding of the platform through readily available materials.

- Online Courses: Zoho Payroll offers online courses covering various aspects of payroll management. These courses are designed to equip users with the knowledge and skills needed to effectively use the platform.

- Webinars: Regular webinars provide valuable insights into new features, updates, and best practices. These interactive sessions allow users to ask questions and learn from experts.

- Community Forums: Active community forums provide a platform for users to share experiences, ask questions, and learn from each other’s experiences.

Available Support Channels

The table below Artikels the various support channels available for Zoho Payroll users.

| Support Channel | Contact Information |

|---|---|

| Email Support | [email protected] |

| Phone Support | +1-XXX-XXX-XXXX (US) |

| Live Chat | Available on the Zoho Payroll website |

| Community Forum | [Link to Zoho Payroll Community Forum] |

User Experience

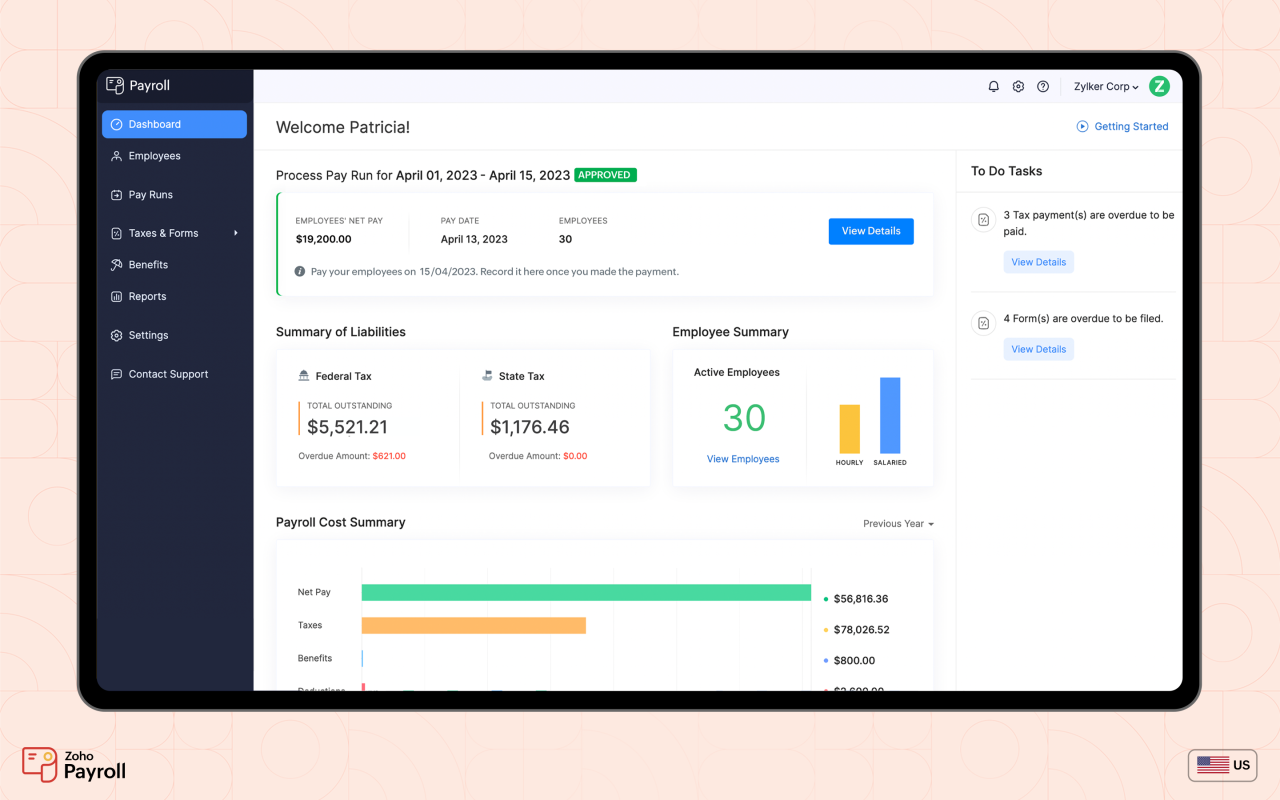

Zoho Payroll prioritizes a smooth and intuitive user experience, making payroll management accessible and efficient for businesses of all sizes. This user-centric approach simplifies complex tasks, allowing users to focus on strategic business operations rather than intricate administrative processes.

Interface Overview

Zoho Payroll boasts a clean and modern interface, designed with ease of navigation in mind. The layout is well-organized, with clear categorization of features and functionalities. Key elements, such as employee data entry fields, payment schedules, and reporting tools, are readily accessible. This streamlined design reduces the learning curve for new users and ensures efficiency for experienced ones.

Ease of Use and Navigation

Zoho Payroll is designed with intuitive navigation, enabling users to quickly locate the required information and complete tasks efficiently. The platform’s logical structure and consistent design elements facilitate seamless transitions between different modules. Users can easily access and manage employee data, generate payrolls, and produce reports, all within a well-structured environment.

Common User Workflows

Typical workflows in Zoho Payroll include:

- Employee Onboarding: Users can easily add new employees, input relevant details, and configure their payroll settings. This streamlined process reduces administrative overhead and ensures accurate payroll calculations from the start.

- Payroll Processing: The platform allows users to input payroll data, generate payslips, and manage deductions and benefits, streamlining the entire payroll cycle. The automated calculations reduce manual errors, ensuring accuracy and timely processing.

- Reporting and Analysis: Zoho Payroll provides comprehensive reporting tools to track payroll expenses, analyze trends, and gain insights into workforce costs. These reports facilitate informed decision-making and strategic planning.

Navigating the Platform for Tasks

Completing tasks within Zoho Payroll is straightforward. For instance, to generate a payslip for an employee, users navigate to the employee’s record, select the desired pay period, and generate the payslip. Similarly, to manage employee deductions, users access the employee’s profile, update deduction information, and save the changes. The platform’s clear navigation structure and well-defined steps guide users through each task with ease.

User Interface and Intuitive Design

| Task | Navigation Path | Interface Elements |

|---|---|---|

| Add a new employee | Payroll > Employees > Add Employee | Clear form fields for name, contact details, employment start date, etc. |

| Generate payslips | Payroll > Payslips > Select pay period > Generate | Configurable fields for salary, deductions, and net pay |

| Run payroll report | Payroll > Reports > Select report type | Interactive charts and customizable filters |

This table illustrates the straightforward navigation paths within Zoho Payroll. The intuitive design and clear labeling of interface elements ensure a user-friendly experience.

Closing Summary

In conclusion, Zoho Payroll emerges as a robust and adaptable solution for businesses of all sizes. Its comprehensive features, user-friendly interface, and commitment to security and compliance position it as a powerful tool for managing payroll effectively. This guide has provided a clear understanding of Zoho Payroll’s capabilities, allowing businesses to make informed decisions about adopting this platform to enhance their operations and focus on their core mission.